Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Foreign investors have flocked to saudiaramco’s $12 billion share sale, people familiar with the matter said

This marks a turnaround from the oil giant’s 2019 listing that ended up as a largely local affair. The deal attracted significant interest from foreign investors, according to the people, who declined be identified as the information is private. It wasn’t immediately clear exactly how much demand came from overseas, but those investors put in enough bids to more than fully cover the offering, the people said. Source: Bloomberg

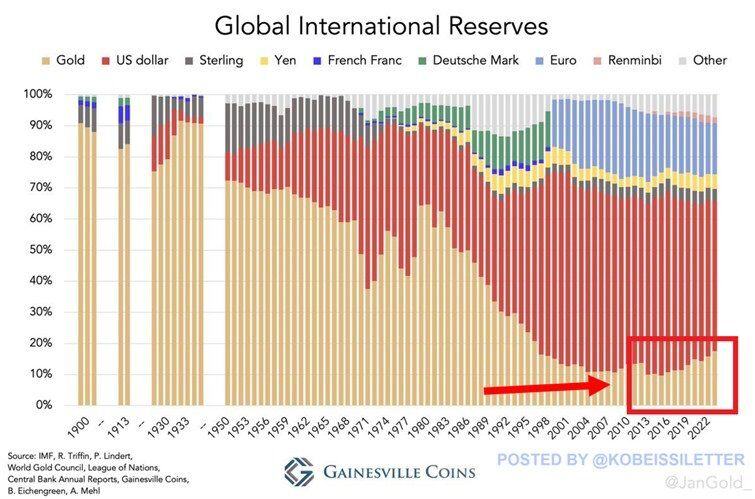

BREAKING: Gold's share of global international reserves jumps to 17.6% in 2023, the most in 27 years.

Source: WinSmart, Gainesville Coins, The Kobeissi Letter

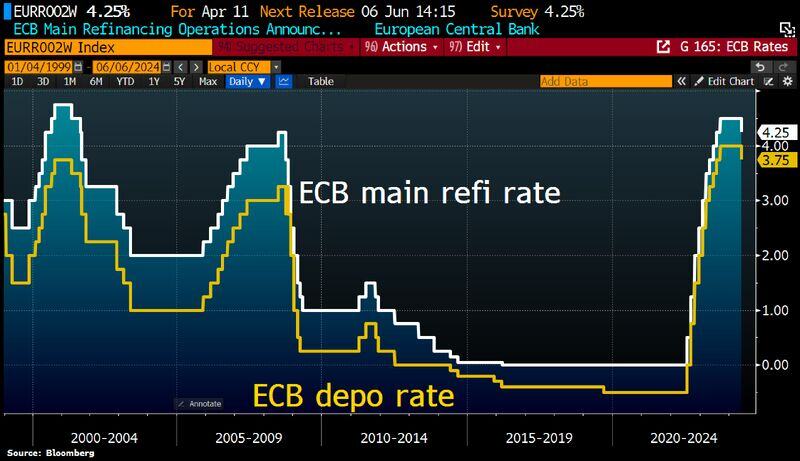

A hawkish cut? As expected, ECB cuts rates by 25bps despite higher inflation projections for 2024 and 2025.

Main rate now at 4.25%, Deposit rate now at 3.75. ECB not pre-committing to any particular rate path. ECB to follow data-dependent, meeting-by-meeting approach. The main surprise of the day is inflation forecasts being revised slightly upwards for 2024 (2.5% vs. 2.3%) and 2025 (2.2% vs. 2%), suggesting that the ECB will maintain a restrictive stance, keeping key rates above the neutral rate for the next 12 to 18 months. Bond yields have slightly increased across maturities without significant weakness in peripheral rates. The market is now pricing in fewer than two rate cuts for the remainder of the year, aligning with expectations of one rate cut per quarter. Source: Bloomberg, HolgerZ

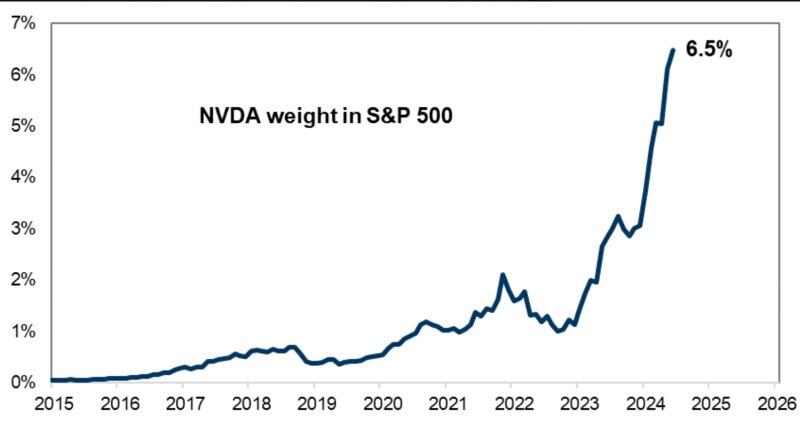

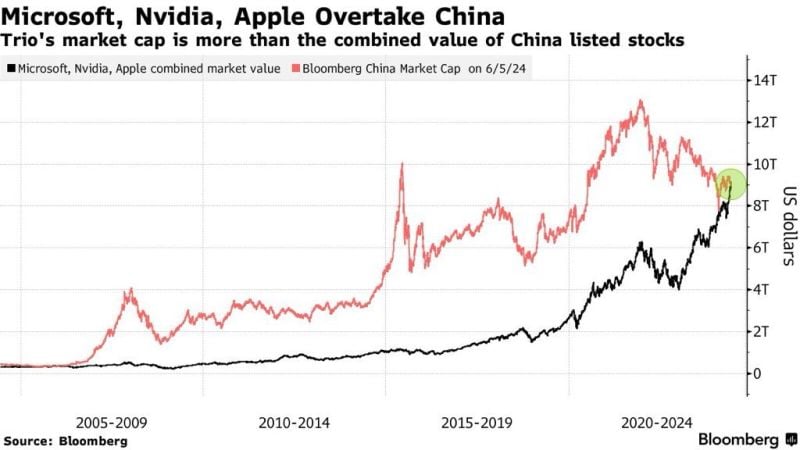

It’s official: Nvidia, Apple, and Microsoft are now bigger than China’s entire stock market.

Source: Bloomberg, www.zerohedge.com

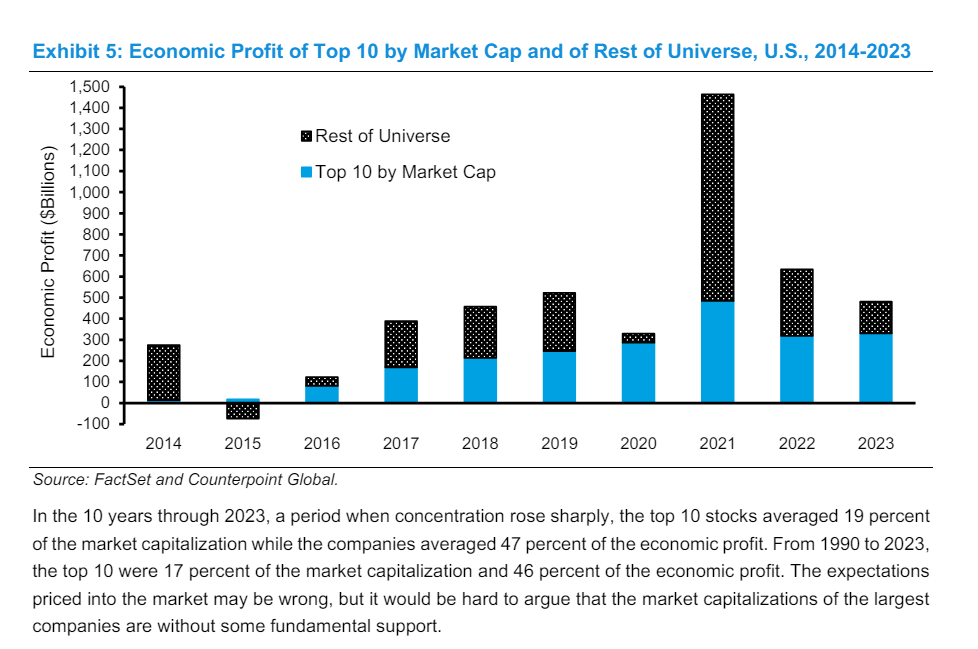

Michael Mauboussin latest research about stock market concentration: "How much is too much?"

Please read Michael Mauboussin’s (head of Morgan Stanley’s Consilient Research) latest article in which he argues that the rising concentration in the US stock market indices is justified by the companies’ underlying fundamentals. The article can be freely accessed on the Morgan Stanley Investment Management website. Source: Consilient Research for Morgan Stanley Investment Management’s Counterpoint Global

Bitcoin Logarithmic Monthly Chart

With a logarithmic chart, it is sometimes easier to identify a trend. The trend has been bullish since the start of Bitcoin. It’s now testing again a major resistance level. Will it be able to breakout ? Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks