Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

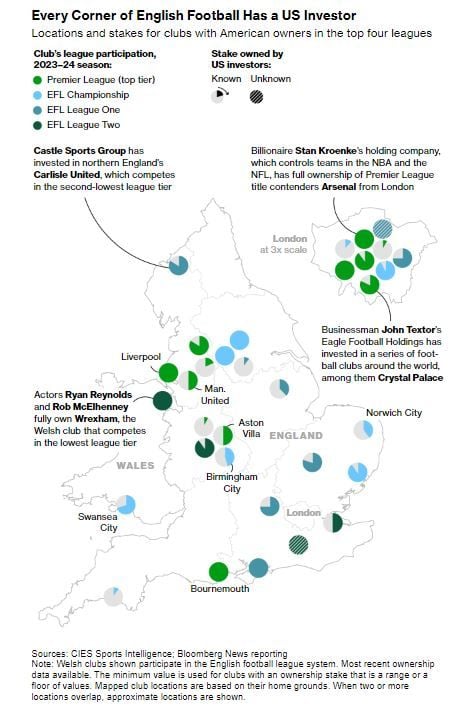

Are Americans Taking Over English Football ?

More than a third of the 92 professional teams in England’s top four leagues now have some form of US ownership. source : bloomberg

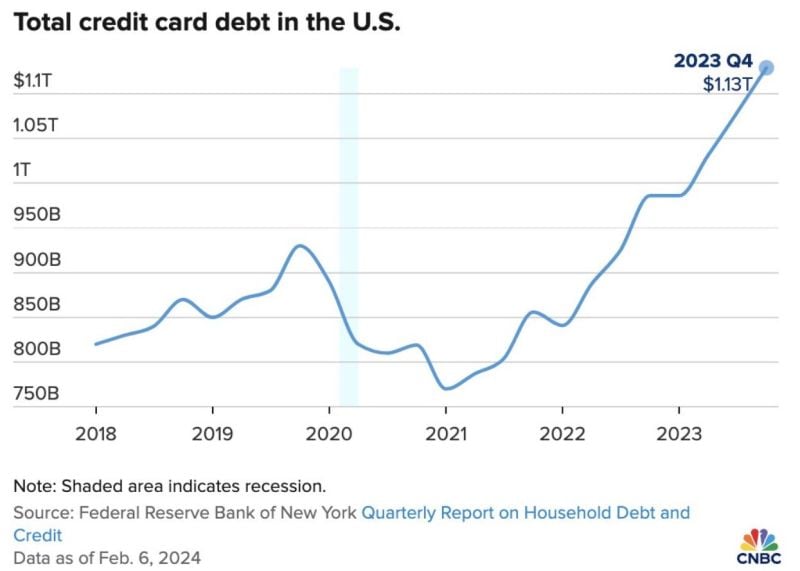

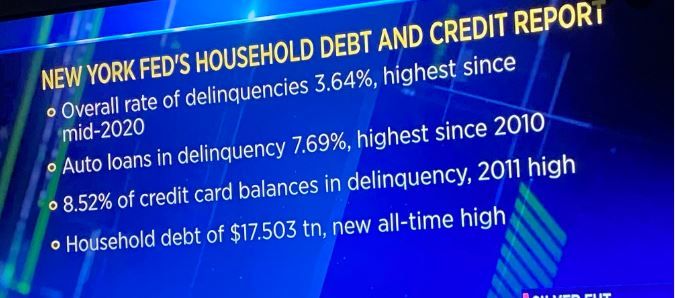

New York Fed's Household Debt and Credit Report

Total household debt climbed by $212 billion in the fourth quarter of 2023 to $17.5 trillion, the New York Federal Reserve said in its latest quarterly Household Debt and Credit Report. Amid the rise in debt, delinquency rates and the transition into troubled status were both higher. source : cnbc

A Los Angeles office building just sold for 52% less than its price five years ago.

The office building was originally purchased in 2018 for $92.5 million. Now, it sold for $44.7 million even after over $11 million in renovations. Just weeks ago, the Aon Center in downtown LA sold for $147.8 million, 45% less than its previous purchase price in 2014. Source: The Kobeissi Letter

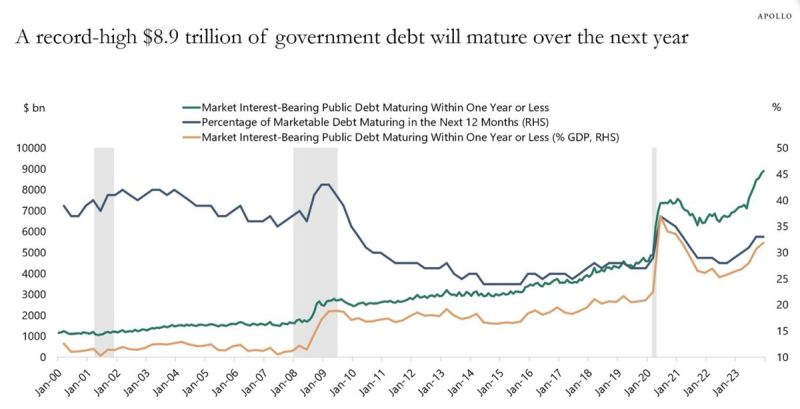

A record $8.9 trillion of government debt will mature over the next year.

Meanwhile, the government deficit in 2024 is projected to be $1.4 trillion. This means that someone will need to buy more than $10 trillion in US government bonds in 2024. That's nearly ONE THIRD of all outstanding US federal debt right now. All while the Fed is expected to start cutting rates, making buying these bonds less attractive. Who's going to fund all of this debt? Source: The Kobeissi Letter, Apollo

Investing with intelligence

Our latest research, commentary and market outlooks