Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- tech

- ETF

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- china

- France

- UK

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- brics

- recession

- africa

- Market Outlook

- Yields

- Focus

- shipping

- wages

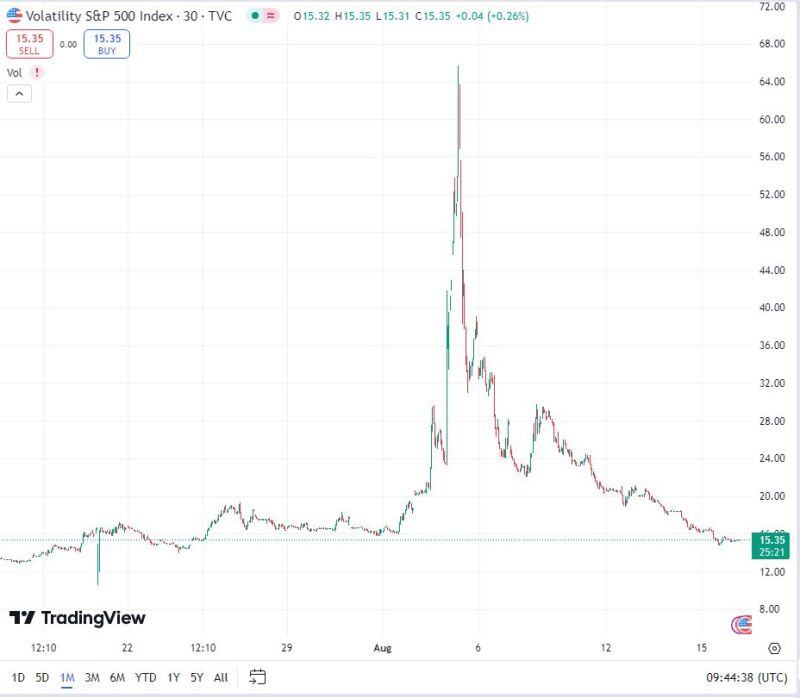

The VIX is now LOWER than it was before August 1st.... what a round trip...

Source: TradingView

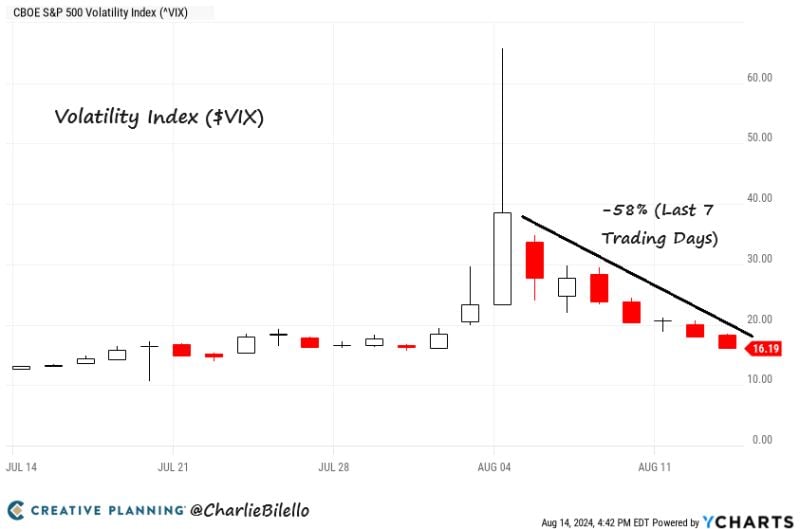

The $VIX has declined 58% (from 38.57 to 16.19) over the last 7 trading days, the biggest 7-day volatility crash in history.

Source: Charlie Bilello

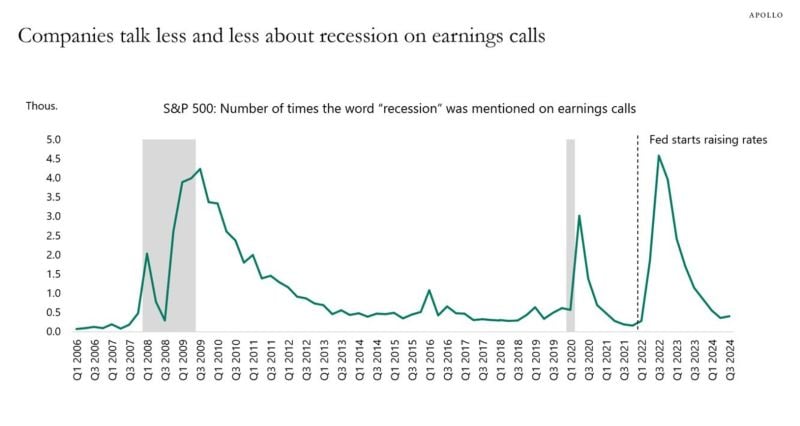

Torsten from Apollo: the reality is that firms on earnings calls talk less and less about recession

Source: Mike Z.

$SBUX Starbucks replaces CEO Laxman Narasimhan with $CMG Chipotle CEO Brian Niccol

$CMG Chipotle's stock is up 773% since Brian Niccol became CEO in March 2018 Just 9 S&P 500 stocks have performed better than $CMG since March 2018 $SBUX must have paid him the star bucks... Source: Stocktwits

There's the rest of the market .. and then there's $NVDA

Source: Markets & Mayhem

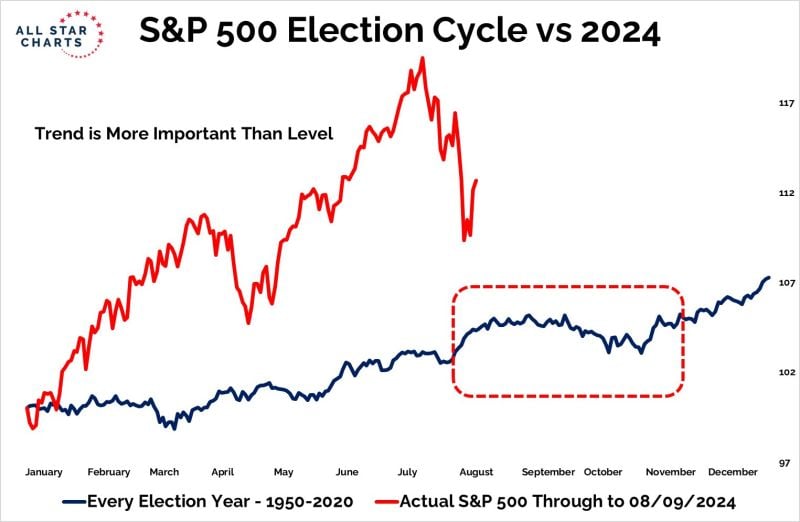

On average with the 4-year cycle... the next few months are sideways at best...

Source: Grant Hawkridge

Investing with intelligence

Our latest research, commentary and market outlooks