Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Economists polled by German research institute Ifo expect global inflation to avg 7% in 2023, before slightly easing to 6% in 2024.

The avg expectation of 4.9% for the long term until 2026 is still high, Ifo said, though marginally below the 5% estimate in Q1. Lowest level of inflation expectation was recorded in Europe, yet economists do not expect the rate to return to ECB's 2% target by 2026. Source: HolgerZ, Bloomberg

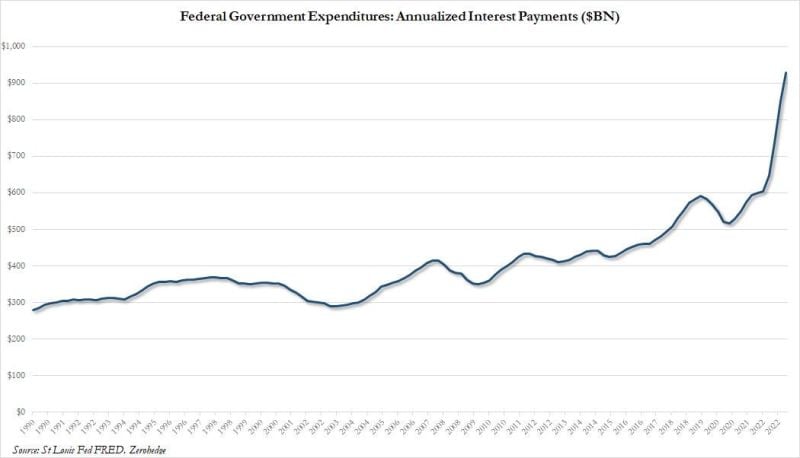

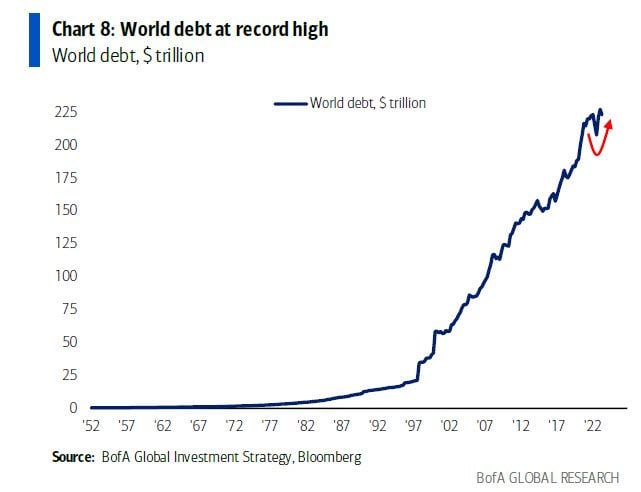

According to new US government data, annualized interest payments on US debt just crossed $900 BILLION for the first time in history

Government spending jumped 15% in June, the same month we had the debt ceiling “crisis.” Ironically, in the same month we had a debt ceiling crisis, US Federal spending hit a near record and annualized interest expense crossed $900 billion. Source: The Kobeissi Letter

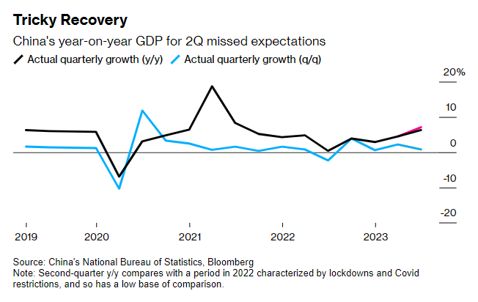

China reports Q2 GDP miss, fueling calls for more stimulus

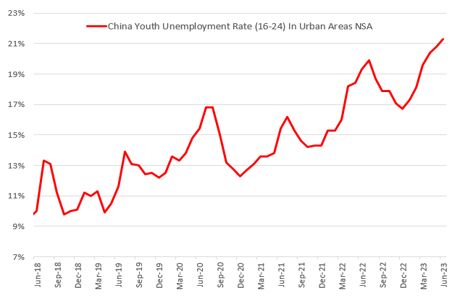

China said Monday that 2nd quarter gross domestic product grew by 6.3% from a year ago, missing expectations (+7.3%). This marked a 0.8% pace of growth from the first quarter, slower than the 2.2% quarter-on-quarter pace recorded in the first three months of the year. The unemployment rate among young people ages 16 to 24 was 21.3% in June, a new record. Retail sales for June rose by 3.1%, a touch below the 3.2% expected. Industrial production for June rose by 4.4% from a year ago, better than the 2.7% forecast. So far, Beijing has shown reluctance to embark on greater stimulus, especially as local government debt has soared. A Politburo meeting expected later this month could provide more details on economic policy. Source: Bloomberg, CNBC

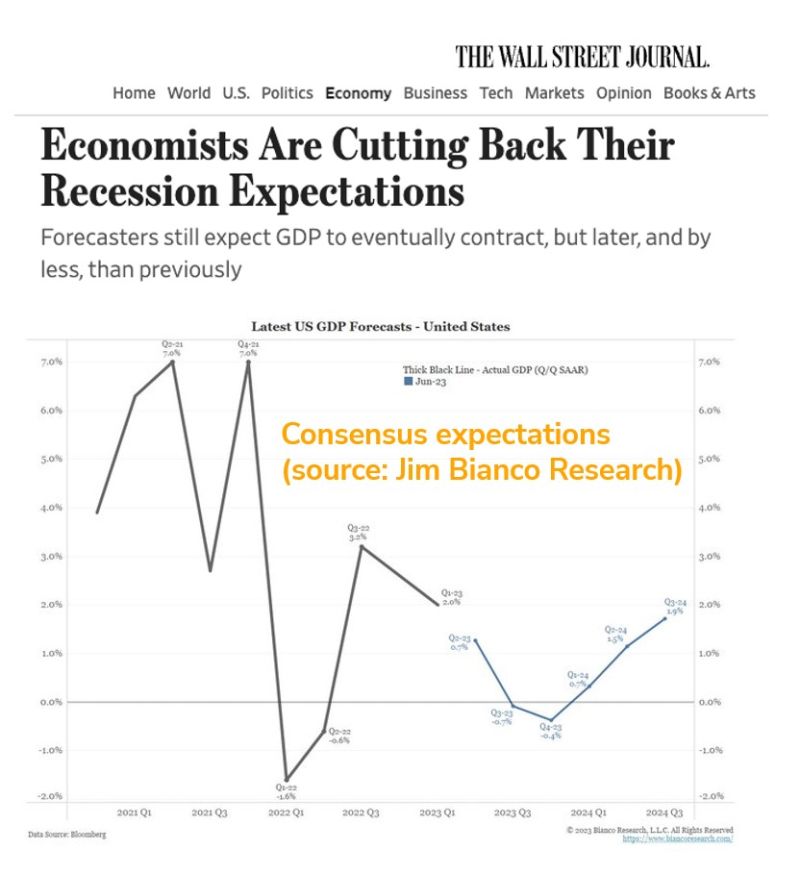

Wall Street is giving up on us recessoon risk as highlighted by a Wall Street Journal article

Jim Bianco Research shows consensus expectations for the coming quarters are pointing towards a very small contraction. The blue line is the June update of a survey conducted by Bloomberg of around 70 economists showing the median forecast for the next six quarters.

Is the wageflation story behind us?

Maybe not yet...United pilots could get raises of up to 40% under a preliminary deal, after similar agreements were made at Delta and American Airlines For the first time in many decades the labor force has the upper hand in negotiating across a broad swath of industries, and they're using it as much as they can. Bottom-line: The wageflation story isn't quite over yet. Instead, it is evolving. Source: Markets Mayhem, Wall Street Journal

The Biden administration announced it would automatically cancel education debt for 804,000 borrowers

The Biden administration announced it would automatically cancel education debt for 804,000 borrowers, for a total of $39 billion in relief. The debt cancellation is a result of the administration’s fixes to repayment plans, which included updated counts of borrowers’ payments. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks