Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

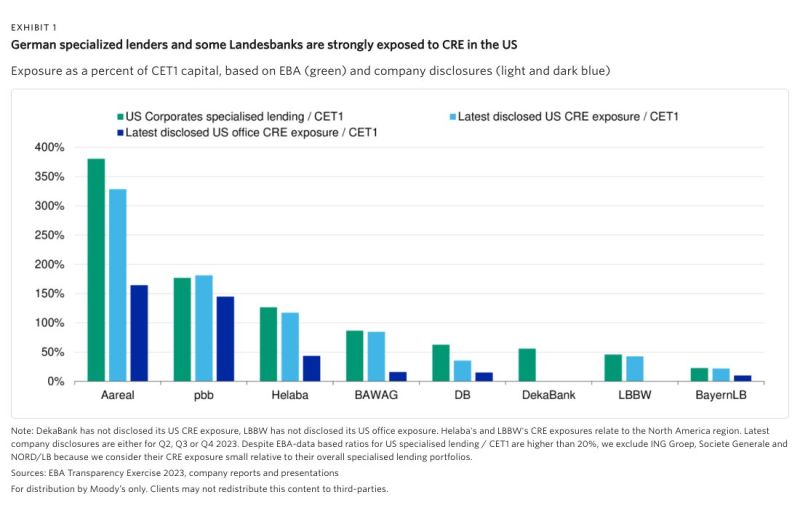

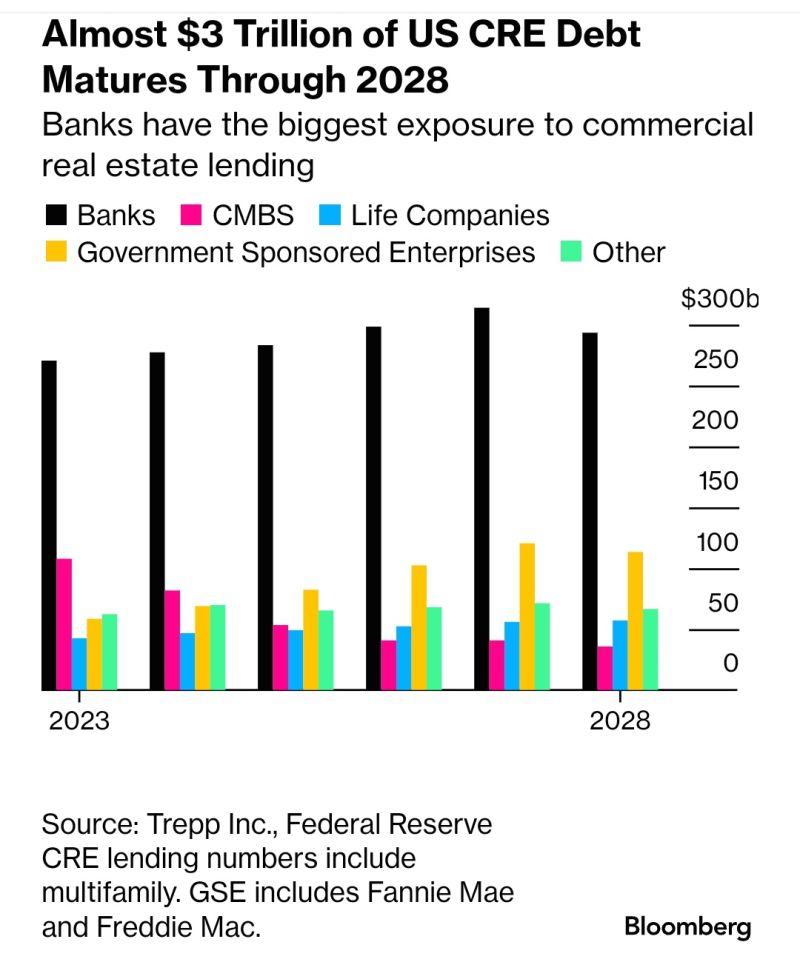

What is the exposure of German banks to us commercial real estate?

According to Moody's, Aareal Bank & Deutsche Pfandbriefbank have the largest exposure compared w/their capital levels. The shares of Deutsche Pfandbriefbank, which is the most shorted in Germany, have recently lost a quarter of their value. In case of Deutsche Bank, there is a gap between banks' exposure to US specialized lending and exposure to banks' US CRE book as DB engages to a material extent in other asset-based or project lending that would also qualify as specialised lending, according to Moody's. Source: Dekabank, HolgerZ

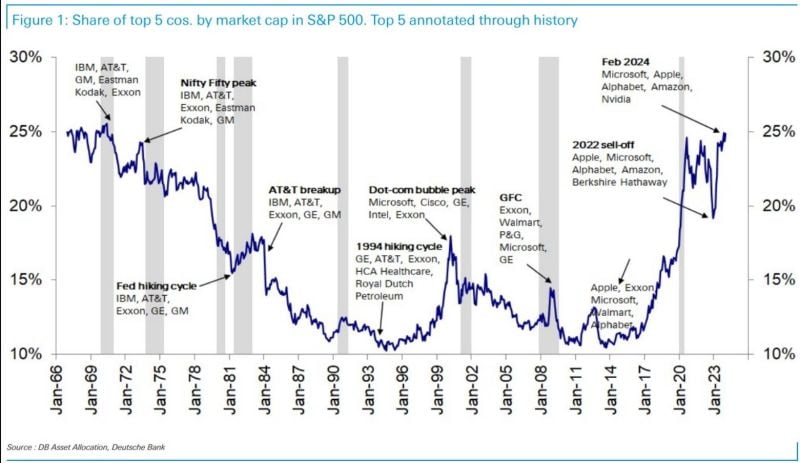

The rally on Wall Street has meant that US equities now have a weighting of ~70% in the popular MSCI World index.

That is a record. The risk is correspondingly high if US equities go out of fashion. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks