Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

BREAKING: US House votes to authorize an impeachment inquiry into President Biden.

This escalates a probe that has been open for months. The House voted 221 to 212 to open the inquiry. Biden family finances and businesses are in focus. Another historic development in 2023. Source: The Kobeissi Letter

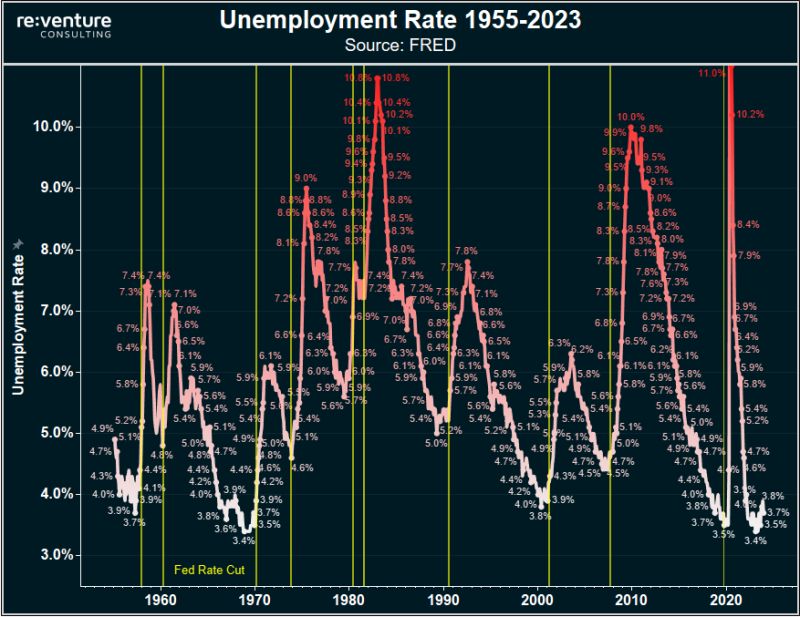

After 2 years of the most aggressive FED rate hike cycle since the 1980s, the price of US houses (3 years change) is rising at the fastest pace in 40 years...

that sounds a bit counterintuitive at first glance as most surveys show that the housing affordability is at record low Source: BofA

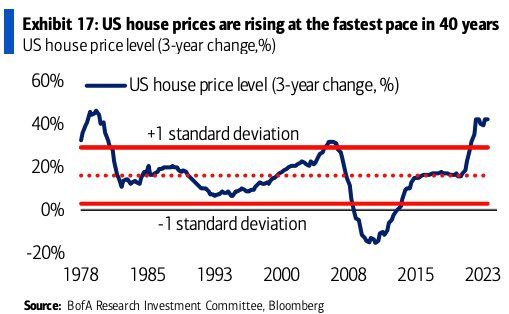

Who owns US Treasuries? For the first time since 1998, the private foreign sector now holds more US Treasuries than the official foreign sector

For 25+ years, the biggest foreign holders of US Treasuries were central banks around the world. However, this has now changed. reasons? QT but also foreign central banks buying less US Treasuries. Meanwhile, yield starving private investors keep accumulating US Treasuries. Source: Apollo, The Kobeissi Letter

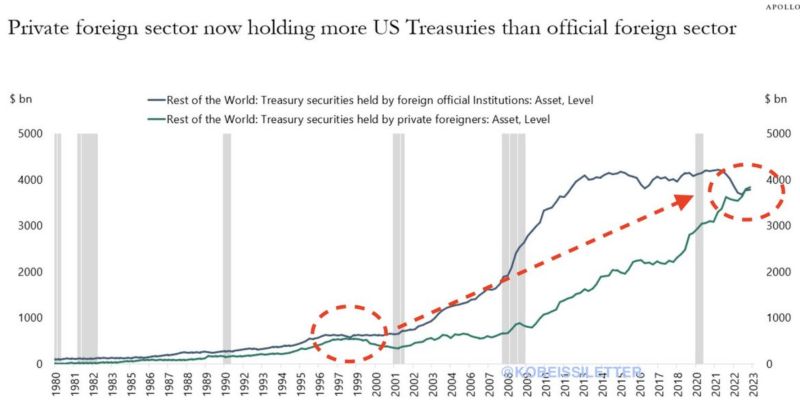

US CPI has moved down from a peak of 9.1% in June 2022 to 3.1% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Gasoline, Used Cars, Medical Care, Apparel, New Cars, Food at Home, Electricity, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

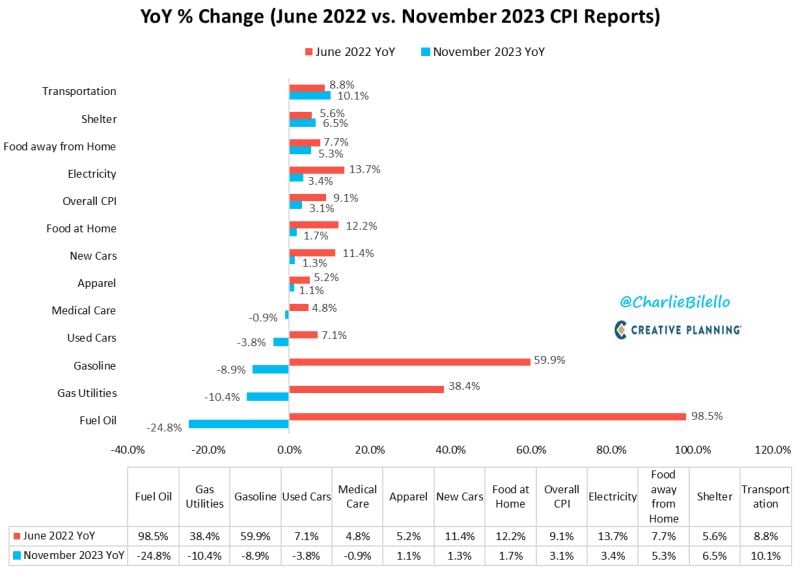

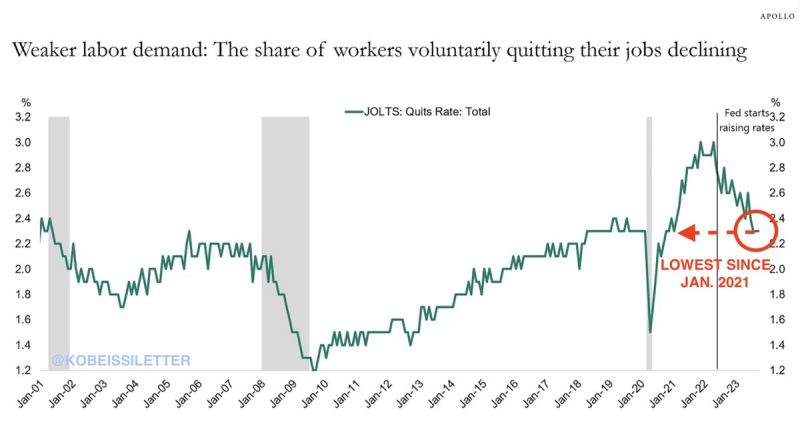

The share of workers voluntarily quitting their jobs is down to 2.3%

This is the lowest since January 2023 and down from 3.1% prior to the Fed started rate hikes. Weaker labor demand will be the theme of 2024 as job growth slows and rates stay higher for longer. Furthermore, as excess savings have now been depleted, consumers are more reliant on holding a job. Source: The Kobeissi Letter

A slightly disappointing US CPI inflation numbers for the markets...

US YoY CPI eased to 3.1% in November from 3.2% while the important core reading was unchanged at 4% YoY, despite seeing the MoM tick a bit higher. The so-called super-core, a measure watched by the Fed, meanwhile rose at one of the fastest monthly paces this year.

Investing with intelligence

Our latest research, commentary and market outlooks