Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- gold

- ETF

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- nasdaq

- FederalReserve

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

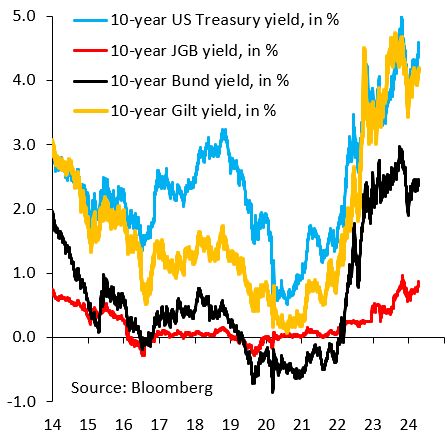

The 10-year US Treasury yield (blue) is marching back towards its high last October.

Recall that - at the time - US Treasury announced that it would issue less longer-term paper, which is what stopped that rise. That card has now been played and yields are rising again... Source: Robin Brooks

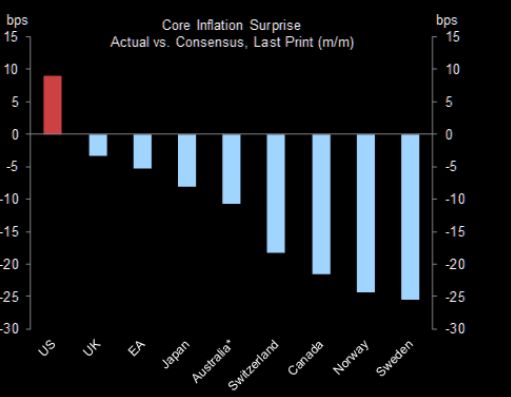

Did you know that the US is the only G10 economy where the latest core inflation print surprised to the upside?

Source: Goldman Sachs, TME

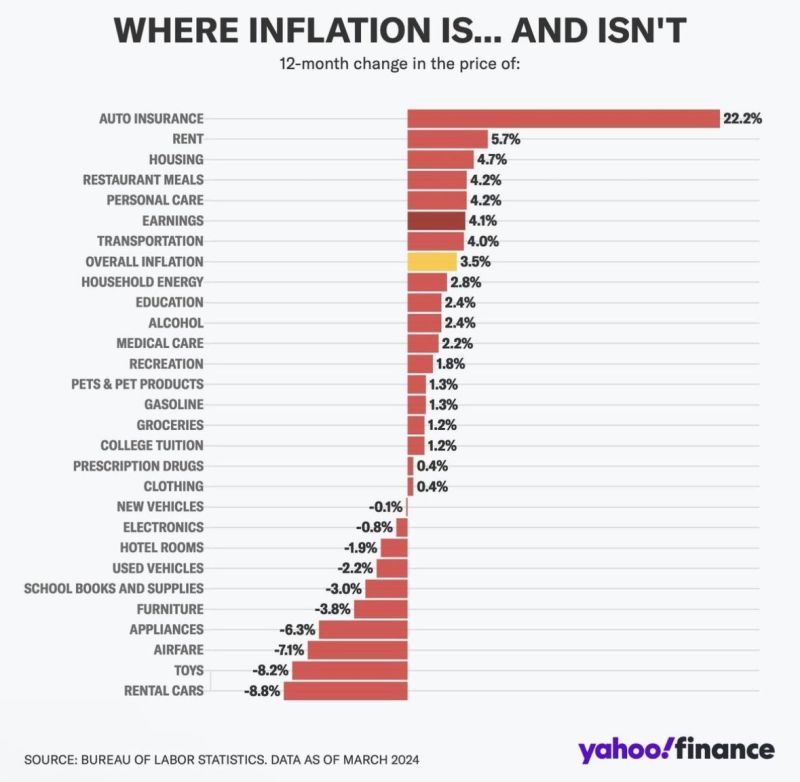

US inflation continues to rise, with no decrease in sight according to Zerohedge.

Since January 2021, inflation has not fallen in a single month, leading to an overall increase of 19% in less than four years. Additionally, the US has not seen a year-over-year inflation print below 3% in 36 consecutive months. The Fed's 2% target has also been surpassed for 37 straight months. This compounding inflation may have long-term impacts on the economy. Source: The Bobeissi Lezzer

CLS declines delaying FX cutoff as US stock changes loom

CLS Group, the largest currency settlement system, said on Tuesday it will not change its cut-off time for payment instructions for foreign exchange trades, dealing a blow to foreign asset managers hoping for some reprieve from a new U.S. rule putting them at risk of transaction failure. Beginning May 28, the U.S. Securities and Exchange Commission requires investors start settling U.S. equity transactions one day after the trade, or T+1, instead of the current two days. source : investing

Investing with intelligence

Our latest research, commentary and market outlooks