Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

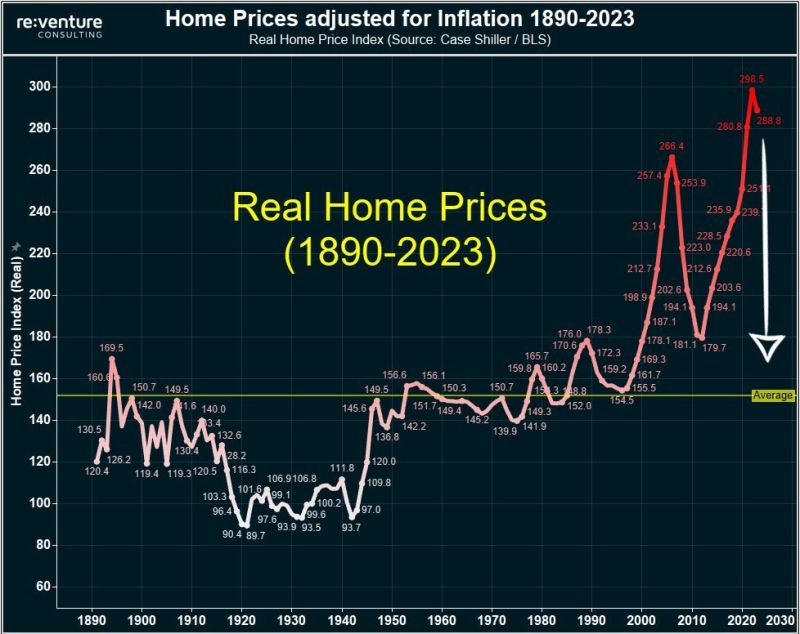

As highlighted by The Kobeissi Letter, the US housing market is having its historical moment

The US housing market is having its historical moment. Indeed, Real home prices in the US are currently almost 10% MORE expensive than they were in 2008. In fact, real home prices are now 80% ABOVE the 130-year historical average, according to Reventure. This means that even on an inflation adjusted basis, home prices have never been more expensive. Meanwhile, housing supply is 40% below the historical average. All while mortgage demand is at its lowest since 1994 and the median homebuyer now has a $3000/month payment. Source: The Kobeissi Letter, Reventure

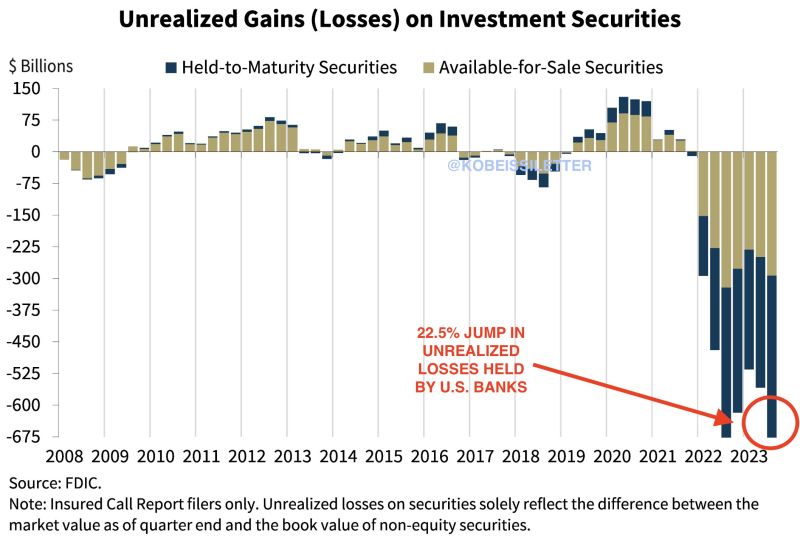

Is the US banking crisis really over?

Unrealized losses on investment securities held by US banks hit $684 billion in Q3, according to the FDIC. This marks a 22.5% jump compared to unrealized losses seen last year. The jump was primarily driven by rising mortgages rates reducing the value of mortgage-backed securities held by banks. Despite these challenges, the FDIC states that banks remain "well capitalized." This comes as usage of the Fed's emergency funding facility for banks hit another record high of $114 billion. Source: The Kobeissi Letter

Buying a home is now 52% more expensive than renting, the highest premium on record (note: the premium peaked at 33% during the last housing bubble in 2006)

Source: Charlie Bilello

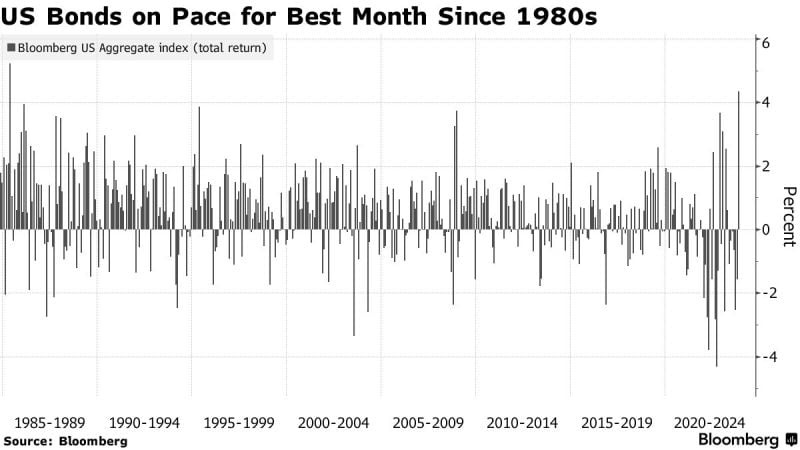

Bond Market's Best Month Since 1980s Sparks Cross-Asset Rally

In a year in which little has gone right in the US bond market, November turned out to be a month for the record books. Investors frantically bid up the price of Treasuries, agency and mortgage debt, sparking the best month since the 1980s and igniting a powerful pan-markets rally in everything from stocks to credit to emerging markets. Source: Bloomberg

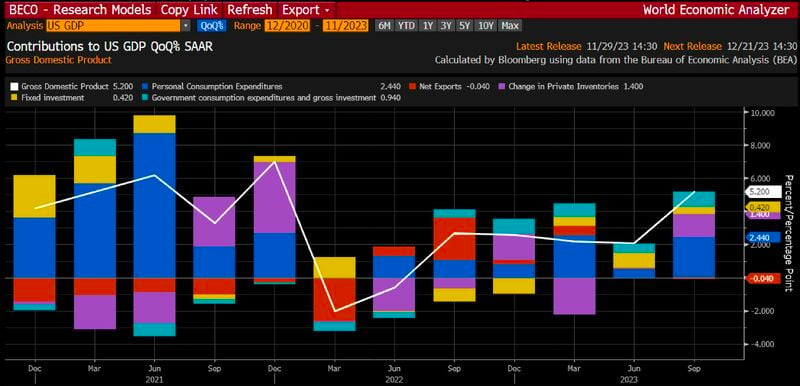

US GDP update shows US economy grew at more robust annualized rate of 5.2% in Q3, revised from +4.9% and after +2.1% QoQ in Q2

The Q3 contribution from inventories was +1.4%, revised from +1.3%, after 0% in Q2. Contribution from consumers +2.4% revised down from prev 2.7%. Contribution from net exports was -0.04%, revised from -0.08%, after +0.04% in Q2. Source: HolgerZ, Bloomberg

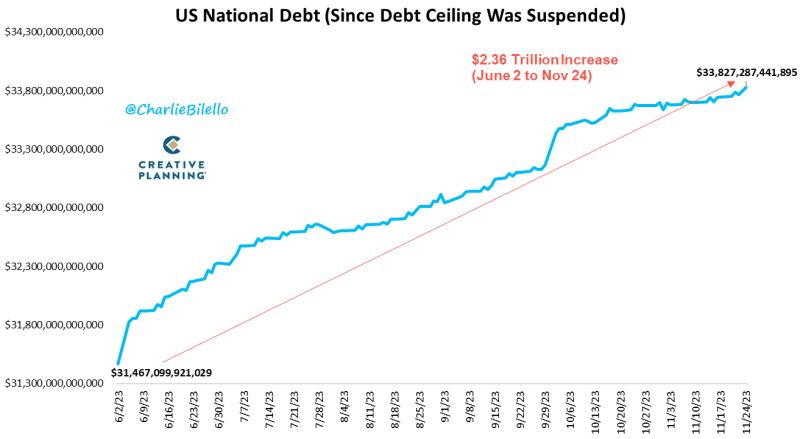

Per Bloomberg, US Treasury issuance next year is expected to reach $1.9 trillion...

Excess supply of US Treasuries remains a key downside risk for bonds (and thus for equities given the still high correlation between the 2). Note that every Treasury auction is now very closely monitored by investors with some immediate consequences on market returns (e.g last week: strong auction triggered a drop in US Treasury yields on Wednesday and a rise in sp500). Source picture: Markets Mayhem

Investing with intelligence

Our latest research, commentary and market outlooks