Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

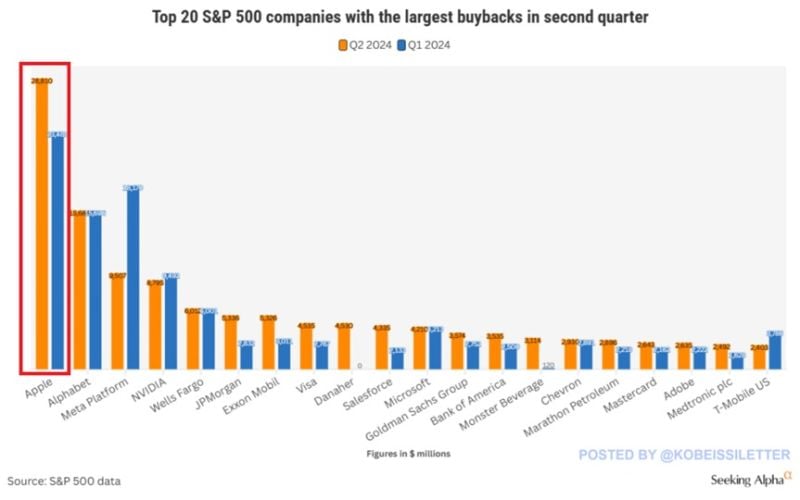

BREAKING: S&P 500 buybacks jumped 35% in Q2 2024 to $236 billion, near the all-time record.

Furthermore, a massive 52% of stock repurchases were conducted by the index's top 20 firms. This compares to a long-term average of 48% and pre-pandemic average of 45%. Apple, $AAPL, Alphabet, $GOOGL, Meta, $META, and Nvidia, $NVDA ALONE back $63 billion of stock. The Information Technology sector saw $68 billion of repurchases while Financials and Communication Services saw $45 billion and $35 billion, respectively. Buybacks are fueling the stock market rally. Source: The Kobeissi Letter

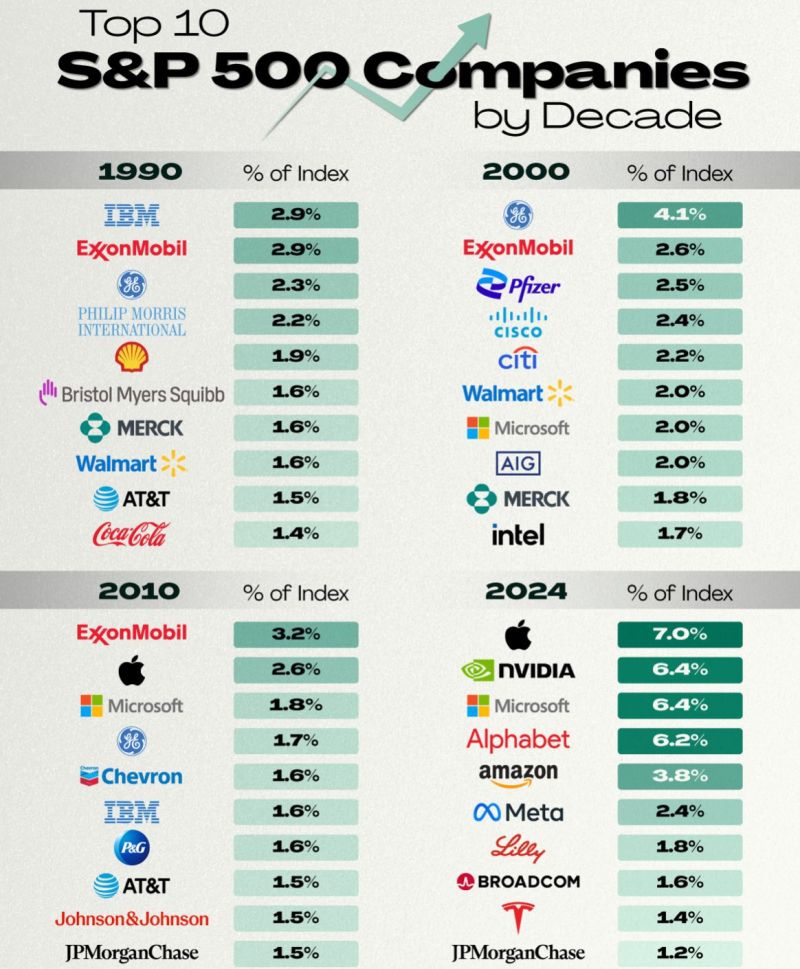

No one can predict the future so just S&P 500 and chill...

Source: Dividend Talks on YouTube

BofA: With the S&P 500 up ~50% over the last two years, history suggests more modest index gains going forward.

Returns were most frequently in the 0-10% range following periods where the index was up 40-50% over a two-year period Source: Mike Zaccardi, CFA, CMT, MBA

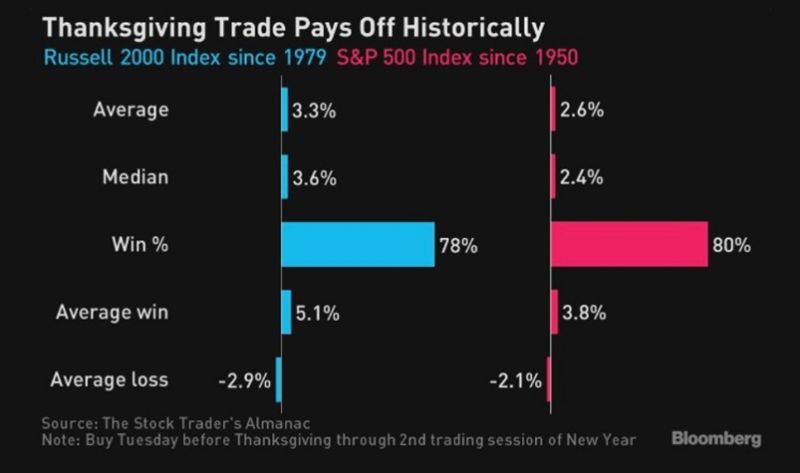

Strong seasonal pattern kicking off today through the second trading day of the New Year…

Source: Bloomberg

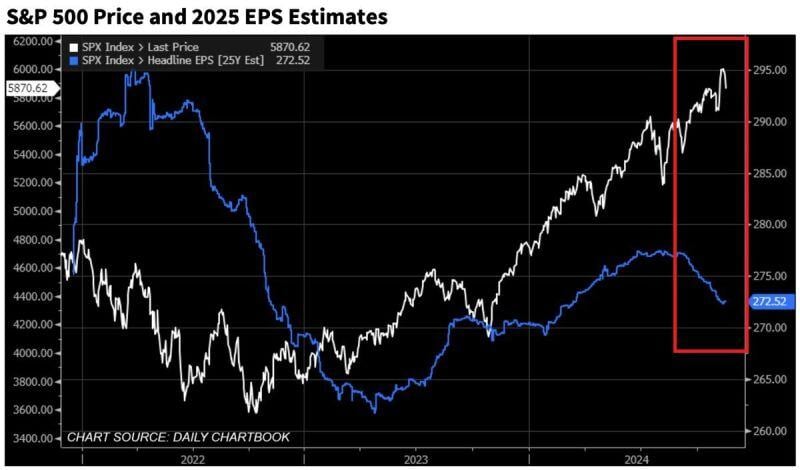

S&P500 earnings estimates for 2025 have rolled over and declined over the last few weeks.

At the same time, the S&P 500 continued to rise making valuations even more stretched (expensive). Will earnings estimates catch up or stocks fall? Source: Global Markets Investor

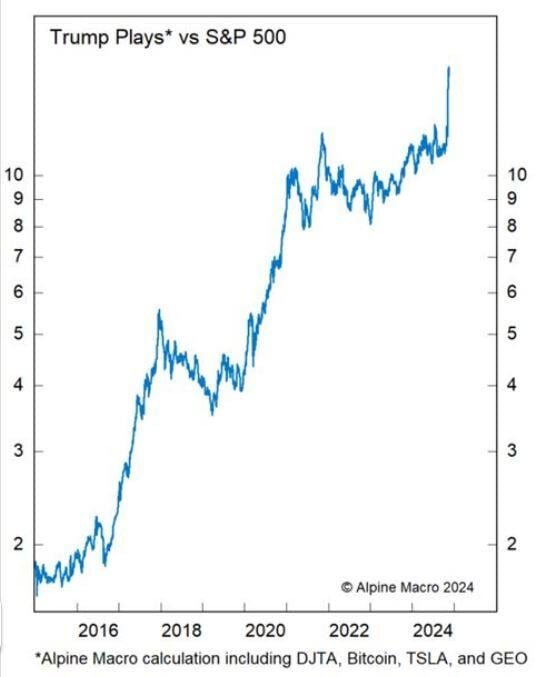

Here's the outperformance (vs. S&P 500) of a pure play Trump index created by Alpine Macro.

It owns DJTA, Bitcoin, Tesla and GEO equally-weighted

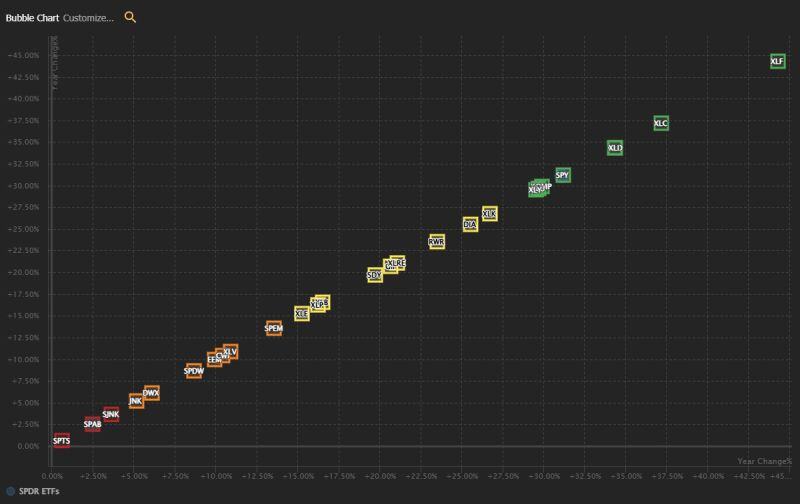

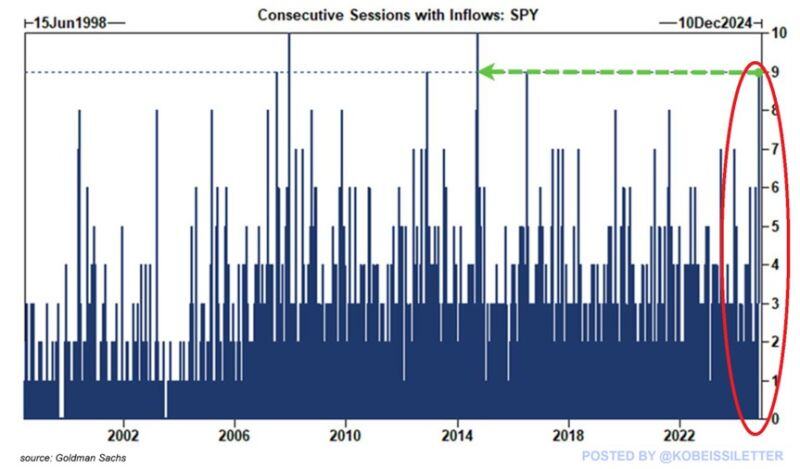

The S&P 500 ETF, $SPY, just saw 9 consecutive days of money inflows, the longest streak since 2014.

Investors have poured $18 billion into $SPY over these 9 days as post-election buying continues. Since 2000, $SPY has only seen 4 streaks with 9 to 10 straight days of inflows: in 2007, 2013, 2014, and 2016. Massive inflows supported the 5%+ run in the S&P 500 following the election. Over the last 13 months, the S&P 500 has now added more than $15 TRILLION of market cap. Source: The Kobeissi Letter, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks