Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

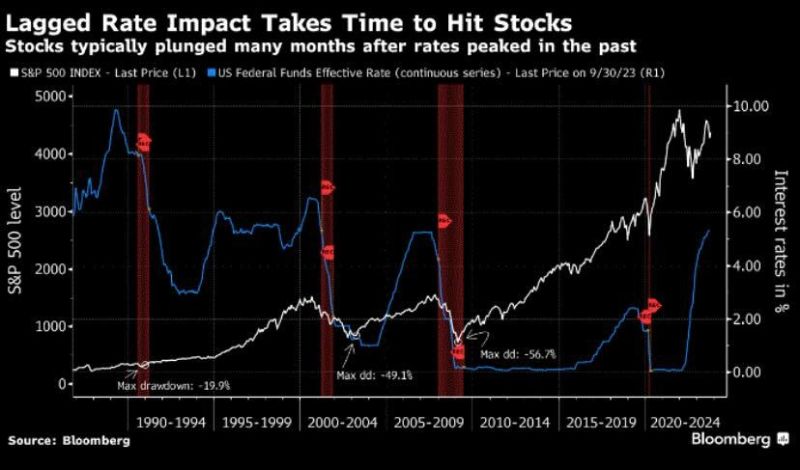

As we moved into 2024, one downside risk needs to be kept in mind:

tightening monetarypolicy cycle often operates with a lag. As shown on the chart below, stocks typically plunged many months after rates peaked in the past. Source. Bloomberg, Cheddar Flow

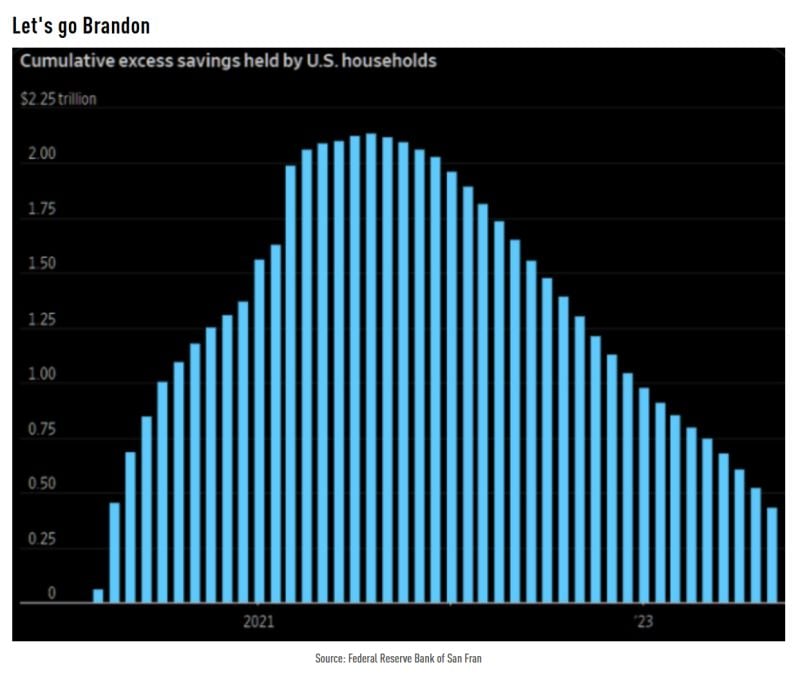

US households still have an estimated $433 billion in excess savings remaining from the 2020-21 stimulus programs

Source: TME

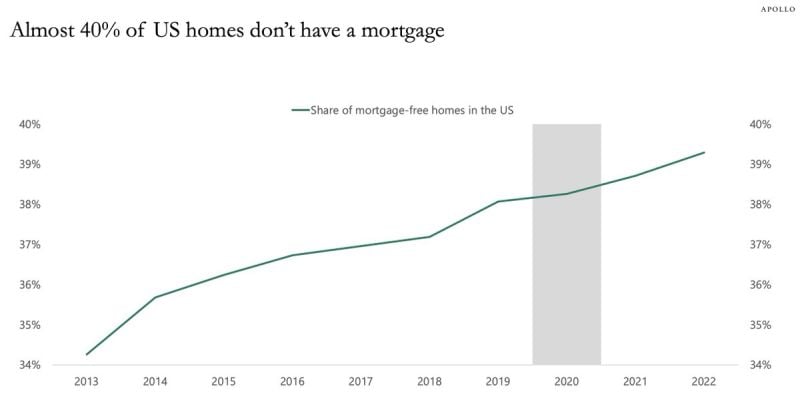

As highlighted by The Kobeissi Letter, a record ~40% of all US homes currently do NOT have mortgages

At first, this seems like great news, but it really just emphasizes how UNAFFORDABLE this market is. Currently, a record ~35% of housing market transactions are all cash purchases. In other words, this market is becoming ONLY affordable for those who are buying with CASH. As interest rates hit 20-year highs and home prices are up 30%+ since 2020, affordability is only getting worse. This is called an affordability crisis. Source: The Kobeissi Letter

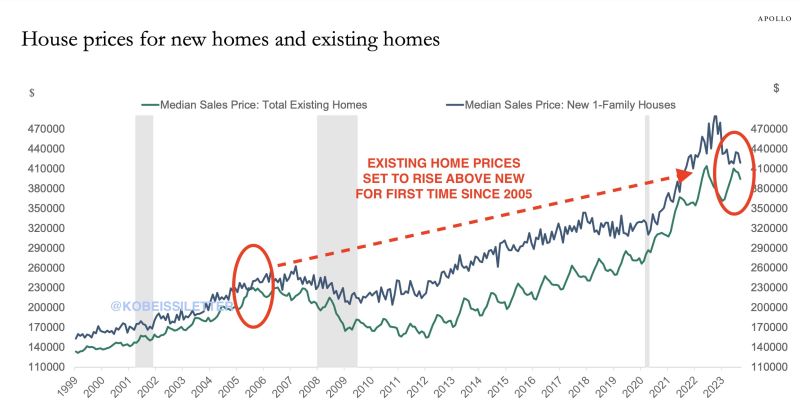

THE US REAL ESTATE MARKET IS MAKING HISTORY...

As highlighted by The Kobeissi Letter -> For the first time since 2005, new home prices are set to drop below existing home prices. In other words, new will be selling for LESS than old. The median new home price is down to ~$410,000 while the median existing home prices is nearing $400,000. Why is this happening? ~90% of mortgages outstanding currently have an interest rate that is below 5%. Many mortgage rates are BELOW the current inflation rate. A mortgage issued in 2020 or 2021 is effectively an asset now. Truly historic. Source: The Kobeissi Letter

Amid a collapse in 'hard' economic data, 'soft' surveys from S&P Global was expected to see both Services and Manufacturing PMIs slide further in preliminary November data

However, the data was more mixed with US Manufacturing falling more than expected to 49.4 - back into contraction - (vs 49.9 exp) from 50.0 in October. However, US Services unexpectedly rose from 50.6 to 50.8 (exp 50.3). Source: Bloomberg, www.zerohedge.com

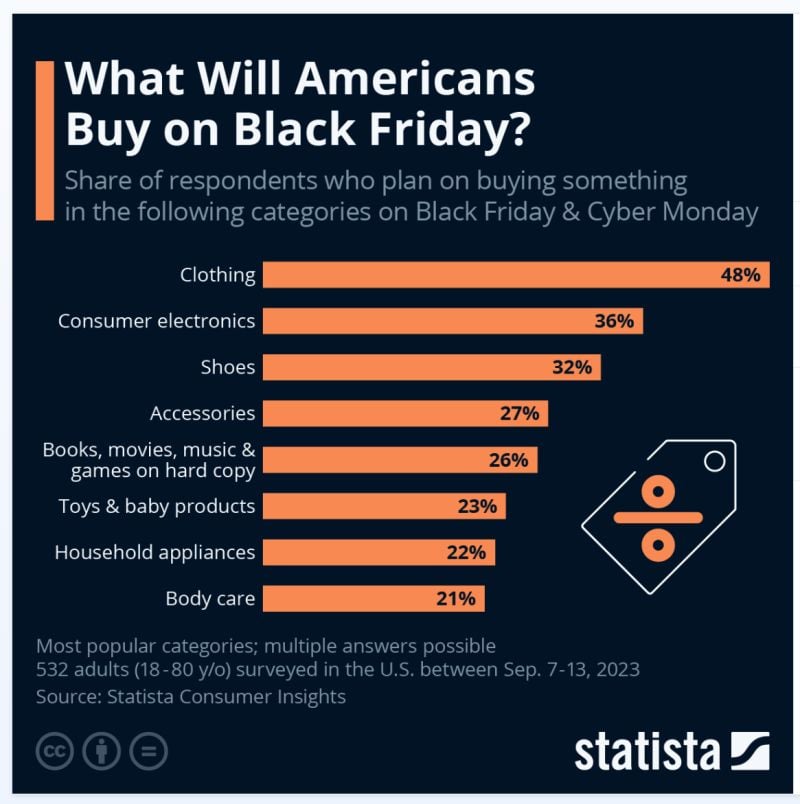

What Will Americans Buy on Black Friday?

TODAY IS BLACK FRIDAY... Black Friday falls on the fourth Friday of November each year, with Cyber Monday following just three days later. The two shopping days are some of the busiest of the year in the United States, with an estimated $19.6 billion raked in over the 2021 Thanksgiving weekend in e-commerce revenue alone. U.S. shoppers keen to make the most of discounted prices were asked in a Statista survey which items they were planning on buying. As the following chart shows, clothing, electronics and shoes are among the most popular choices this year. In terms of other shopping behaviors, the same survey found that where 41 percent of U.S. respondents said they would be shopping via online stores, 28 percent were undecided and 25 percent planned on heading to brick-and-mortar shops. Source: Statista

Investing with intelligence

Our latest research, commentary and market outlooks