Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

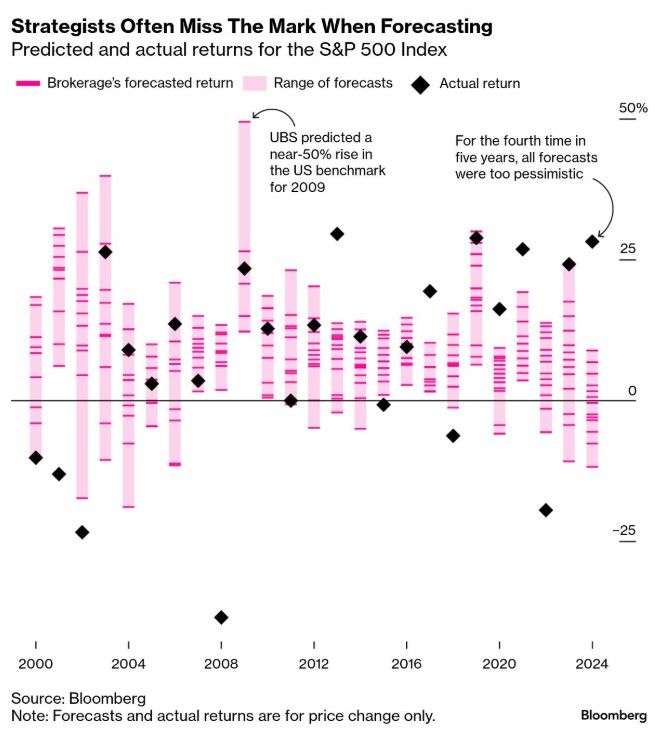

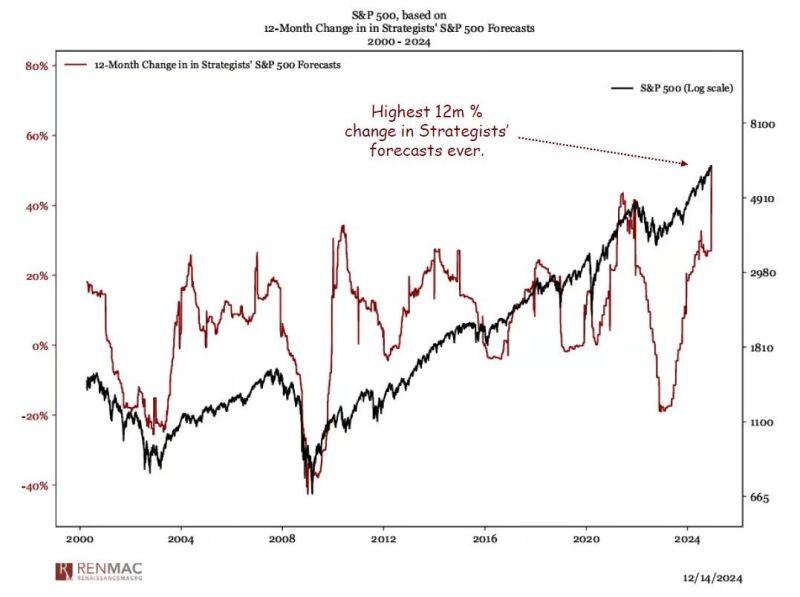

Can Wall Street Get It Right?

The annual tradition of predicting where the S&P 500 will land at year-end has once again raised eyebrows. As Wall Street strategists share their projections for 2025, historical missteps in forecasting cast doubt on their accuracy. 2022: A challenging year where the S&P 500 fell by 19.4%, far worse than predictions. 2023: Despite experts forecasting a modest gain of 6.2%, the index surprised with a remarkable rise of 24.2%. 2024: A consensus estimate of 3% growth was dwarfed by an actual gain of nearly 24% by mid-December. For 2025, the consensus now points to a 9.6% price gain, translating to an 11%+ total return with dividends. source :bloomberg, economicstime

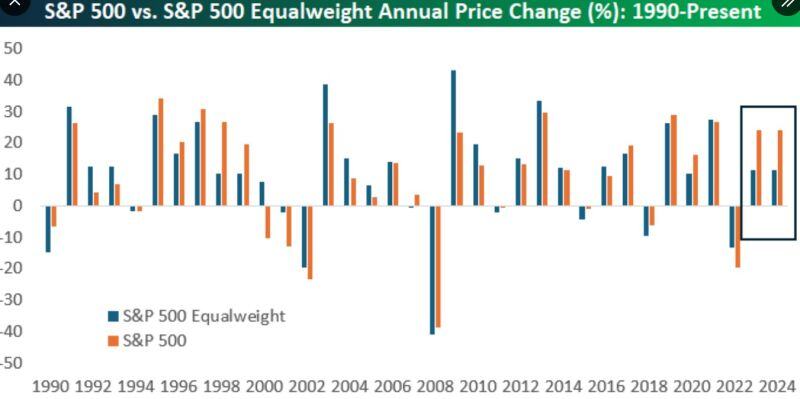

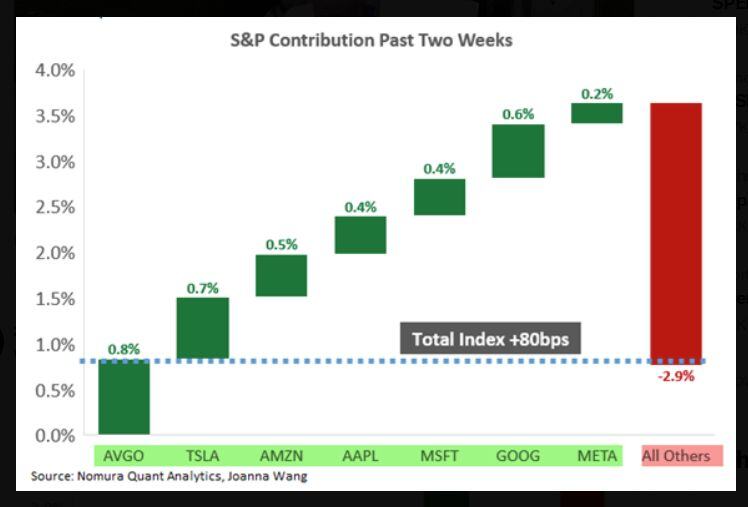

The S&P 500 and S&P 500 Equalweight are on track to have roughly the same price gain in 2024 as they did in 2023.

Equalweight in 2023: +11.56 Equalweight in 2024: +11.47 Cap-weighted in 2023: +24.23% Cap-weighted in 2024: +24.34% source : bespoke

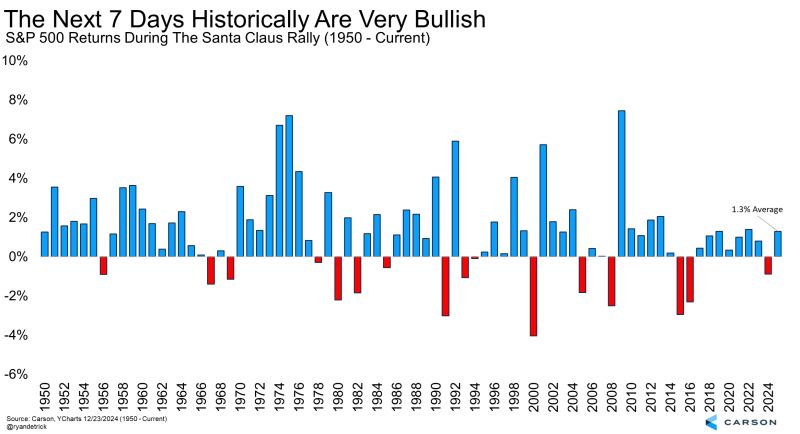

The next 7 days are officially the Santa Claus Rally period.

Down last year, but down back-to-back years only twice since 1950. Source: Ryan Detrick, CMT @RyanDetrick

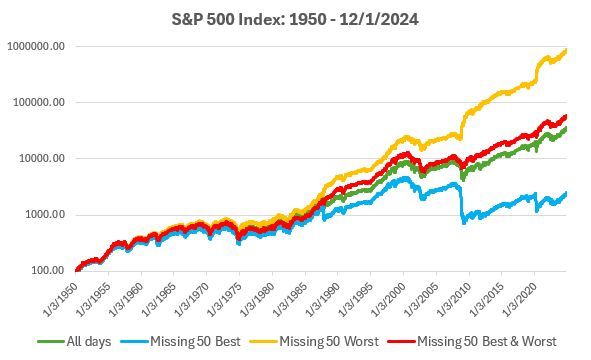

Remember: timing the market versus time in the market.

Source: Willie Delwiche, CMT, CFA @Tyler_Lovingood

🚨 S&P500 erased $1.8 TRILLION of market cap on Fed "hawkish cut".

‼️ Big Tech, Bonds, Bullion and Bitcoin fell sharply after the Fed cuts rates by 25 basis points - which is exactly what 97% of market participants expected. So what happened❓ 👉 Actually, today's market reaction had NOTHING to do with the rate decision. Rather, it would about the Fed's outlook for 2025 which shifted SHARPLY in the hawkish direction. 👉Indeed, the hashtag#Fed reduced their outlook from 3 to 2 rate cuts in 2025. 👉Furthermore, the Fed now sees hashtag#inflation at 2.1% at the end of 2026, still slightly above their 2.0% target. ⚠️ The stock market's decline accelerated after Powell said one specific sentence in his press conference today: "Today was a closer call but we decided it was the right call." ⚠️The US Dollar surged to its highest since November 2022 after he said that. Clearly, the Fed has acknowledged that inflation is an issue, once again. ⚠️On top of this, Cleveland Fed President Beth Hammack dissented in today's decision. 1 out of 19 Fed officials sees no rate cuts in 2025 and 3 officials see just 2 rate cuts. Only 5 Fed officials currently see 3 or more interest rate cuts in 2025 in a sudden hawkish shift. This led to what appears to have been the biggest panic sell in the market since the Yen carry trade collapsed. Small cap stocks fell nearly 5% today and the Dow posted a 10-day losing streak for the first time since 1974. Sentiment is shifting as we look into 2025.

The stat of the day >>>

Yes, the Fed has already cut near all-time-highs and you know what ❓ The Bulls 🐮 Liked it 👍 The S&P 500 is less than 2% away from all-time highs the day before a Fed decision. Since 1980, there were 20 other times they cut rates within 2% of ATHs. The S&P 500 was higher a year later 20 times 🚀 Source: Ryan Detrick, CMT @RyanDetrick

Investing with intelligence

Our latest research, commentary and market outlooks