Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

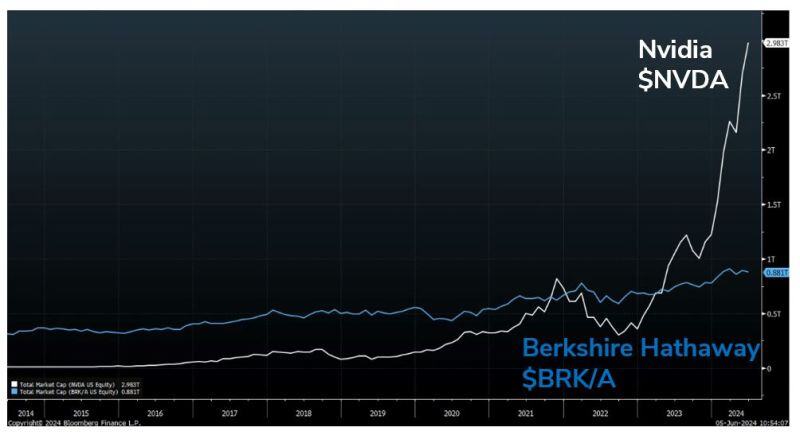

Over the past 32 trading days, Nvidia $NVDA has gained more than $1 trillion in market cap.

To put that into some sort of perspective, the 6-week gain is greater than the total market cap of Berkshire Hathaway $BRKA, which Warren Buffett has spent 6 decades in building... Source: Jesse Felder

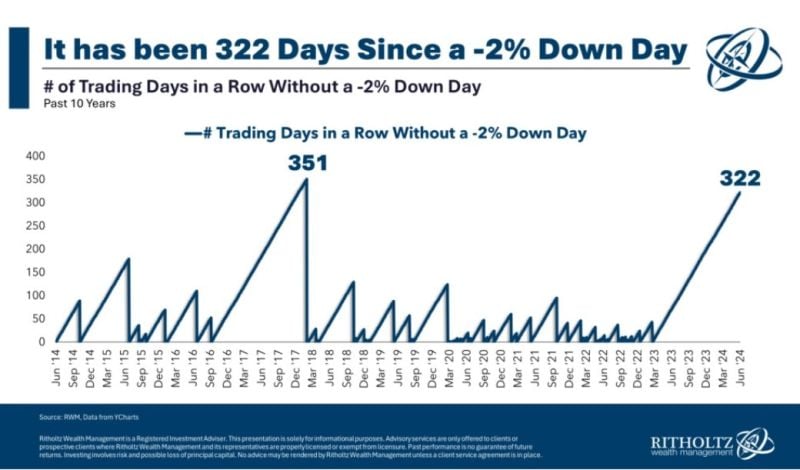

It has been a very quiet year so far for US equity markets...

No down day > 2% for the SP500 despite Middle East conflict, China doing military exercises around Taiwan, Fed interest rates cuts expectations moving from 6 to less than 2, etc. Source chart: Ritholtz

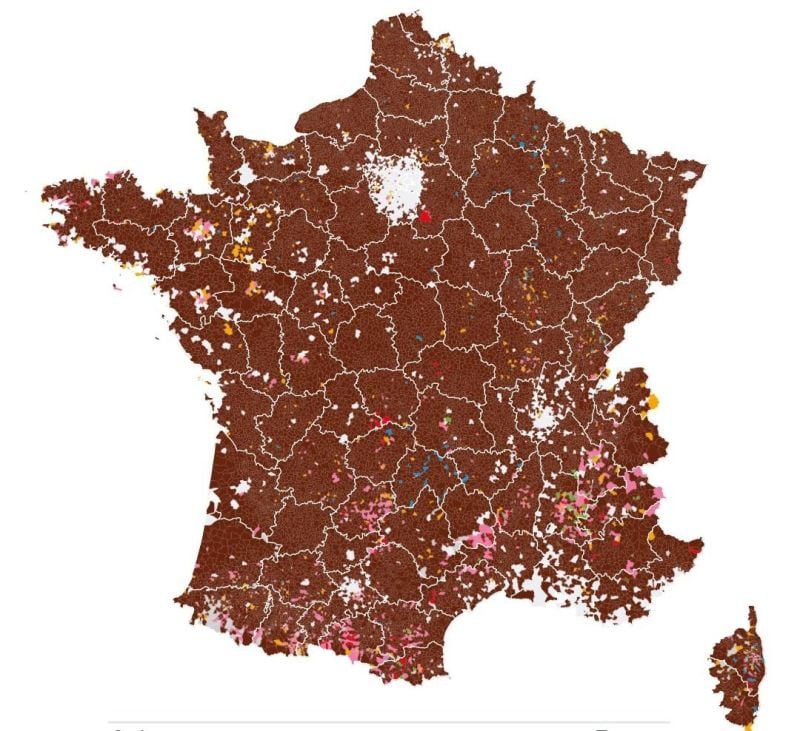

EU Parliamentary elections in France.

In brown where Far-right Le Pen party has won yesterday. Source: Xavier Ruiz

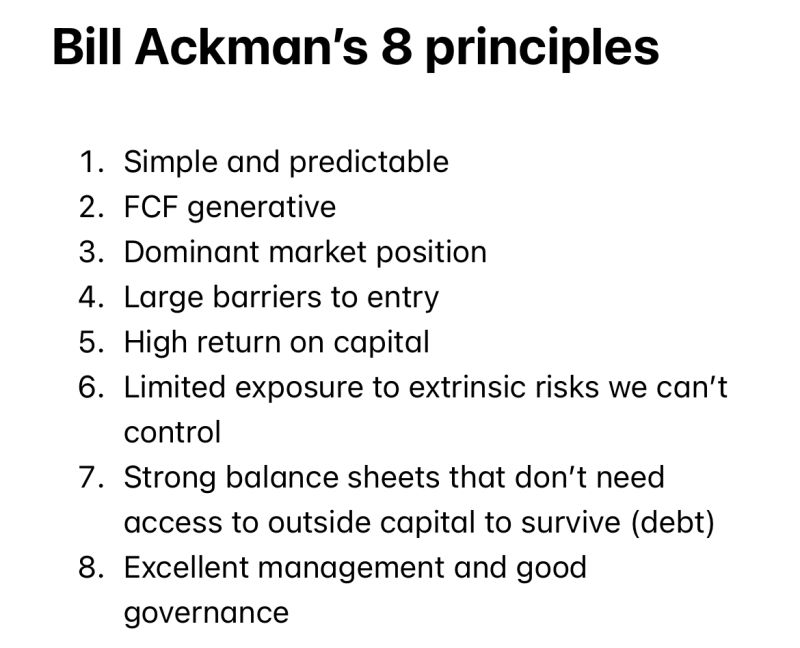

Notes from Bill Ackman 's fireside chat in Omaha - thru David Park on X:

People Underestimate the Power of Checklists - Pershing Square had the best 6 years of its history since they inscribed their checklist into a piece of "stone" - "If I ever veer [off this checklist] just hit me over the head with this thing" The checklist:

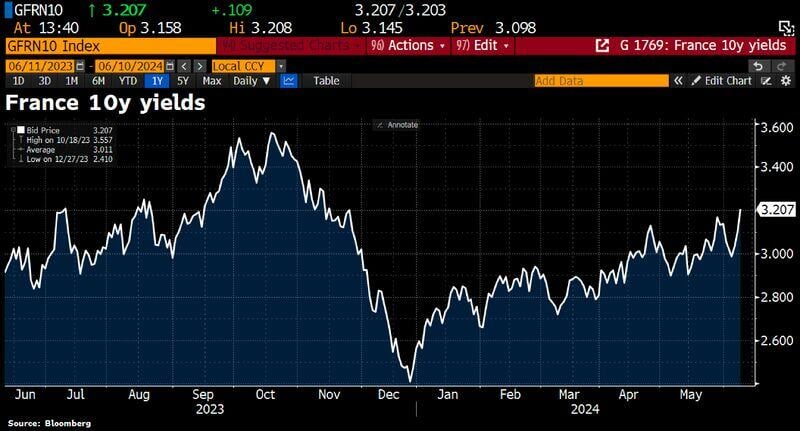

France’s bond yield hit the highest level this year on snap election.

10 year French bond yield climbs 11bps to 3.21%. Risk spread over Germany rose to 54bps, highest since January. Source: Bloomberg, HolgerZ

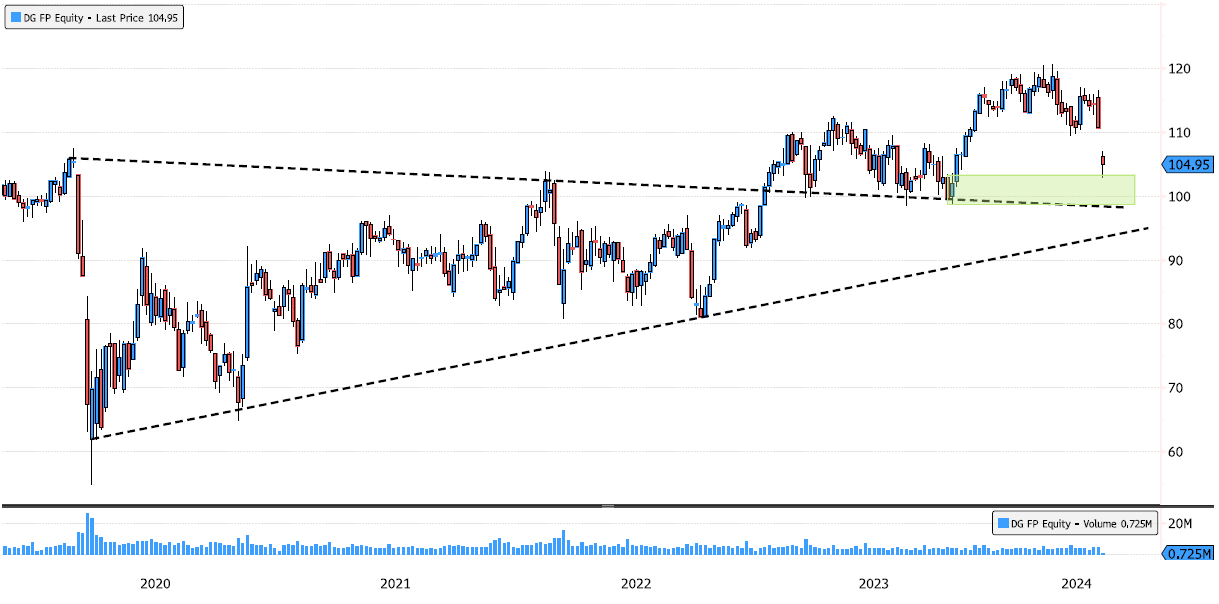

Vinci Testing Back Triangle Breakout Level

Vinci (DG FP) recently posted a new high, confirming once again the bullish trend. It's now retesting the lows of the latest swing. The 98.49 level remains the swing low that mustn't break. Keep an eye on the institutional demand zone between 98.49-103.28. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks