Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

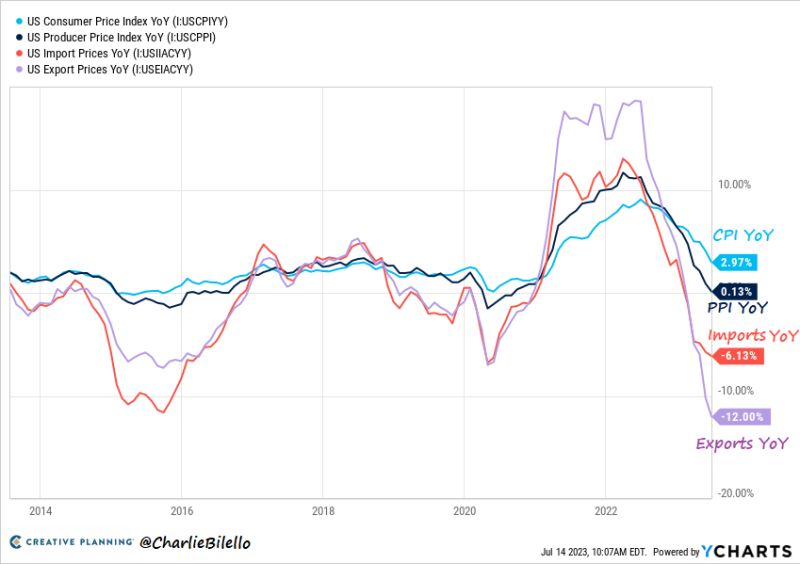

Disinflationary trends in the US

Disinflationary trends in the US 1) CPI Inflation: 3.0%, Lowest since March 2021. 2) PPI Inflation: 0.1%, Lowest since August 2020. 3) Import Prices: -6.1%, Lowest since May 2020. 4) Export Prices: -12%, Lowest on record. Source: Charlie Bilello

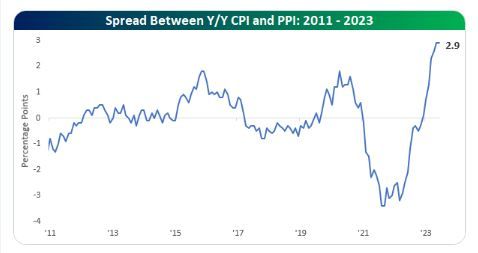

The spread between US CPI and PPI is a good omen for corporate profit margins

The spread between US CPI and PPI is a good omen for corporate profit margins. This is key to widening profit margins. Companies are able to boost the prices they charge consumers more and more relative to their input cost. The spread between y/y CPI and PPI remains at the widest levels since the current incarnation of PPI started in 2011. Source: Bespoke, Lisa Abramowicz

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected

More disinflation in the offing: US PPI slowed to 0.1% YoY in June, from 0.9% in May and lower than expected. This is smallest pace since Aug 2020 and is down from the all-time high of 11.7% YoY from March 2022 in a promising sign for CPI. Source: Bloomberg, HolgerZ

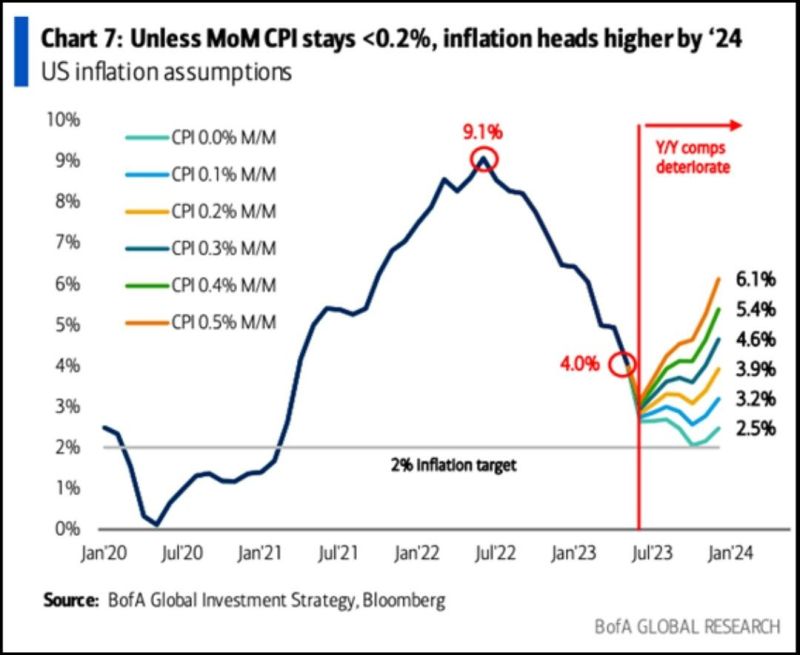

The easy part is over for disinflation as disinflationary base effects are behind us

The easy part is over for disinflation as disinflationary base effects are behind us. The MoM CPI now needs to be lower than 0.2% for #inflation to continue moving lower. Source: BofA

US 30 year Mortgage Rate

The US 30 year mortgage rate has hit a new decade high at 7.38%, up 23 bps since last week, per BankRate

With fiat currency, it is as simple as this...

With fiat currency, it is as simple as this... Source: Wall Street Silver

Investing with intelligence

Our latest research, commentary and market outlooks