Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

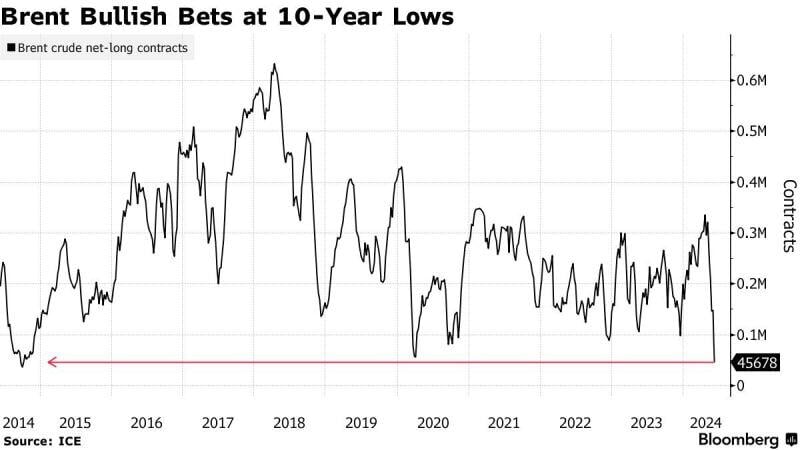

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

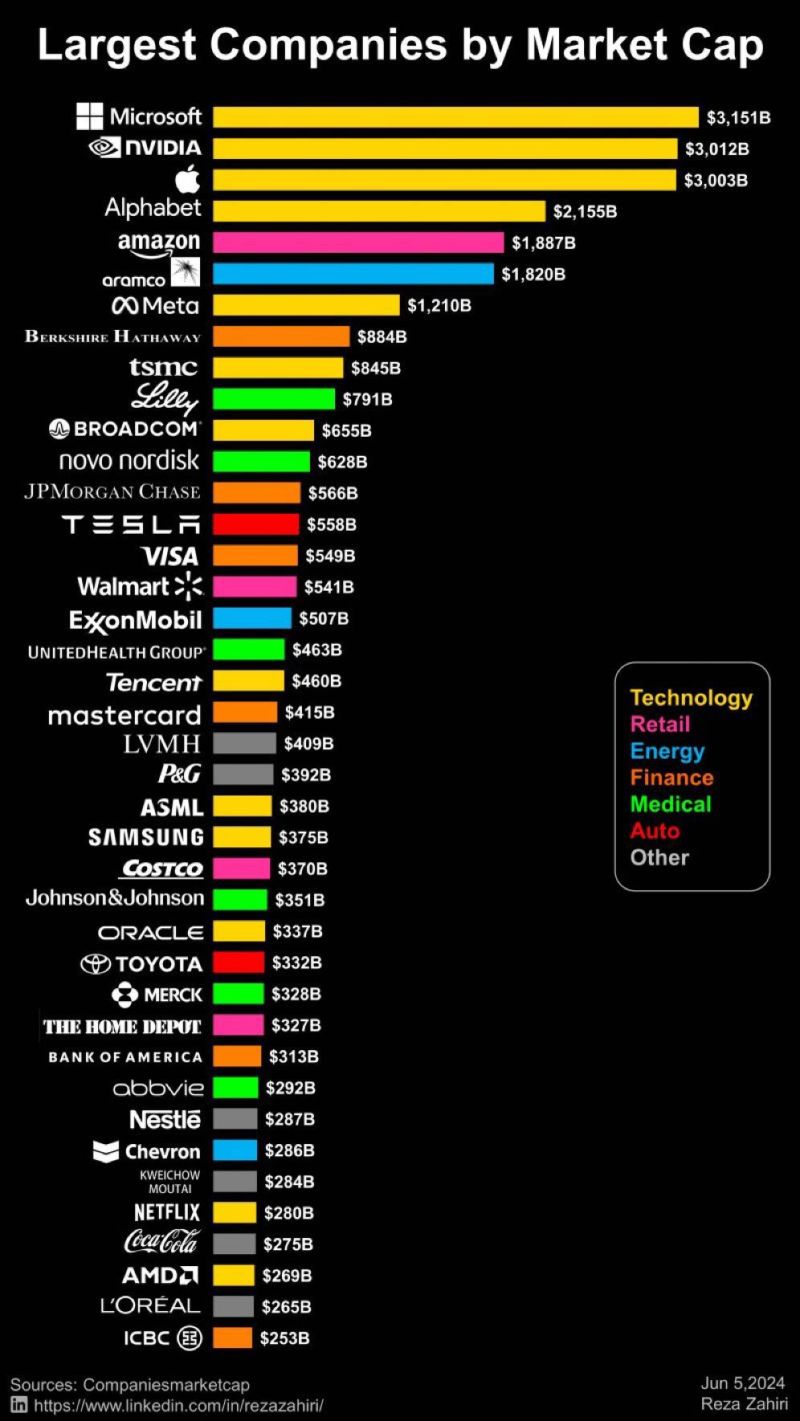

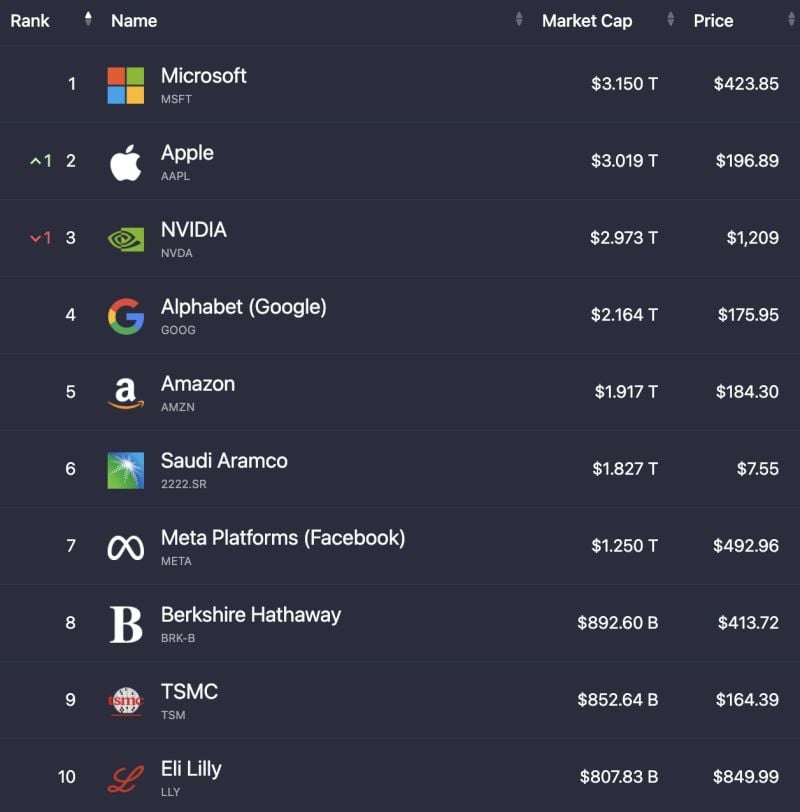

World's largest companies by market cap & the most valued companies

Source: Reza Zahiri

FRANCE | *MACRON'S GROUP THRASHED BY FAR-RIGHT LE PEN'S PARTY IN EU VOTE - BBG

*MACRON GROUP HAS 15%-16%, LE PEN'S HAS 32%-33%: POLLSTERS Source: Bloomberg, Le Figaro, C.Barraud

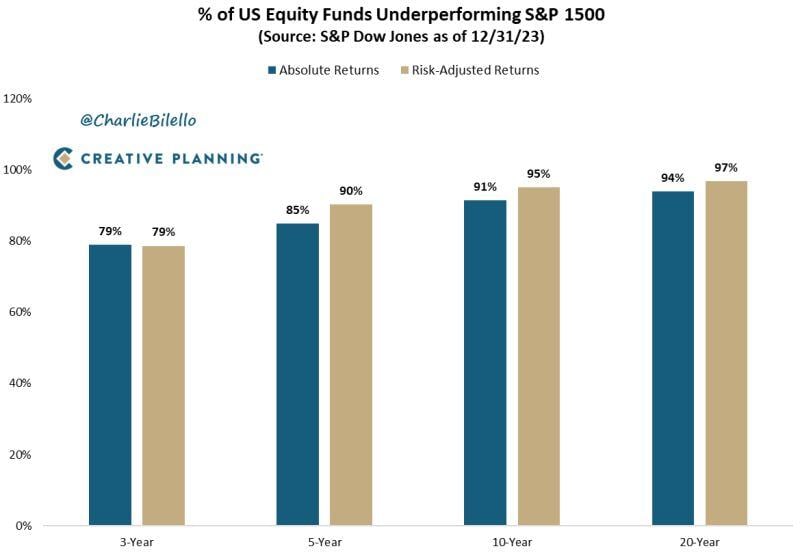

A staggering percentage of US equity funds are underperforming the S&P 1500.

The longer the time period the higher the percentage of underperformers. Source: Charlie Bilello

IMF warns the U.S. needs to reduce its debt burden or else....

Source: FT, Barchart

The top 10 largest stocks in the world are now worth a combined $18.85 Trillion up from $18.21T last week.

Source: Evan

Investing with intelligence

Our latest research, commentary and market outlooks