Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

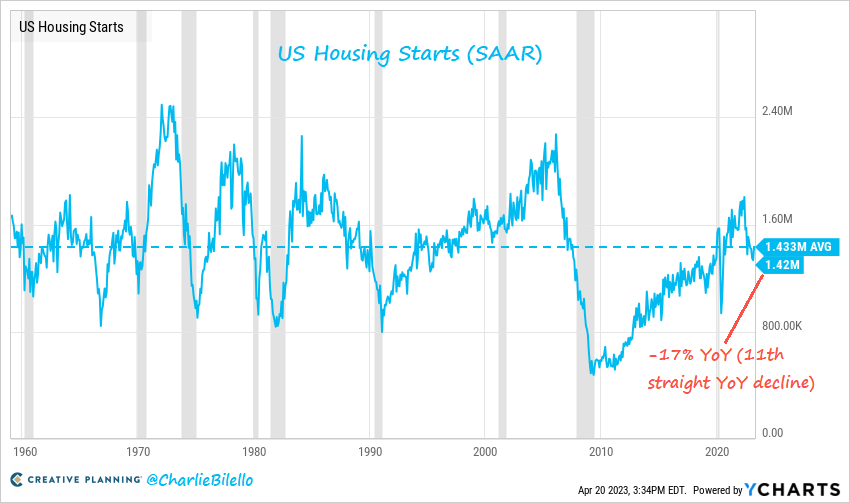

There is a huge dichotomy between US Homebuilders stocks performance and US housing starts

US Home Construction ETF ($ITB) is at a 52-week high, up 25% over the last year. Meanwhile US Housing Starts are down 21% from their peak last April.

US Housing Starts were were down 17% over the last year, the 11th consecutive YoY decline

US Housing Starts were were down 17% over the last year, the 11th consecutive YoY decline (longest down streak since 2009). Tends to be a leading indicator for the economy, recessionary signals continue to build. Source: Charlie Bilello

UK Food Inflation continuing to make cycle highs of up +19.6%

UK Inflation surprises to the upside at +10.1% YoY. The surge in UK Food Inflation has been contributing to it.

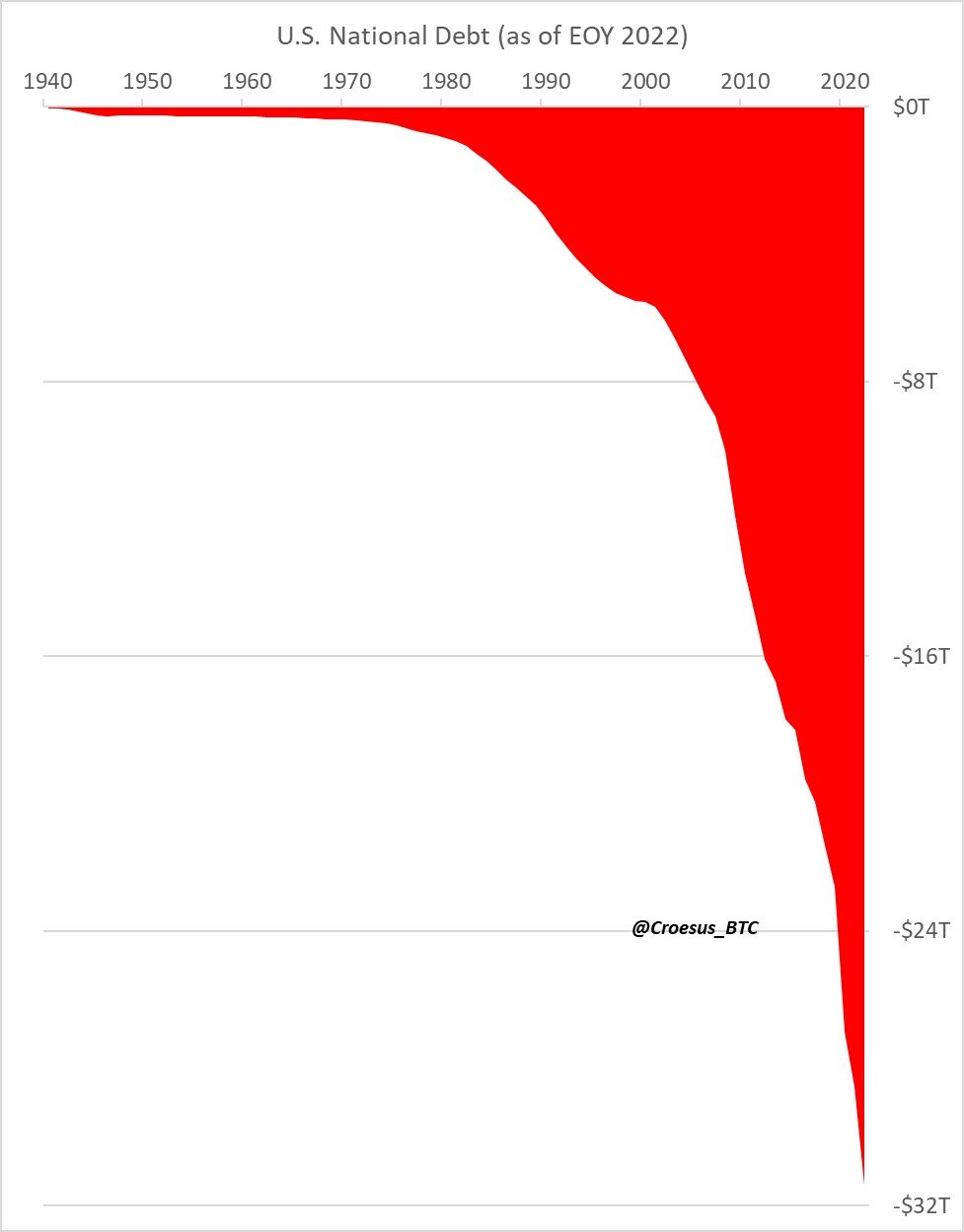

The US debt hole grows bigger. Higher interest rates do not help

The problem with deficits is that they add up. Each annual deficit adds to the total National Debt. This debt hole grows bigger because of annual interest expense on all this debt. Not a problem when interest rates are ~0%. Big problem when they're 5% per year (now). Source: Jesse Myers Croesus_BTC

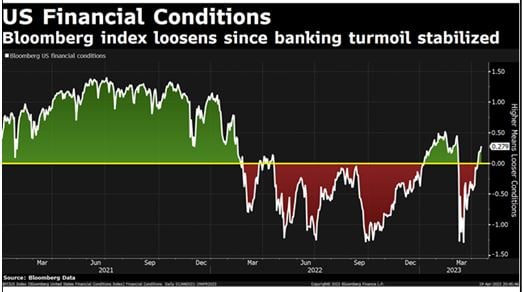

Good news! Bloomberg US Financial conditions has been loosening since banking turmoil stabilized

Source: Bloomberg

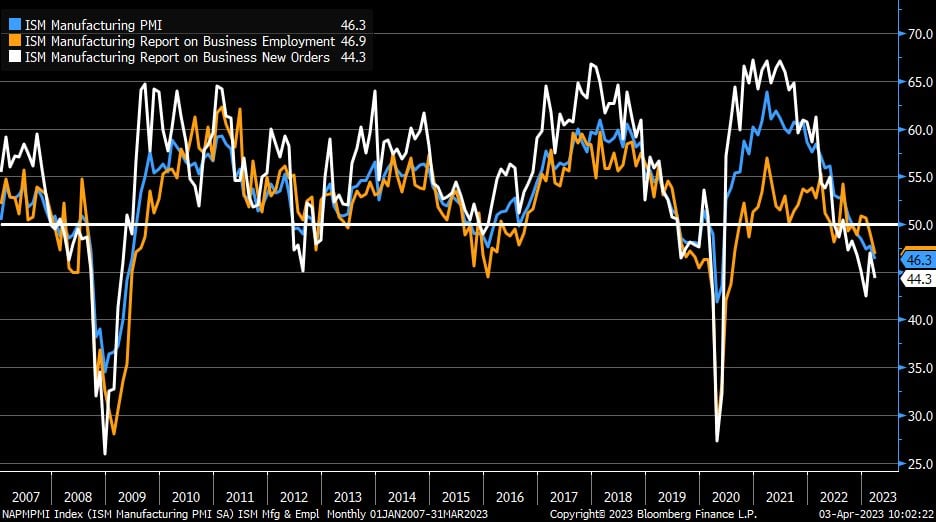

US ISM manufacturing drops to 46.3, the lowest since May 2020, the month after the COVID recession ended

March ISM Manufacturing came out at 46.3 vs. 47.5 est. & 47.7 in prior month; new orders are down to 44.3, prices paid back into contraction at 49.2, and production edged slightly higher (but still contracting at 47.8). Employment fell further into contraction (lowest since July 2020). ISM started surveying in 1948. As this chart shows, this is the 16th time the ISM has been 46.3 or lower. 12 (75%) of these instances, the economy was either in recession or about to enter a recession Source: Liz Ann Sonders, Bianco Research, Bloomberg

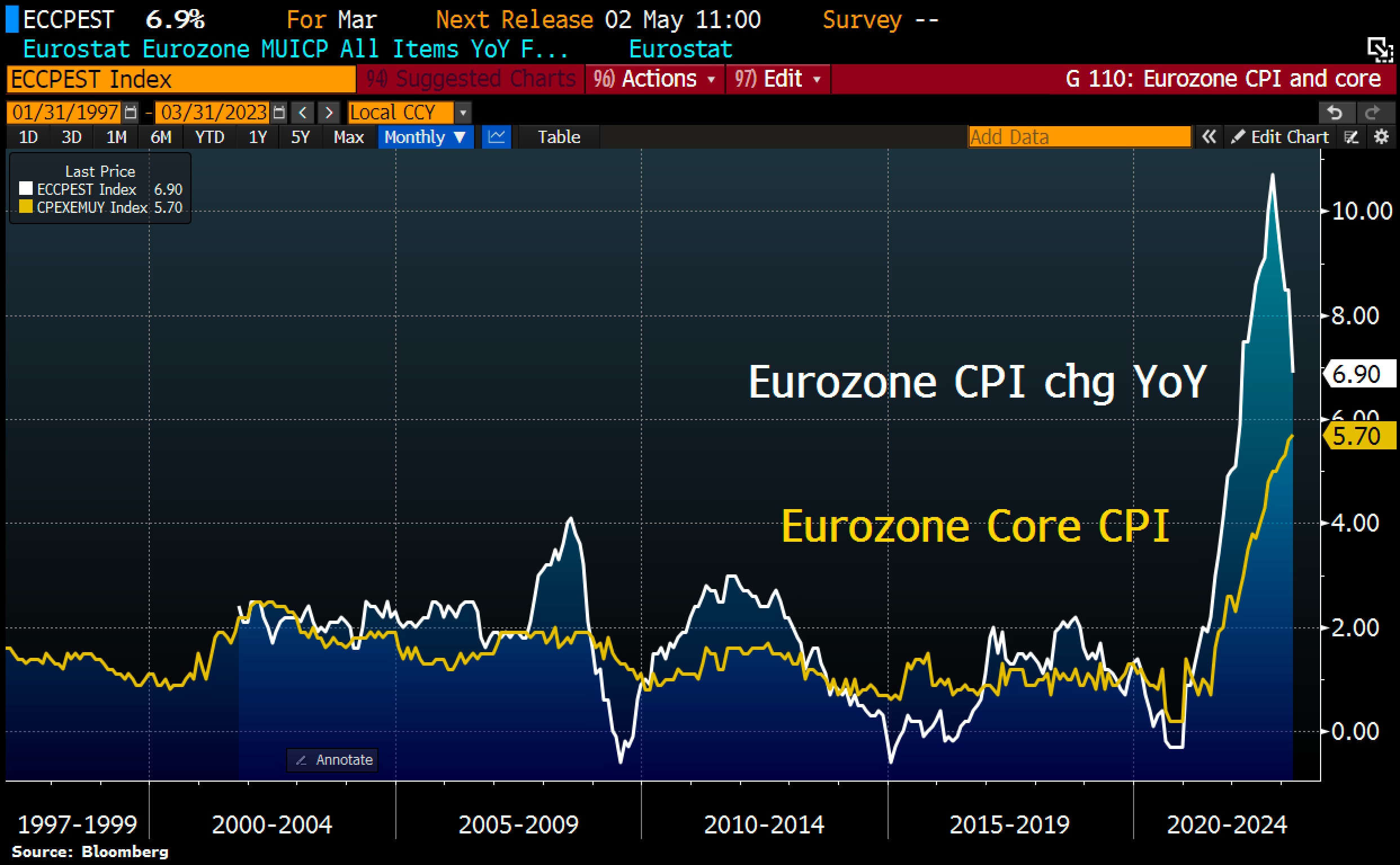

Eurozone headline inflation cools down: core inflation hits all-time-high

Eurozone headline inflation cools significantly to 6.9% YoY in March, down from 8.5% in February and lowest level since February 2022, AND lower than estimated 7.1% Bloomberg poll. But core inflation, which excludes volatile items, quickened to 5.7%, a fresh All-Time-High, showing inflation pressure remains high. Source: HolgerZ, Bloomberg

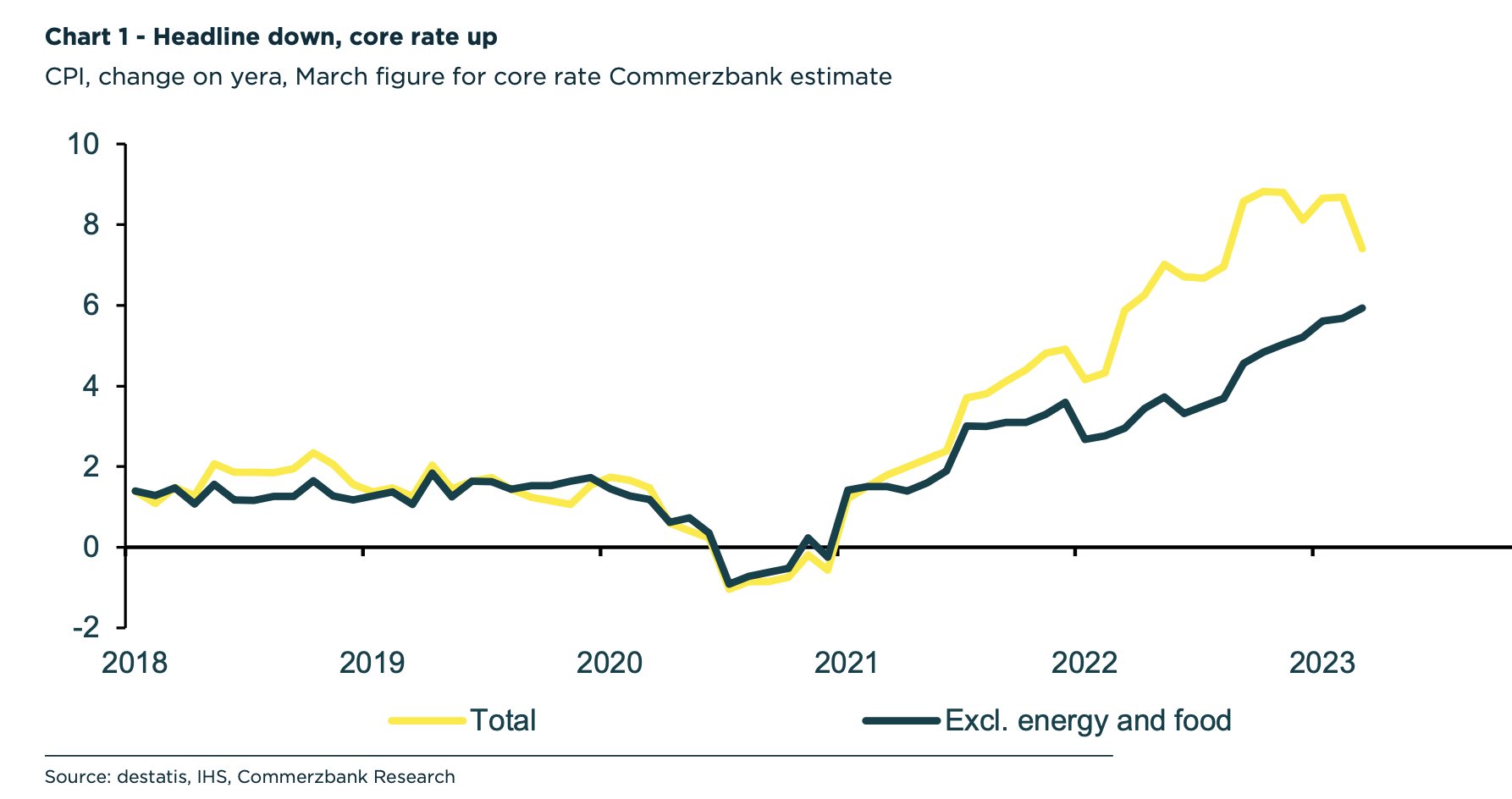

Germany's headline inflation eased significantly but less than expected

Germany's headline inflation eased significantly but less than expected AND underlying price pressure keeps rising. CPI dropped from 8.7% in Feb to 7.4% in March overshooting expectations of 7.3%. Core CPI rose from 5.7% to 5.9%, according to Commerzbank calculations. Source: HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks