Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

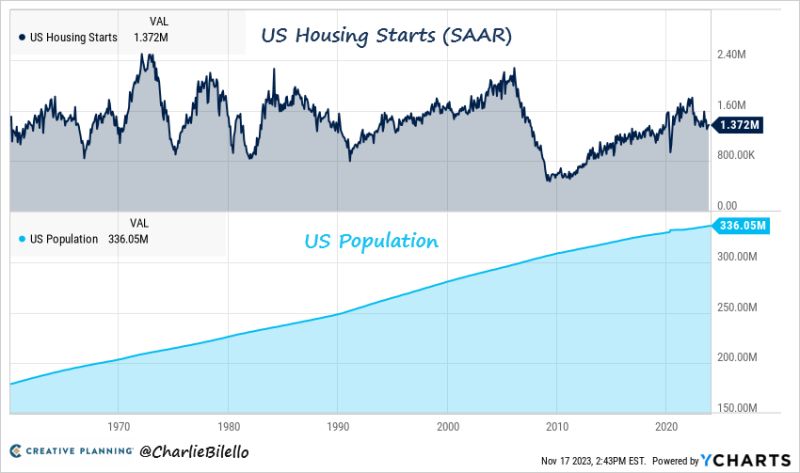

The US population has increased 87% since 1960 but fewer homes are being built today than back then

Source: Charlie Bilello

Hedge Funds betting on a decline in US and European stockmarkets have suffered an estimated $43bn of losses in a sharp rally over recent days.

Short sellers, many of whom had built up bets against companies exposed to higher borrowing costs over the past year or so, have been caught out by a “painful” rebound in “low quality” stocks this month, said Barclays’ head of European equity strategy Emmanuel Cau. That has come as the market has grown more confident that the US Federal Reserve’s cycle of rate rises is finally over. Funds suffered $43.2bn of losses on short bets in the US and Europe from Tuesday to Friday inclusive last week, according to calculations by data group S3 Partners, which do not take account of gains that funds may have made in other stocks they own. Source: FT

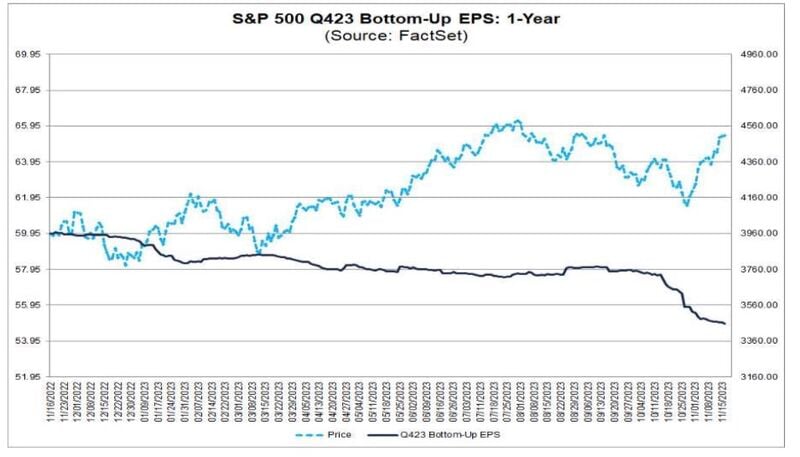

The rally in US stocks in recent weeks has taken attention away from what looks like a pretty concerning forward picture from earnings releases

Q4 earnings expectations have come down considerably in recent weeks, in contrast with equity market strength. Source: Bob Elliott, Factset

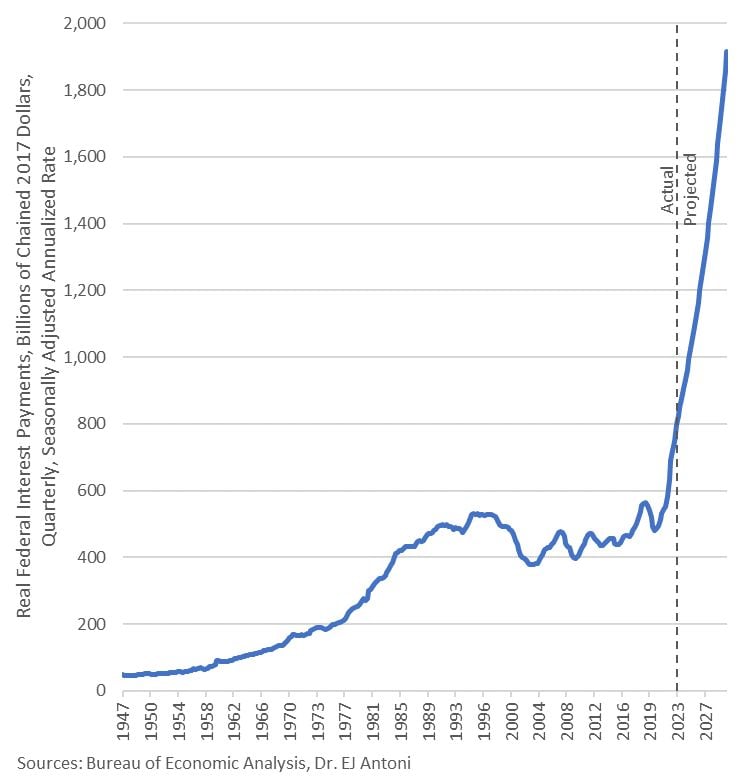

The US government collects about $2.5 trillion per year in personal income taxes. Of that about $1 trillion per year (40%) is being consumed by interest on the national debt

Interest on the debt is growing as old cheap debt matures and gets refinanced at the new higher rates. Plus new debt added every year. Within a few more years, at this pace, 100% of personal income taxes will be going to pay interest on the US national debt. Source: E.J Antoni, WallStreetSilver, BEA

SUMMARY OF FED MEETING MINUTES (11/21/23):

1. All Fed Members agree to “proceed carefully” 2. Fed sees rates “remaining restrictive for some time” 3. Fed sees upside risks to inflation 4. Fed sees downside risks to growth 5. Meeting by meeting approach to resume It's amazing how US markets keep pricing cuts. When the Minutes reiterate, yet again, that while the Fed are cautious they still have a tightening bias.

Investing with intelligence

Our latest research, commentary and market outlooks