Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

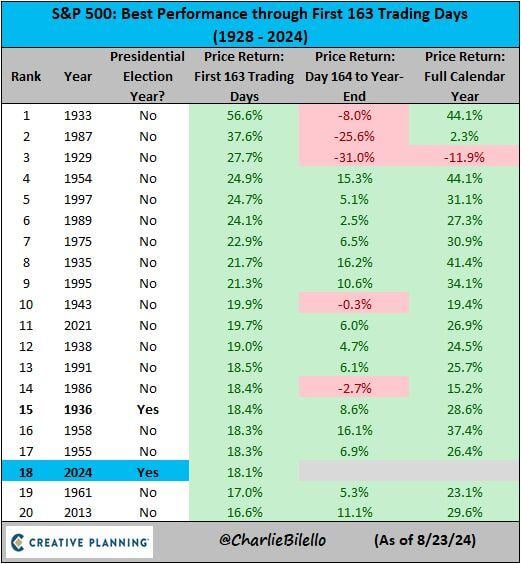

The sp500 is up 18.1% in the first 163 trading days of 2024, the 18th best start to a year going back to 1928 and 2nd best start to a presidential election year ever. $SPX

Source: Charlie Bilello

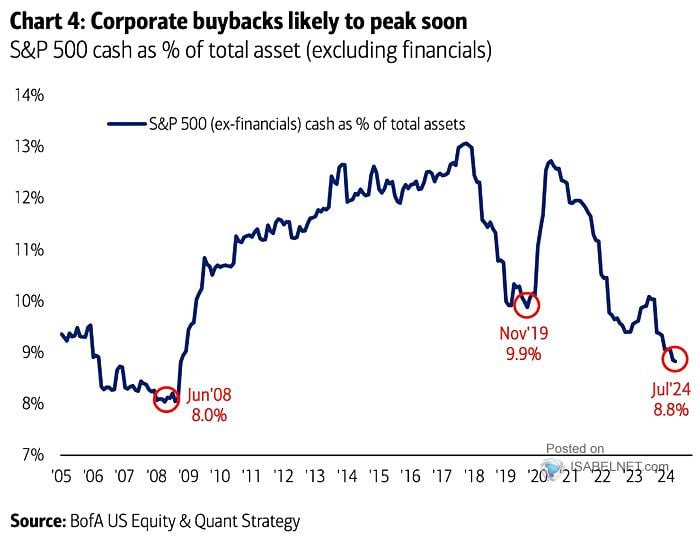

Will the share buyback effect soon fade?

Since 2000, Share Buybacks have comprised ~100% of net equity purchases. Such has been a huge support for higher asset prices. That is all fine until you run out of cash to execute buybacks. Source: h/t @ISABELNET_SA, BofA, Lance Roberts

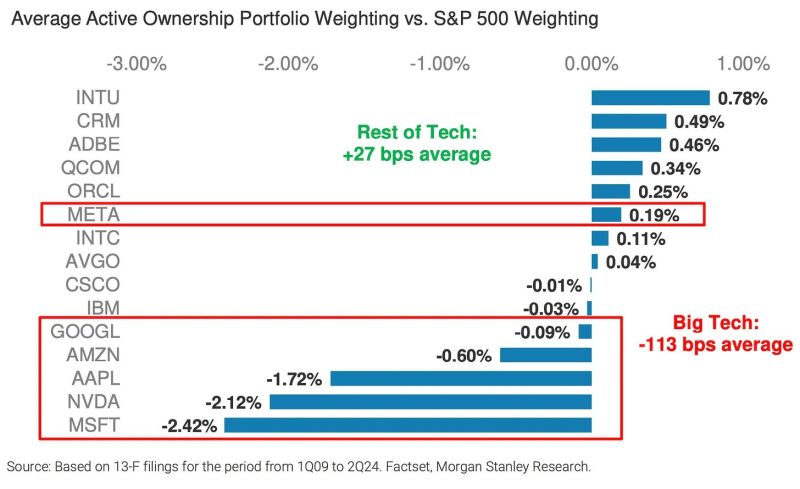

What are the most under-owned and over-owned large-caps stocks in portfolios?

"Of the large cap stocks we evaluate, MSFT, NVDA, AAPL, AMZN, and GOOGL are currently the most under owned in actively managed portfolios vs. the S&P 500, while INTU, CRM, ADBE and QCOM are the most over-owned." - MS Woodring. Source: Daily Chartbook, MS

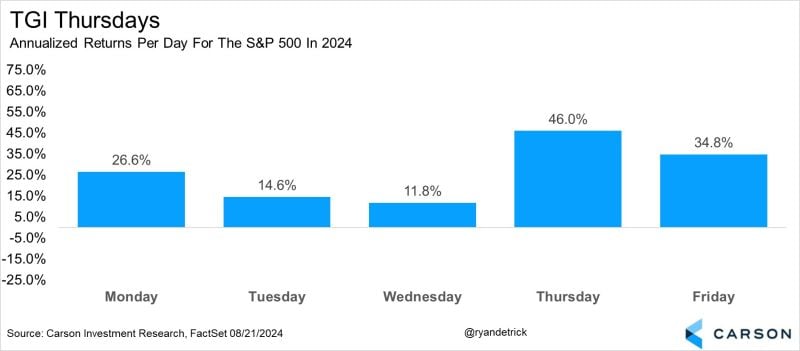

TGI Thursdays

The S&P 500 is up an annualized +46.0% on Thursday so far in 2024. This would be the best return for Thursday since '21 (+51.5%) and best for any day since Friday last year (+53.0%). Bottom line, in bull markets you tend to see strength ahead of the weekend. ✔☑✅ Source: Ryan Detrick, CMT @RyanDetrick on X, Carson research

Here's a look at the 30 best performing S&P 500 stocks over the last 20 years since Alphabet $GOOGL IPO'd

NVIDIA $NVDA is on top followed by Apple $AAPL, Netflix $NFLX and then Monster Beverage $MNST. Alphabet ranks 11th just behind Salesforce $CRM. Source: Bespoke

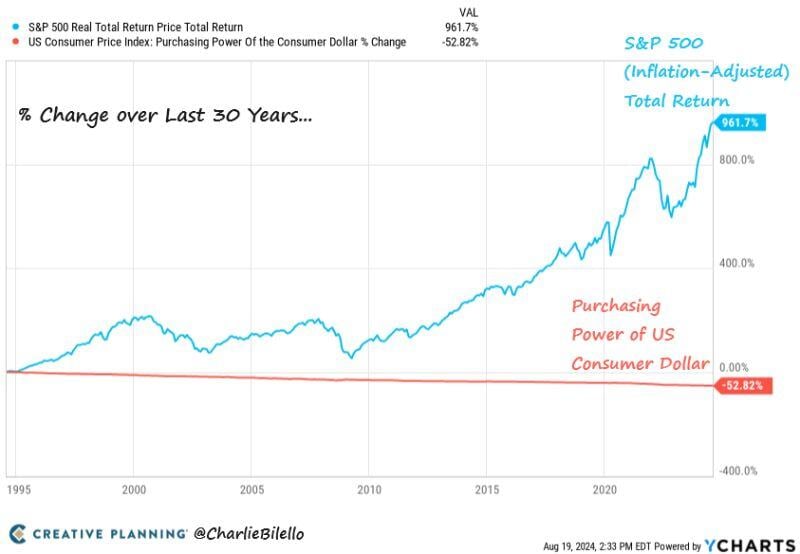

Why you need to invest, in one chart

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation. At the same time, the SP500 has gained 962% (8% per year) after adjusting for inflation. Source: Charlie Bilello

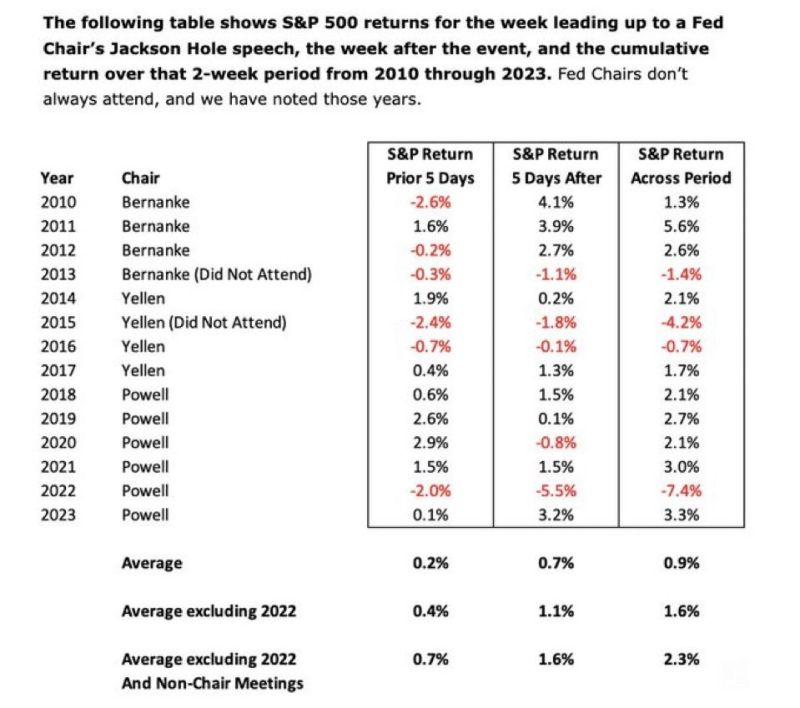

All eyes on Jackson Hole this week

Looking at historical returns, it is rarely a big deal for markets. Will this time be different? Source: The Transcript

Investing with intelligence

Our latest research, commentary and market outlooks