Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

Finally some red on the S&P 500 index heat map...

US stocks plummeted yesterday as 10-year treasury yields and us dollar have risen for the last couple of weeks. Gold and Silver dropped sharply as well. Performance today: S&P 500 -0.9% Nasdaq -1.6% Russell 2000 -0.9% Dow Jones -1.0% Bitcoin -1.6% Bank Index +0.3% VIX +6%, front mth futures VIX +5% Gold -1.1% Silver -3.5% WTI Crude Oil -1.0% Source: Global Markets investor

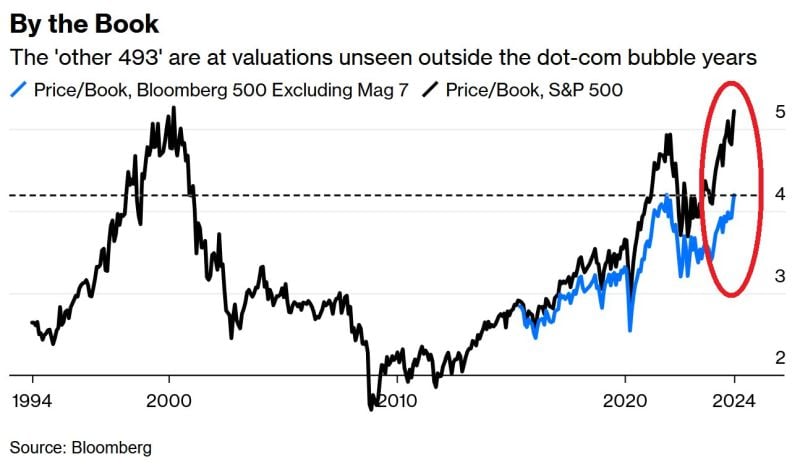

S&P 500 VALUATION IS IN LINE WITH THE 2000 DOT-COM BUBBLE PEAK

S&P 500 Price to Book (assets minus liabilities) ratio is now 5.2x, the most on record and in line with the 2000 Dot-Com bubble burst. When excluding the Magnificent 7 group, the P/B ratio is 4.2x, near a record. Source: Global Markets Investor

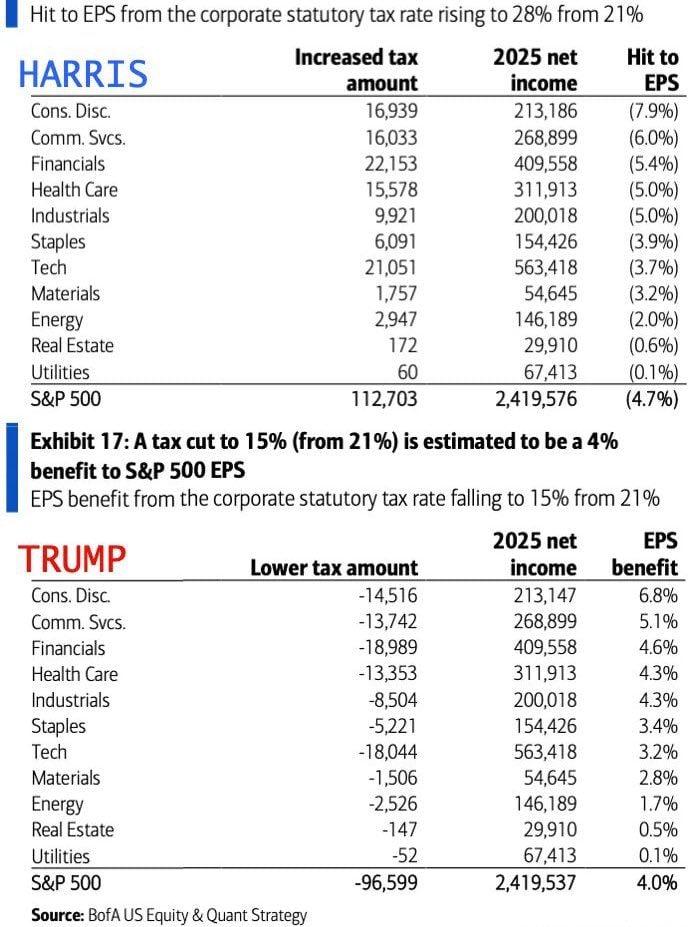

What could be the tax effects on SP500 EPS based on a Trump or Harris win? Here's what BofA projects:

- They said a Harris administration would be a 4.7% headwind to overall S&P EPS growth and a Trump administration would be a 4% tailwind to S&P earnings. - The only caveat here is if we have a split congress. If so, Kamala may win but not be able to pass sweeping tax policies. Given current market action, it seems the market is currently pricing in those 2 scenarios: 1) Either Trump wins 2) or if Kamala does, she can’t pass her new tax policies because of a divided congress. Source: amit @amitisinvesting on X, BofA

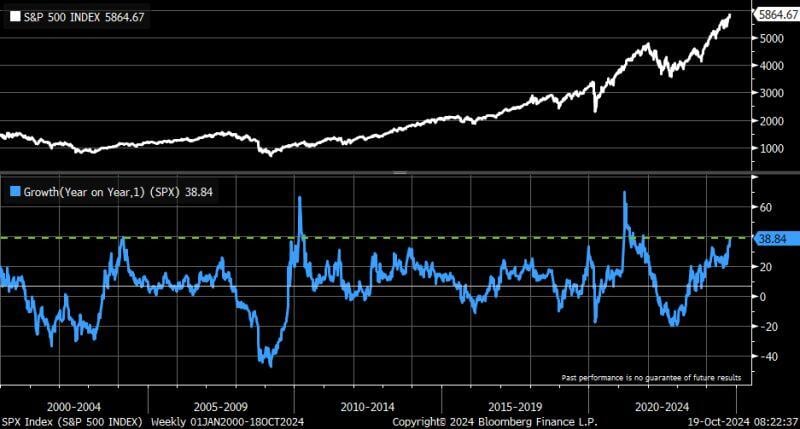

This is quite impressive ... the S&P 500 is up by 38.8% year/year.

Going back to 2000, there are only 25 weeks that had stronger gains, 24 of which were either in 2010 or 2021. Source: Bloomberg, Kevin Gordon on X

🚨THIS HAS HAPPENED ONLY 3 TIMES AFTER THE GREAT FINANCIAL CRISIS🚨

US corporate executives of the S&P 500 companies have been buying the least stock since the start of the 2021 bear market. Chart: @jasongoepfert thru Global Markets Investor

BREAKING: The equity put-to-call ratio has dropped to 0.44, the lowest since July 2023.

This is also the second-lowest level since March 2022. In other words, the appetite for hedging against a stock market decline is at its lowest in years. This is despite October being the worst month for stocks on average during Presidential Election years. Meanwhile. the SP500 has hit 45 all-time highs this year and is up 23% YTD. The resilience of this market is truly remarkable. Source: The Kobeissi Letter

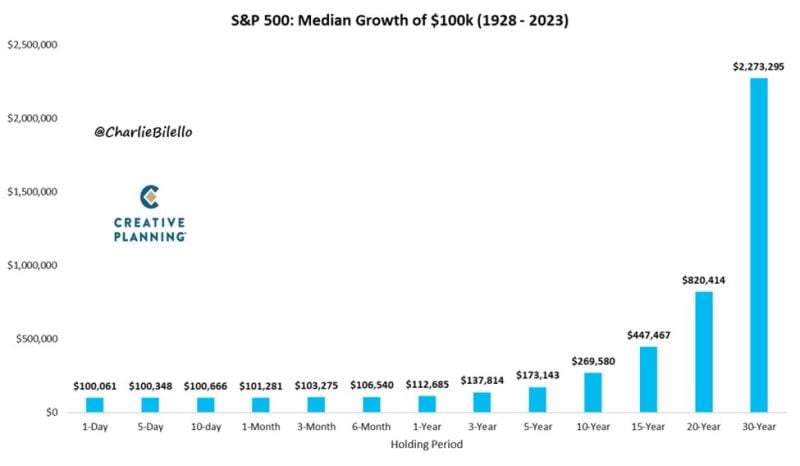

Time in the market vs. timing the market...

Time in the market can work magic! This is an example showing the median growth of 100k given length of time in the market. Source: Peter Mallouk, Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks