Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

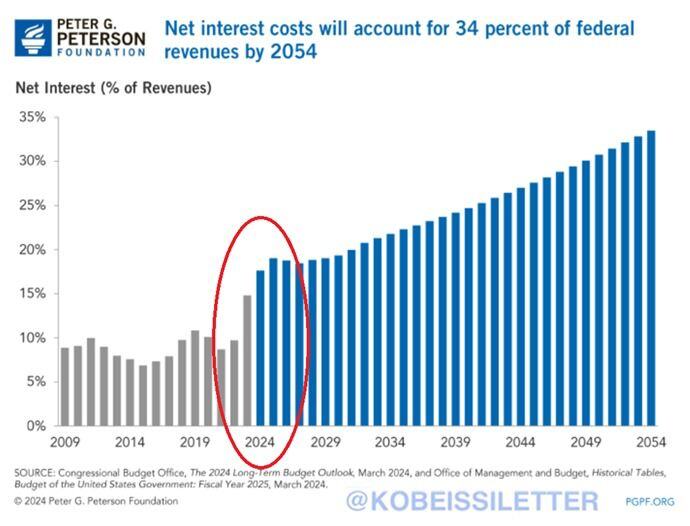

Shocking stat of the day by The Kobeissi Letter:

US net interest payments as a percentage of federal revenues are set to reach 34% by 2054. This means that ONE THIRD of all government revenue would be spent only to service the national debt. Over the past 8 years, the percentage has already doubled to ~15% and is at its highest in 3 decades. Meanwhile, nominal annualized interest payments have crossed above $1 trillion for the first time ever. We could see $1.6 trillion in annual interest expense by the end of the year if the Fed leaves rates steady. The US government needs lower interest rates more than anyone - i.e Fiscal policy leads monetary policy. Source: The Kobeissi Letter, Peter G.Peterson

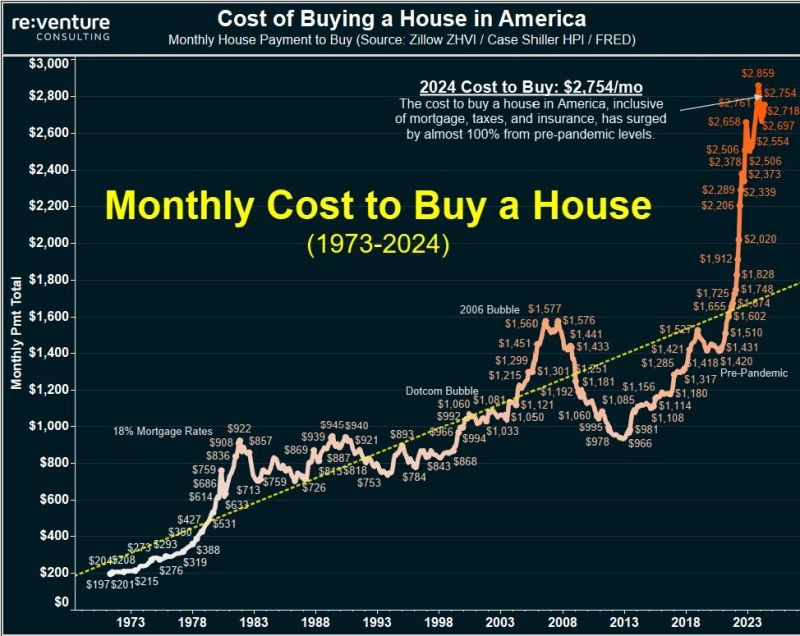

The cost of buying a home in the US rises to $2,750/month, the second highest ever recorded, according to Reventure.

Prior to the pandemic in 2022, the average home in the US would cost $1,400/month. In other words, it is now 100% MORE expensive to buy a home in 2024 compared to 2020. Even at the peak of the 2008 Financial Crisis, the average home payment peaked at $1,550/month. The average US family would need to spend 44% of their PRE-TAX income to buy a home today. Source: The Kobeissi Letter, re.venture

Investing with intelligence

Our latest research, commentary and market outlooks