Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

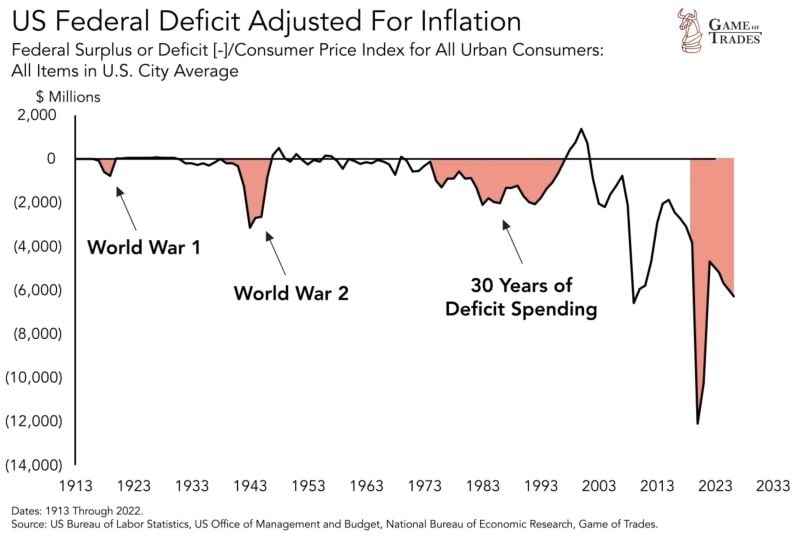

The US is facing a "death spiral" as a result of its mounting debt and the inability of politicians to confront the issue, according to "The Black Swan" author Nassim Taleb.

Per Bloomberg, the Universa Investments advisor who correctly called the 2008 financial crash cast a dire warning about the US debt situation, which has seen the federal debt balance notch $34 trillion for the first time ever to start the year. As long as Congress keeps up its rapid pace of spending, those debts are going to continue to pile up, which could have disastrous consequences for the US economy, Taleb said this week at an event held by Universa Investments. In fact, rising debt in the US is a "white swan," Taleb said, and is an event that poses an obvious risk to markets versus a "black swan" event, which can occur without much warning. That death spiral would necessitate "something to come in from the outside, or maybe some kind of miracle," Taleb said, when asked how the shock would play out, adding that the situation has made him more pessimistic about the political system in the West. Source: Business Insider

FED: DON'T SEE CUTS UNTIL MORE CONFIDENT INFLATION NEARING 2%

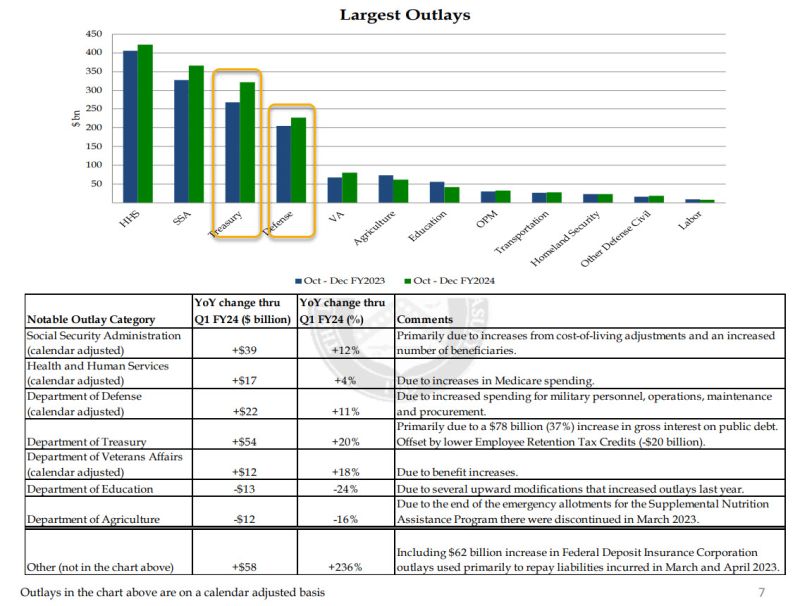

In a nutshell · The FOMC voted unanimously to leave benchmark rate unchanged - as expected - in target range of 5.25%-5.5% for fourth straight meeting while making significant changes to statement · However, the statement was very much more hawkish than expected, as The Fed pushed back aggressively against the dovish market stance. Market reaction: -> The 10-year Treasury yield fell more than 7 basis points to 3.98%. The yield on the 2-year Treasury was last down about 8 basis points at 4.27% -> US equity indices are retreating. Gold is paring gains, dollar is recovering. -> Odds of a March Fed rate cut plummet from 47% to 31% after the Fed interest rate decision. Our take: The U.S. economy enters 2024 from a position of strength. For instance, the S&P PMI came in higher than expected last week. Q4 GDP growth in the U.S. came in at 3.3% annualized, well above expectations of 2.0% growth. And while disinflation is firmly in place, the inflation rate remains above the central bank target. There is thus no reason for the Fed to rush. Nevertheless, we still believe they will have to cut rates at some point for the following reasons: 1/ Keeping rates too high for too long can have long-lasting effects on US economic growth 2/ Keeping rates steady while inflation is coming down imply rising real rates. Keeping positive real rates for too long at a time when Uncle Sam is facing $33T debt and surging interest rates payments is unsustainable

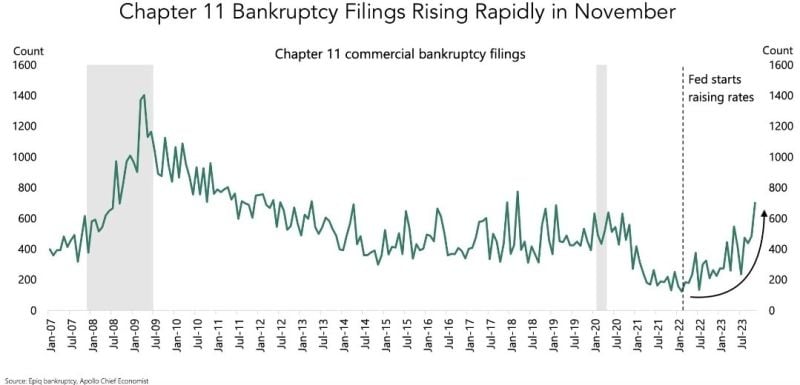

US Bankruptcy filings keep moving higher

This sounds like a logical consequence of 2 years of aggressive FED tightening but still something to keep an eye on Source: Win Smart, CFA

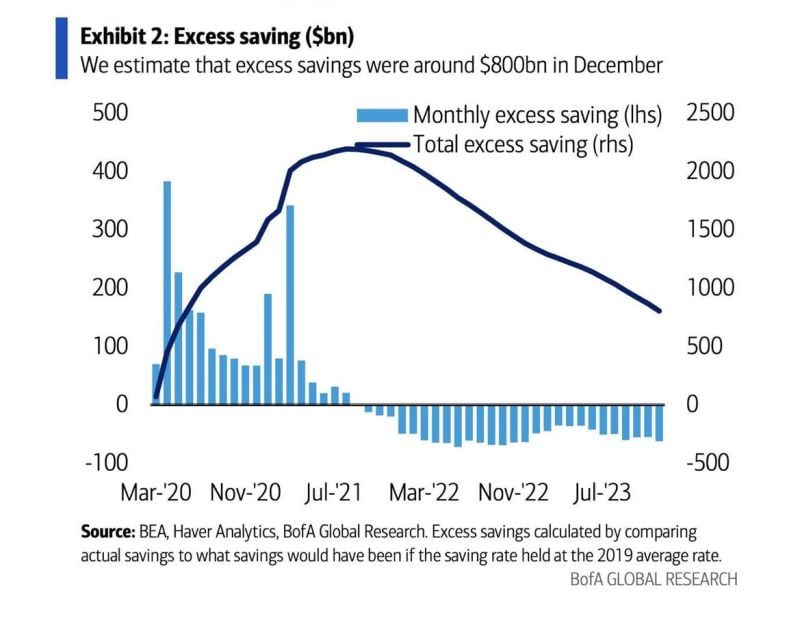

B of A: “.. At the current monthly rundown pace, excess savings should continue to support consumer spending at least through the rest of 2024."

.

Investing with intelligence

Our latest research, commentary and market outlooks