Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

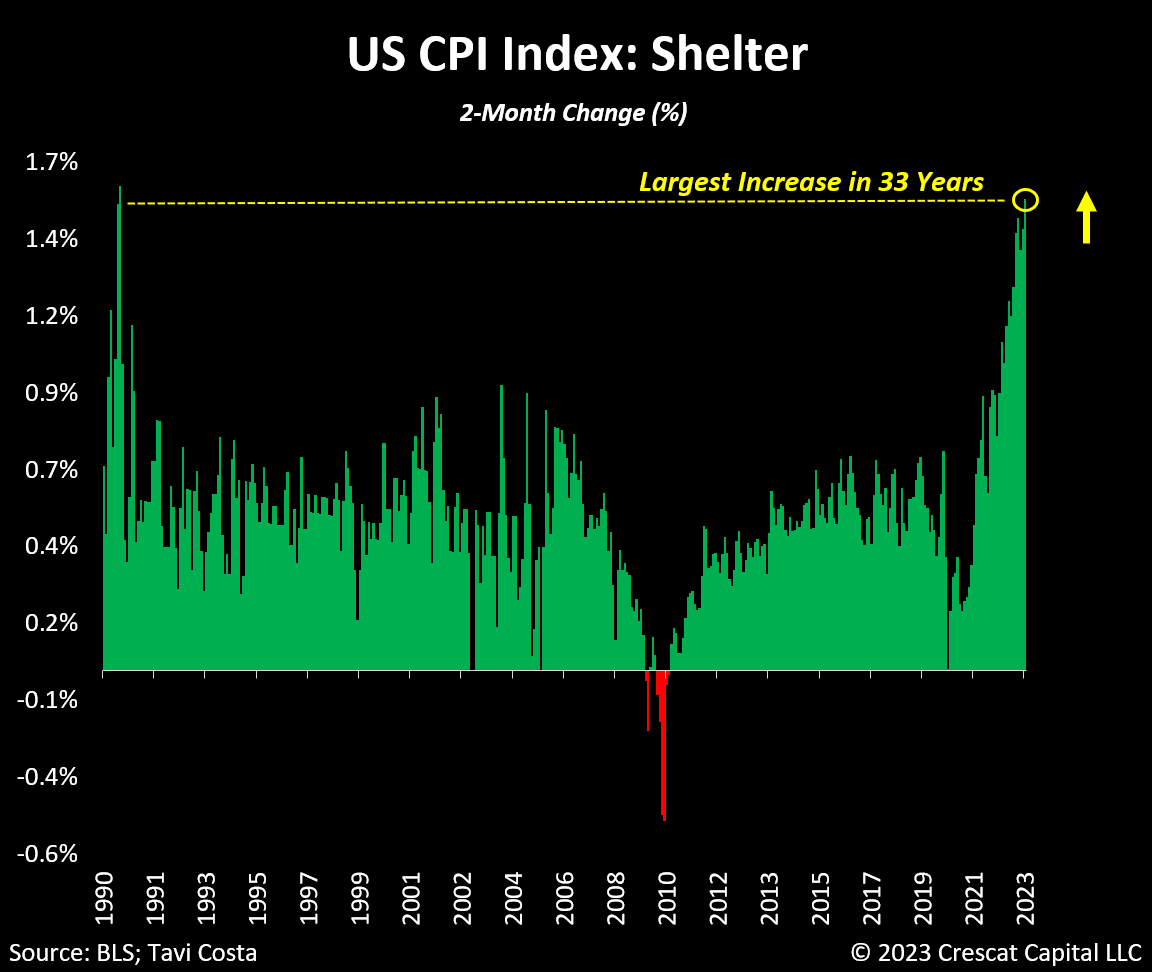

The shelter component of US CPI just had its highest 2-month increase in 33 years

Sourc: Bloomberg, Tavi Costa, Crescat Capital

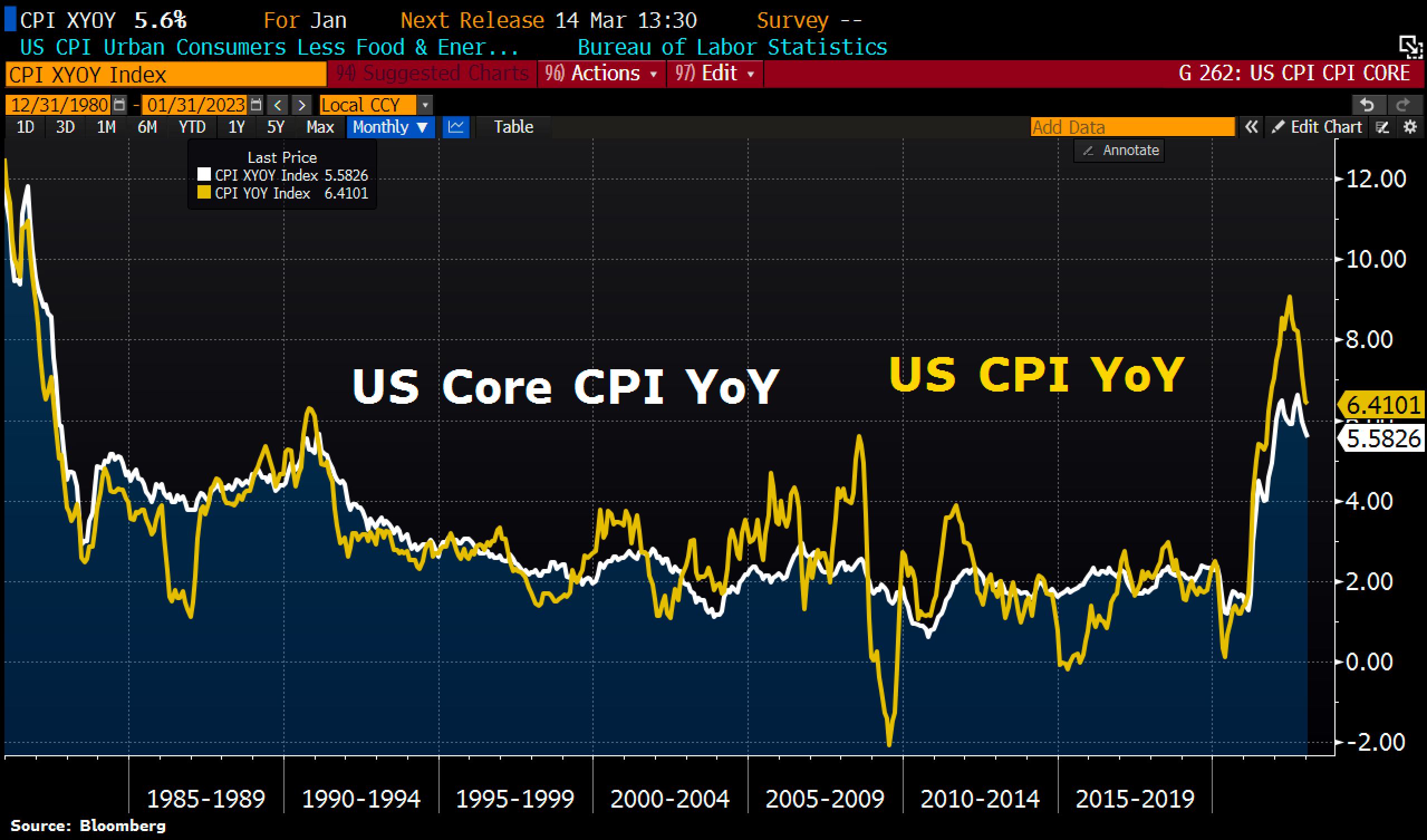

A mixed US CPI report

January US CPI was inline with Street estimates on MoM basis, coming in +0.5% for the headline number and +0.4% for the core. On YoY basis, things ran bit hot, coming in +6.4% headline (down from +6.5% in December but ahead of Street estimates at +6.2%) and +5.6% for the core (down from +5.7% but ahead of St’s +5.5%. Source: Bloomberg, HolgerZ

The US 6 month T-Bill breaches 5% for 1st time since 2007

On the back of somewhat hot CPI data, The US 6 month T-Bill breaches 5% for 1st time since 2007. Source: HolgerZ, Bloomberg

A stronger than expected US GDP in Q1 ?

The GDPNow model estimate for real GDP growth (seasonally adjusted annual rate) in the first quarter of 2023 is 2.1 percent on February 7, up from 0.7 percent on February 1 - source: Atlanta Fed GDPNow

A reality check on Europe's energy shock: the French trade deficit

France's trade deficit in Dec. '22 was the widest in two decades when compared to the same month in previous years, a crude way to adjust for seasonality. Europe's energy shock is large and ongoing. Source: Robin Brooks

US existing home sales have been falling faster today than they did during the Great Financial Crisis

Source: Morgan Stanley

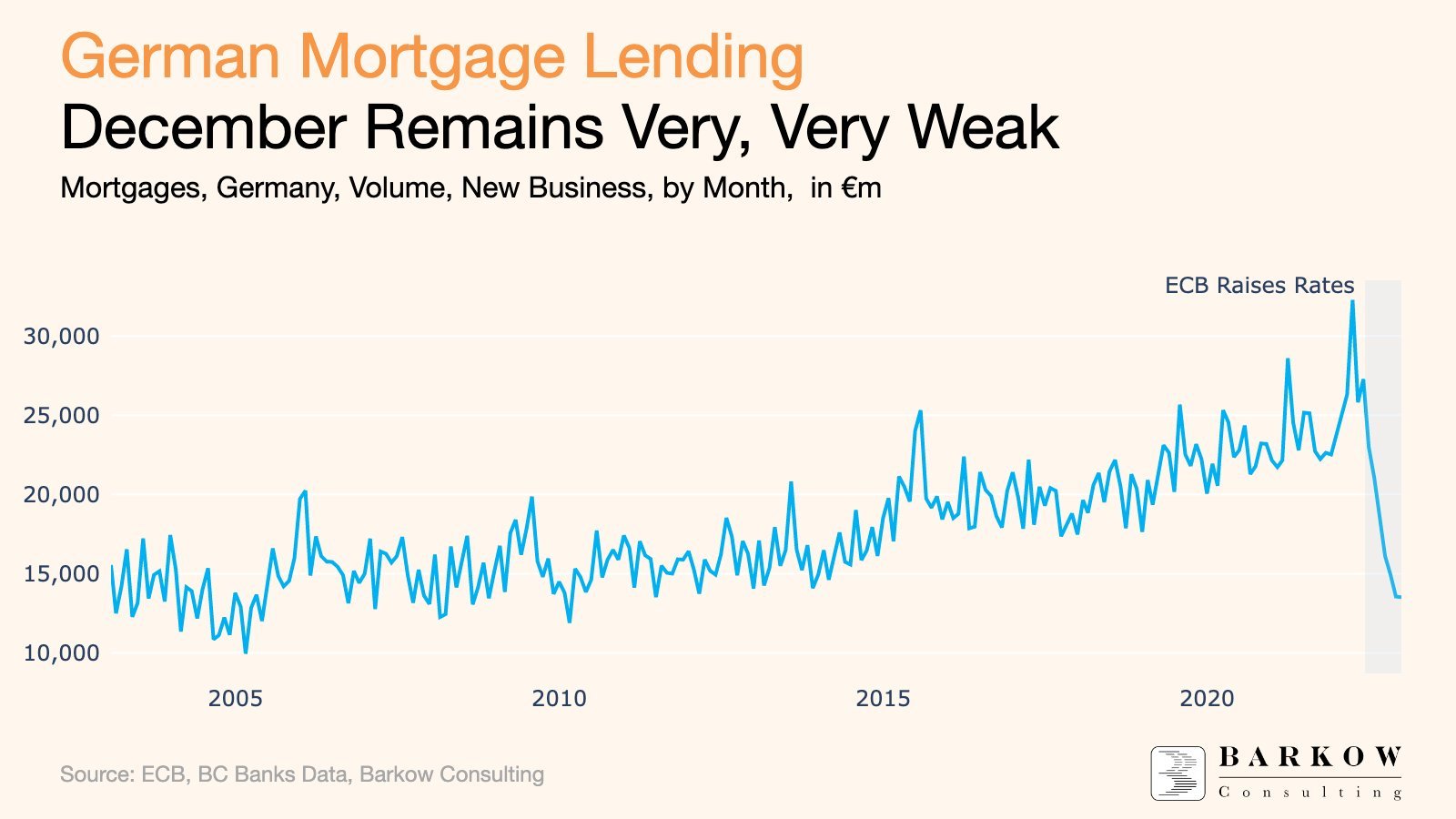

German housing market remains in a freeze

Mortgage lending was down 43% YoY in December, representing 4th negative record in a row since data records began in 2003. Compared with peak of €32.3bn from March 2022, the decline is almost 60%. Source: HolgerZ, Barkow consulting

Investing with intelligence

Our latest research, commentary and market outlooks