Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

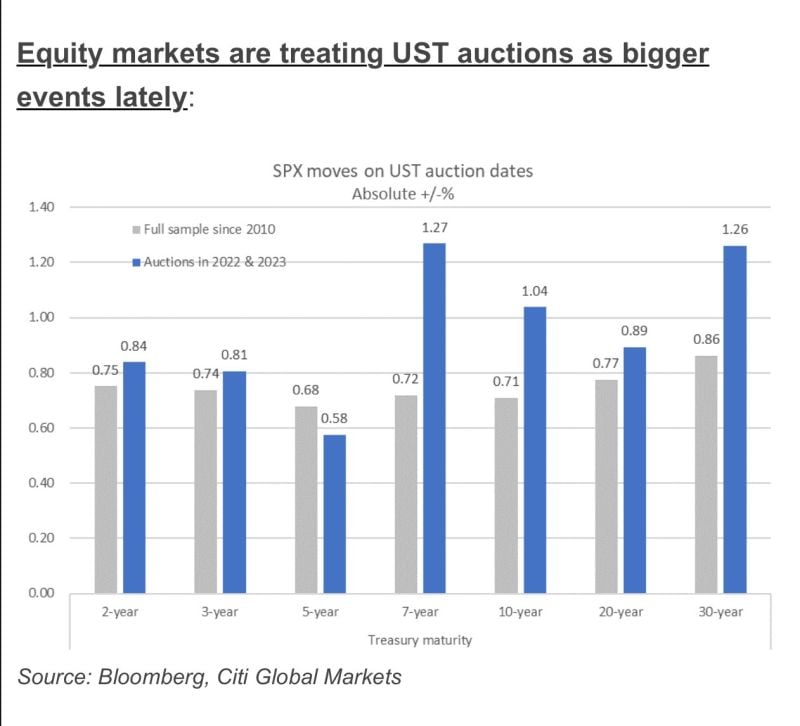

Stock markets care much more about US Treasury auctions now than they used to

Chart from Citi’s Stuart Kaiser thus Lisa Abramowitz

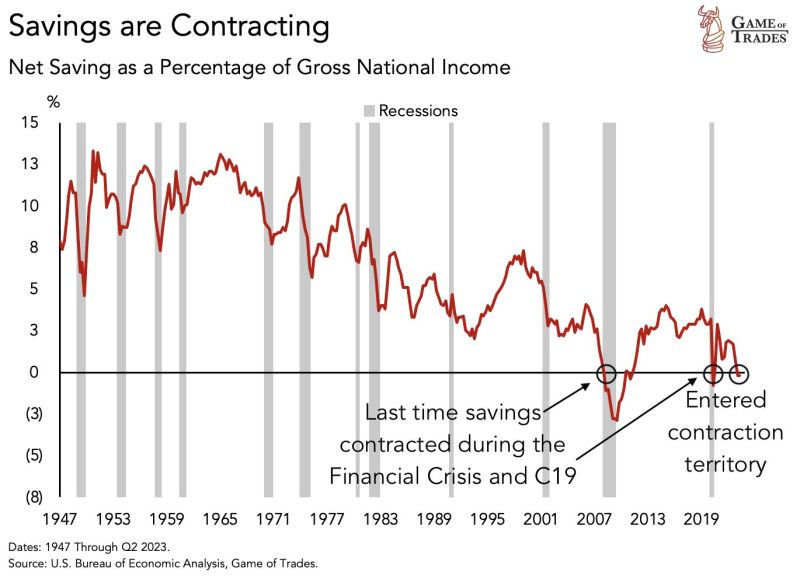

This has happened ONLY 2 times in the last 75 years. In the US, savings as a % of income is now contracting, indicating that people are find it VERY hard to save

The last 2 contractions happened in: - 2008 - 2020 High interest rate + high debt is a MAJOR problem for people Source: Game of Trades

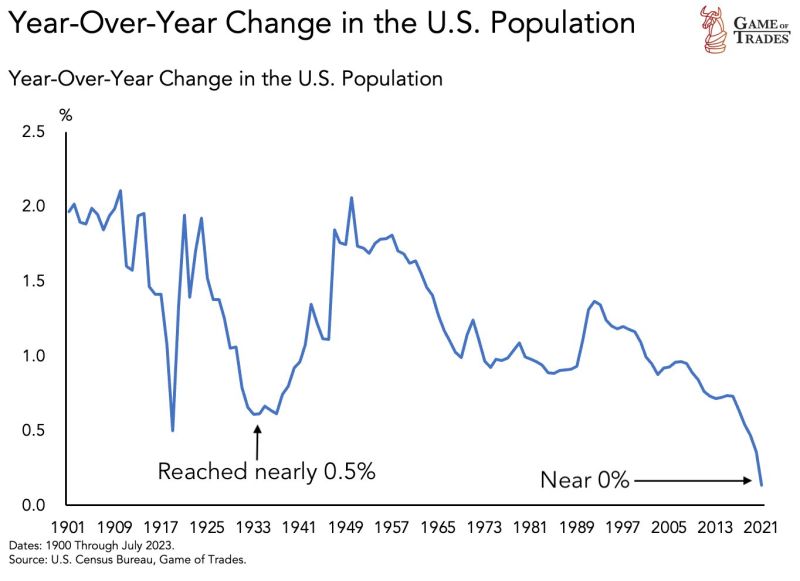

Demographics is becoming a serious issue for US growth

As shown on the chart below, US population growth has collapsed, reaching levels near 0% indicating almost NO growth. This is actually the worst population growth setup seen in over 100 years of US history. Current levels have NEVER been seen in 100+ years. Even during the Great Depression, population growth bottomed out at around 0.5% Source: Game of trades

Investing with intelligence

Our latest research, commentary and market outlooks