Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- tech

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

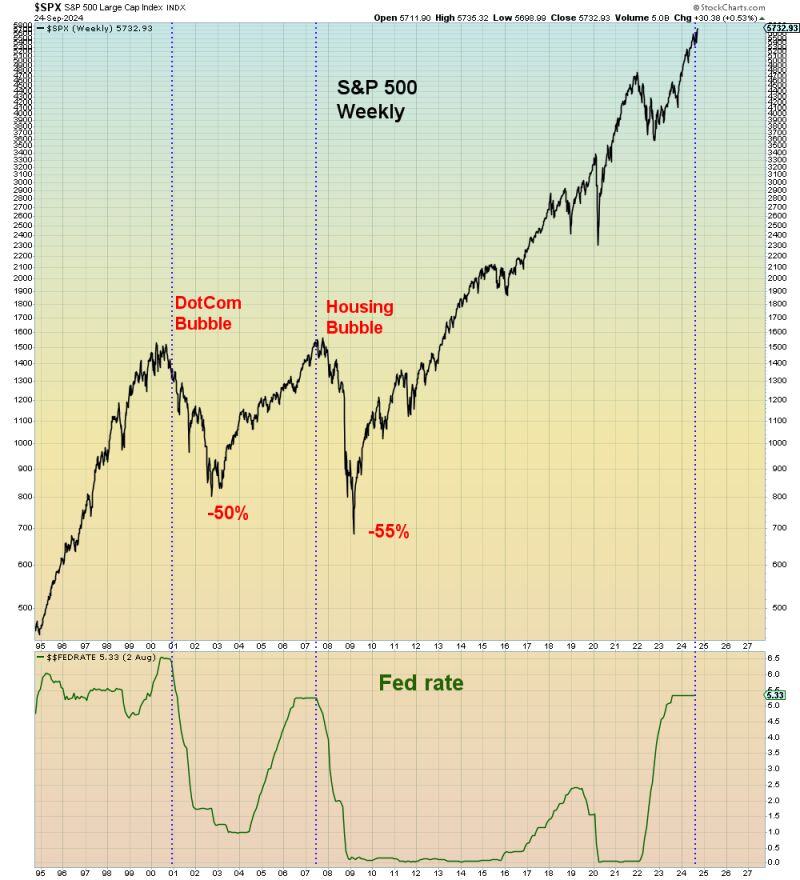

😱 The "shocking chart of the day" that no bulls want to see 😱

Source: Mac10

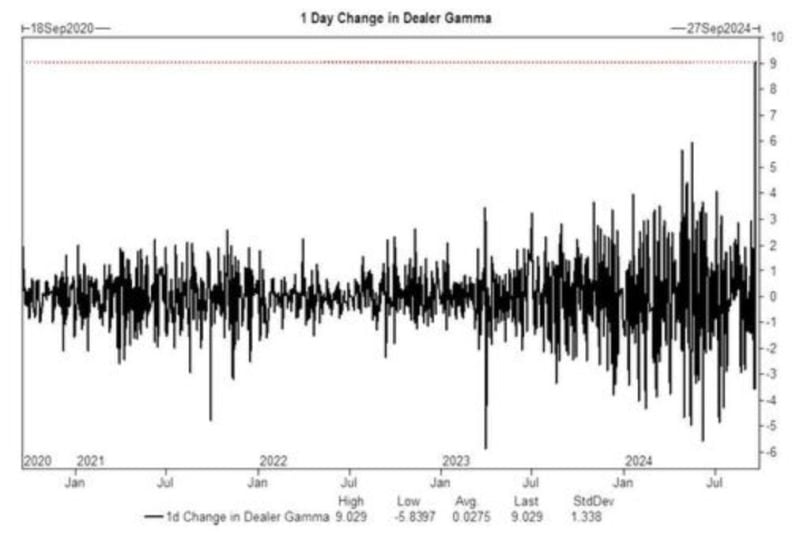

Friday's daily change in S&P 500 Dealer Gamma, $9 Billion, was the largest in history

Source: Barchart

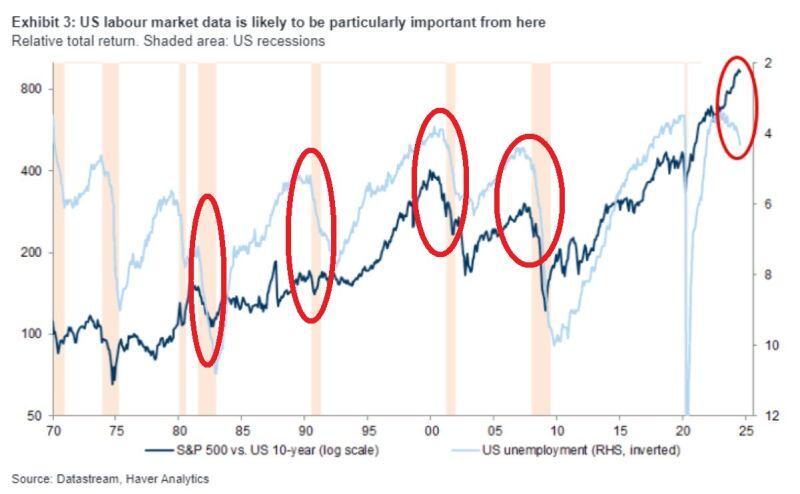

🚨US UNEMPLOYMENT RATE USUALLY RISES BEFORE THE S&P 500 CORRECTION🚨

US jobless rate rose from 3.4% in April 2023 to 4.2% in August near the highest in 3 years. In the past, when the unemployment rate was rising, the S&P 500 index saw significant declines. The us jobs reports in the coming weeks will be key... Source. Global Markets Investor

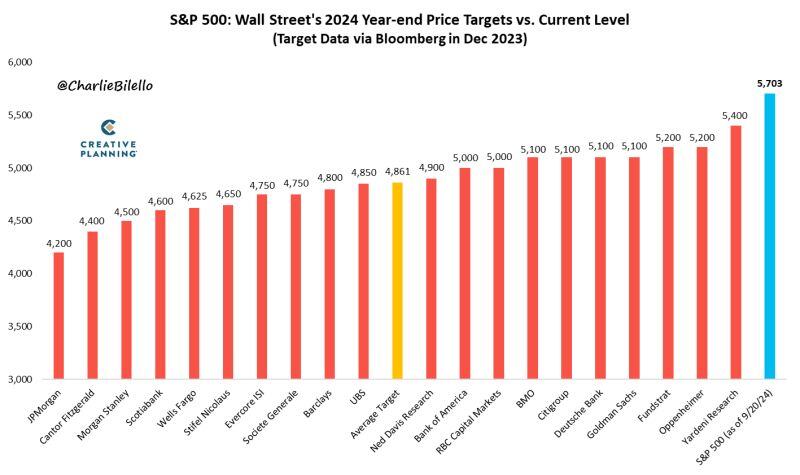

At 5,703, the S&P 500 is now over 300 points above above the highest 2024 year-end price target from Wall Street strategists and 17% above the average target (4,861).

And there's still 3 months to go in the year. $SPX Source: Charlie Bilello

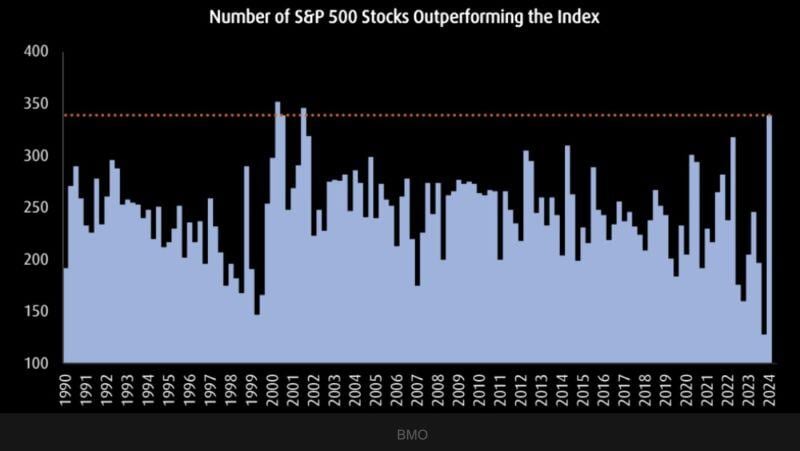

The number of sp500 stocks outperforming the index is the highest since 2002.

Source: Barchart, BMO

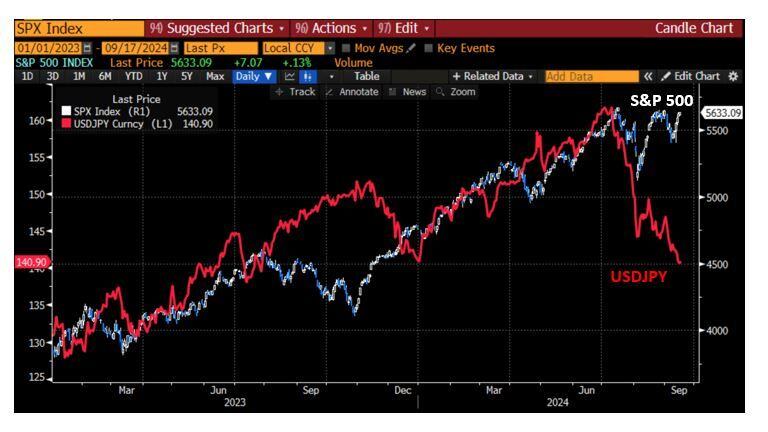

Remember when early August the strengthening of the yen and ensuing carry trade unwinding was seen as a huge threat for the equity market?

Fast forward to mid-September: the S&P 500 and USDJPY are taking two opposite directions. The market doesn't seem to care anymore about the yen... Source: Bloomberg, RBC

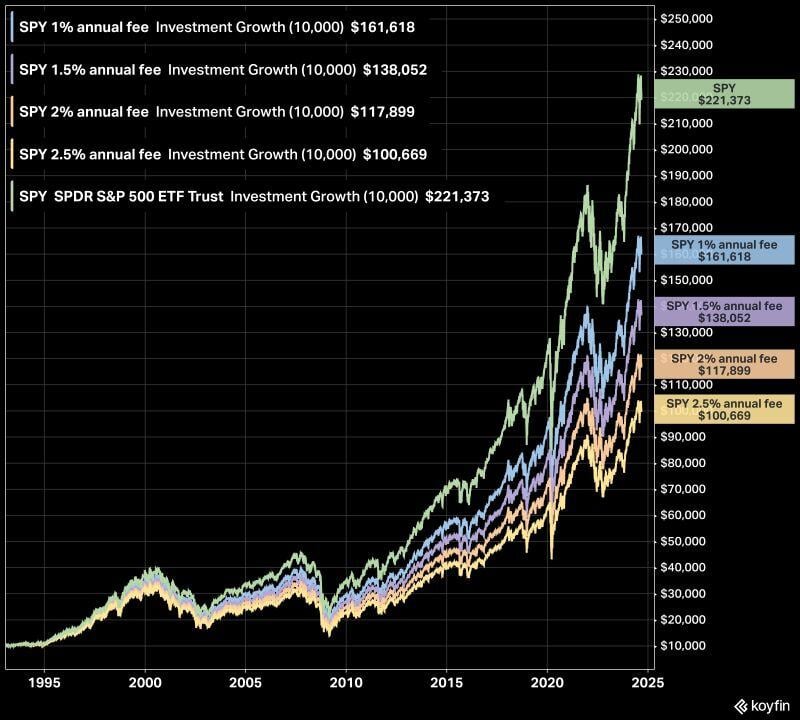

Is buying the dip still the best strategy? The average return when buying the dip in the S&P 500 varies based on timeframe.

Within 6 months of buying a -10% decline, the average return has been +13% compared to a +4% return when holding stocks through the pullback and recovery. Within 12 months, the "buy the dip" strategy has returned a +22% gain, beating a +5% return with the buy and hold strategy. On the other hand, buying dips over a 5-year period has returned +33%, well below a +75% from simply holding. In other words, buying the dip has been a successful strategy during periods of market volatility.

Investing with intelligence

Our latest research, commentary and market outlooks