Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

The US Treasury cash balance just reached another recent low

The latest government report is out, and the US Treasury cash balance just reached another recent low. Only $187 billion is left. Let's keep in mind that February's deficit alone cost $262 billion. Ultimately, this could mean that we are about to see another flood of Treasury issuances if/when the debt ceiling issue gets resolved. Will the natural supply/demand mismatch caused by this dynamic pressure yields higher and create further problems in the fixed-income market= Source: Boomberg, Tavi Costa, Crescat Capital

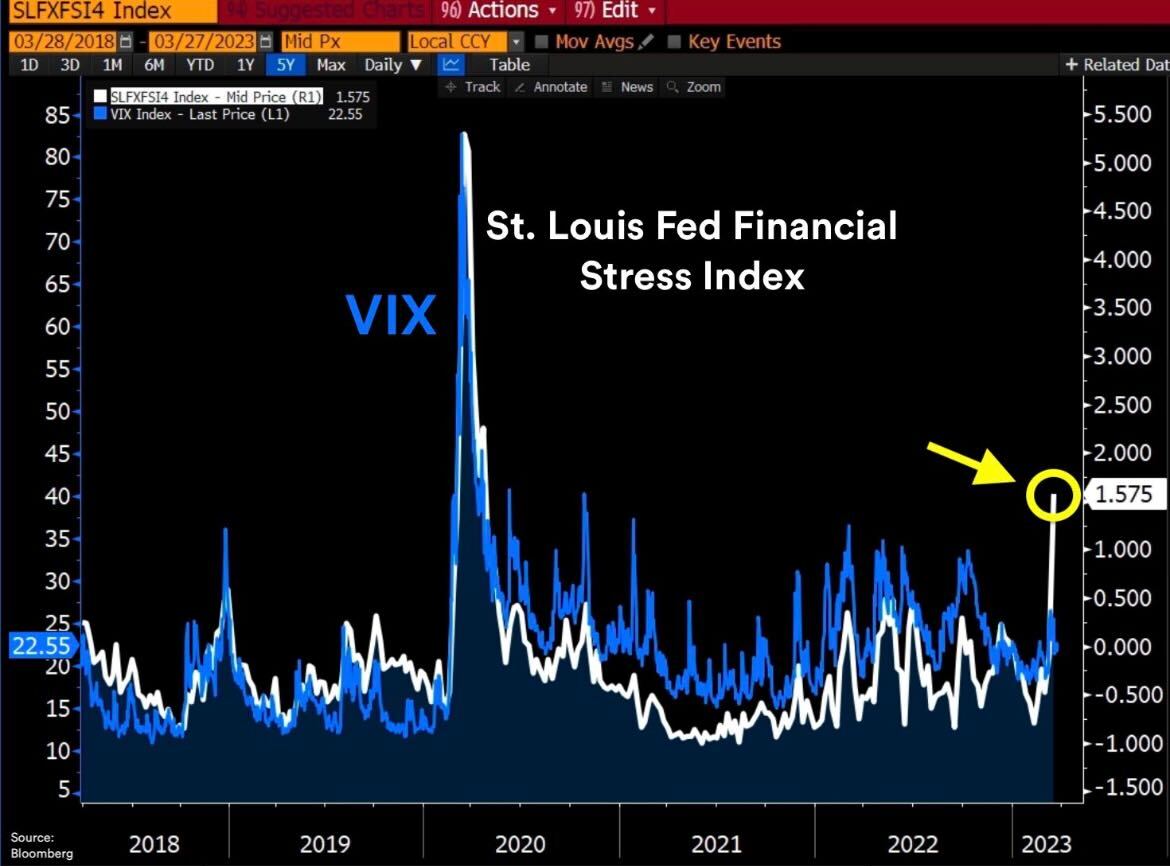

St. Louis Fed Financial Stress Index rises to 1.575 - a level seen only four times during the last 30 years

In every case VIX hit at least 45. During the last two spikes, it hit 80. Source: Bloomberg, Oktay Kavrak, CFA

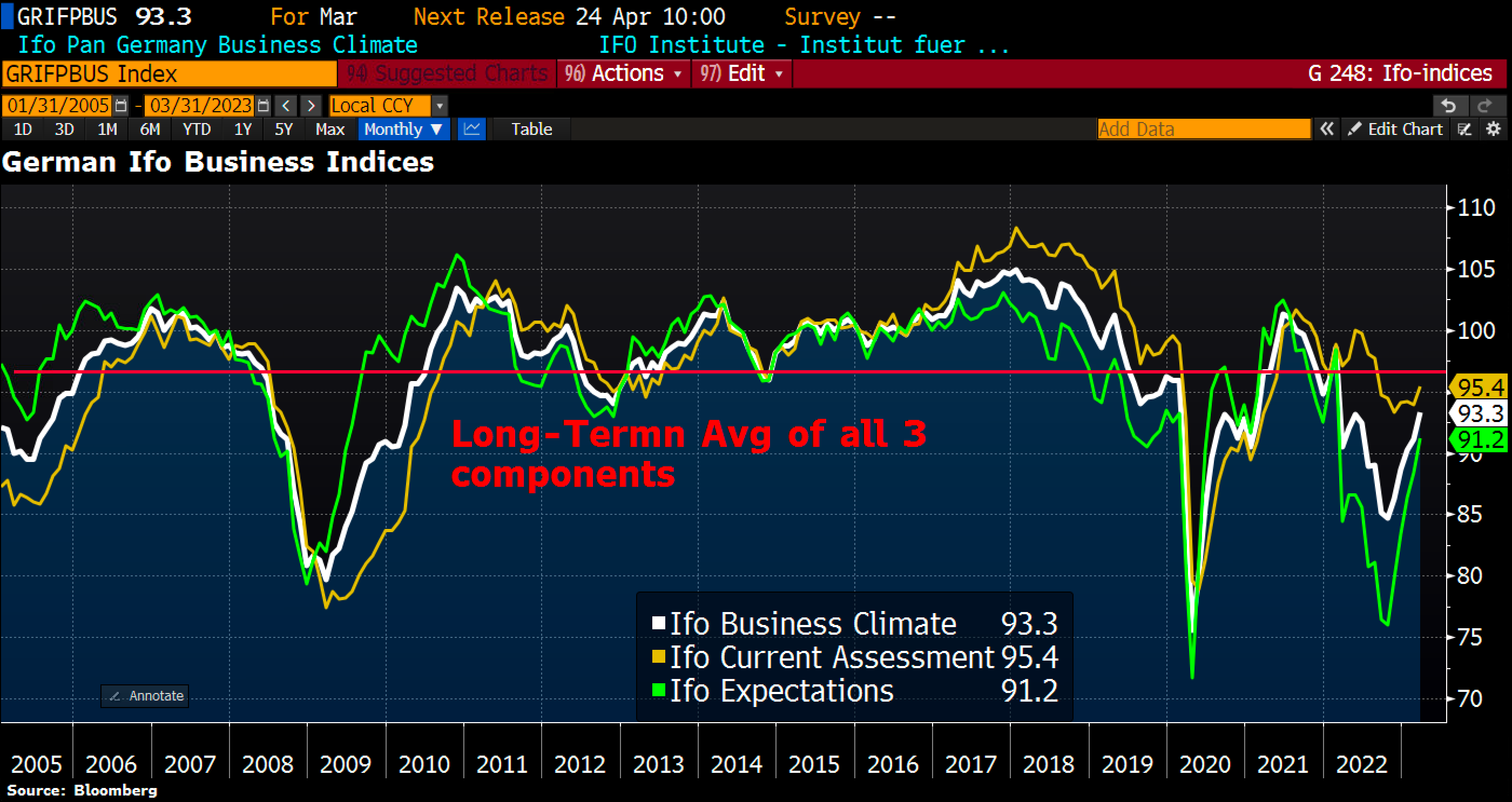

German Ifo business confidence shows economy's resilience against the recent banking crisis

German Ifo business confidence shows economy's resilience against the recent banking crisis, w/all 3 Ifo components rising in March. Data highlight that industry is holding up as the threat of an energy crunch recedes. BUT all 3 indexes remained a bit below long-term avg of 96.6. Source: HolgerZ, Bloomberg

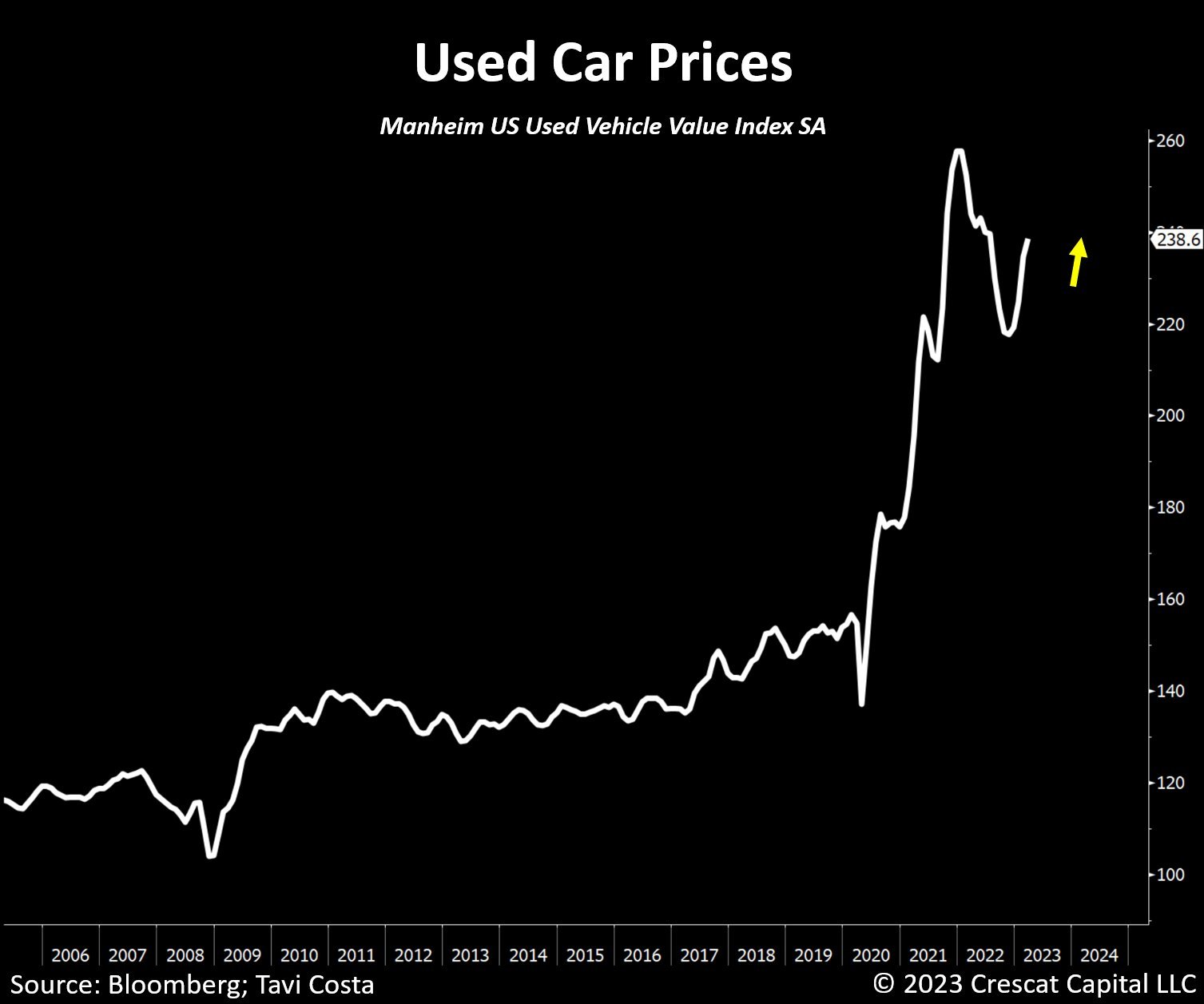

Used car prices increased again for the 5th month in a row

Prices continue to firm up at historical levels, despite being down about 2% on a year-over-year basis. Inflationary forces remain stubbornly high due to structural macro drivers. The Fed just erased 5 months of QT in two weeks. Will it add fuel to the inflation fire? Source: Tavi Costa, Bloomberg, Crescat Capital

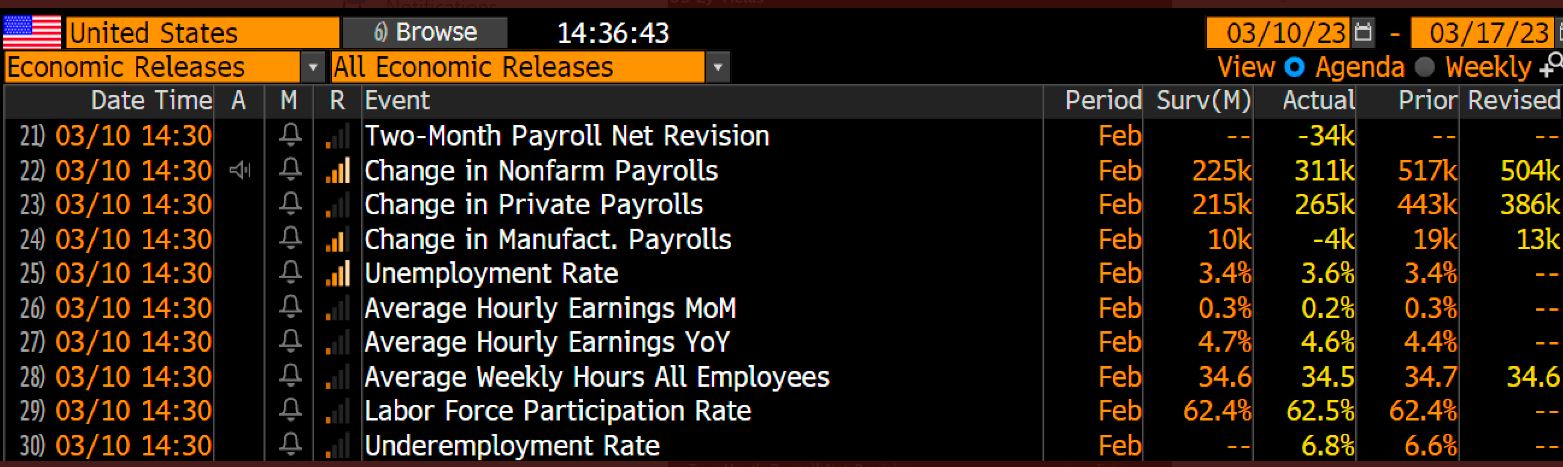

Unemployment rate increased to 3.6%, above expectations

February US jobs data was mixed. US economy created 311k new jobs in February, above forecast of 225k but household numbers below forecasts with unemployment rate rises to 3.6% above 3.4% expected AND wages cool. Monthly wages rose 0.2% vs 0.3% expected.

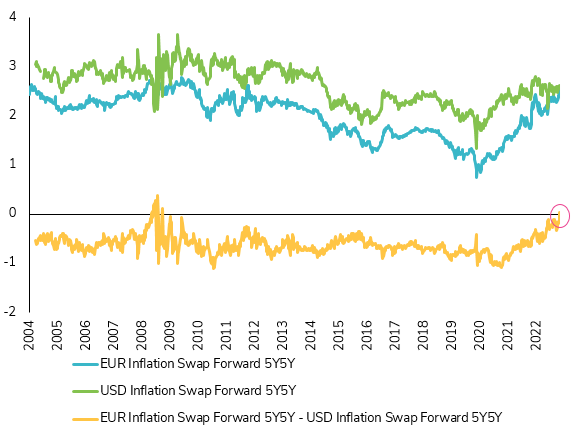

Another indicator shows that inflation is expected to be higher in EUR than in US in the medium term!

The 5y 5y forward inflation swap, an indicator of what the market expects inflation to be over the next decade, is rising faster in Europe than in the United States. In fact, markets seem to expect more inflationary pressure in Europe than in the U.S. over the medium term. This is quite significant because the last time this gap between inflation expectations in Europe and the US was in positive territory was in 2009! So more pressure on the ECB to continue tightening monetary policy! Source: Bloomberg

Long term inflation expectations higher in Europe than in US!

For the first time in more than 10 years, markets expect long-term inflation to be higher in the Eurozone than in the U.S. A direct result of the fact that the FED seems to be fighting inflation more aggressively than the ECB? Source: Bloomberg

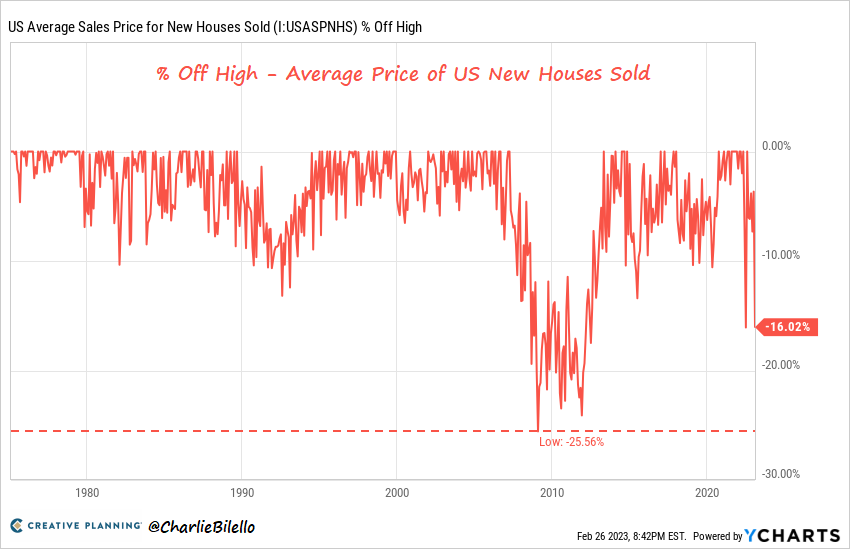

The average price of a new home sold in the US is down 16% from its peak last July

After the last housing bubble peak the average new home price fell 25% nationally. Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks