Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

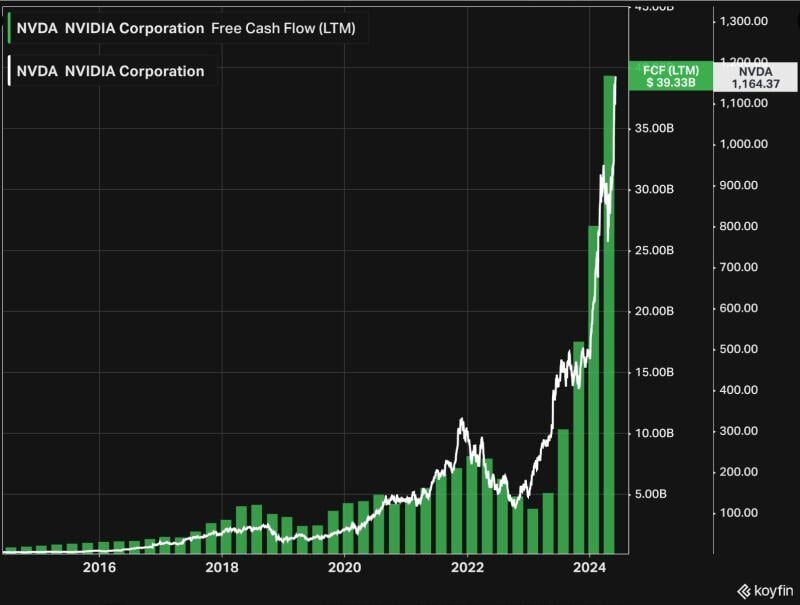

BREAKING: Nvidia stock, $NVDA, officially crosses above $1,200 for the first time in history.

Nvidia now has a market cap of $2.95 TRILLION and is just 3% away from passing Apple, $AAPL, as the largest public company in the world. To put things into perspective: the market cap per employee of Nvidia has hit almost $100,000,000. Source: Bloomberg, HolgerZ

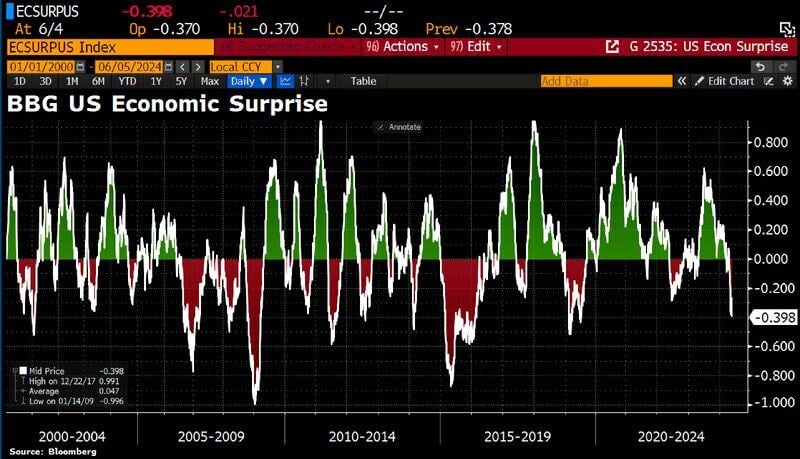

As economic data continues to underwhelm (ISM Manufacturing, JOLTs), the BBG US economic surprise index has plunged to its lowest level in 5 years.

Source: Bloomberg, HolgerZ

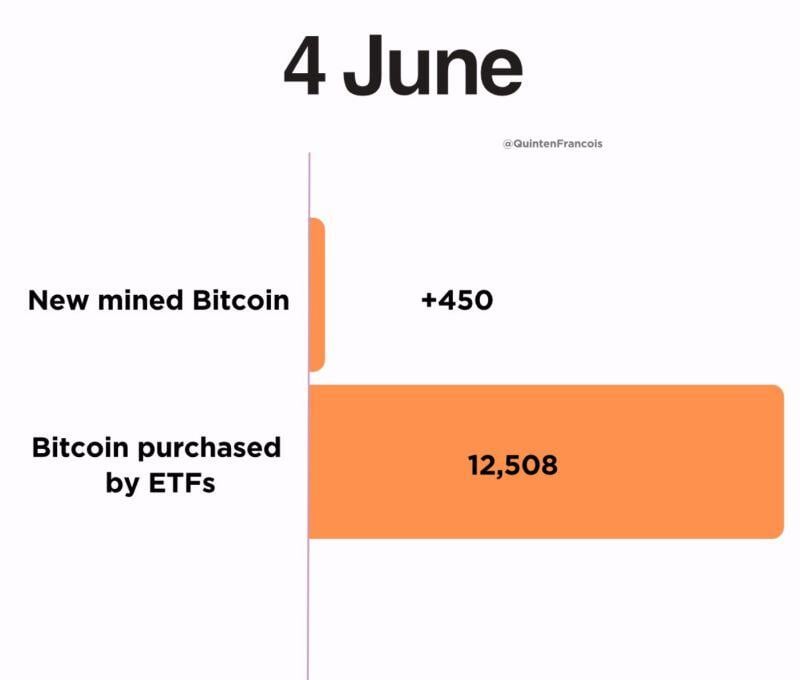

NEW: Spot Bitcoin

ETFs bought 12,508 BTC yesterday, while miners only produced 450 BTC.

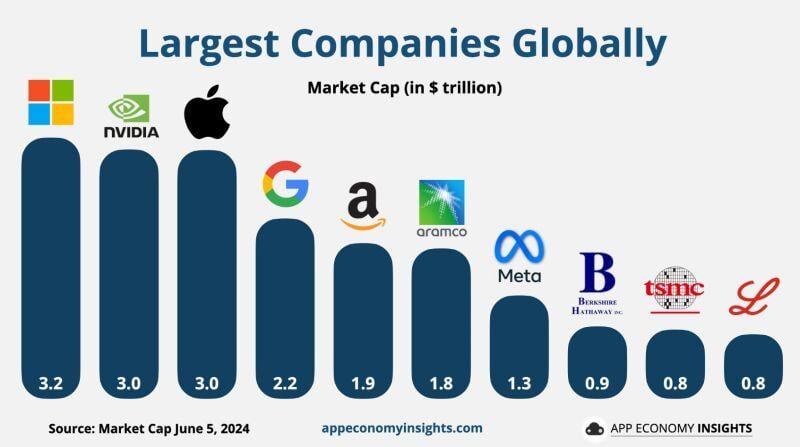

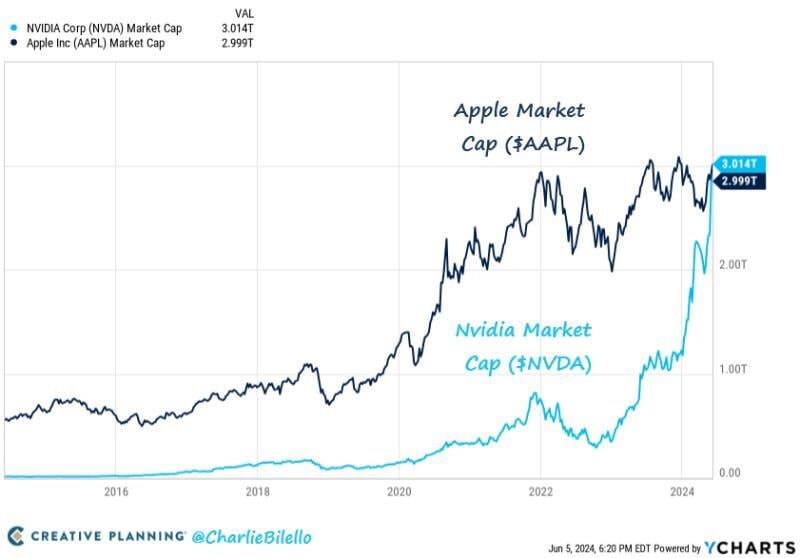

NVIDIA $NVDA reaches a $3T valuation and overtakes Apple $AAPL as the 2nd largest company globally.

Source: App Economy Insights

Just 3 stocks - Microsoft $MSFT, Nvidia $NVDA, and Apple $AAPL - now account for 20% of the S&P 500

Source: Barchart

Nvidia, $NVDA, was up another 6% yesterday (including after hours) moving to a record $1,237/share.

This puts the stock up 155% in 2024 ALONE, adding $1.83 TRILLION of market cap. To put this in perspective, Nvidia has now added as much market cap as the entire value of Amazon, $AMZN, in 6 months. 10 years ago Apple had a market cap 53x higher than hashtag#Nvidia. Today, Nvidia ended the day with a market cap of $3 trillion, surpassing Apple to become the 2nd largest company in the world. Note that Nvidia has also accounted for almost HALF of the S&P 500's YTD market cap gain... Source: Charlie Bilello. The Kobeissi Letter

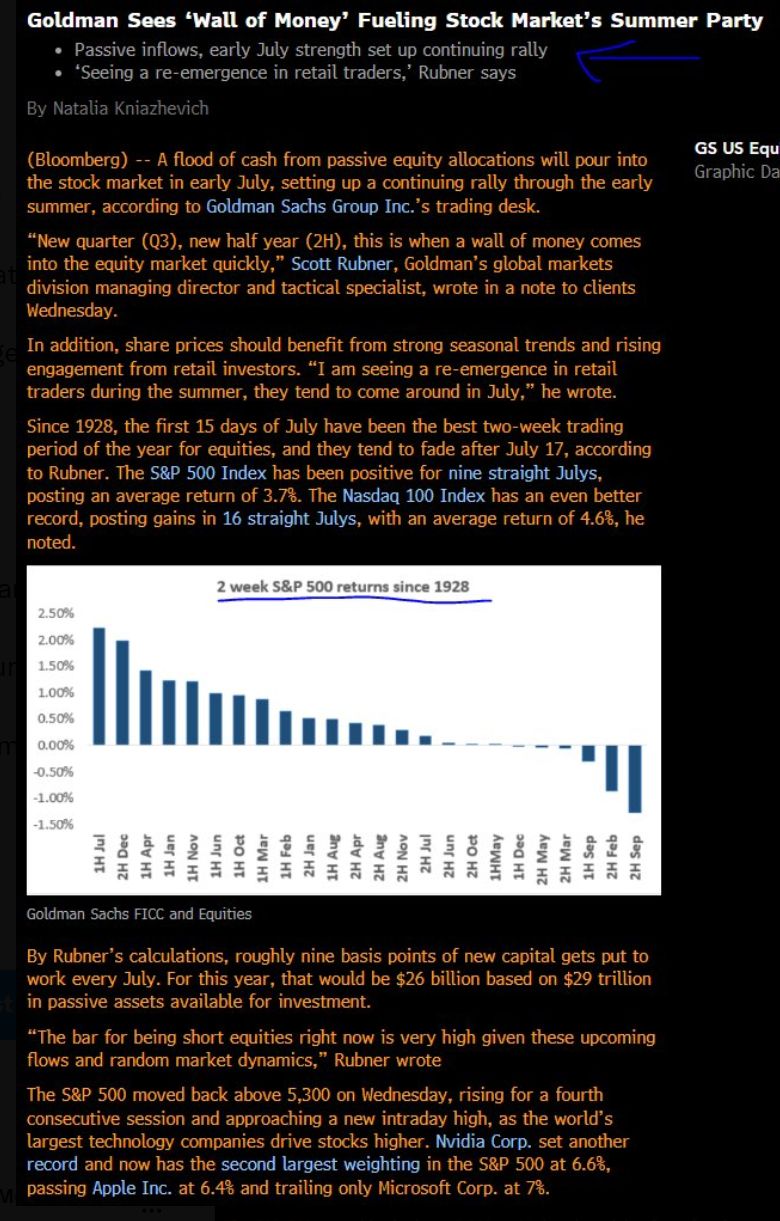

* Goldman Sees ‘Wall of Money’ Fueling Stock Market’s Summer Party

Source: Carl Quintanilla, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks