Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- sp500

- Bonds

- Asia

- bitcoin

- Central banks

- markets

- technical analysis

- investing

- inflation

- europe

- Crypto

- interest-rates

- Commodities

- geopolitics

- performance

- gold

- ETF

- tech

- nvidia

- AI

- earnings

- Forex

- Real Estate

- oil

- bank

- FederalReserve

- Volatility

- apple

- nasdaq

- emerging-markets

- magnificent-7

- energy

- Alternatives

- switzerland

- trading

- tesla

- sentiment

- Money Market

- russia

- assetmanagement

- France

- UK

- china

- ESG

- Middle East

- amazon

- ethereum

- microsoft

- meta

- bankruptcy

- Industrial-production

- Turkey

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

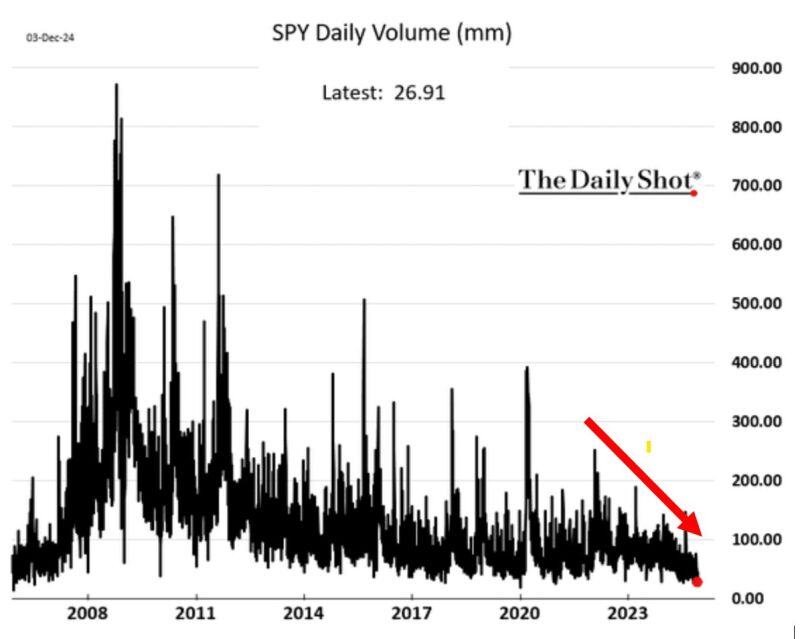

US STOCK MARKET LIQUIDITY IS FALLING

S&P 500 ETF daily trading volume PLUNGED to 26.9 million on Tuesday, near the lowest since 2007. At the same time, S&P 500 futures trading volume FELL to the lowest in 3 YEARS. This increases the risk of some wild moves going forward. Source: Global Markets Investor, The Daily Shot

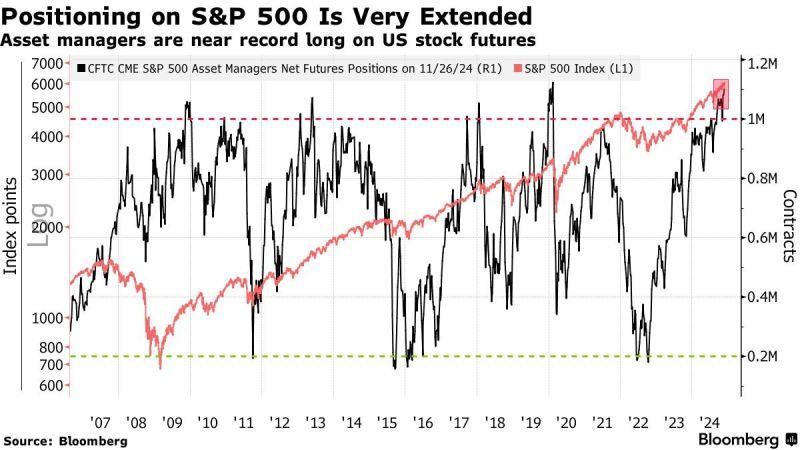

S&P 500 futures positioning is very extended. Nearing record long levels, according to Citi.

Source: Barchart, Bloomberg

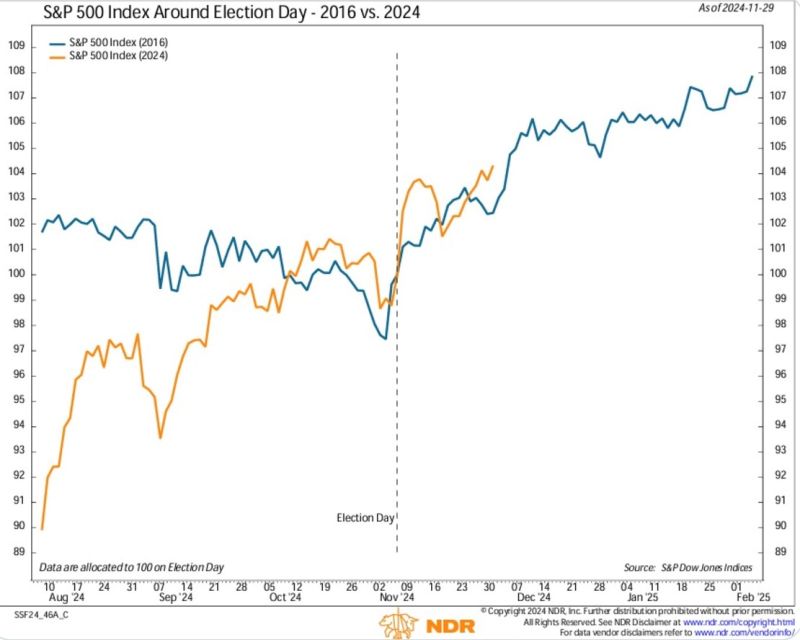

Interesting analog regarding Trump 1.0 vs Trump 2.0 from NDR.

S&P 500 rallied after both elections.

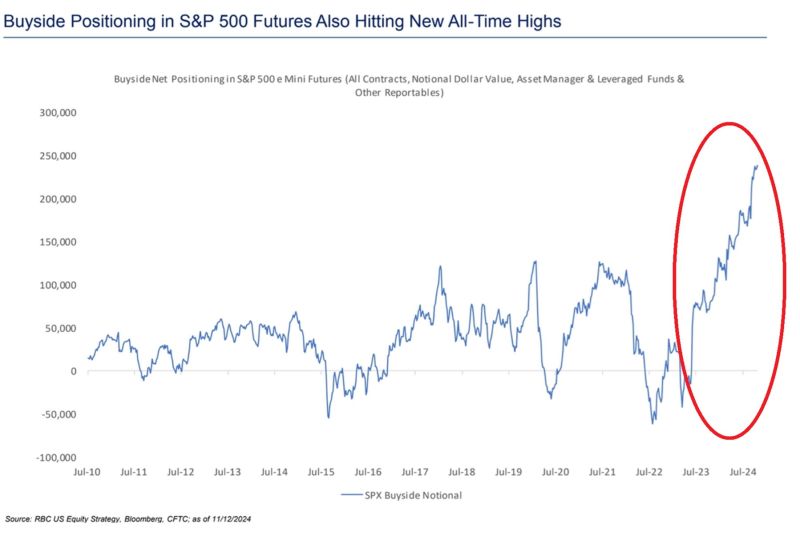

🚨INSTITUTIONAL INVESTORS HAVE NEVER BEEN MORE BULLISH🚨

Asset managers, leveraged funds and other investors net LONG positioning in the S&P 500 exceeded 240,000 contracts, the most on record. This is DOUBLE the amount seen in 2021 before the bear market started. Euphoria is an understatement. Source: Global Markets Investor

Wow! JPMorgan's S&P 500 target for the end of 2024 was 4,200. For 2025, it's now 6,500

Source: Trend Spider

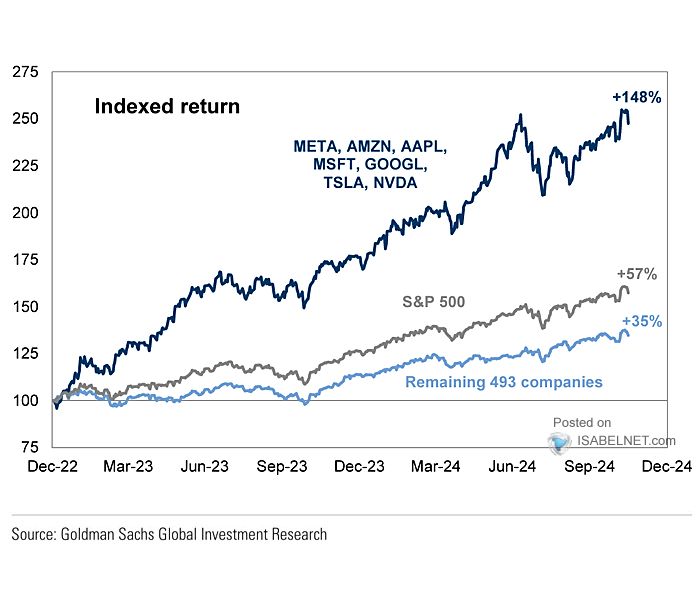

With their massive market caps and impressive price appreciation, the Magnificent7 stocks have played a crucial role in driving the S&P 500 index’s performance.

Without them, S&P 500 returns since December 2022 would be much closer to average, still good, mind you, but more average. 🤣 @ISABELNET_SA thru Lance Roberts on X

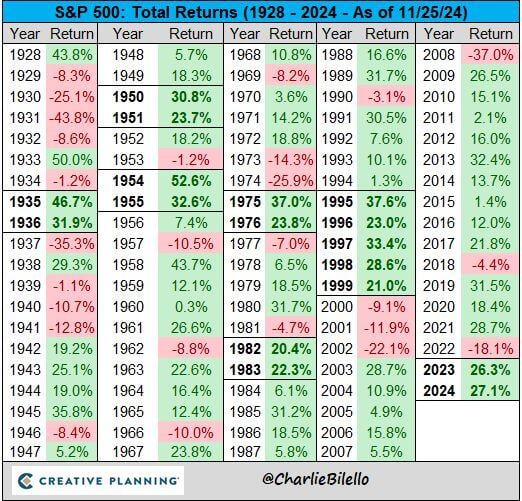

The S&P 500 is currently on pace for back-to-back years with a total return above 20%.

The last time that happened: 1998-1999. $SPX Source: Charlie Bilello

The S&P 500 has gained over $10 trillion in value this year.

Source: Brew Markets

Investing with intelligence

Our latest research, commentary and market outlooks