Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

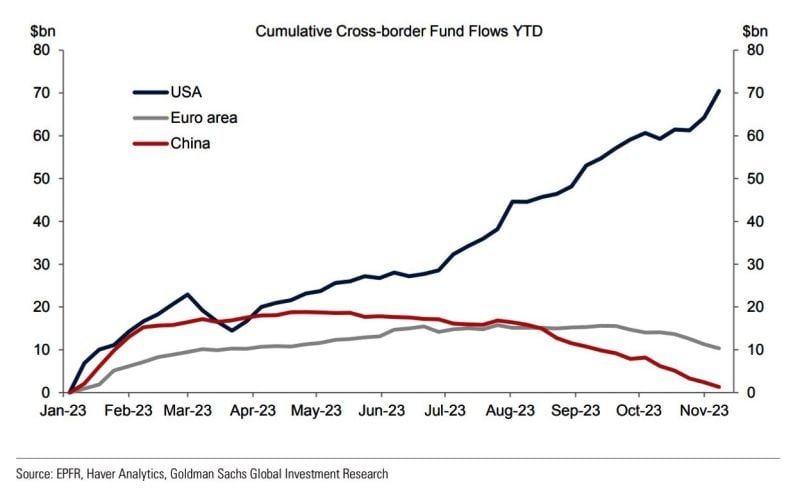

Fund flows continue to move to the US at the expense of the rest of the world

Source: Michael A. Arouet, Goldman Sachs

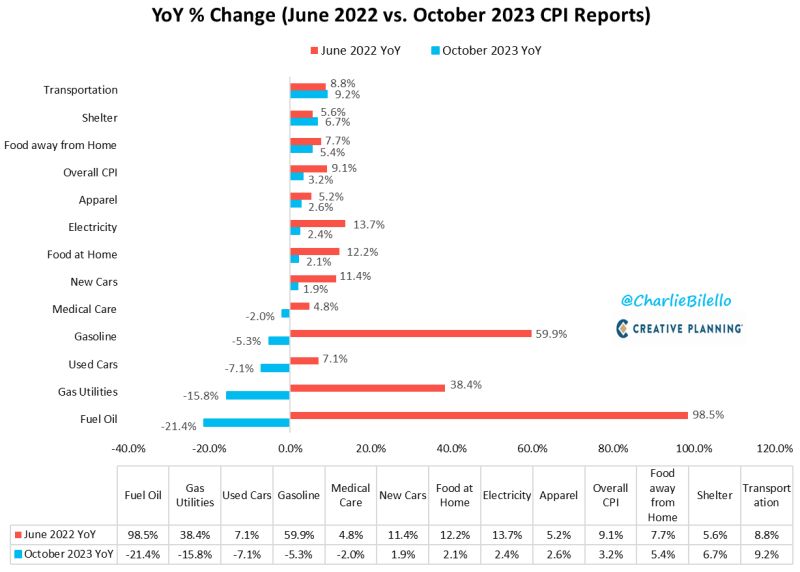

US CPI has moved down from a peak of 9.1% in June 2022 to 3.2% today

What's driving that decline? Lower rates of inflation in Fuel Oil, Gas Utilities, Used Cars, Gasoline, Medical Care, New Cars, Food at Home, Electricity, Apparel, and Food away from Home. Shelter and Transportation are the only major components that have a higher inflation rate today than June 2022. Source: Charlie Bilello

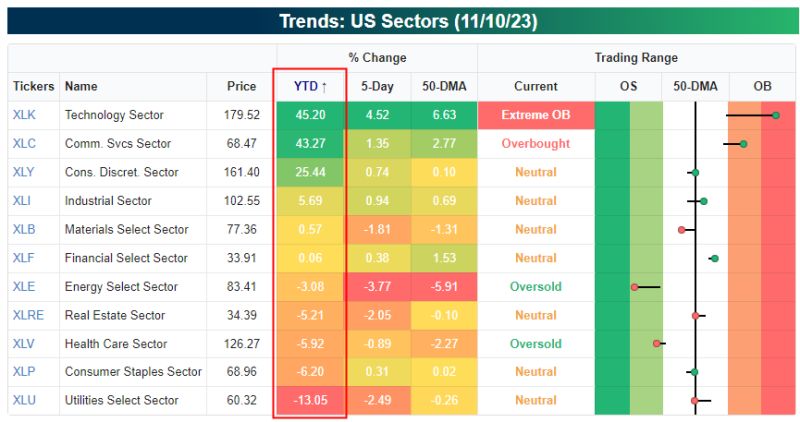

When the book on 2023 closes, extreme sector divergence will surely be considered one of the major plot points

Technology and Communication Services are each up more than 40% YTD, while five of eleven sectors are in the red on the year. Source: Bespoke

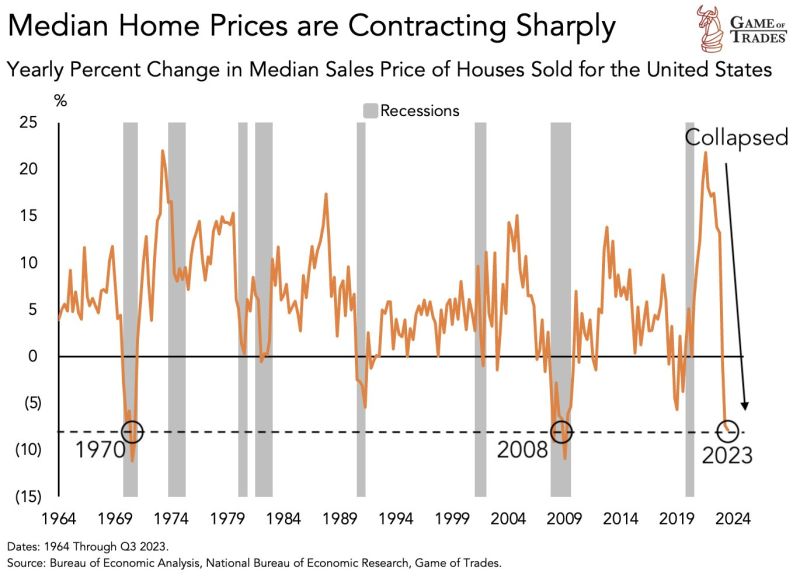

US median home prices are contracting aggressively. In just 2 years, the % has gone from over 20% to -7.9%. This is THE sharpest collapse on record

Current levels have occurred ONLY 2 times in the last 60 years: 1. 1970 2. 2008 Both instances ended with equities declining more than 30%. Source: Game of Trades

Prospective California homeowners currently in the market would need to make $221,200 annually to qualify to purchase a median-price, single-story home in California, typically costing $843,600

The latest figures show that California’s housing affordability rates continue to decrease. The figures released during the third quarter are down from 16% in the second quarter of 2023. For comparison, about 56% of California home buyers could afford a home during the first quarter of 2012, the index’s peak high. Source: Wall Street Silver

Investing with intelligence

Our latest research, commentary and market outlooks