Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

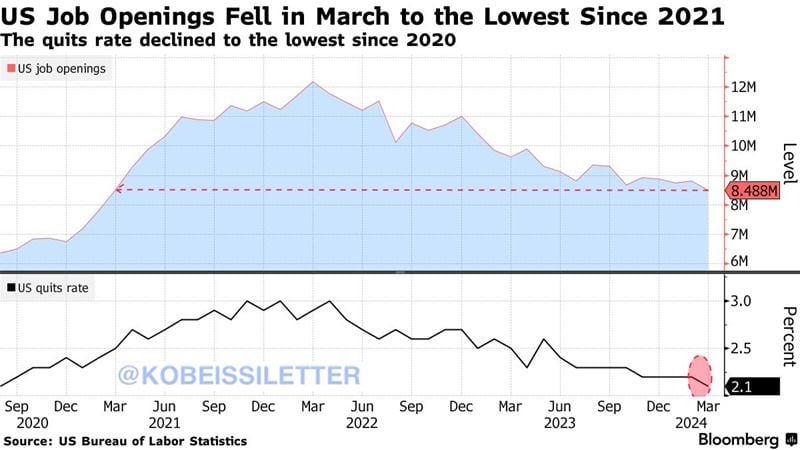

US job openings dropped in March to the lowest level in 3 years.

US available vacancies declined to 8.49 million from 8.81 million in February, hitting the lowest level since March 2021. Job openings have been declining for the past 2 years since the March 2022 peak of 12 million vacancies. Meanwhile, the quits rate has fallen to 2.1%, the lowest since August 2020. This suggests that many currently employed individuals are either losing confidence and/or are more dependent on their jobs. All eyes are on Friday's jobs report. Source: The Kobeissi Letter

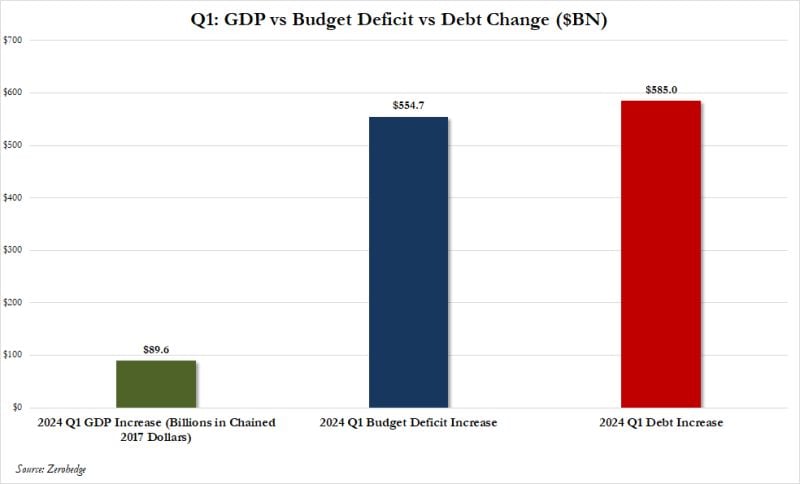

To the moon!!! US Treasury boosts April-June borrowing estimates to $243b from $202b.

US reiterates a cash-balance estimate of $750bn for the end of June. US Treasury cites lower cash receipts for bigger borrowing estimates. No Mrs Yellen, this is not virtual reality... (picture stollen to Jim Bianco)

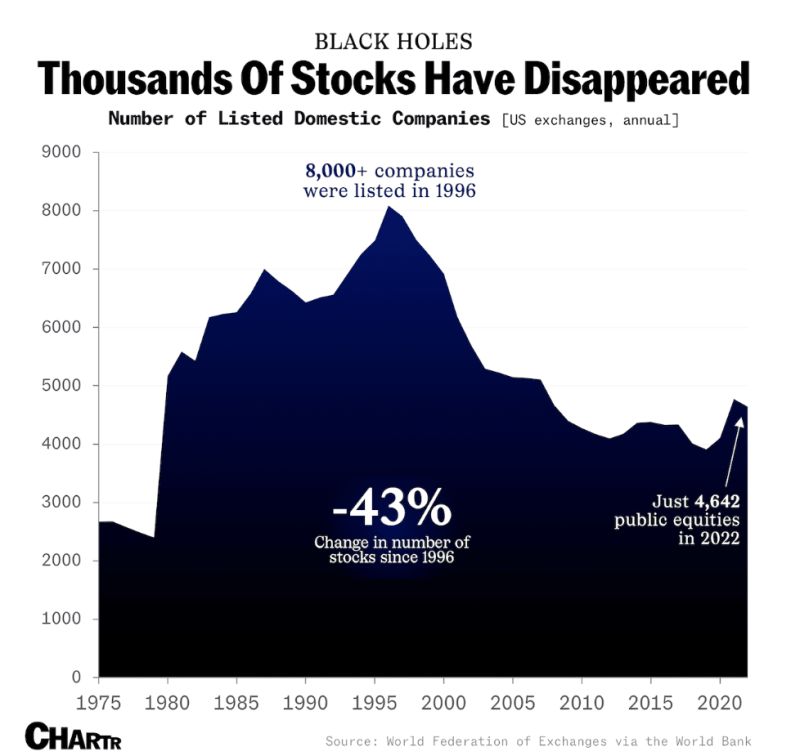

Where did all the stocks go?

Since the late 1990s, the number of US publicly traded companies has plunged from just over 8K in 1996 to about 4.6K in 2022. (It’s bounced back a bit more recently.) Source: Quartr

Investing with intelligence

Our latest research, commentary and market outlooks