Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- equities

- Food for Thoughts

- macro

- Bonds

- sp500

- Asia

- Central banks

- markets

- bitcoin

- technical analysis

- investing

- inflation

- interest-rates

- europe

- Crypto

- Commodities

- geopolitics

- performance

- ETF

- gold

- AI

- nvidia

- tech

- earnings

- Forex

- Real Estate

- oil

- bank

- Volatility

- FederalReserve

- nasdaq

- apple

- emerging-markets

- magnificent-7

- Alternatives

- energy

- switzerland

- sentiment

- trading

- tesla

- Money Market

- russia

- France

- ESG

- UK

- assetmanagement

- Middle East

- microsoft

- ethereum

- meta

- amazon

- bankruptcy

- Industrial-production

- Turkey

- china

- Healthcare

- Global Markets Outlook

- recession

- africa

- brics

- Market Outlook

- Yields

- Focus

- shipping

- wages

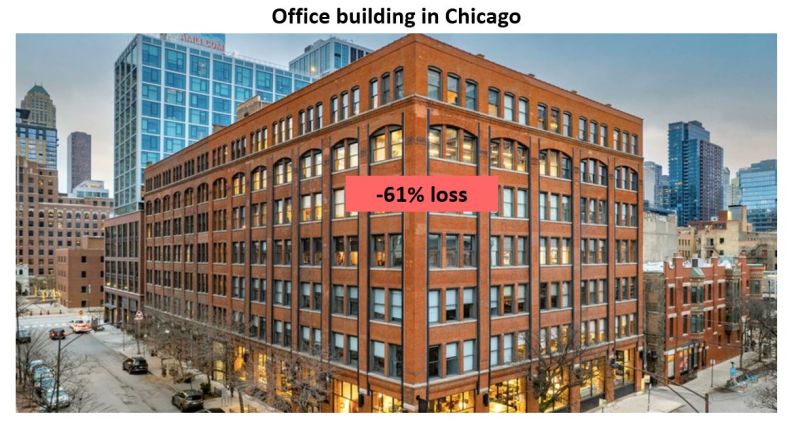

Here's one illustration of the US commercial real estate market meltdown: values of commercial real estate continues to get destroyed in Chicago...

A 155k SF office building in Chicago just sold for $17 million, or $109 per SF The seller took a huge 61% loss, paying $44 million for the building in 2017 Here's a worrying snippet from Crain's: "Thanks to remote work and higher interest rates, real estate investors can buy downtown office buildings on the cheap these days. Add a motivated seller trying to unload all of its office stock and the discount gets even steeper. Many office properties in the heart of the [Chicago] are now worth less than the mortgages tied to them, fueling a historic wave of distress." It will be interesting to see how bad the US commercial real estate meltdown gets (particularly in office) but it's certainly a story to keep an eye on in 2024 as big opportunities emerge". Source: TripleNetInvest

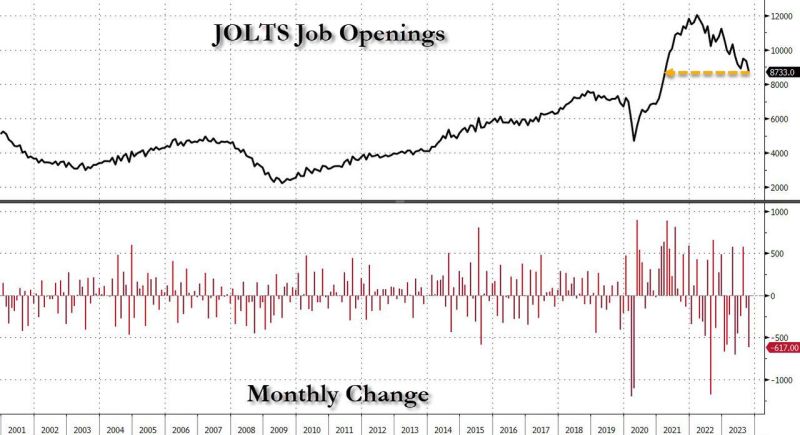

The US job market is starting to crater...

With consensus expecting only a modest drop from the reported September 9.553 million job openings, what the BLS reported moments ago instead was a stunning collapse of 617K job openings to just 8.733 million, the lowest since March 2021. This was a 6-sigma miss to the consensus estimate of 9.3 million... Source: www.zerohedge.com, Bloomberg

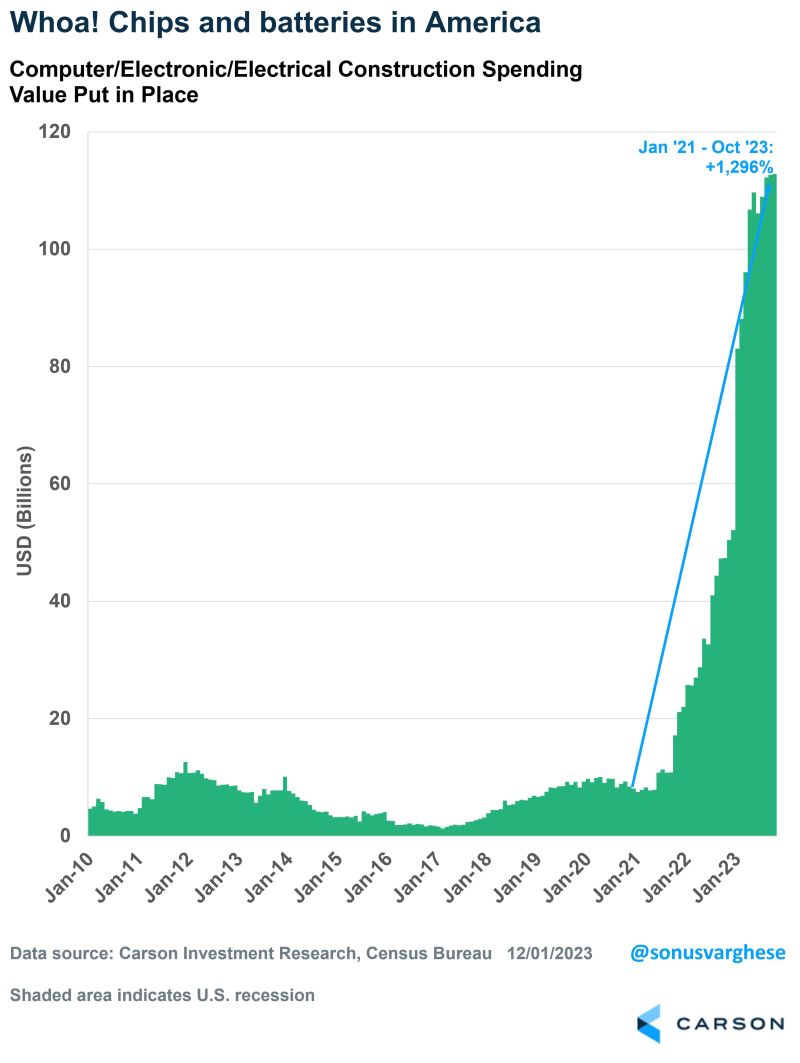

How do you say CHIPS act* in one chart?

Not all fiscal policy has to be a bad thing... this could indeed lead to a big increase in the productivity we will see over the coming years due to this. Source: Ryan Detrick, Carson * CHIPS Act -> In July 2022, Congress passed the CHIPS Act of 2022 to strengthen domestic semiconductor manufacturing, design and research, fortify the economy and national security, and reinforce America’s chip supply chains. The share of modern semiconductor manufacturing capacity located in the U.S. has eroded from 37% in 1990 to 12% today, mostly because other countries’ governments have invested ambitiously in chip manufacturing incentives and the U.S. government has not. Meanwhile, federal investments in chip research have held flat as a share of GDP, while other countries have significantly ramped up research investments. To address these challenges, Congress passed the CHIPS Act of 2022, which includes semiconductor manufacturing grants, research investments, and an investment tax credit for chip manufacturing. SIA also supports enactment of an investment tax credit for semiconductor design.

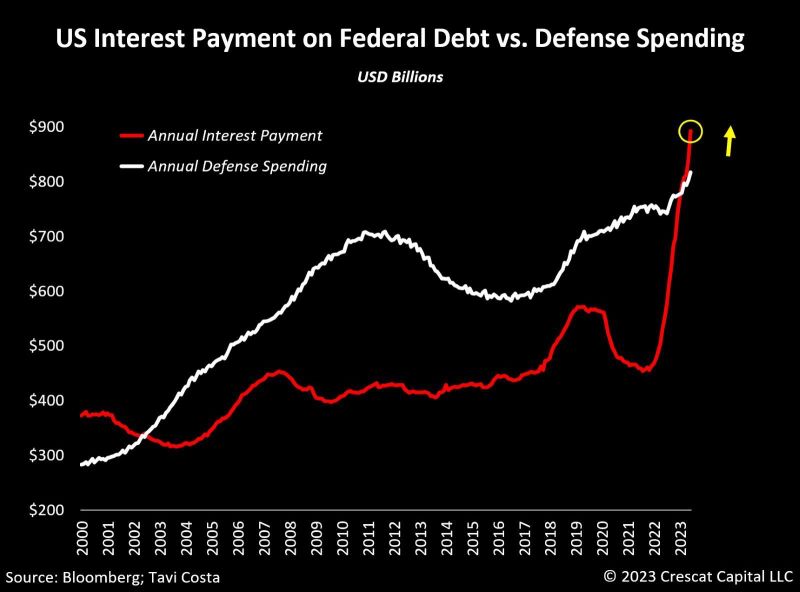

As highlighted in the Kobeissi Letter and in the chart below from Tavi Costa >>> Annualized interest expense on US Federal debt is nearing $1.1 TRILLION

To put this in perspective, 2023 defense spending was $821 billion. This means the US is on track to spend 34% MORE on interest expense than defense spending. In 2023, the US government produced $4.4 trillion in revenue. This means that 25% of receipts in the entire 2023 are equivalent to Uncle Sam's annual interest expense. Rising rates and falling tax revenue are both occurring at the same time. A tricky combination

Interesting development highlighted by The Kobeissi Letter:

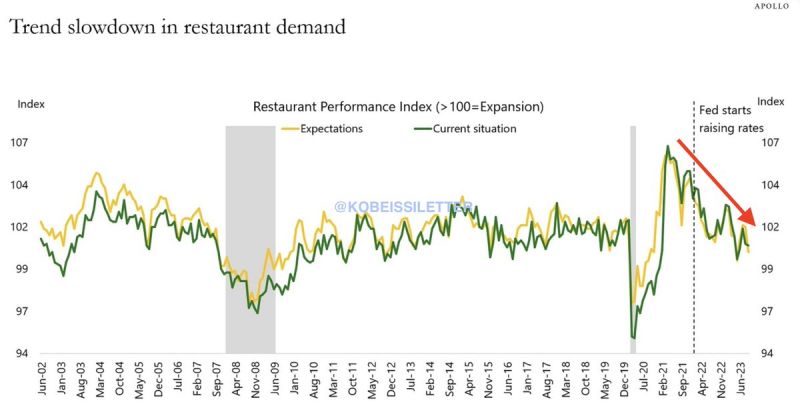

Is the slowdown in restaurant activity signalling that a FED pivot Indicators of restaurant activity continue to show signs of weakness in the US. Interestingly, this has been almost perfectly correlated with the Fed raising rates. Restaurant activity in the US hit an all time high in August 2021. Since the Fed started raising rates in March 2022, restaurant activity has moved in a straight line lower. As excess savings are depleted and inflation remains an issue, consumers are cutting back. And more credit card debt is not the solution here.

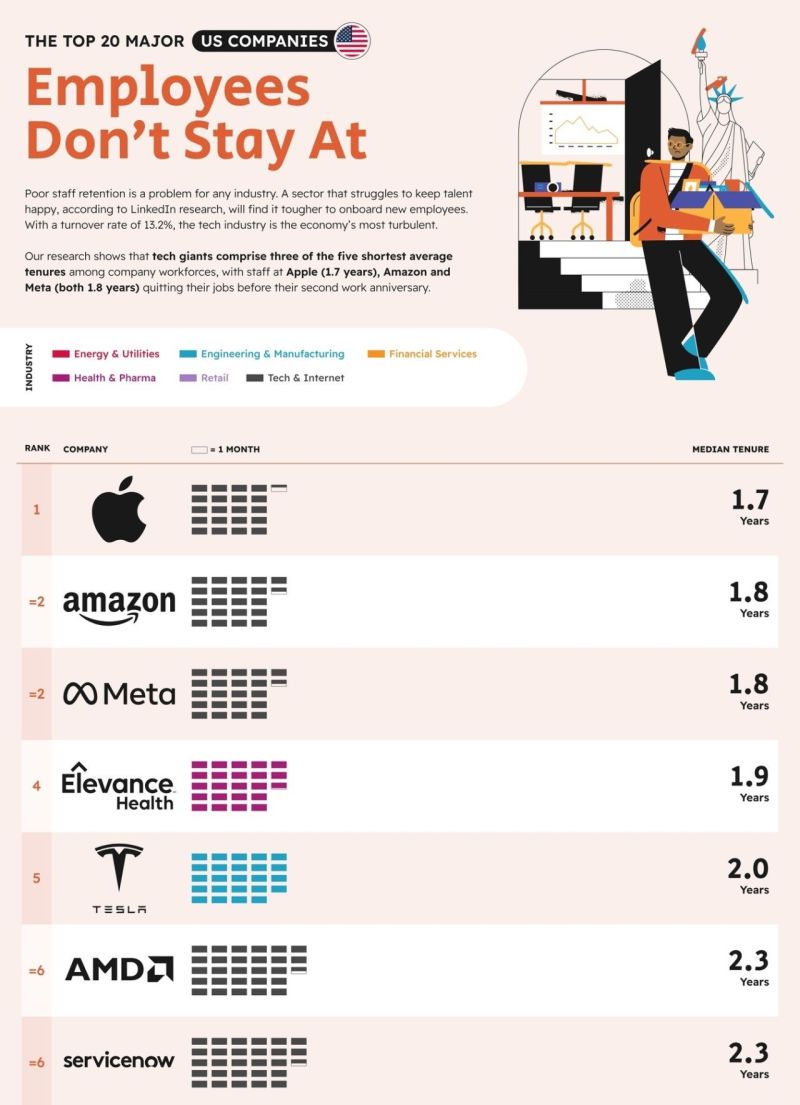

Ranked: Worst U.S. Companies for Employee Retention 💼

This graphic by NeoMam Studios is part of Visual Capitalist’s Creator Program, featuring work from the world’s top data-driven talent ✅

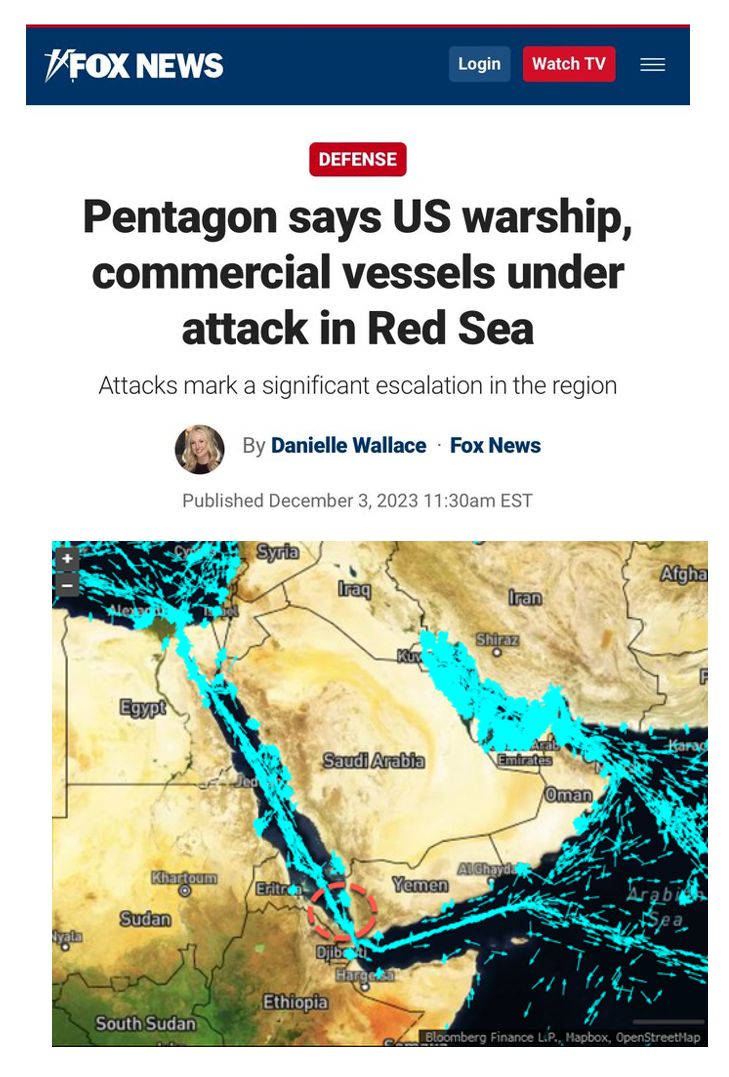

The Pentagon said Sunday a U.S. warship and multiple commercial vessels are under attack in the Red Sea.

‘We’re aware of reports regarding attacks on the USS Carney and commercial vessels in the Red Sea and will provide information as it becomes available,’ the Pentagon said, according to the Associated Press.” Meanwhile, "Gulf of Tonkin" is trending on X in the US. Source: Fox News, www.zerohedge.com

Investing with intelligence

Our latest research, commentary and market outlooks