Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

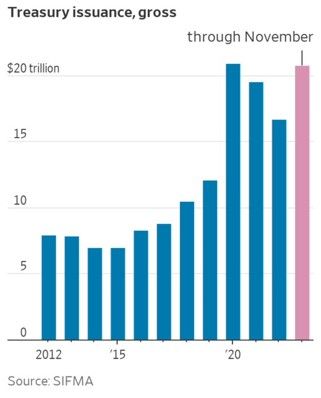

HEAVY SUPPLY REMAINS AN ISSUE FOR US TREASURIES

The US Treasury is selling $108 billion of 3-year, 10-year and 30-year bonds on Monday and Tuesday, along with $213 billion of shorter-term bills. This year’s Treasury sales are poised to surpass the record set in 2020. Source: Lisa Abramowitz, WSJ

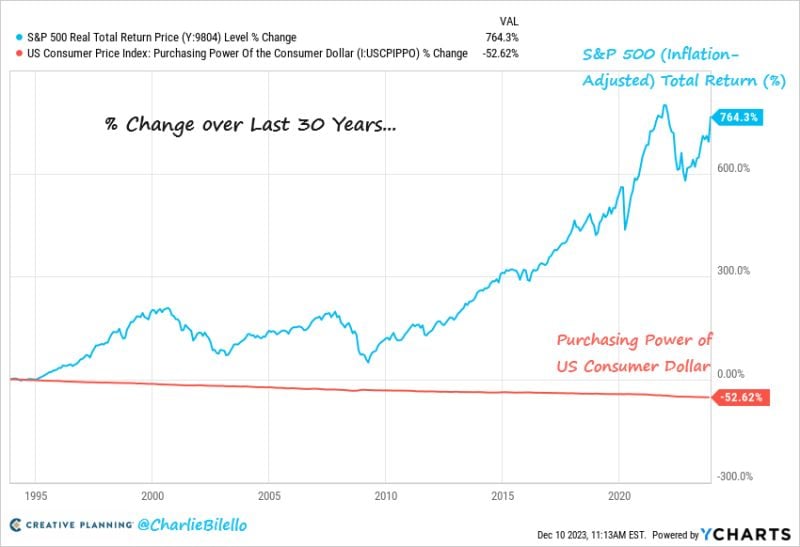

Over the last 30 years, the purchasing power of the US consumer dollar has been cut in half due to inflation

At the same time, the S&P 500 has gained 764% (>7% per year) after adjusting for inflation. Source: Charlie Bilello

Nice one by Lyn Alden -> Since the start of 2020, the United States has taken on $10.7 trillion in new public debt (i.e. accumulated deficits)

That's about $80k per household in four years. Have households received that much in deficit spending? Some did, but likely very few of them... Source: Lyn Alden

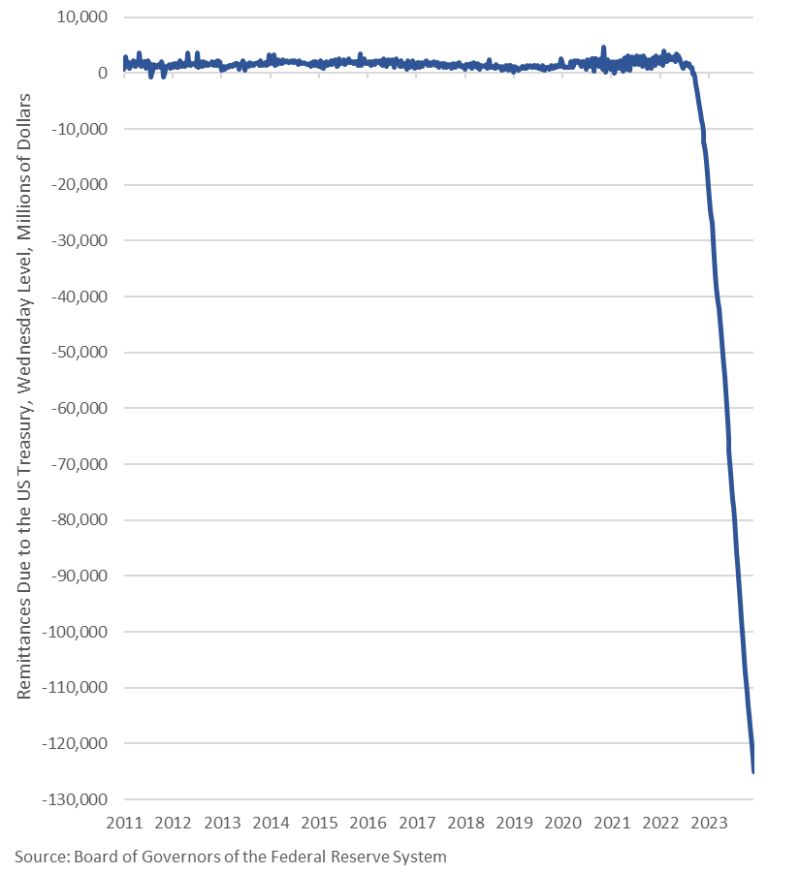

Losses at the Fed have now passed $125 billion

Source: Win Smart, CFA

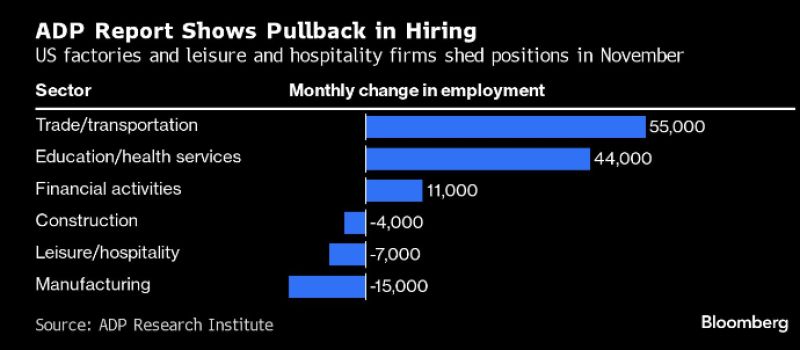

The ADP jobs report shows that the US labor market is cooling

U.S. firms scaled back hiring in November. Adding only 103k private payrolls compared 130k expected, according to ADP. Job cuts were seen in manufacturing, construction, and leisure/hospitality sectors. ADP’s report is based on payroll data covering +25 million US private-sector employees. Source: Genevieve Roch-Decter, CFA, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks