Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

"Positioning is extremely long... Non-dealer positioning in US index futures is at a all-time highs. Systematic positioning (CTAs + Vol Control + Risk Parity) is near 1y highs."

Source: JP Morgan, TME

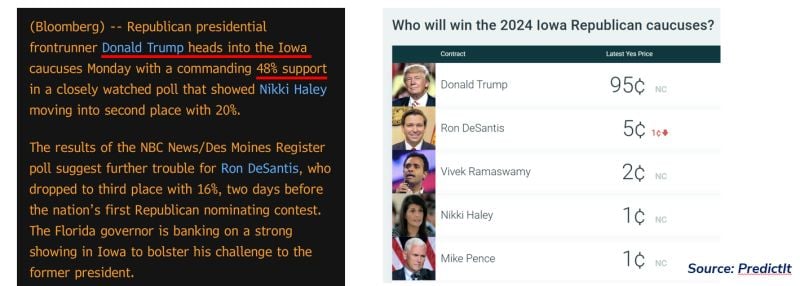

US 2024 Presidential race: Trump heads into Iowa caucuses

The Iowa caucus on January 15 launches the long designation process of the Republican and Democrat candidates to the US presidential election. On that day, only Republicans will vote (Democrats will hold their own later in 2024). While Iowa is a small state, and not very representative of the country’s population (90% of Iowa’s population is white), it is seen as very important for candidates to gather positive momentum for the remaining of the campaign and the following state caucus and primaries. In the current context, the Iowa caucus may already provide a hint on whether any challenger to Trump within the Republican party has the potential to compete with the former President, or not. Source: Bloomberg, PredictIt

Key takeaways from Taiwan's President election;

1) Re-elected President Lai Ching-te (DPP party) favors closer ties with the US and an expected status quo regarding the situation of Taiwan and the existing relationships. We don’t expect any significant change in Taiwan’s policies 2) We note that US President Biden statement post-election has been very balanced (Official congratulations to Lai-Ching Te but no support to Taiwan independence vote) Source: Bloomberg

The Fed balance sheet expanded last week by $5.7BN - the most since March's SVB crisis...

Source: Bloomberg, www.zerohedge.com

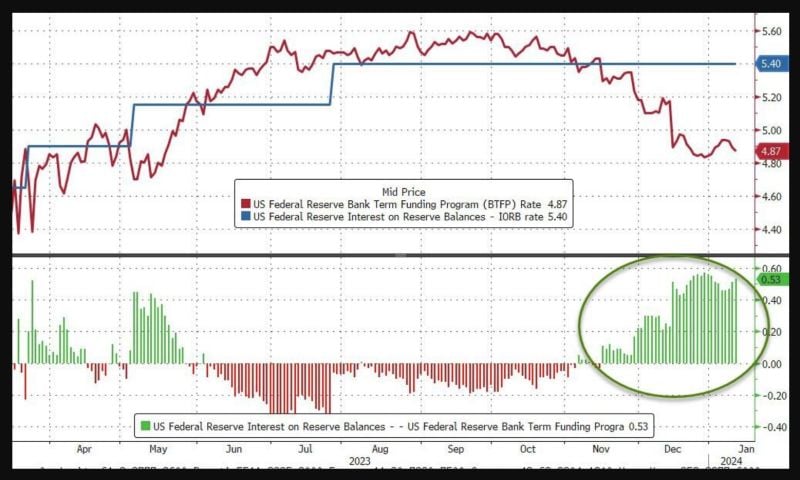

Wondering by us bank stocks are doing well?

Since the introduction of the Bank Term Funding Program (BTFP) in March, there is a nice arbitrage opportunity for banks - watch out on the chart below the gap between the rate on the Federal Reserve’s nascent funding facility and what the central bank pays institutions parking reserves. Since March / SVB crisis, the BTFP-Fed Arb continues to offer 'free-money' to banks - and usage of the BTFP has risen by $38BN since the arb started to exist. Source: Bloomberg. www.zerohedge.com

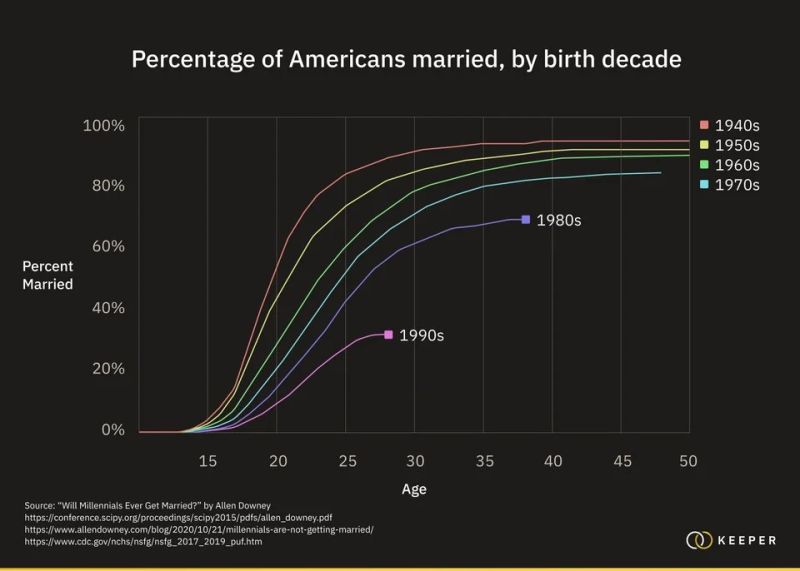

Less and less Americans are getting married.

This is negatively impacting family formation and leading to a slower population growth rate as a result. Source: Markets & Mayhem, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks