Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

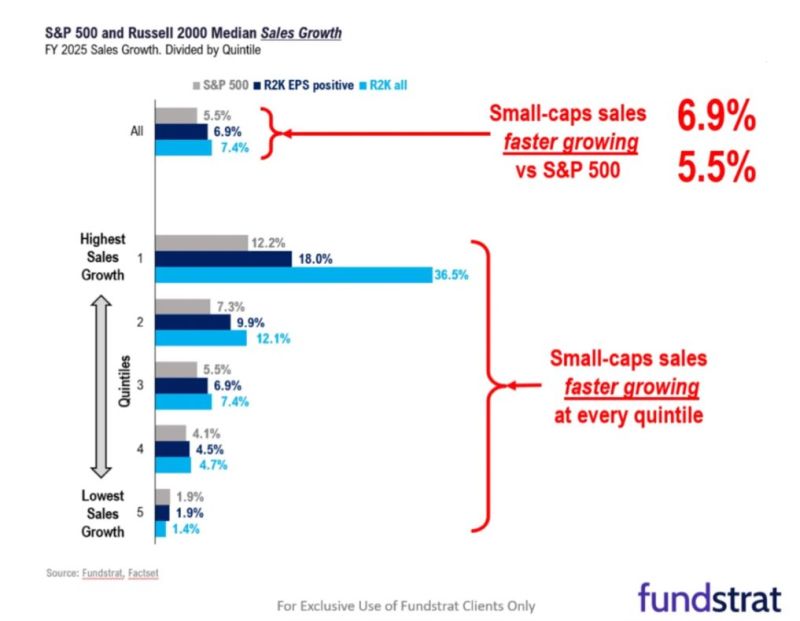

A contrarian idea on us small caps?

=> FUNDSTRAT: “.. Our top idea for 2024 is small-caps, where we see at least 50% upside .. Russell 2000 companies are set to grow .. faster than the $SPX .. Valuations are far more attractive .. when CEO confidence recovers, we also see the low valuations as setting the stage for synergistic M&A ..” Source: Carl Quintanilla, Fund strat

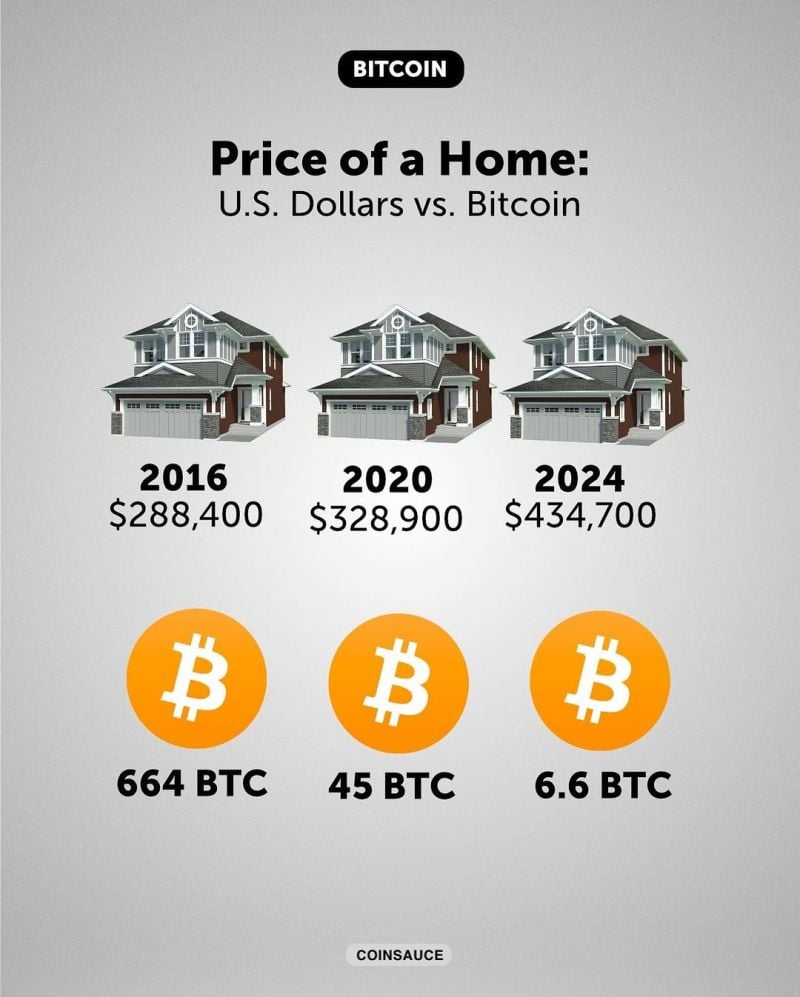

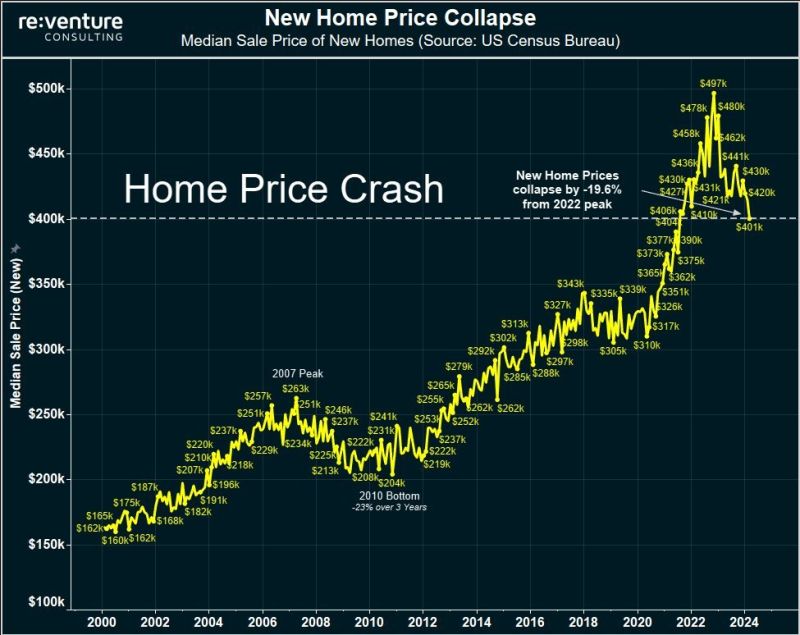

BREAKING: US new home prices are now down 20% from their highs, in bear market territory, and falling faster than rates seen in 2008, according to Reventure.

New home prices peaked in late-2022 at $497,000 and have fallen to $401,000 as of the latest data. In the financial crisis, new home prices dropped by 23% from 2007-2010, according to Reventure. US Home prices are down roughly the same amount in just 1.5 years, or half the amount of time. Still, new home prices are ~20% above pre-pandemic levels and existing home supply is near record lows. Is the hashtag#us housing market beginning to crack? Source: The Kobeissi Letter, Re-venture

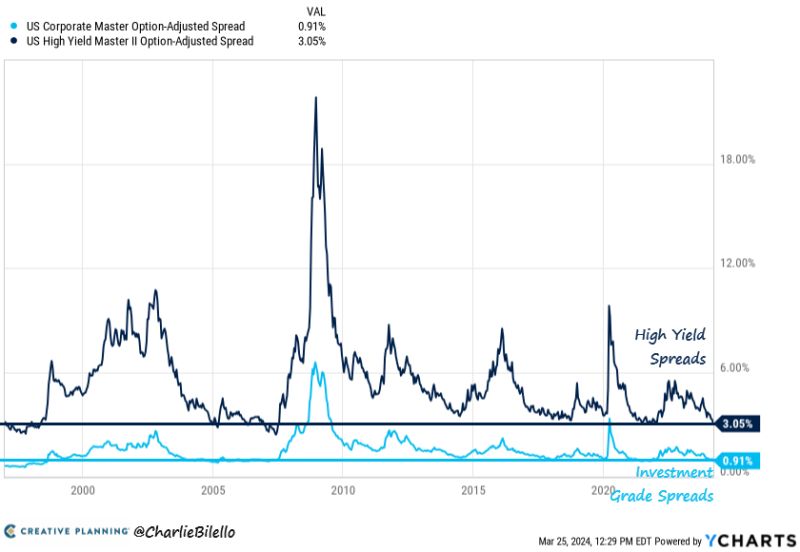

Are us financial conditions becoming too easy to tame inflation ?

Source: Bloomberg, Steno Research, Macrobond

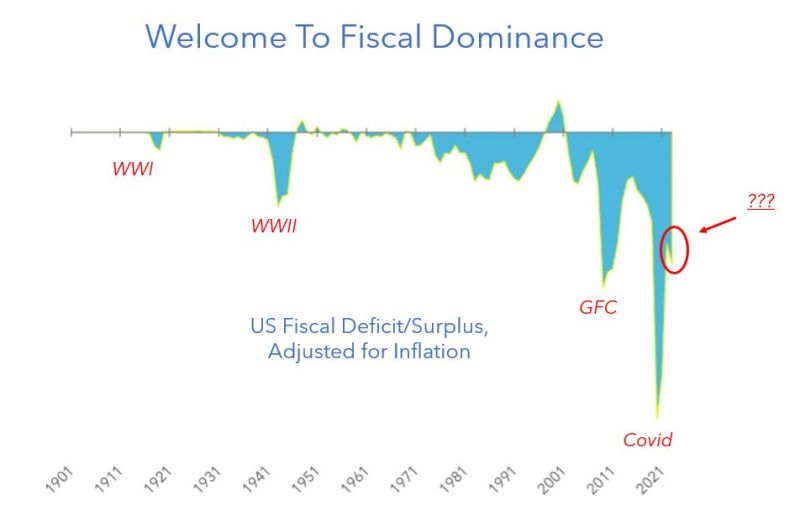

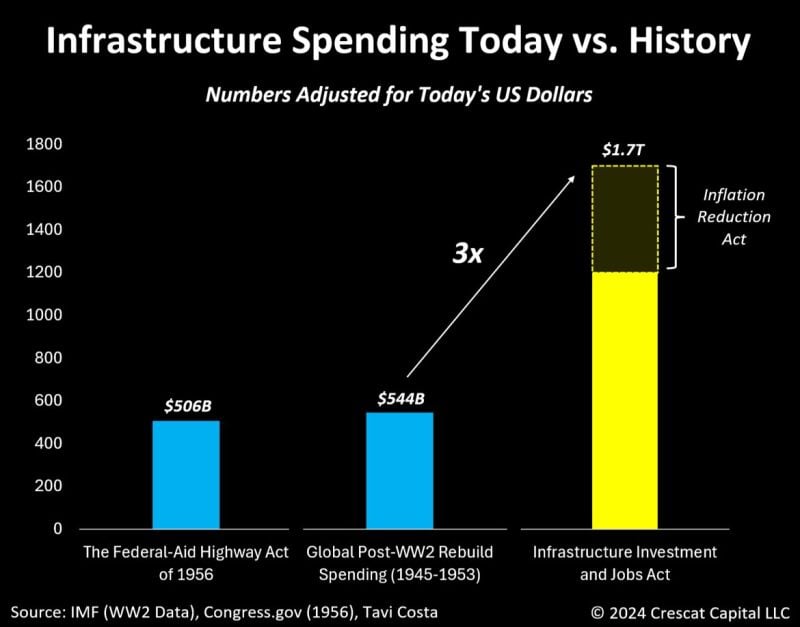

As highlighted by Tavi Costa, today’s US infrastructure spending is likely to dwarf what we experienced during the rebuild period post-WWII by the US and the rest of the world.

Escalating geopolitical tensions and growing disagreements among nations are incentivizing countries to bolster their self-reliance in domestic operations. These circumstances are poised to catalyze what could evolve into one of the most ambitious infrastructure initiatives in history, with the potential to be highly inflationary. The last major infrastructure push in the United States occurred in 1956 with the National Interstate and Defense Highway Act under President Dwight D. Eisenhower. Initially budgeted at $25 billion, equivalent to approximately $207 billion in today's currency. This initiative pales in comparison to the recent Infrastructure Investment and Jobs Act, which authorizes government spending nearly six times that amount, totaling $1.2 trillion. The chart below also considered the Inflation Reduction Act passed in 2022, expecting a significant portion of those funds to be directed towards new infrastructure projects, including those associated with the green revolution and other initiatives. Sources: Tavi Costa, Crescat Capital, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks