Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

China's Inflation Rate Eases to Zero

Deflation in China? China's Consumer Price Index (CPI) year-on-year growth rate in June dropped to 0% (prev. 0.2%). Producer Price Index (PPI) year-on-year growth rate dropped to -5.4% (prev. -4.6%). Source: Bloomberg

SNB won’t let slowing inflation stop a rate hike

Source: Bloomberg

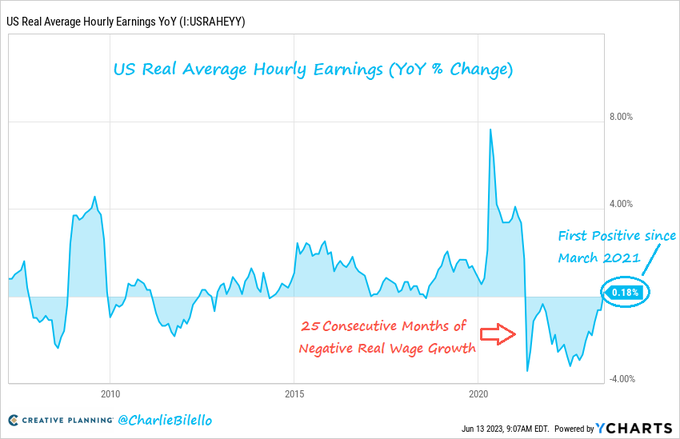

US real average hourly earnings turn positive again

US wages outpaced inflation on a YoY basis in May by 0.2%, ending the ignominious streak of 25 consecutive months of negative real wage growth. Source: Charlie Bilello

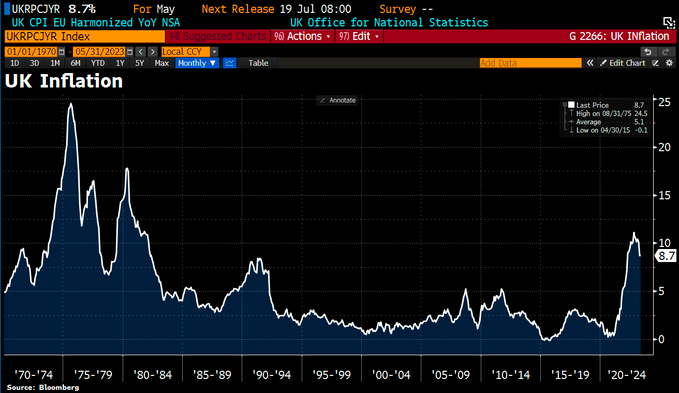

UK inflation stays stuck at 8.7% while economists had expected a decline to 8.4%.

Source: HolgerZ, Bloomberg

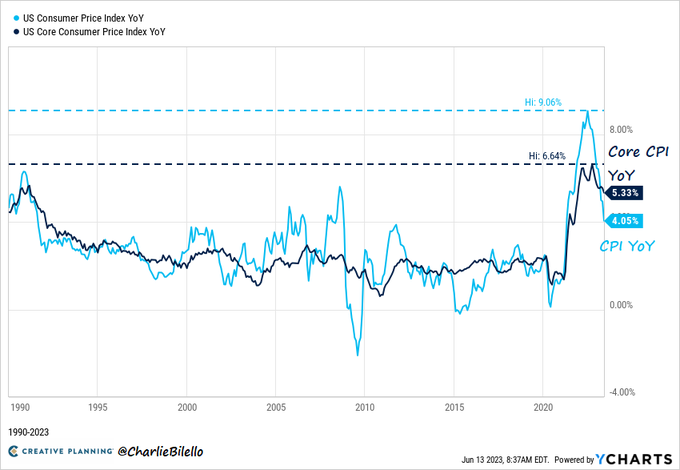

US CPI continues to cool down

Overall US CPI moved down to 4.0% in May, the 11th consecutive decline in the YoY rate of inflation and the lowest level since March 2021. US Core CPI (ex-Food/Energy) moved down to 5.3% YoY, the lowest reading since November 2021. Source: Charlie Bilello

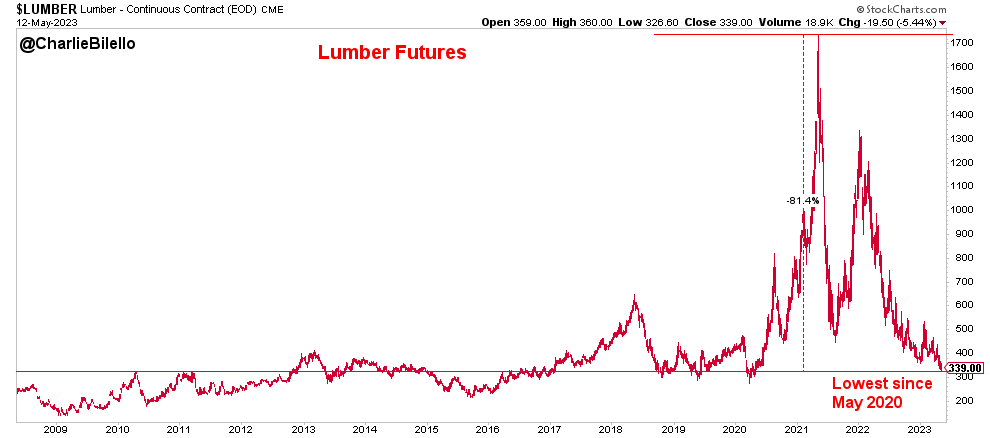

Lumber futures are at their lowest levels since May 2020, down 81% from the peak in May 2021

Source: Charlie Bilello

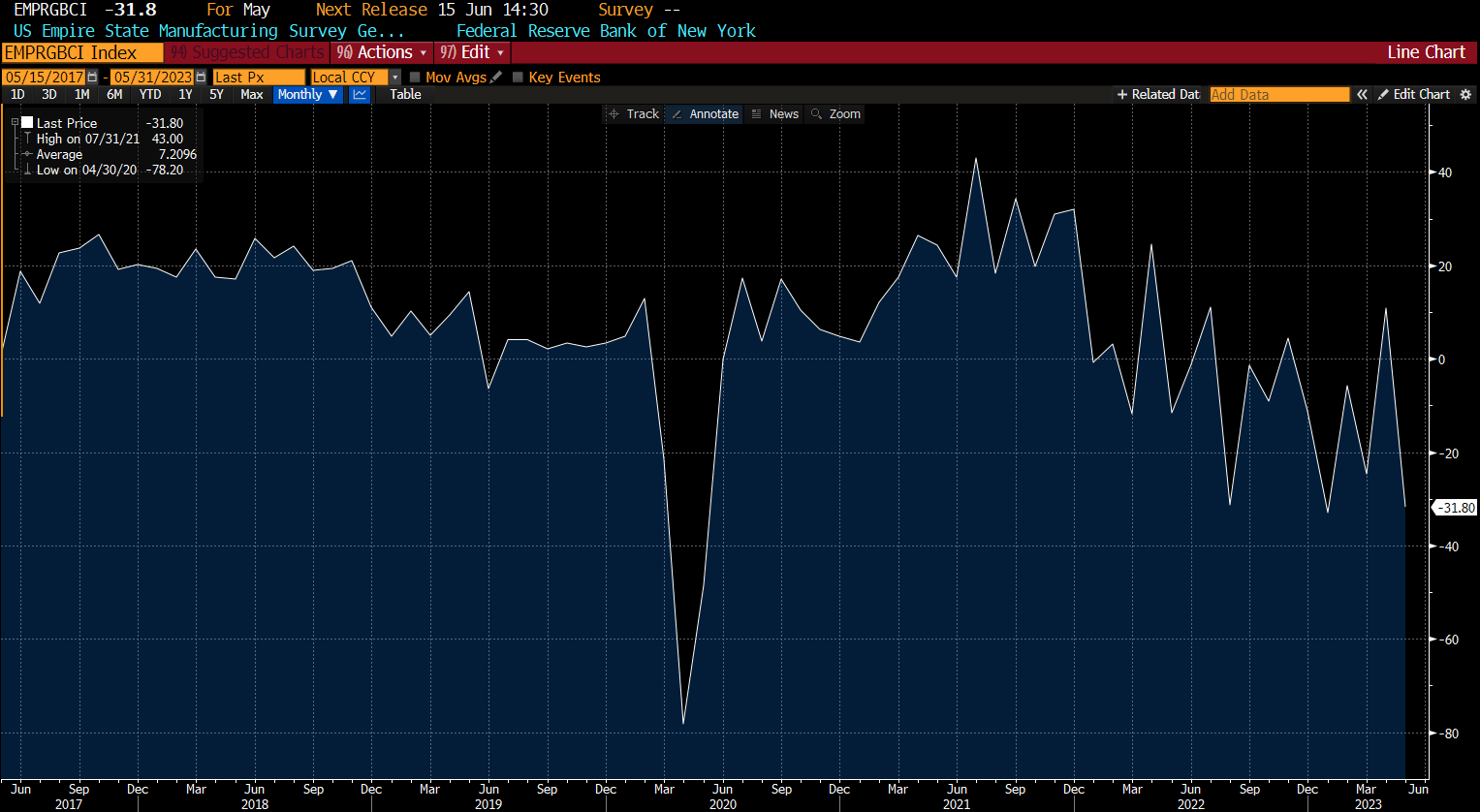

US MAY EMPIRE STATE FACTORY INDEX FALLS TO -31.8 (lowest since Jan.2023), EST. -3.9

The orders index also slid by the most since April 2020, hitting the lowest level since the start of the year. The shipments gauge plummeted more than 40 points. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks