Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

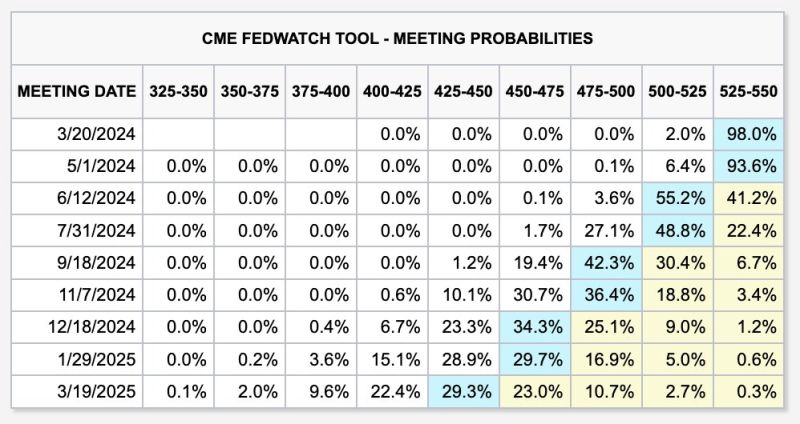

US Rate-cut expectations were revised downward last week.

For the first time this year, markets now only see 3 interest rate cuts in 2024. This also happens to be the first time that markets align with the latest Fed guidance. Odds of a rate cut in this week are down to 2% and odds of a rate cut in May are down to ~7%. Just 3 months ago, markets saw SEVEN rate cuts in 2024 with rate cuts beginning this month. Source: The Kobeissi Letter

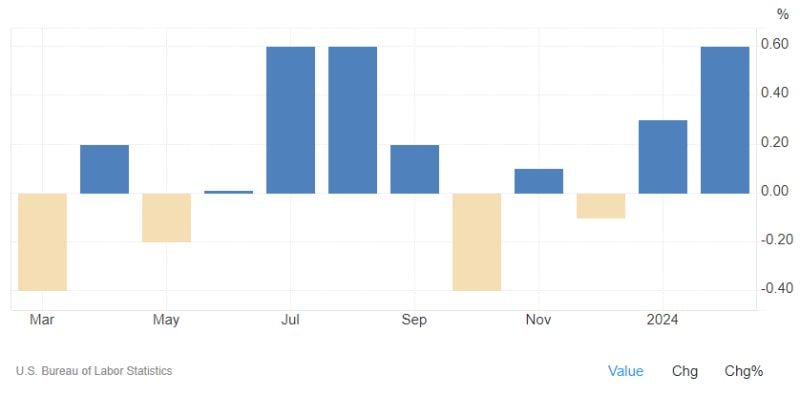

The US Producer Price Index surged by 0.6% MoM in February 2024, marking the largest increase since August and surpassing expectations.

Goods prices rose notably, led by a 4.4% surge in energy costs. Meanwhile, services edged up by 0.3%. Despite a slowdown in core rate growth, yearly inflation accelerated to 1.6%, surpassing forecasts. YoY: 1.6% vs 1.1% est. MoM: 0.6% vs 0.3% est. Core YoY: 2% vs 1.9% est. Core MoM: 0.3% vs 0.2% est. Bottom-line >>> PPI came in stronger than expected driven by a surge in energy costs and higher insurance costs among other categories. Not a breakout to the upside, but declining trend is leveling off.

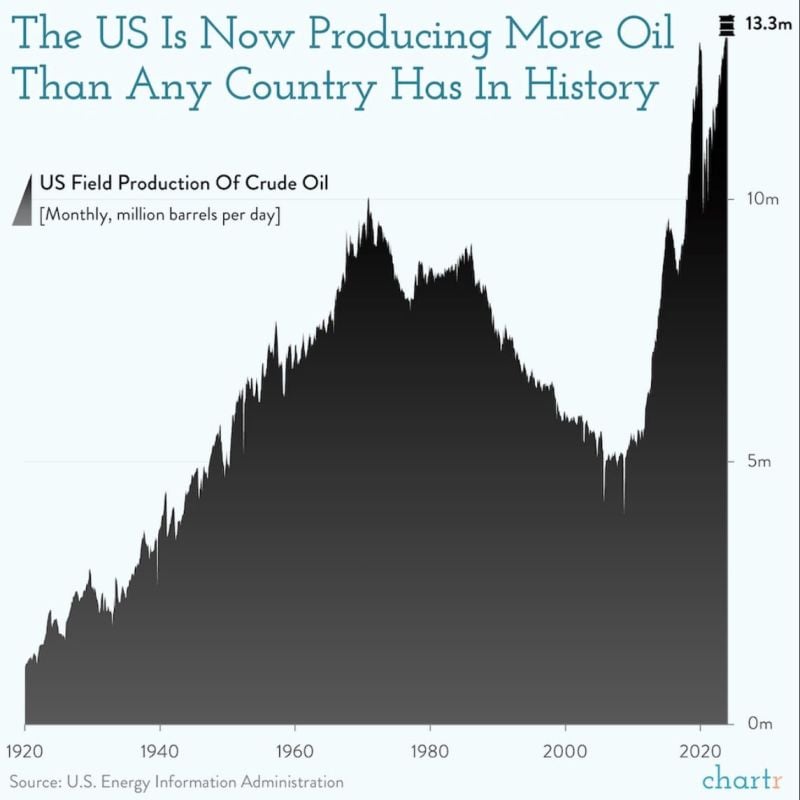

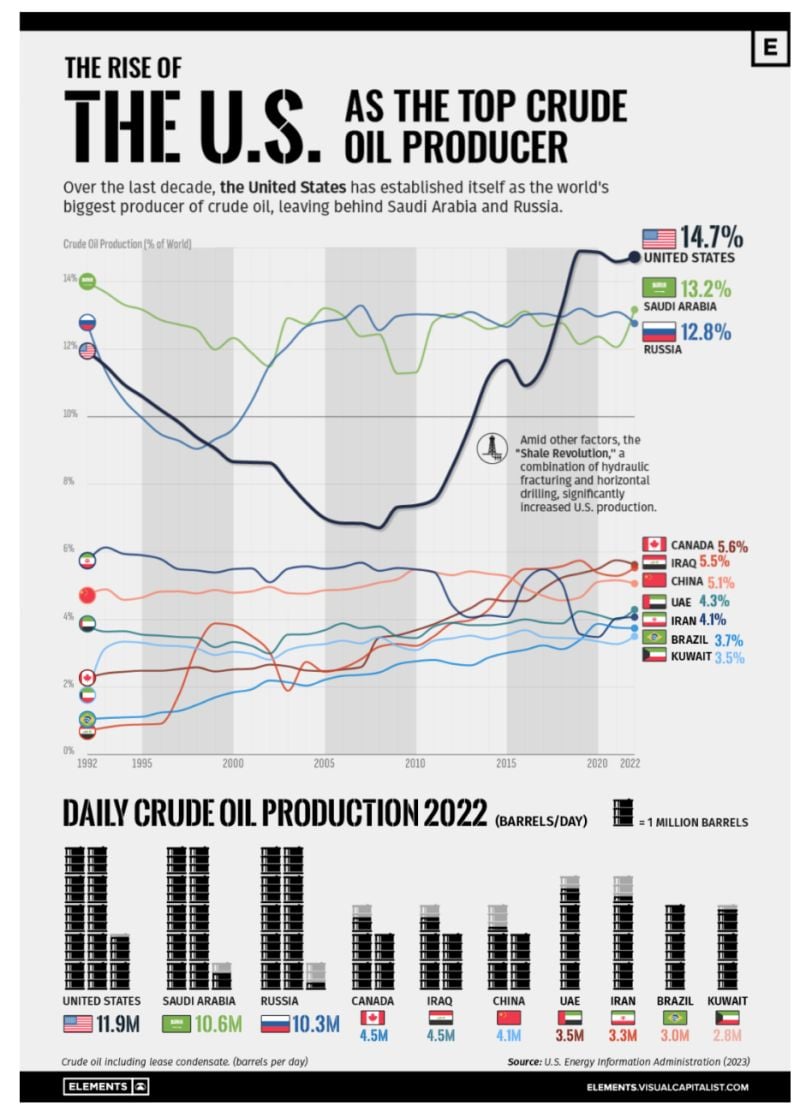

Visualizing the Rise of the U.S. as Top Crude Oil Producer - by Elements & Visual Capitalist

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia. This infographic illustrates the rise of the U.S. as the biggest oil producer, based on data from the U.S. Energy Information Administration (EIA).

Investing with intelligence

Our latest research, commentary and market outlooks