Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

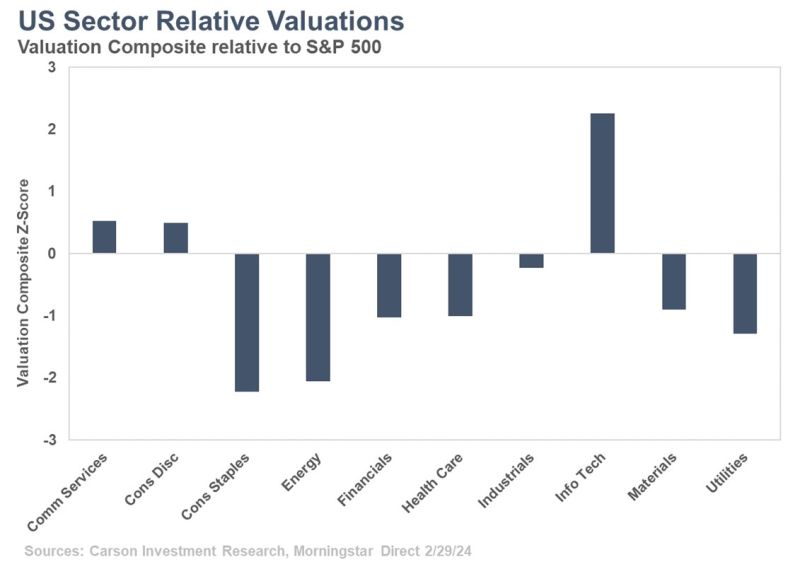

US stocks are expensive. That is true, but it is mainly due to tech.

If you look around you'll notice that areas like the cyclicals (energy, financials, materials, and industrials) are all fairly valued and in some cases outright cheap. Source: Carson Investment Research

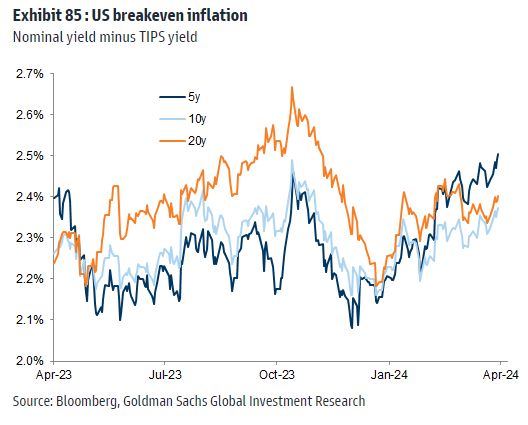

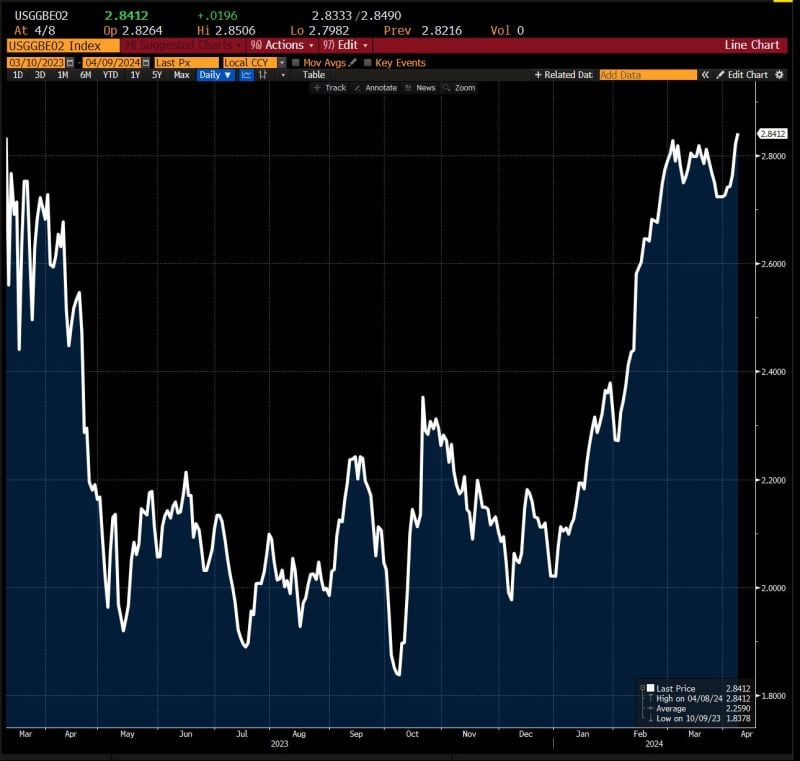

US breakeven inflation rates rising

Source: Win Smart; Goldman Sachs, Bloomberg

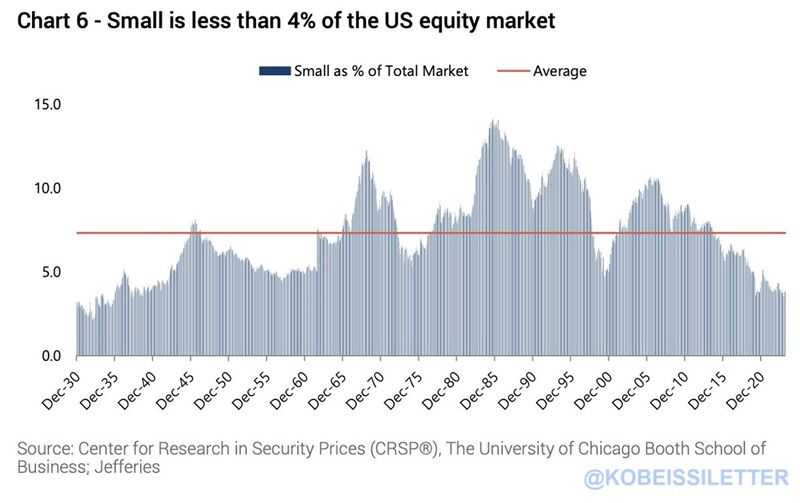

US smallcap stocks now account for less than 4% of the entire US equity market.

They now reflect the same percentage of the market as 1930 before the Great Depression. As AI-hype as spreads, small cap stocks have significantly underperformed large caps. Currently, more than one-third of the Russell 2000 index has negative earnings, down from ~45% in 2020. Small-cap stocks are now hated more than ever. Source: The Kobeissi Letter

Ahead of US inflation numbers tomorrow (Wednesday), US 2-year breakeven rates just rose to 13-month highs...

Source: Bloomberg, David Ingles

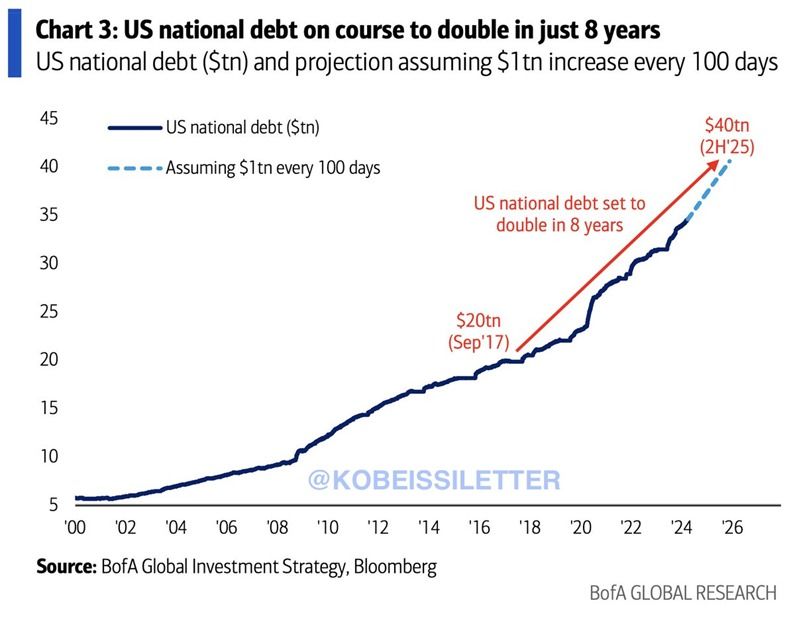

The US Federal debt is set to DOUBLE in just 8 years, rising from $20 trillion in 2017 to $40 trillion in 2025.

Currently, US Federal debt is rising by a whopping $1 trillion every 100 days. To put this in perspective, if US debt hits $40 trillion in 2025 that would be a $17 TRILLION increase since 2020. That would be a ~570% jump in US Federal debt since 2000, a 25-year period. The worst part? This analysis assumes that we are on track for a "soft landing." What happens if a recession hits? Source: The Kobeissi Letter, BofA

Investing with intelligence

Our latest research, commentary and market outlooks