Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

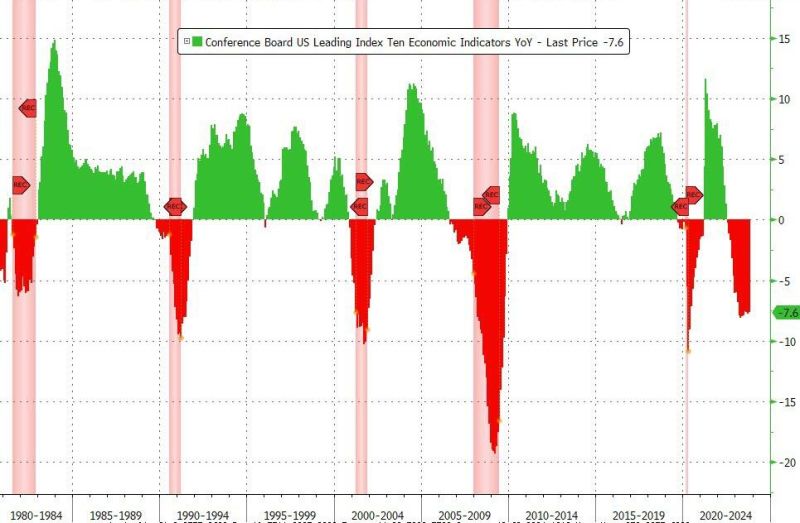

US Leading Indicators Tumble For 19th Straight Month

Worst Streak 'Since Lehman' on a year-over-year basis, the LEI is down 7.6% (down YoY for 16 straight months) - close to its biggest YoY drop since 2008 (Lehman) outside of the COVID lockdown-enforced collapse... Source: Bloomberg, www.zerohedge.com

BREAKING: Binance >>>

Department of Justice is seeking a penalty of $4 billion from Binance in order to settle a criminal investigation Crypto exchange Binance is nearing a settlement with the U.S. Department of Justice to resolve a criminal investigation into alleged money laundering, bank fraud, and sanctions violations, unnamed sources told Bloomberg. If the settlement deal goes through, it would be one of the largest-ever penalties in a crypto case. Negotiations have included the possibility of criminal charges against Binance's founder and CEO Changpeng Zhao, also known as CZ. However, as it currently stands the deal would allow the crypto exchange—the world's largest by volume—to keep operating while holding its leadership accountable. If finalized, Binance would likely pay the fine as part of a deferred prosecution agreement. This would require Binance to meet prescribed conditions like overhauling compliance programs, according to the report. Source: Decrypt, Altcoin Daily

US Continuing Jobless Claims Surges To 2 Year High

The number of Americans filing for jobless benefits for the first time last week jumped to 231k (from an upwardly revised 218k), up to its highest since August...Worse still, continuing claims keeps rising, to 1.864mm - the highest since November 2021... Source: Bloomberg, www.zerohedge.com

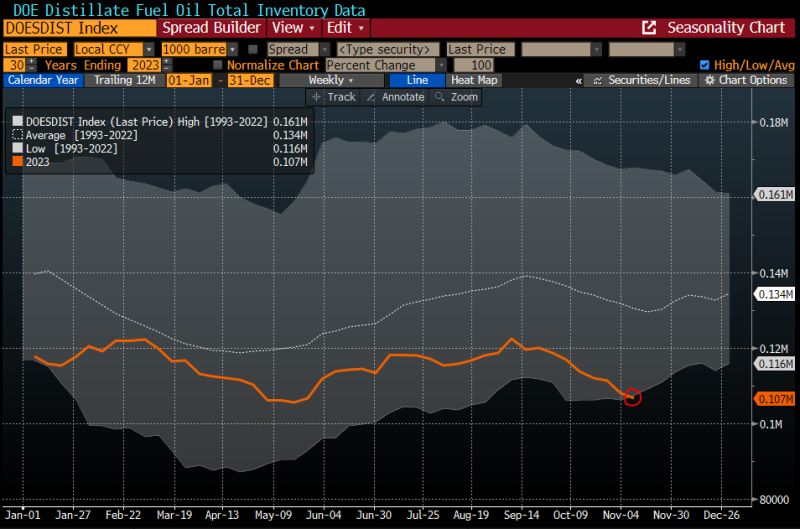

Let's hope the US economy is truly slowing down -- particularly manufacturing --, and that the winter is mild

US stocks of distillate fuel (diesel and heating oil) are ending the fall season at their lowest **seasonal** level in data since 1982 | Source: Javier Blas, Bloomberg

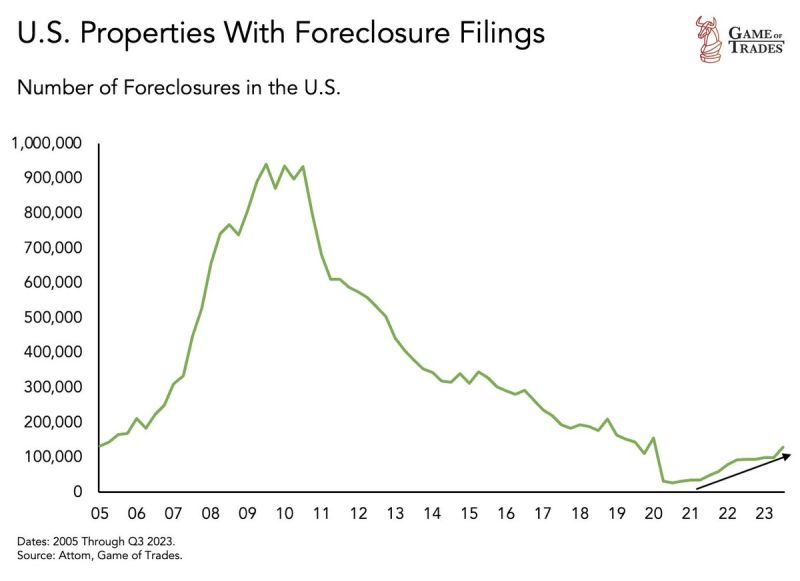

Property foreclosure filings have been increasing recently

This is the result of high interest rates resulting in rising mortgage defaults. Source: Game of Trades

President Joe Biden and China’s President Xi Jinping have their first in-person meeting in about a year

This is the first time since 2017 that Xi has stepped foot on American soil. Although the US-China relationship is breaking, experts and U.S. officials caution not to expect markedly improved relations post-meeting. Mrs Yellen might be rather in favor of some kind of cooperation... Source image: Michel A.Arouet

Investing with intelligence

Our latest research, commentary and market outlooks