Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Is the golden era of 60/40s coming to an end?

And if equities / bonds correlation stay positive, which asset classes should be added to portfolios? hard assets and commodities? alternatives (private debt, private equities, etc.)? cash on an opportunistic basis? Source chart: Tavi Costa, Bloomberg

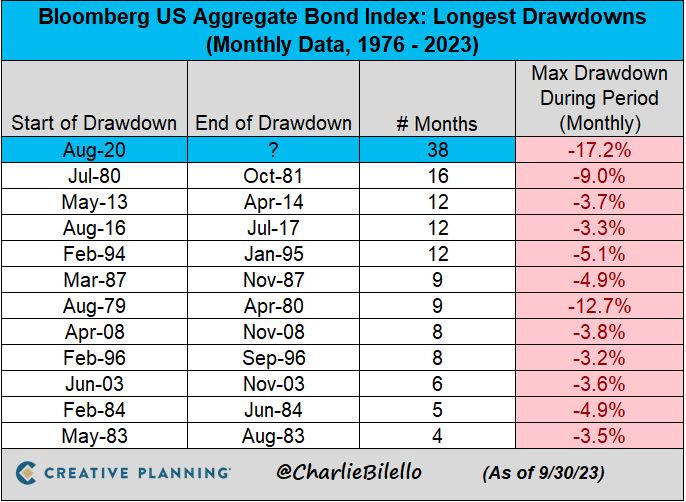

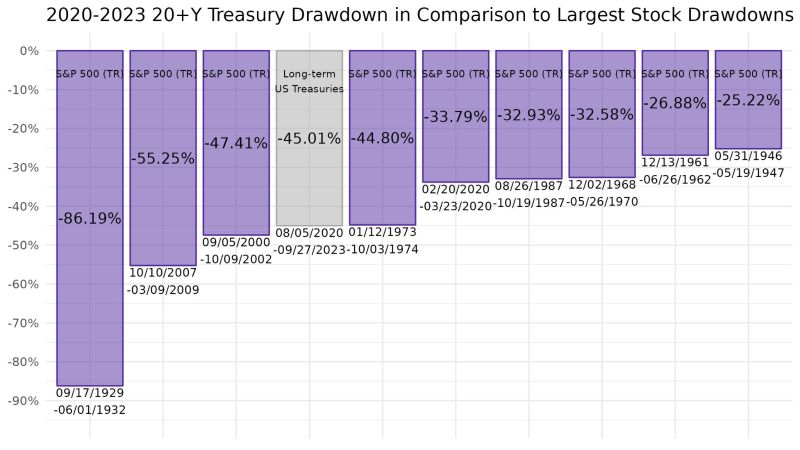

Yes you can lose a lot of money with bonds...

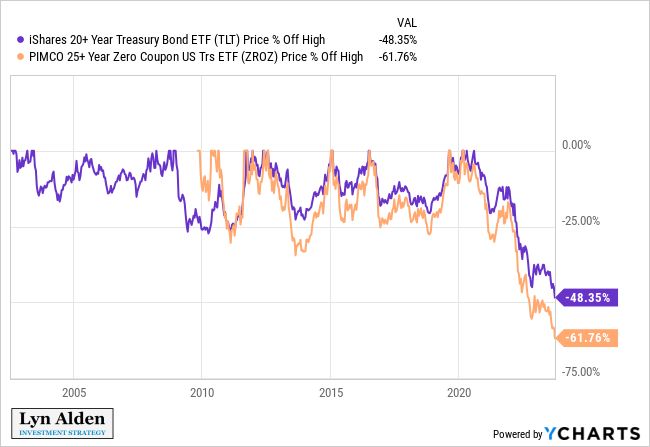

The Pimco 25+ Year Zero Coupon US Treasury ETF is off more than 60% from its high

US 10 year yields keep rising in tandem with oil

WTI oil now trades at $93.5/bbl. So is oil & inflation fears the only reason for bond yields to move upward? Probably not. The fact that real yields are also on the rise shows that inflation is not the only culprit. Investors are adjusting to the reality of rates staying high for longer than expected. They are also requesting positive real yield to get compensated for being invested in US treasuries at the time the US Treasury is issuing massive amount of debt while the FED keeps shrinking its balance sheet through QT. Source chart: Bloomberg

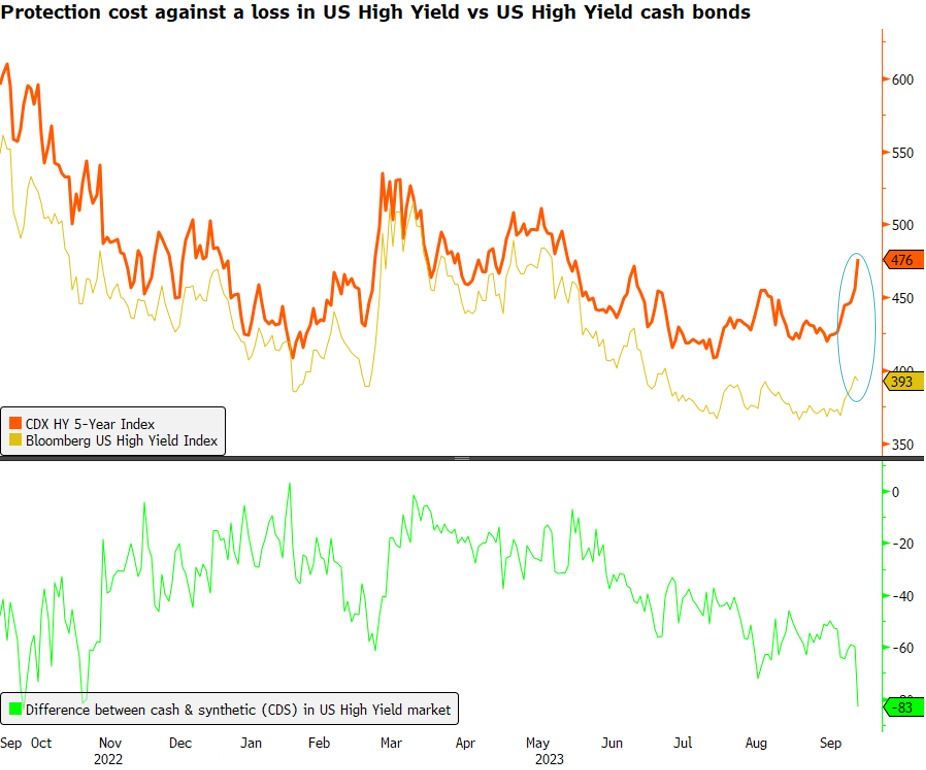

US HY: watch out for take-off!

The disparity between cash and synthetic in High Yield (HY) has recently hit levels not witnessed since October 2022. While HY credit spreads in the cash bond market appear more resilient in response to the rapid increase in real rates, the CDX HY index, comprised of 5-year CDS of HY companies, has expanded by over 60 bps in just two weeks. The question now is, how long will this disconnect between the two markets persist? Source: Bloomberg #HighYield #CreditMarkets #Finance #Investing

Apollo just said that bonds are now more attractive than equities...

The spread between corporate bond yields and the S&P 500 earnings yield just hit its highest since 2008, at 1.5%. This spread was negative for nearly 13 years before turning positive in mid-2022. Even in 2020 this spread did not turn positive amidst the global lockdowns. Source: The Kobeissi Letter, Apollo

Investing with intelligence

Our latest research, commentary and market outlooks