Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

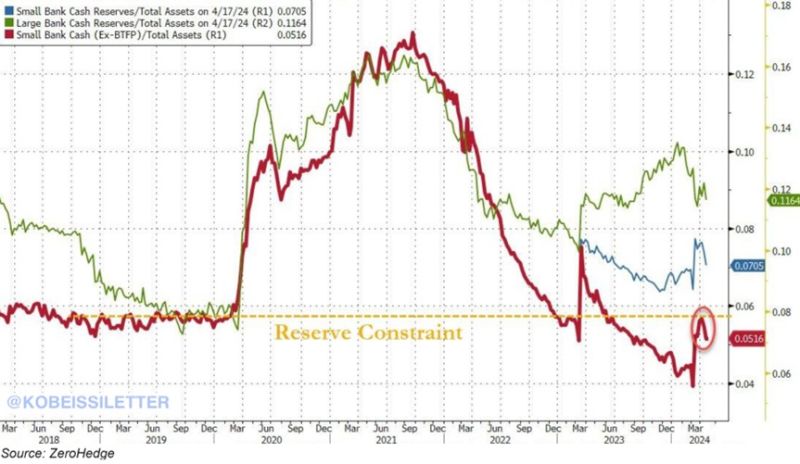

US small bank cash reserves plummeted by $258 billion last week below the level considered a constraint, according to ZeroHedge.

This excludes a $126 billion still sitting at the Fed’s emergency lending program that expired in March. It marked the largest decline in bank deposits since April 2022 when $336 billion came out of the banking system. Meanwhile, US regulators have seized Republic First Bank on Friday and agreed to sell it to Fulton Bank, another regional bank with $6 billion in total assets. The FDIC projects the failure will cost the fund around $667 million. Is the US regional bank crisis really over? Source: The Kobeissi Letter, www.zerohedge.com

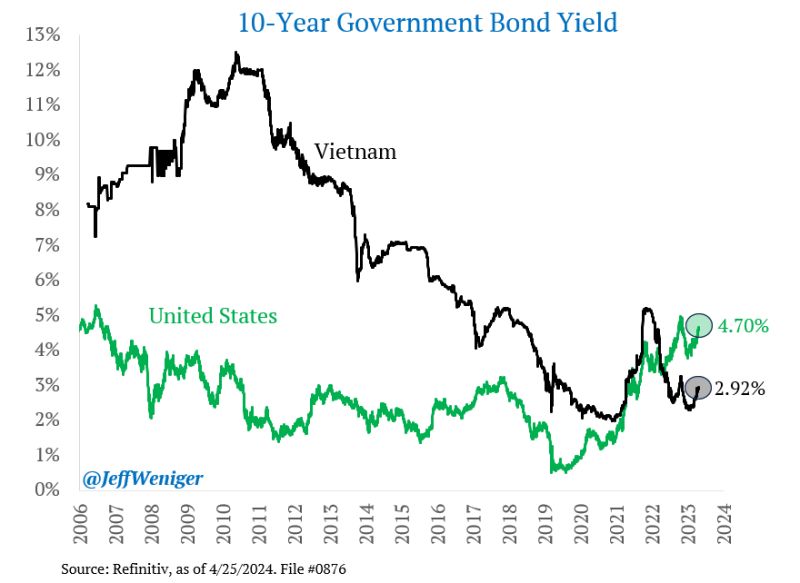

OOPS... stagflationary numbers out of US !!!

Real GDP expanded at a 1.6% rate in Q1, trailing all forecasts. Main growth engine – personal spending – rose at a slower-than-forecast 2.5% pace. BUT a closely watched measure of underlying inflation advanced at a greater-than-expected 3.7% clip... While "soft" macro data in the first 3 months of the year were "goldilocks" for markets (Growth surprising on the upside + disinflation), the effective Q1 print does not look as rosy... Source: HolgerZ, Bloomberg

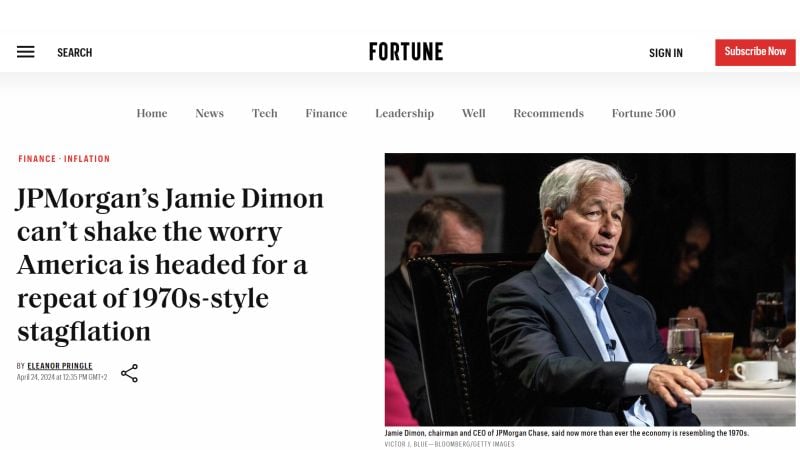

Wall Street stalwart Jamie Dimon is concerned history may be repeating itself with the U.S. economy returning to the embedded stagflation it battled 50 years ago.

Speaking at the Economic Club of New York on Tuesday, JPMorgan CEO Dimon said now more so than ever the economy is resembling the 1970s, when both inflation and unemployment were high but economic growth was weak.

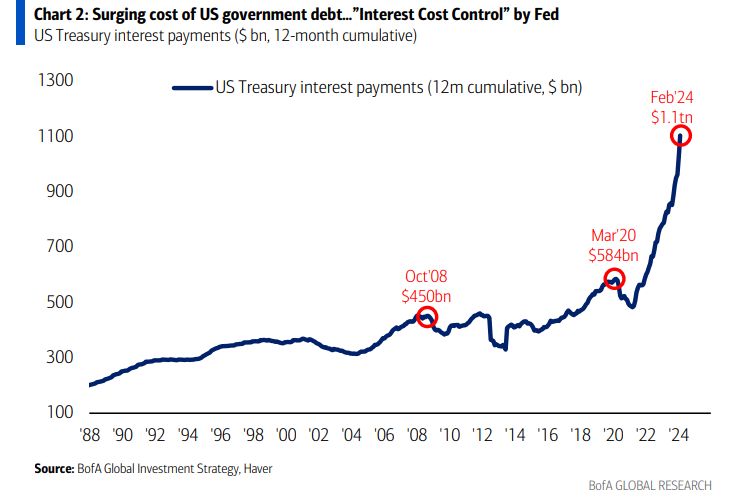

The annual interest expense on US debt is literally moving in a straight line higher, now at $1.1 TRILLION.

To put this in perspective, less than 3 years ago the annual interest expense on this debt was $450 billion. That's a 144% jump as total US debt has surged by over $11 TRILLION since 2020. Even in 2008, at the peak of the Financial Crisis, annual interest expense was just $450 billion. As interest rates surge and debt levels hit record highs, the US paying the prices for decades of deficit spending. Money is not "free" anymore... Source: BofA, The Kobeissi Letter

How is it possible? Below is the number of initial filings for unemployment insurance.

Five of the last six weeks, the exact same number. Effectively the same number in the last 11 weeks, except for the holiday weeks (President's Day and Easter). As highlighted by Jim Bianco, how is this statistically possible? --- Consider The US is a $28 trillion economy. It has 160 million workers. Initial claims for unemployment insurance are state programs, with 50 state rules, hundreds of offices, and 50 websites to file. Weather, seasonality, holidays, and economic vibrations drive the number of people filing claims from week to week. Yet this measure is so stable that it does not vary by even 1,000 applications a week. Just the number of applications incorrectly filed out every week should cause it to vary more than this...

Investing with intelligence

Our latest research, commentary and market outlooks