Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Robinhood $HOOD has acquired cryptocurrency exchange Bitstamp for $200 million

Source: Barchart

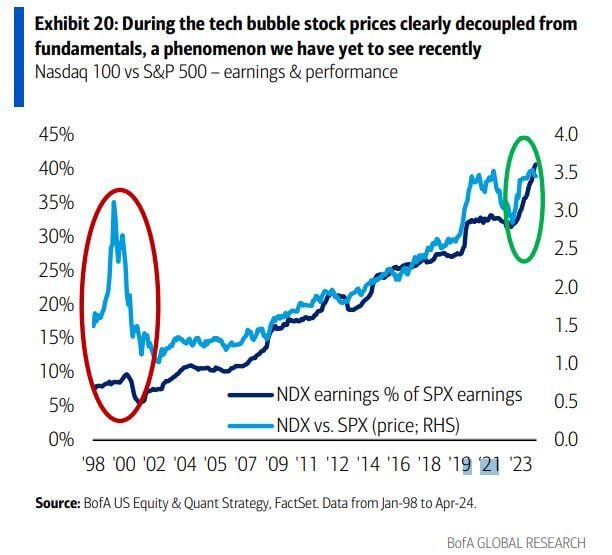

Dot Com Bubble vs. Now - Things don't look similar - at least from an earnings angle

Source: Barchart, BofA

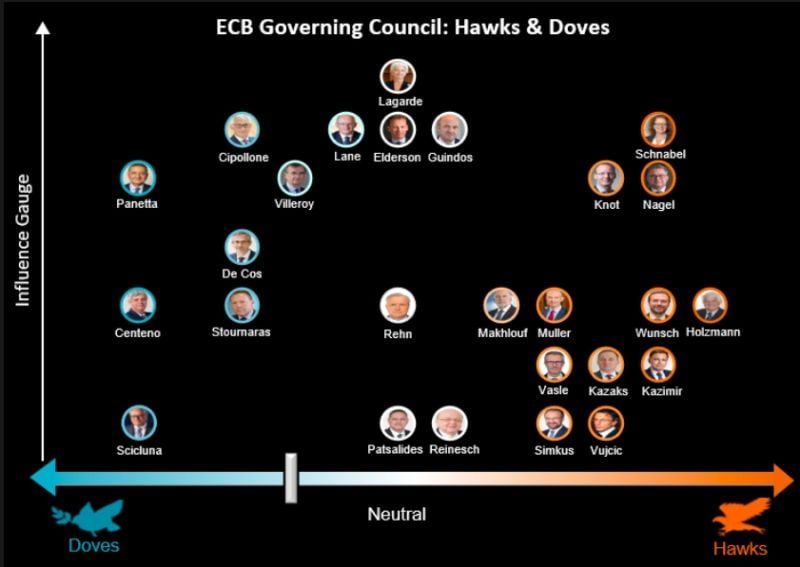

Austria’s hawkish central bank chief Robert Holzmann was the sole dissenter on ECB rate cut, BBG reports, citing a person familiar with the matter.

Source: HolgerZ, Bloomberg

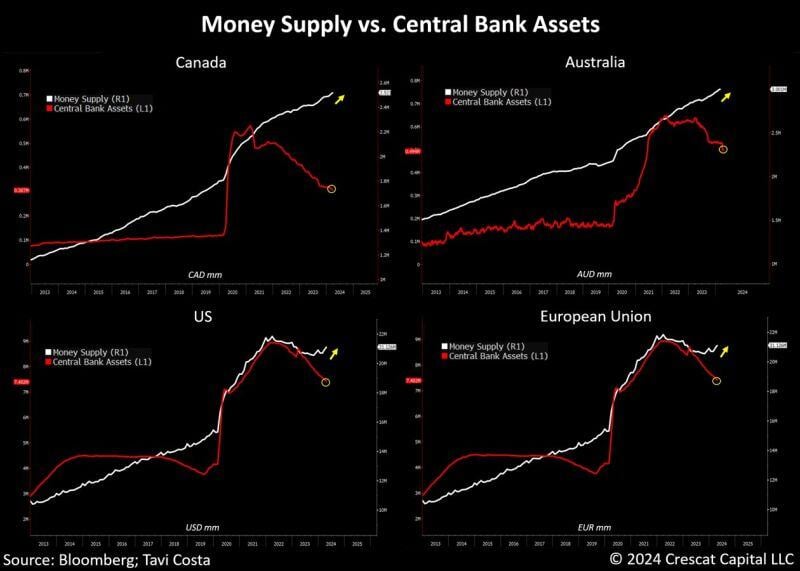

As highlighted by Tavi Costa:

Despite quantitative tightening in most developed economies, their money supply continues to grow substantially, undermining their policies in a significant way. "Today's ECB decision to cut rates highlights how central banks are trapped and forced to reinstate financial repression even as inflation remains higher than historical norms. These policies act as a relief valve to alleviate financial stress, leading to a surge in prices of hard assets with limited supply". Source: Crescat Capital, Bloomberg

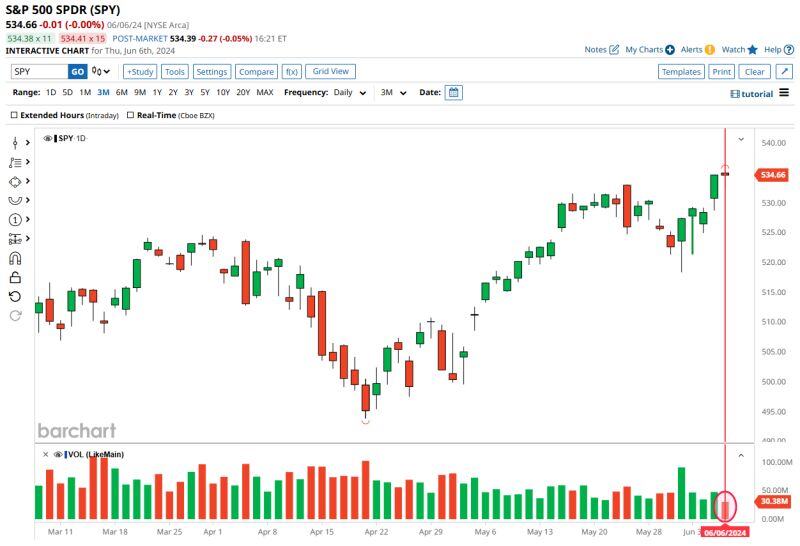

🚨: S&P 500 $SPY finished with its lowest volume in 18 years (excluding holiday-shortened trading days)

Source: Barchart

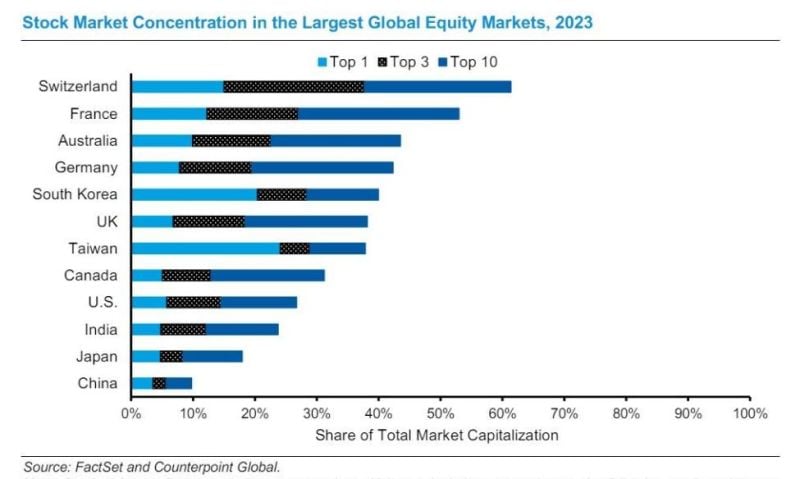

What US stock market concentration? Exhibit below

courtesy of Morgan Stanley and Factset - shows the market concentration at the end of 2023 for a dozen of the largest markets around the world. The U.S. is the fourth MOST DIVERSIFIED market notwithstanding the recent increase in concentration...

Investing with intelligence

Our latest research, commentary and market outlooks