Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

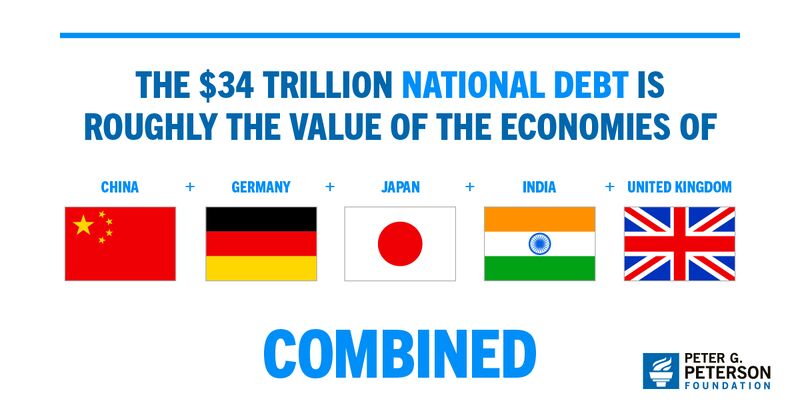

BREAKING: Total US debt hits $34 trillion for the first time in history, putting US debt up 100% since 2014

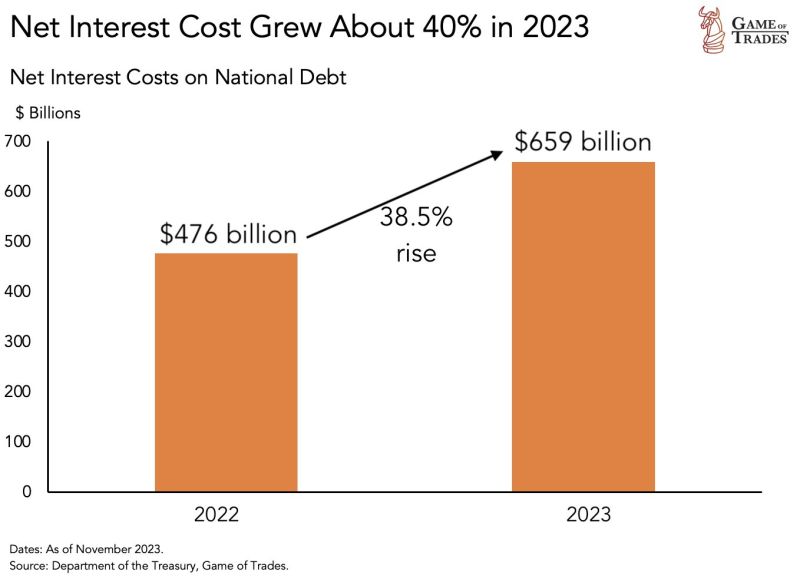

Since the debt ceiling "crisis" ended in June 2023, total US debt is up nearly $3 trillion. This debt balance is more than the value of the economies of China, Germany, Japan, India and the UK COMBINED. The US is now spending $2 billion PER DAY on interest expense alone. Debt per capita is at a record high of $101,000. Source: The Kobeissi Letter

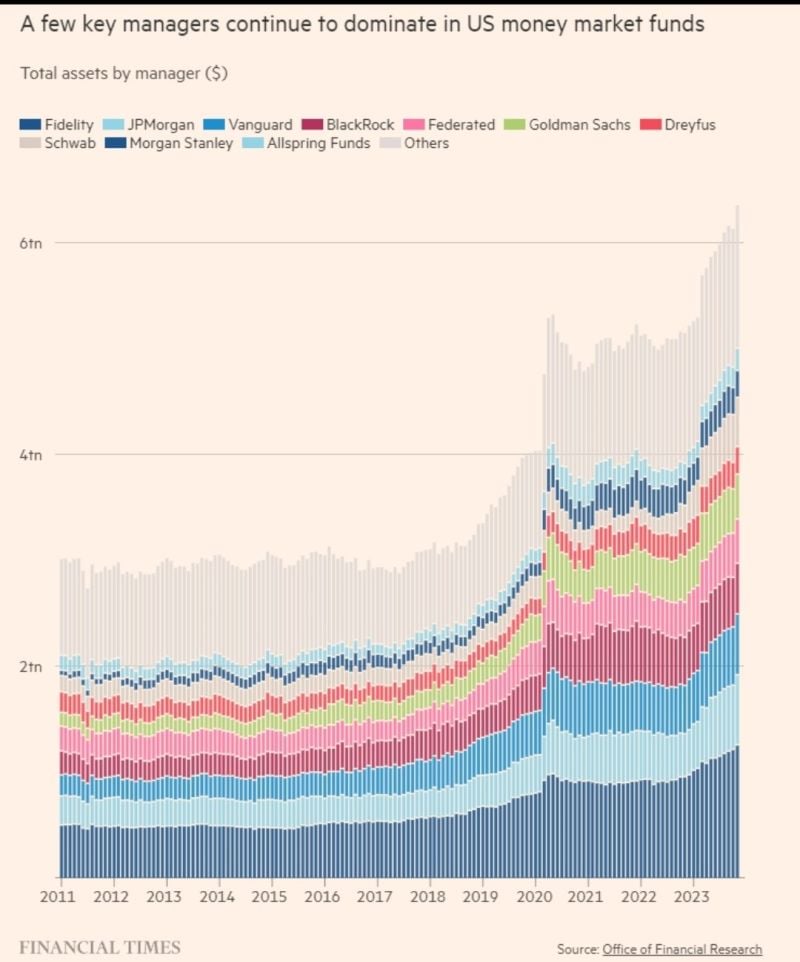

All-Time High $6.3 Trillion sitting in U.S. Money Market Funds

Source: Win Smart, CFA, FT

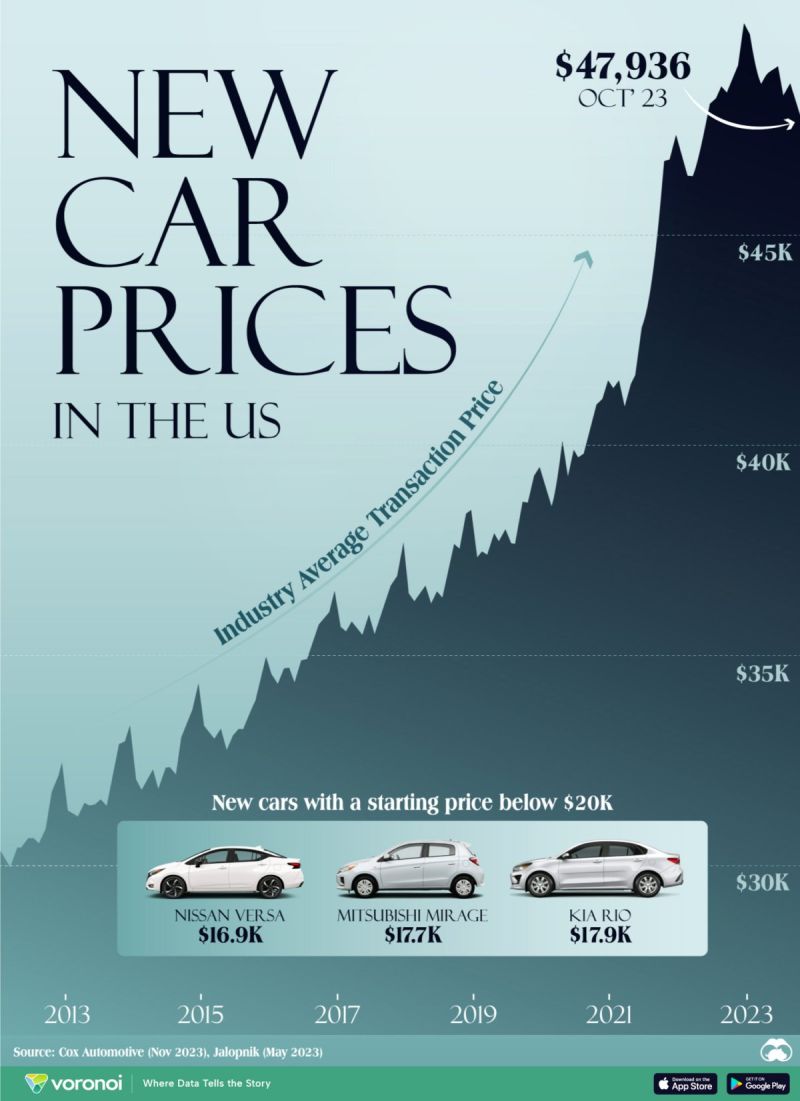

The Growth of New Car Prices in the U.S.

Source: Visual Capitalist

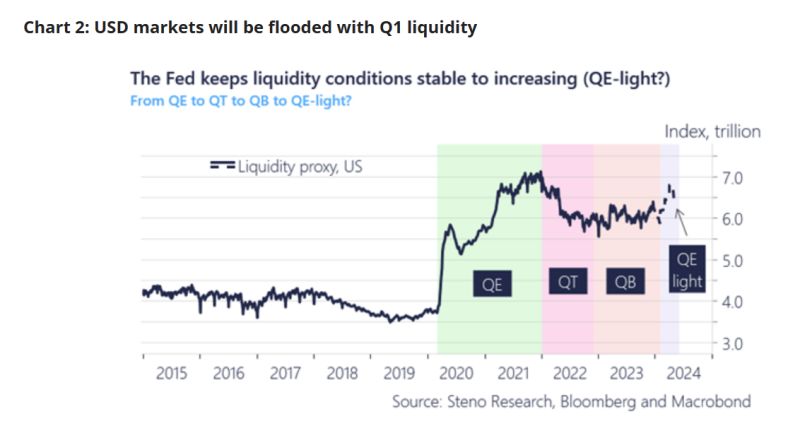

LIQUIDITY MATTERS... From QE (Quantitative Easing) to QT (Quantitative Tightening) to QB (Quantitative Balancing) to QE Light

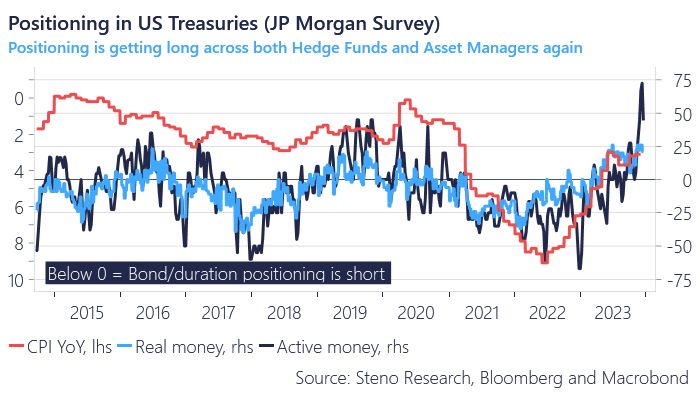

Some interesting views by Andreas Steno Larsen (Steno Research / Macrobond): 2024 Q1 -> While we are celebrating our inflation-progress, Powell and Yellen intend on handing out "Stealth QE / QE light" gifts to the banking system in Q1-2024. Steno Research view is that USD liquidity is likely going to increase massively in Q1 due to a series of technicalities surrounding the BTFP, ON RRP and TGA facilities. These three liquidity adding mechanisms will more than outweigh the QT program (running at a little less than $95bn a month on average), leaving a very benign liquidity picture ahead for Q1-2024. By their estimates, liquidity will increase with $8-900bn until end-March, which almost resembles a QE-light / stealth QE scenario. This will in case be one of the fastest liquidity additions on record, only outpaced during the early innings of the pandemic! If this happens, such a liquidity injection might be a massive tailwind for risk assets...

Investing with intelligence

Our latest research, commentary and market outlooks