Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- nvidia

- tech

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- France

- UK

- assetmanagement

- ESG

- Middle East

- china

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

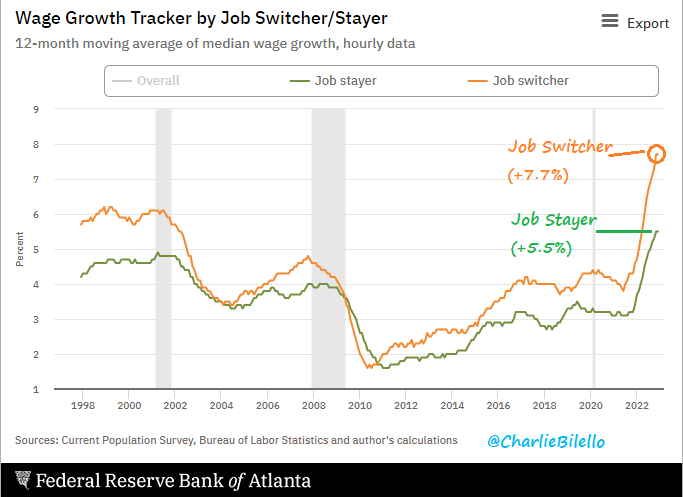

US wage growth: mind the the gap...

US workers who switched jobs received pay increases of 7.7% over the last year vs. 5.5% for those who stayed at their jobs. With data going back to 1997, this is the widest gap we've ever seen. Source: Charlie Bilello

Eurozone business activity back to growth

The start of 2023 saw Eurozone business activity show a tentative return to growth after six successive months of decline. But better growth in Jan came with rates of inflation edging higher in both manufacturing and services. Source: Jeffrey Kleintop, S&P Global

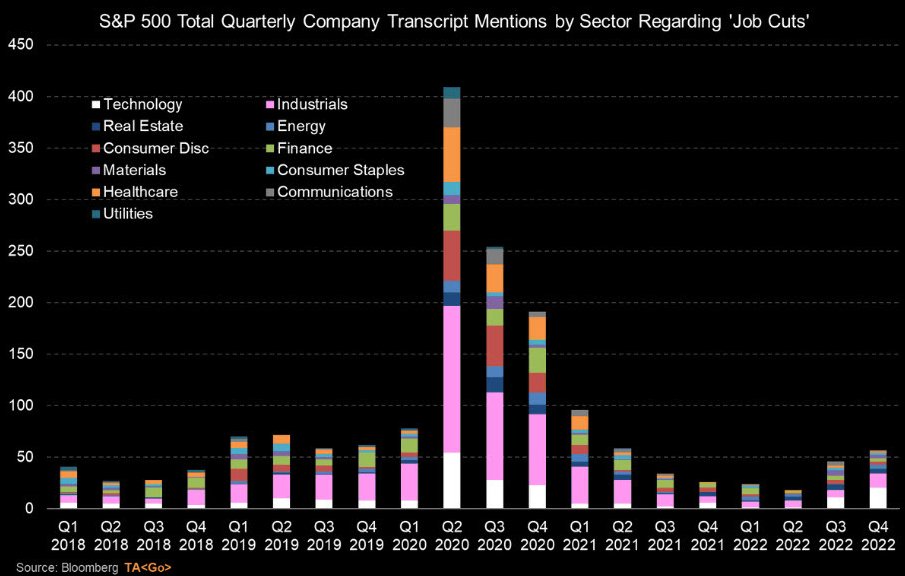

More companies are mentioning ''job cuts'' in the US

More companies are mentioning ''job cuts'' in the US. Still a limited amount, but now approaching 2019 levels. These figures would be consistent with 100k Non-Farm Payrolls ahead. The labor market is weakening, and if it doesn't the Fed will push until it does. Source: MacroAlf

Energy prices collapsed: European Gas Future now 84% below ATH, German 1y ahead Power Price 85% below ATH

Source: Bloomberg, HolgerZ

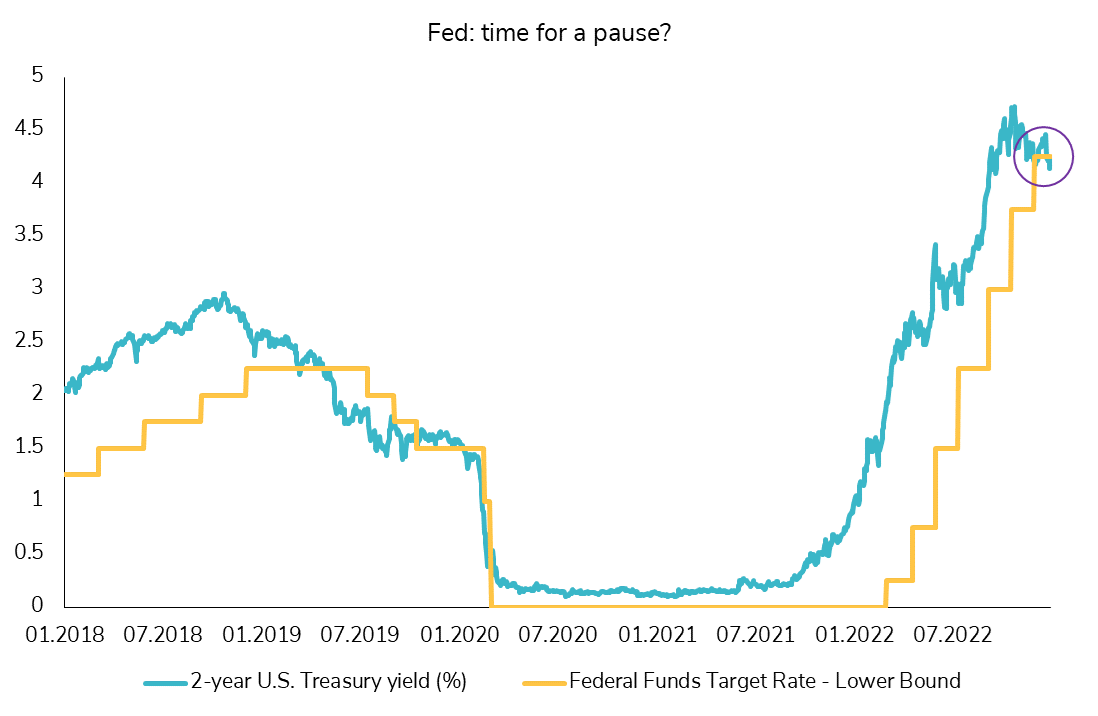

The Federal Reserve's hiking cycle: close to the end?

For the first time in this rate hike cycle, the 2-year U.S. Treasury yield is below the federal funds rate (lower bound). The market seems to be more and more convinced that this rate hike cycle of the US central bank will end soon.

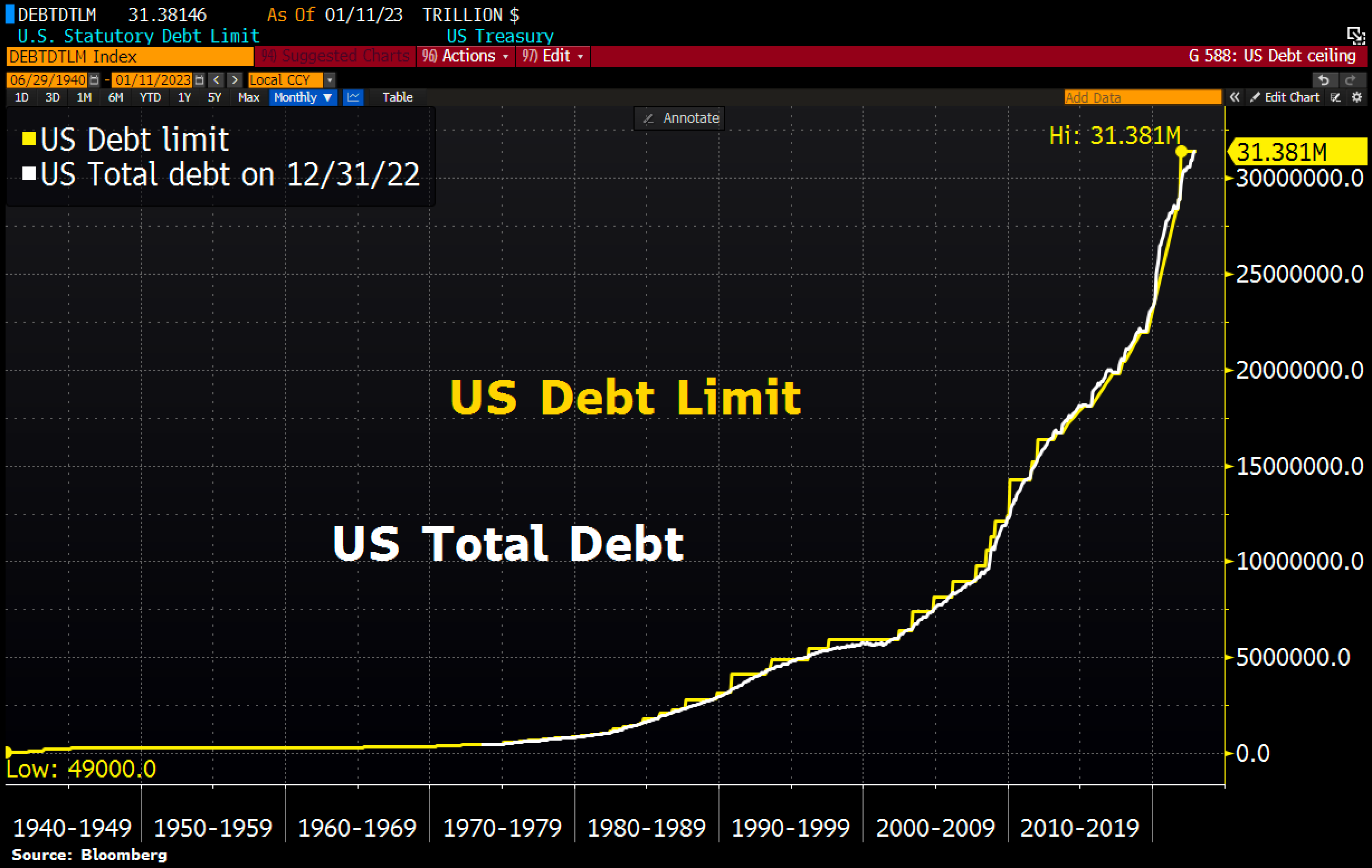

US will hit its debt limit Thursday, start taking steps to avoid default, Yellen warns Congress

Source: Bloomberg, HolgerZ

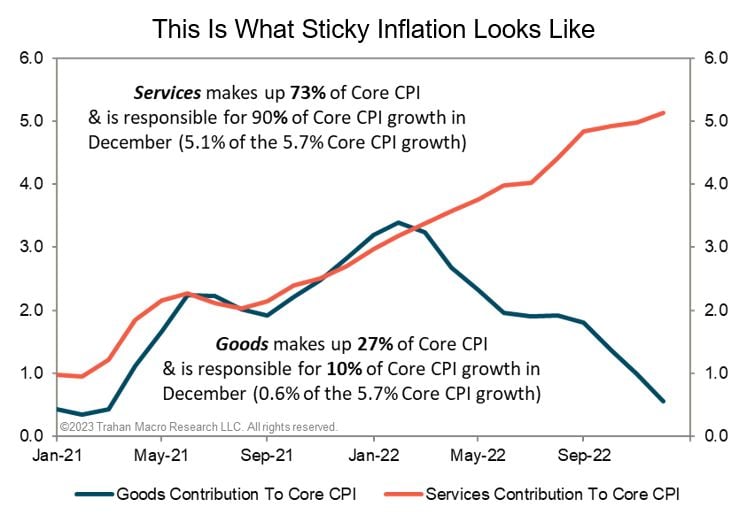

While inflation is cooling down, The Fed might need to keep tightening

While US inflation is materially lower from its peak, the chart below from Trahan Research shows why the Fed's job is probably NOT over. This chart shows the contribution of both Services and Goods inflation. Even if Goods CPI goes to 0% , Services inflation alone would still leave Core inflation above 5%. As long as core inflation stays above 5%, the Fed is unlikely to pivot.

Investing with intelligence

Our latest research, commentary and market outlooks