Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- tech

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

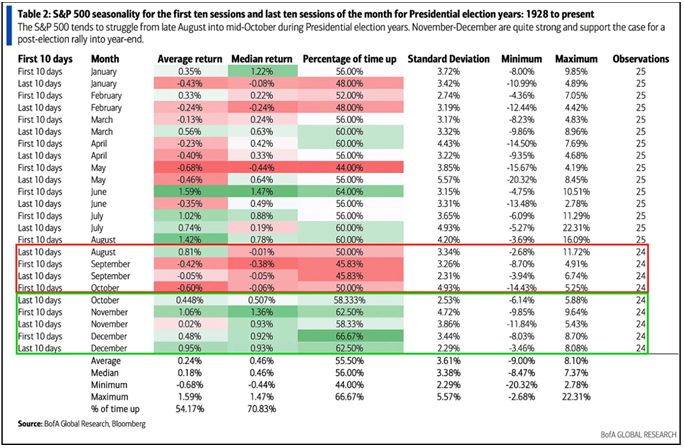

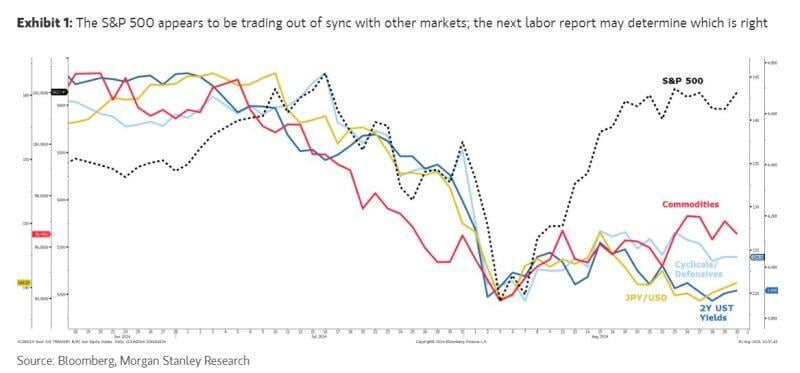

Markets tend to struggle from now until mid-October during Presidential election years

BofA

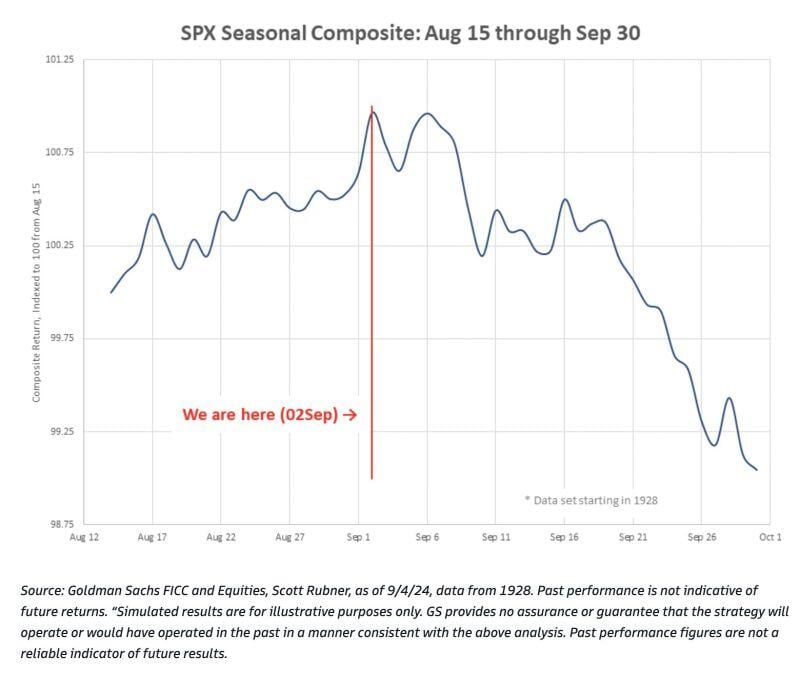

This Goldman chart shows that September is historically weak for global equities and risk assets w/avg return at -2.31%.

Sept 16th has been a seasonal turning point, w/2H Sept being the worst performing 2 weeks of the year, BUT maybe this seasonality gets pre-traded by market participants this year. Goldman says flow-of-funds, such as the quarter-end pension rebalancing can explain the annual weakness in September. Source: HolgerZ, GS

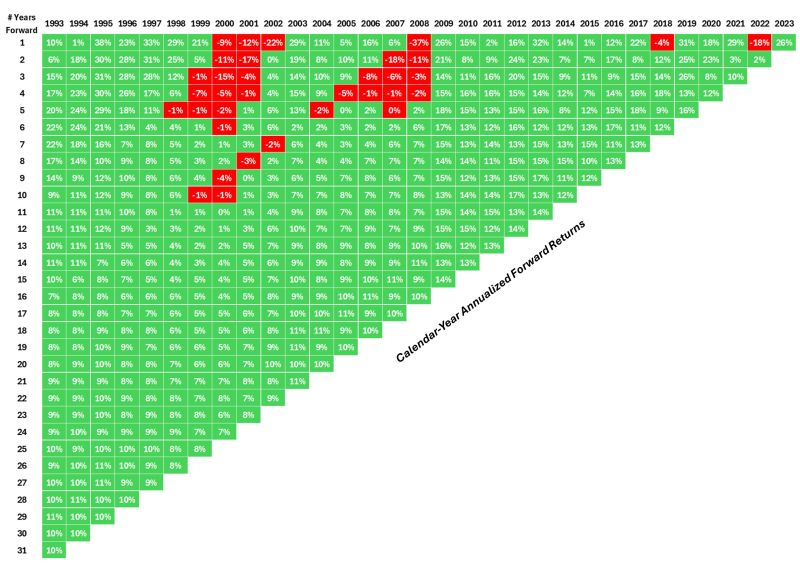

31 Years of Stock Market Returns in one chart offering a different perspective.

The past cannot predict the future. However, studying the past can provide a baseline to help set expectations when it comes to risk and a potential range of outcomes. Here’s a different way to look at returns over various time horizons for the S&P 500 going back to 1993, courtesy of awealthofcommonsense.com This is how to read this chart: 1) Pick a starting year. 2) Then, go down the number of years and the corresponding square will tell you the annualized return from that starting point. For example, the 9-year annual return starting in 1993 was 14% per year. You can see there’s been more green than red since 1993 but there were some painful periods for investors. There were no losses going out 11 years or more but starting in 1999 or 2000 led to a lost decade. You also had multiple time frames with losses going out 2, 3, 4 and 5 years into the future. Five years can feel like an eternity in the stock market. The range of outcomes is also interesting to consider. - The 10 year annual returns ranged from -1% to 17%. Over 15 years there was a high of 14% and a low of 4%. - On a 5 year time horizon the range was -2% to 29% annualized. Bottom-line: Your experience in the stock market can vary drastically depending on your timing. The good news is that the long term removes a lot of variation from the equation. Look at the returns in the bottom left — they’re all in a fairly tight range. The 31-year annual return from 1993 through 2023 was around 10% per year, right at the long-term averages. Not bad. Link to full article: https://lnkd.in/eutSyyYQ Source: Ben Carlson @awealthofcs

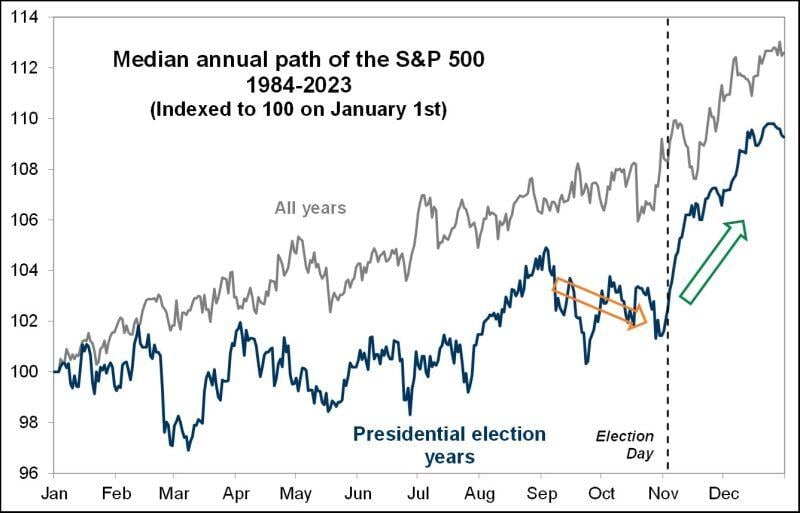

Yesterday's rout is right on schedule: in presidential election years, markets peak right around Labor Day then trap door all the way until the election.

September and October tend to be weak in election years. This doesn't mean the world will fall apart, but just be aware the calendar over the next 8 weeks isn't doing anyone any favours. "Plans are useless, but planning is everything." Eisenhower Source: Goldman Sachs, www.zerohedge.com, Ryan Detrick

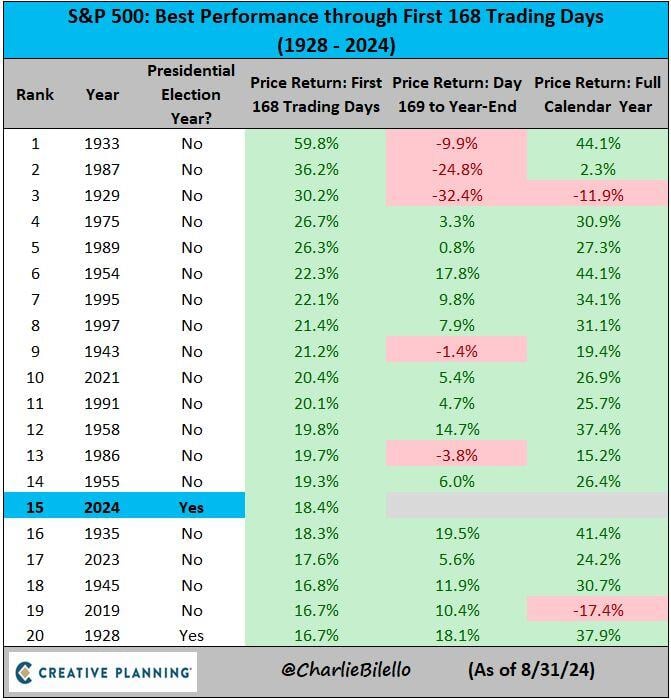

The S&P 500 is up 18.4% in the first 168 trading days of 2024, the 15th best start to a year going back to 1928 and best start to a presidential election year ever.

Source: Charlie Bilello

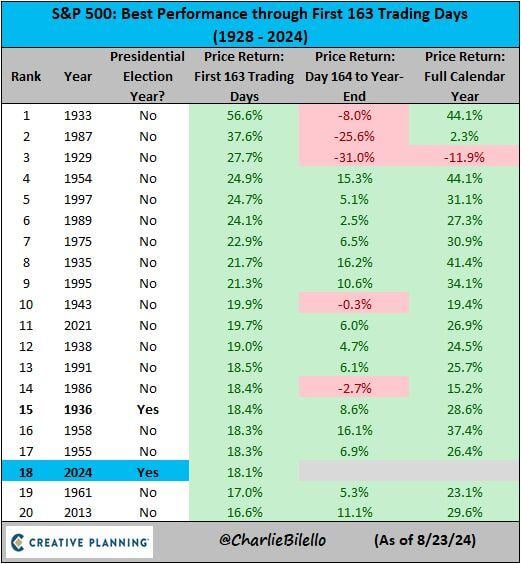

The sp500 is up 18.1% in the first 163 trading days of 2024, the 18th best start to a year going back to 1928 and 2nd best start to a presidential election year ever. $SPX

Source: Charlie Bilello

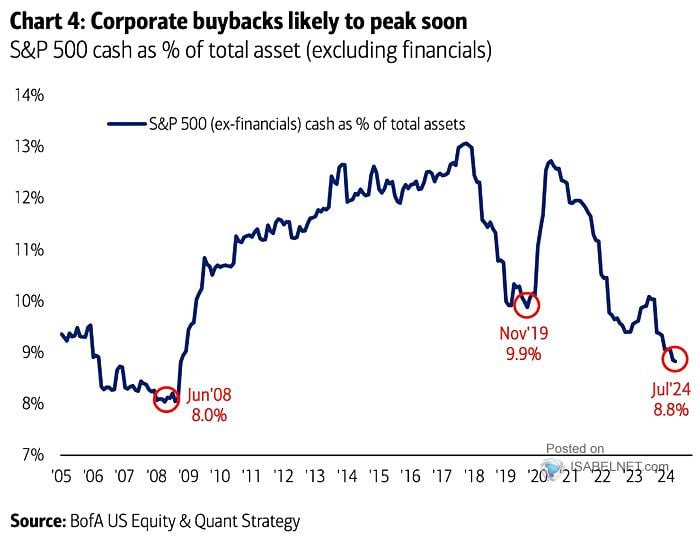

Will the share buyback effect soon fade?

Since 2000, Share Buybacks have comprised ~100% of net equity purchases. Such has been a huge support for higher asset prices. That is all fine until you run out of cash to execute buybacks. Source: h/t @ISABELNET_SA, BofA, Lance Roberts

Investing with intelligence

Our latest research, commentary and market outlooks