Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

In a surprise Monday ruling, SCOTUS determined Donald Trump is eligible to run for office again

The decision is a massive victory for Trump, whose eligibility on Colorado's ballot was challenged. The decision was issued one day ahead of Super Tuesday when 16 states will hold primary elections. Source: Business Insider

Another damming poll for Biden: With 8 mths left until Nov election, Joe Biden’s 43% support lags behind Donald Trump’s 48% in the national survey of registered voters

The share of voters who strongly disapprove of President Biden’s handling of his job has reached 47%, higher than at any point in his presidency. The betting markets are now also backing Trump. PredictIt has him 6%-pts ahead. Source: Bloomberg, HolgerZ

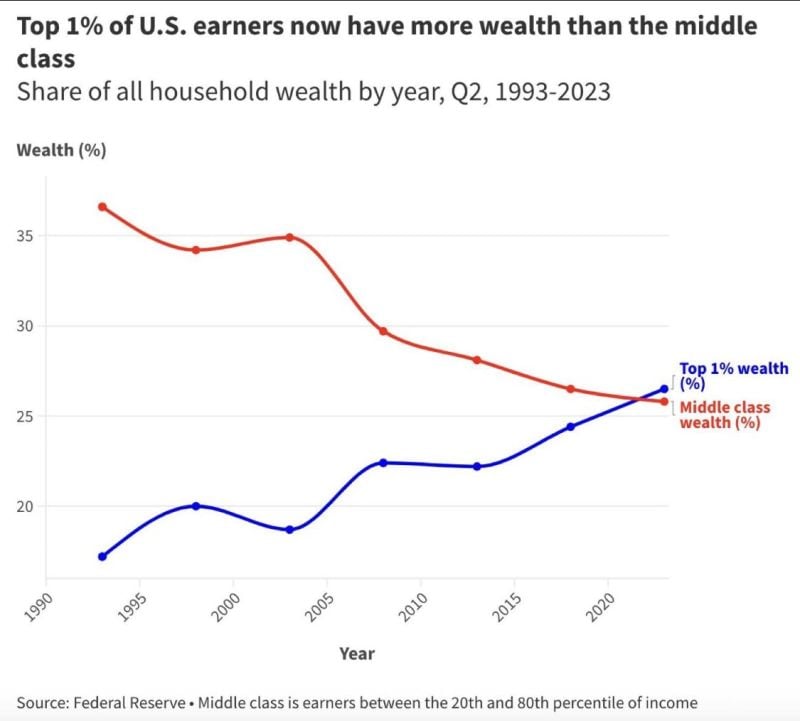

Wealth inequality keeps rising

The Top 1% of US earners now have more wealth than the middle class

🚨 February numbers are in and the Mag 7 are now the 𝗙𝗮𝗻𝘁𝗮𝘀𝘁𝗶𝗰 𝟰 year to date

Nvidia , Meta , Microsoft and Amazon driving all the gains while Apple , Google and Tesla fall out of the 7. Source: John Haslett, CA(SA), FRM

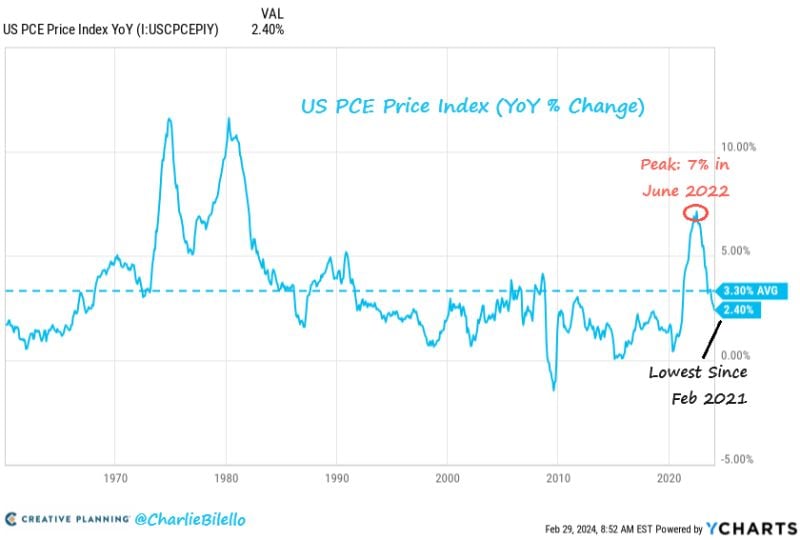

More evidence of a decline in US Inflation...

The PCE Price Index moved down to 2.4% in January, its lowest level since February 2021. Cycle peak was 7% in June 2022. Source: Charlie Bilello

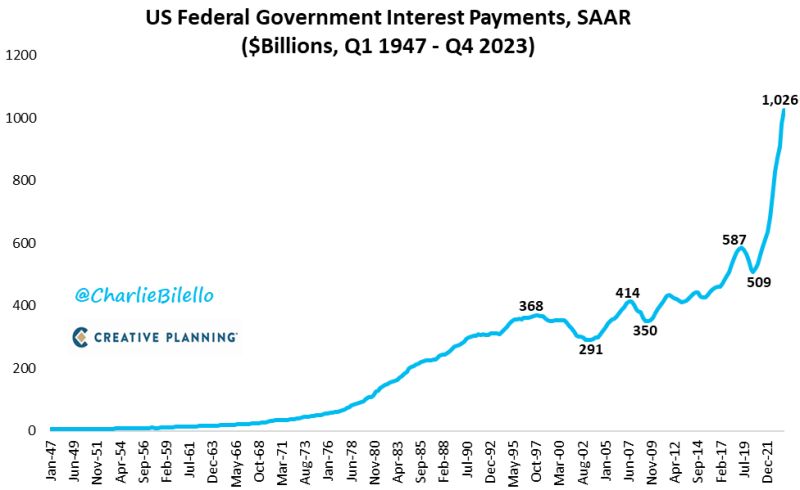

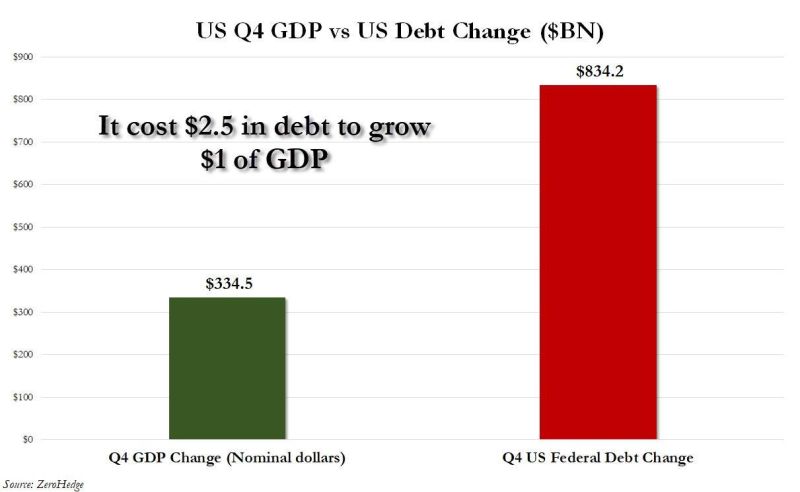

When you invest in US debt, think twice...

In Q4 2023, nominal GDP grew by 3.2% according to data on Wednesday. This would mean a $334.5 billion increase in nominal GDP. Meanwhile, over the same time period the US added $834.2 billion of debt. In other words, it cost us $2.50 of debt for every $1.00 of GDP last quarter, according to Zerohedge. As Fed Chair Powell recently said, "we are on an unsustainable fiscal path." What's the long term plan here? Source: The Kobeissi Letter, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks