Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

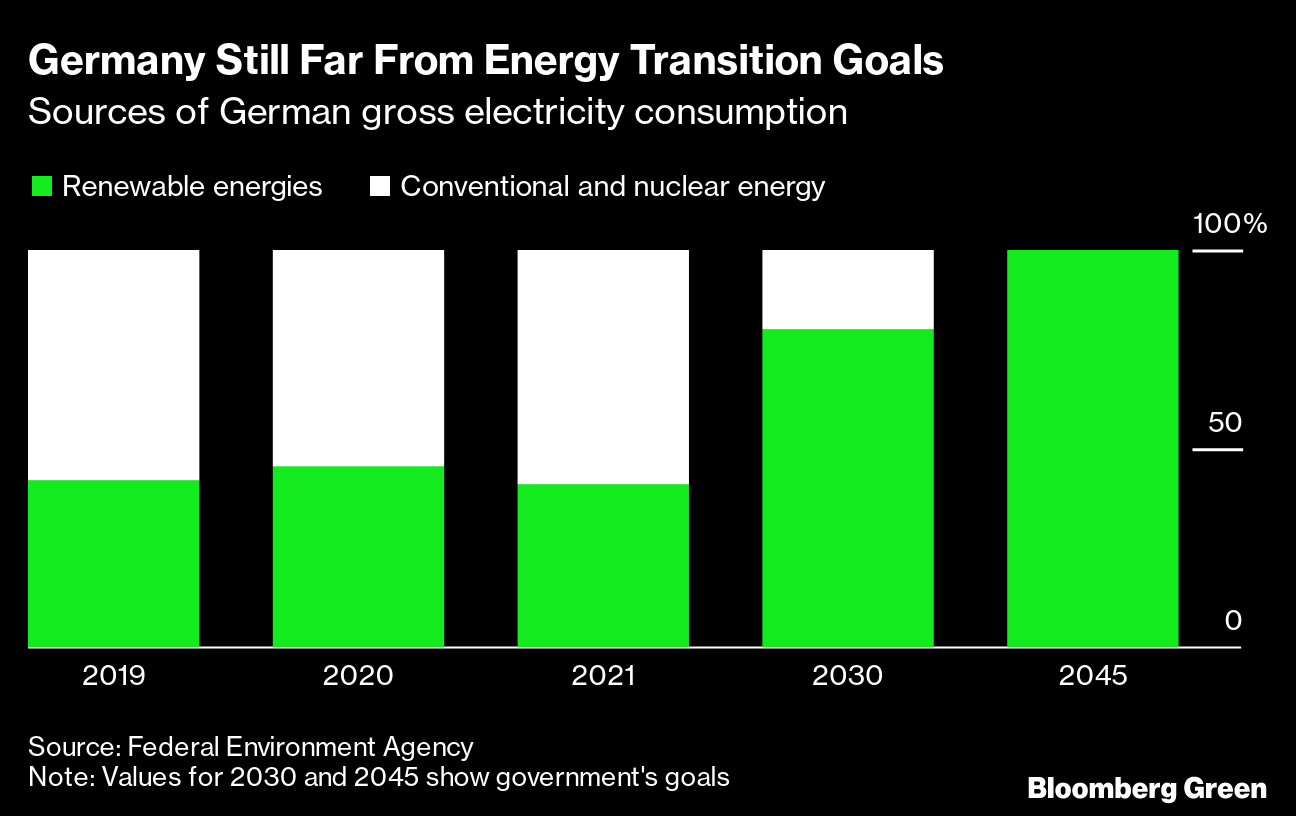

Germany is still far from its energy transition goals

Germany must invest $1tn in expansion of renewable energy by 2030 in order to cover 80% of its electricity needs from renewable sources by then. Germany needs 43 soccer fields of solar power every day, boldest project since WWII. Source: Bloomberg, HolgerZ

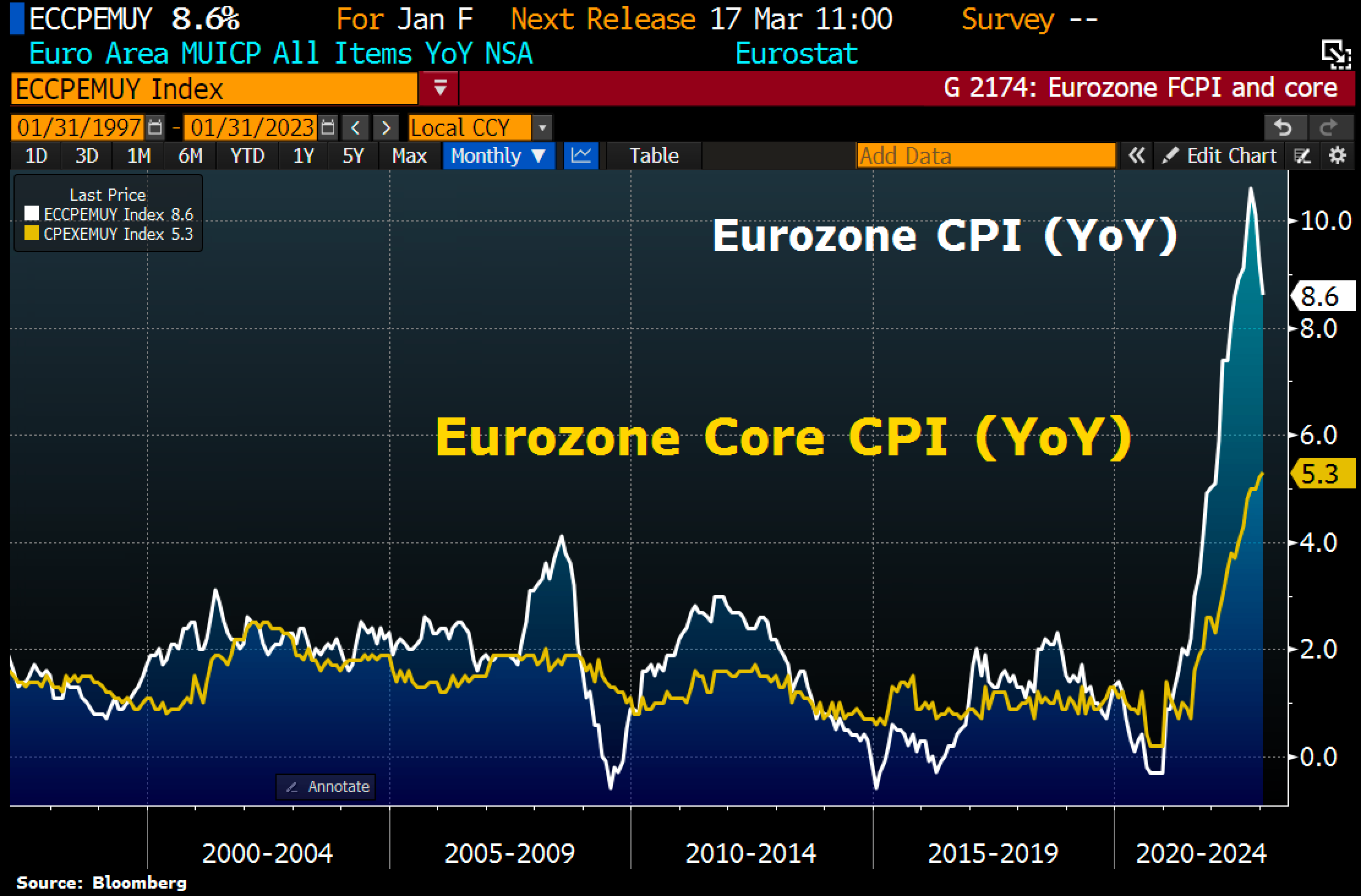

Eurozone inflation for January tops earlier estimate

Eurozone CPI rose 8.6% in Jan YoY, up from 8.5% increase prev estimated. Core CPI, which strips out volatile categories, was 5.3%, up from preliminary estimate of 5.2% and fresh ATH. Core gives ECB hawks new fuel for more hikes.

Fed Terminal Rate has climbed 50bps year-to-date and keeps rising

This is the chart that is rattling the markets: Fed Terminal Rate has climbed 50bps year-to-date and keeps rising!

German Food CPI jumped 20.2% YoY in January

Supermarket inflation remains elevated in Gernmany. Food CPI jumped 20.2% YoY in January. Following the rebalancing of the basket of goods by German Statistics Office, food now has a higher weight in inflation rate. Share rose by 2ppts from 8.5% to 10.5%. Source: HolgerZ, Bloomberg

China ramps up cash injection to prevent funding stress

The People’s Bank of China offered 835 billion yuan ($121 billion) of cash via seven-day reverse repurchase contracts on Friday, resulting in an injection of 632 billion yuan on a net basis. That’s the largest one-day addition on record in data going back to 2004 - Sources: C.Barraud, Bloomberg

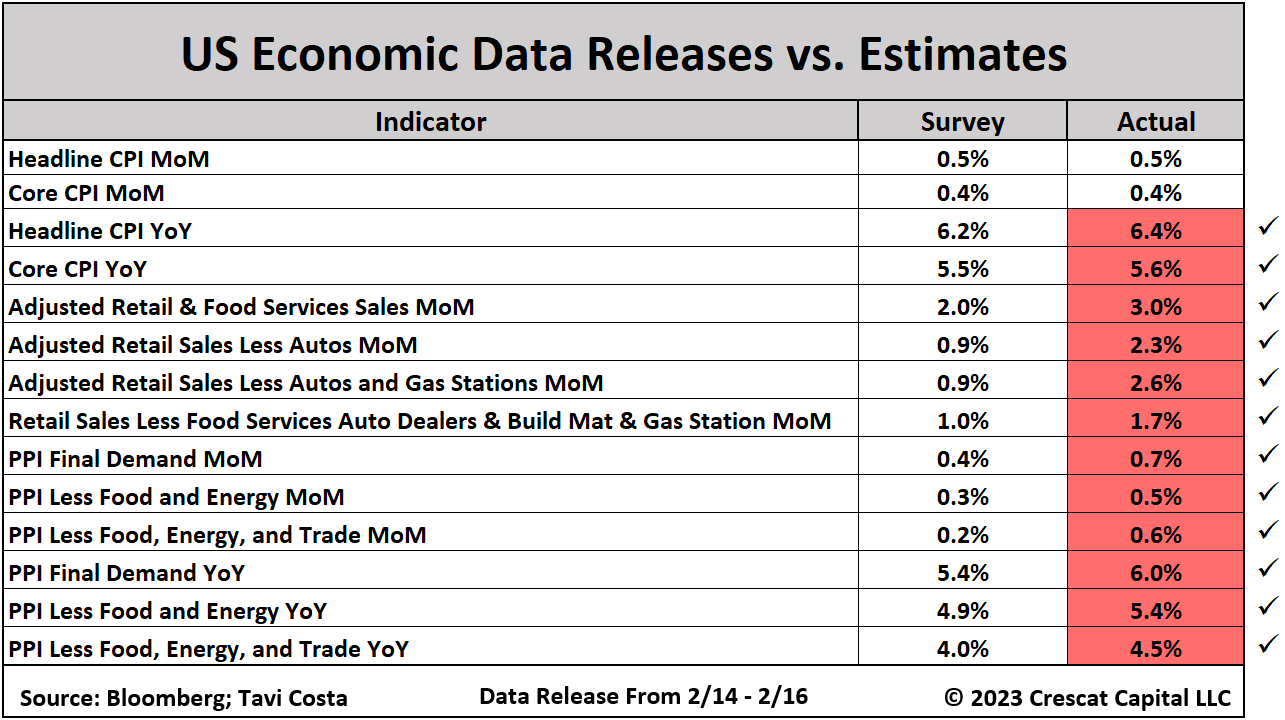

14 economic indicators reported this week related to the US consumer and prices. 12 of them came in above expectations.

Source: Tavi Costa, Crescat Capital

Investing with intelligence

Our latest research, commentary and market outlooks