Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

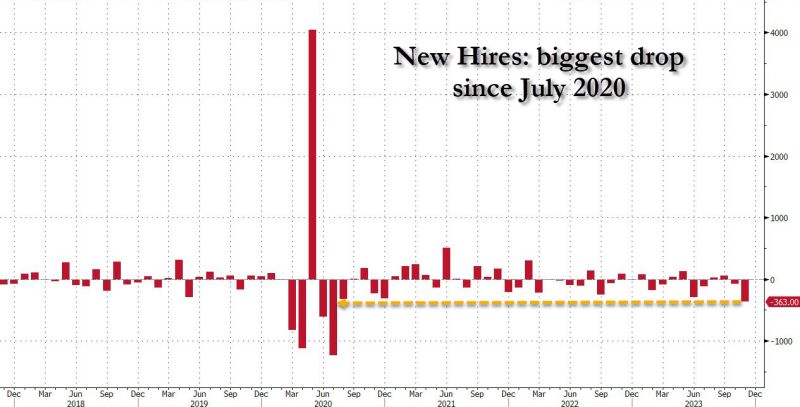

Could a hot US job print invalidate the downward trend in bond yields?

The US 10 year is flirting with the massive 4% levels again. A close above it and things could become even more "dynamic" to the upside. Note 21 day right here, while 50 day remains way higher. Source: Refinitiv, TME

FED meeting minutes key takeaways:

1) rates likely at or near their peak 2) 2pct inflation target is maintained 3) monetary policy is likely to stay restrictive for some time 4) clear progress has been made on inflation (dixit the Fed) 5) see rate cuts by the end of 2024 FOMC views continue to diverge from market expectations (2x more rate cuts are currently priced vs. Fed guidance) Source: CNBC, The Kobeissi Letter

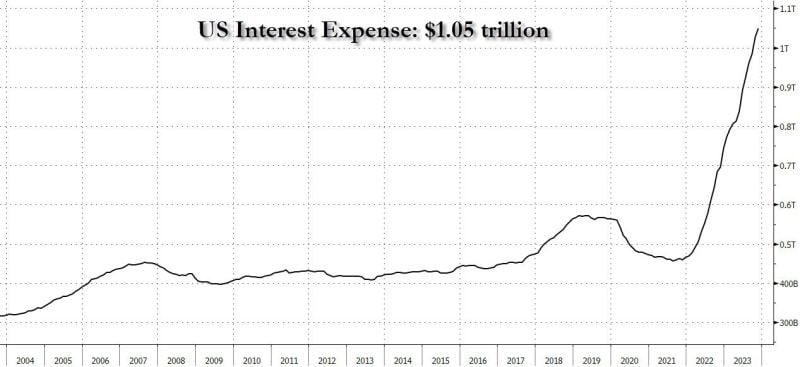

US Interest expense ~$1.1 trillion as of today

That's $250BN more than the Defense Budget; $250BN more than spending on Medicare, $200BN more than spending on health, and will surpass the $1.35 trillion spending on Social Security this year, becoming the single biggest outlay Source: www.zerohedge.com

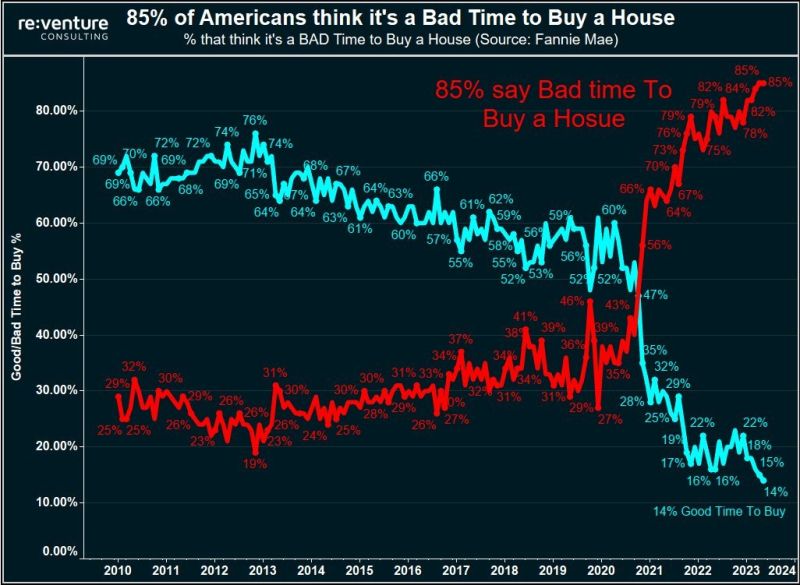

A record 85% of Americans now say it's a bad time to buy a house, according to Reventure

Two years ago, just ~30% of Americans thought it was a bad time to buy a home. Even in 2008, during the worst housing crisis of all time, this metric did not top 85%. In a market with high rates and supply levels 40% below the historical average, affordability is at all time lows. Source: The Kobeissi Letter

Investing with intelligence

Our latest research, commentary and market outlooks