Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

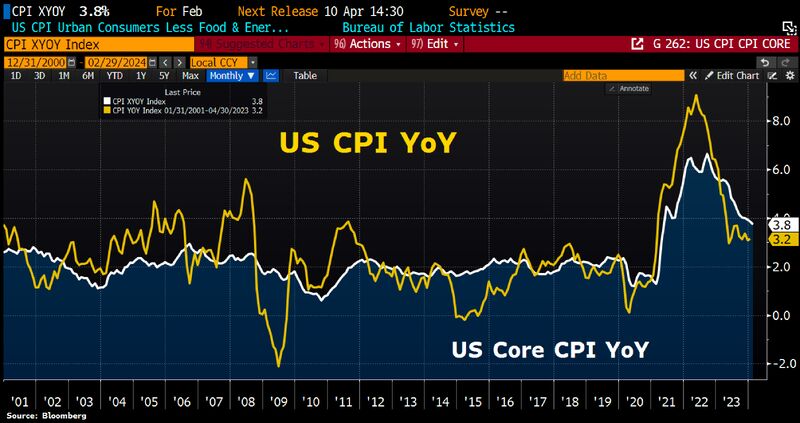

US inflation looks sticking, at least decline in the US headline CPI is stalling since Jun 2023.

In Feb, CPI rose by 0.4%MoM, both overall & excluding energy & food. Prices for services in particular increased, reflecting rising wage costs. High inflation rate in Jan was not an outlier. Source: Bloomberg, HolgerZ

The US is pumping more oil than any country in history

US crude production has surpassed every record in history for six years in a row, the US Energy Information Administration wrote on Monday. Its latest peak reached in 2023 is unlikely to be broken by any near-term competitor, it said.Including condensate, last year's US crude production averaged 12.9 million barrels per day, eclipsing the 2019 global record of 12.3 million barrels per day.A monthly record also occurred in December, at over 13.3 million b/d. Source: business insider

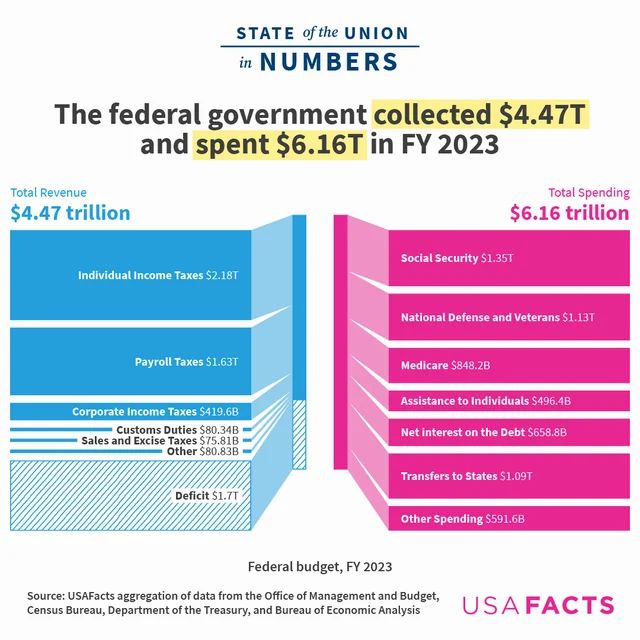

The US federal government collected $4.47 trillion and spent $6.16 trillion during FY 2023 . . .

Source: Markets & Mayhem

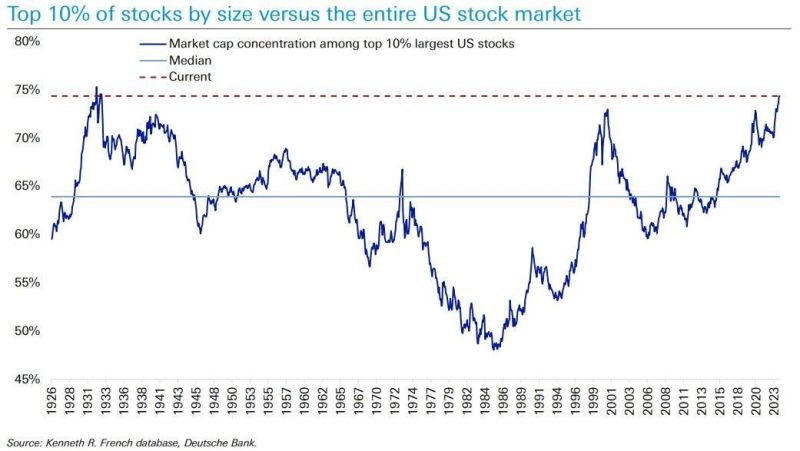

Less and less listed companies; but big companies are getting bigger...

The number of publicly listed companies in the US has declined by 50% since 1995. Currently, there are just over 4200 public companies in the US. The same trend has been seen in the number of banks in the US which was at 31,000 in 1920 but just 4,000 today. Meanwhile, the top 10% of stocks in the US now reflect ~75% of the entire market. This is, by far, the most concentrated 🇺🇸 stock market since the Great Depression in 1931. Even in the Dot-com bubble of 2001, concentration of the top 10% of stocks peaked at ~72% before the 2008 Financial Crisis, it peaked at nearly 66%. Big companies are indeed getting bigger! Source: The Kobeissi Letter, Wall Street Engine

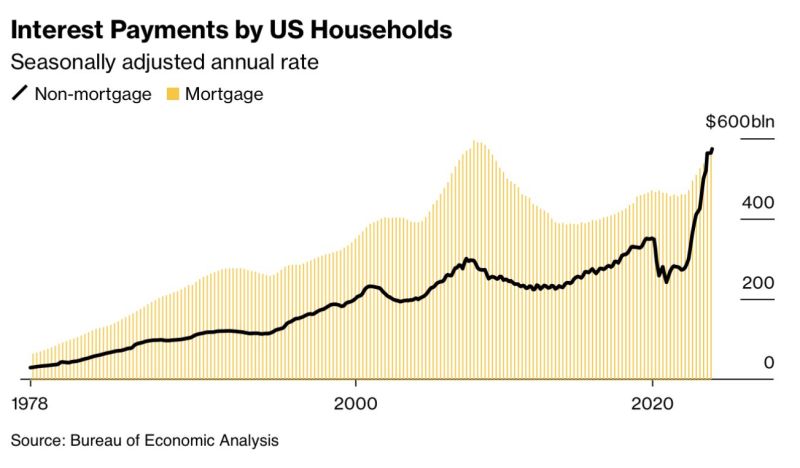

U.S. Households are now spending a record $573.4 billion on non-mortgage interest payments which for the first time in history is roughly the same as mortgage interest payments.

source : Barchart

U.S. companies will have to start telling the public about their climate risks

The SEC voted Wednesday to impose climate-disclosure requirements that will be significantly softer than those it proposed in March 2022 after the agency received thousands of comment letters and numerous litigation threats over the plan. In the biggest change, the regulator won’t force companies to quantify pollution from their supply chains or customers, known as Scope 3 emissions. Additionally, firms will face a higher bar for when they need to reveal more direct carbon footprints in their regulatory filings, which are known as Scope 1 and Scope 2 emissions. source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks