Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

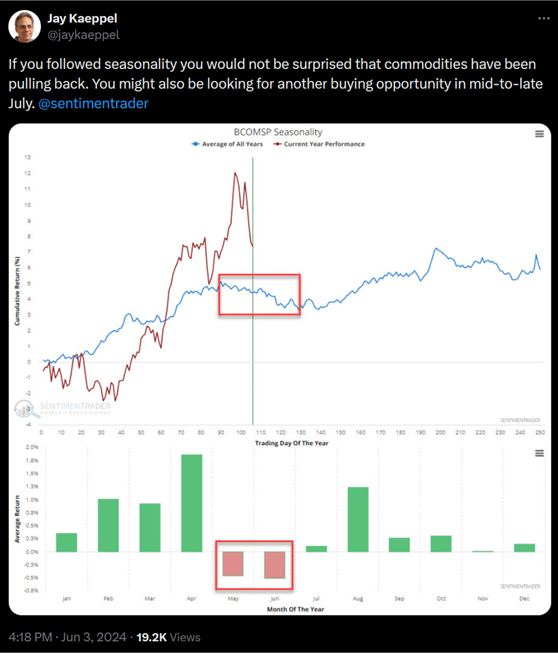

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

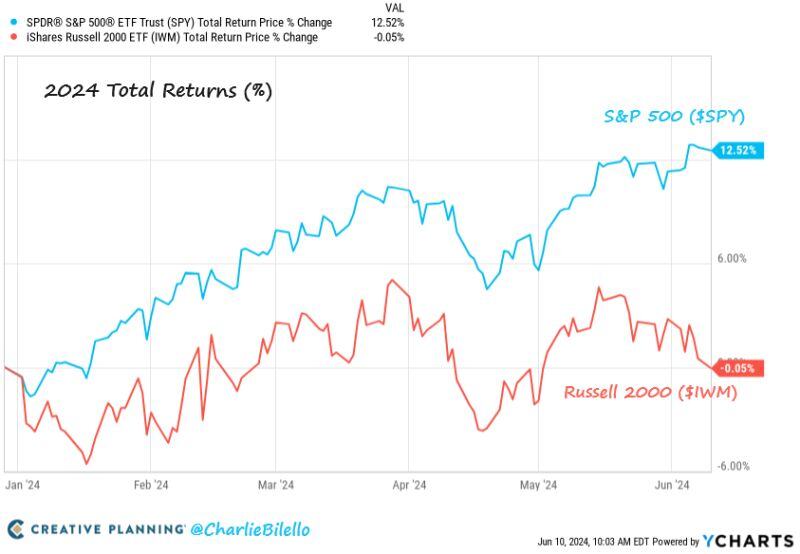

Small cap stocks are now down on the year while Large caps are still up 12.5%. $SPY $IWM

Source: Charlie Bilello

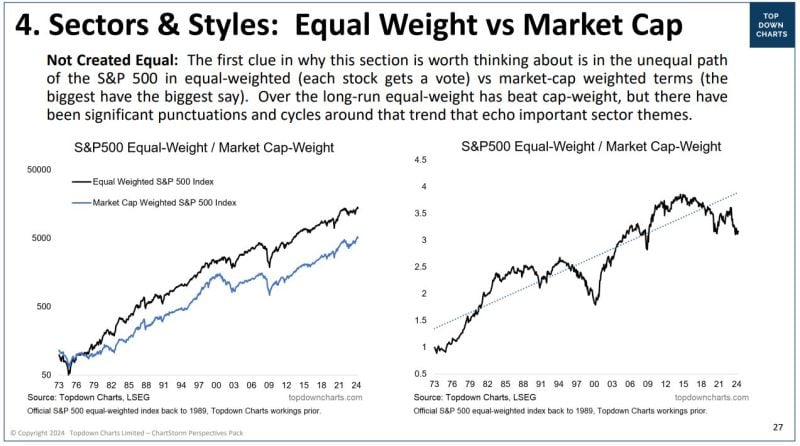

Below is an extract of a great chart pack by Topdown Charts / Callum Thomas

https://lnkd.in/eCV4GauM Over the long-run equal-weight has beat cap-weight, but there have been significant punctuations and cycles around that trend that echo important sector themes.

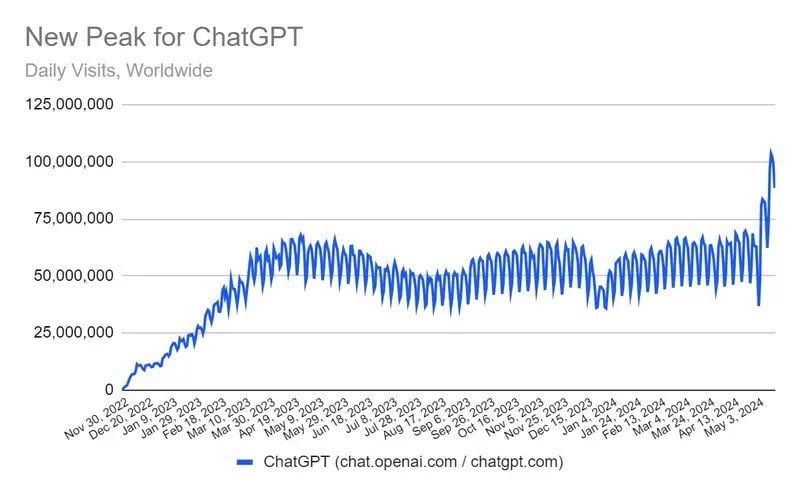

In the first three weeks of May, OpenAI’s ChatGPT averaged 77 million daily visits, putting it on track to reach 2.3 billion visits last month

A new monthly record after setting its previous record of 1.8 billion visits a year ago. Source: Beth Kindig $MSFT $NVDA $GOOG $AMZN

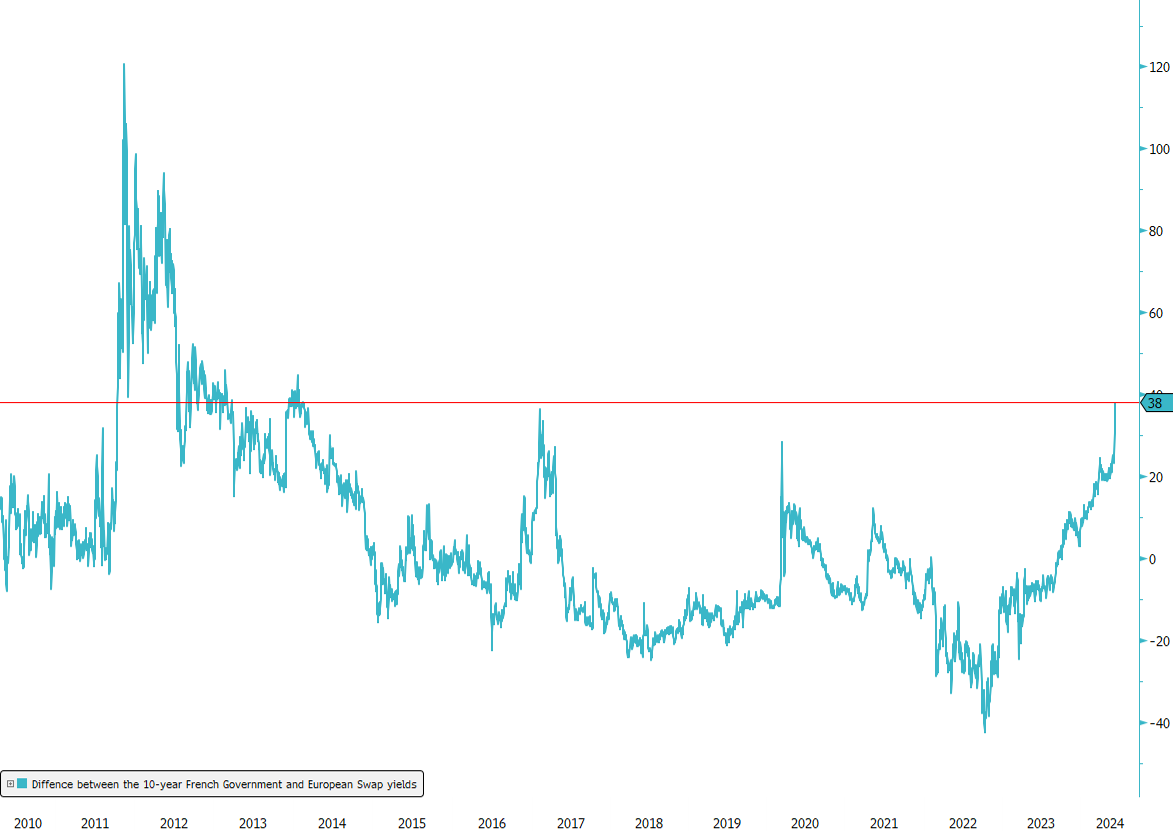

France's 10-Year Borrowing Costs Surge Against European Benchmarks!

The gap between the 10-year French government bond yield and the 10-year EUR Swap rate, a key benchmark for borrowing costs in Europe, has significantly widened since the recent European elections in France The trend was already "en marche" since S&P recently downgraded France’s credit rating from AA to AA-, following a similar downgrade by Fitch last year. Moody’s has also indicated that the current situation might lead to another downgrade. While other countries like Ireland and Spain have seen their financial health improve, France seems to be facing more challenges. Political uncertainty and reliance on international investors might cause money to leave France, pushing borrowing costs even higher. Higher interest rates on French bonds mean that investors want bigger returns because they see more risk in lending money to France. Japanese investors, who own a lot of French bonds, might start investing more in their own country due to rising interest rates there, reducing demand for French bonds. Additionally, some hedge funds are betting against European government bonds, showing a lack of confidence in the stability of European economies, including France. This trend underscores the growing concerns about France’s economic and political stability in the broader European context. Source: Bloomberg

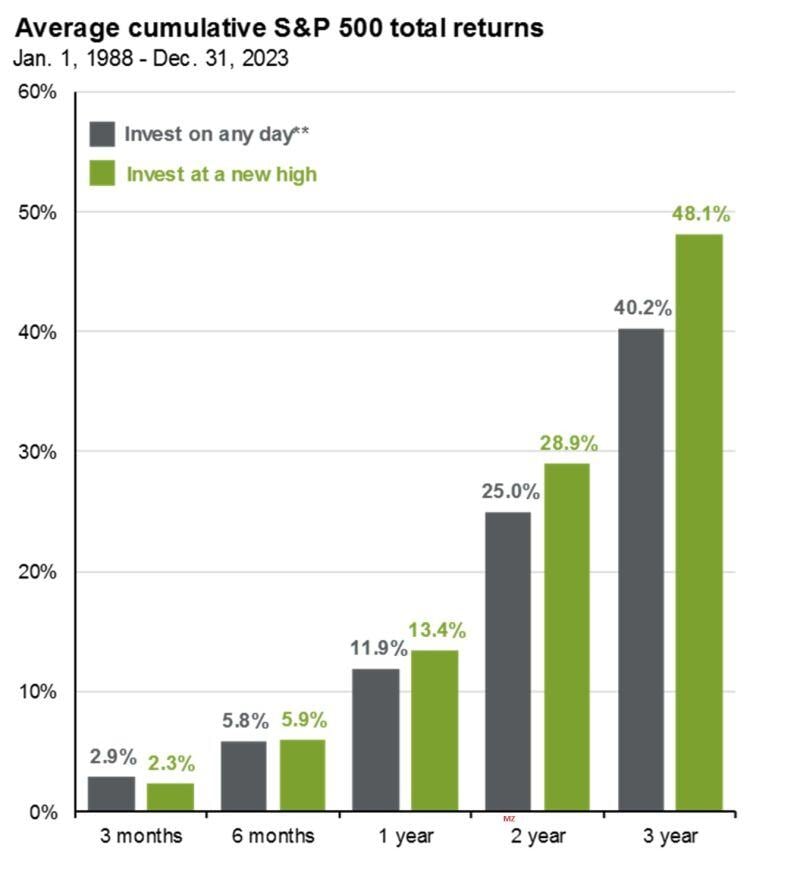

Reminder: investing at all-time highs is safer than investing during drawdowns $SPY

Source: Mike Zaccardi

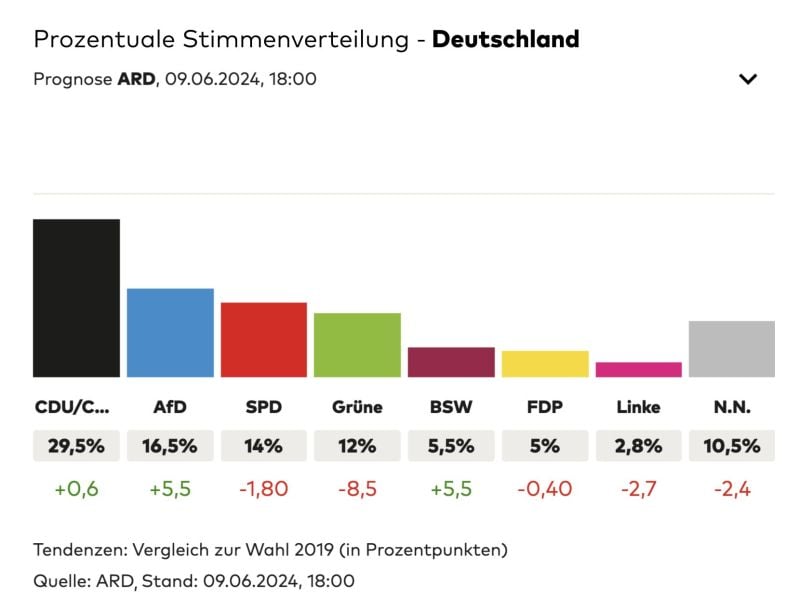

The traffic light coalition in Germany suffers a historic rout in the European elections.

German Chancellor Scholz’s SPD crashed to 14%, their worst-ever result, falling to 3rd place behind the far-right AfD, exit polls show. The other 2 parties in Scholz’s ruling alliance – the Greens and the FDP – got 12% and 5% respectively. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks