Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- performance

- AI

- Rate

- gold

- Real Estate

- earnings

- markets

- debt

- Commodities

- Treasury

- tech

- yield

- nvidia

- Germany

- europe

- Japan

- bank

- nasdaq

- oil

- cpi

- warren-buffett

- useful

- Forex

- interest

- humor

- apple

- fed

- interest-rates

- market cap

- energy

- returns

- dollar

- hedge fund

- GDP

- quotes

- geopolitics

- magnificent-7

- valuations

- asset

- ECB

- finance

- BOJ

- crudeoil

- india

- sentiment

- Swiss

- highyield

- Volatility

- options

- recession

- semiconductor

- vix

- economy

- growth

- mortgage

- Money Market

- Positioning

- cash

- charts

- exports

- trading

- bubble

- ipo

- deficit

- price

- sales

- EM

- UK

- bearish

- tesla

- wages

- ESG

- EV

- Flows

- credit-card

- saudiarabia

- spending

- Turkey

- futures

- index

- meta

- revenue

- russia

- EUR

- assetmanagement

- bankruptcy

- cocoa

- profit

- supply

- unemployment

- watches

- consumers

- Brazil

- Election

- car

- chart

- credit-rating

- cryptocurrencies

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- currencies

- insider

- spx

- yen

- FUND

- africa

- amazon

- copper

- deflation

- investmentgrade

- manufacturing

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- microsoft

- msci

- pricing-power

- private markets

- productivity

- sec

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- charlie-munger

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- liquidity

- luxury

- retirement

- russel2000

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jobs

- leadership

- lending

- monetarypolicy

- moneydebasement

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- bankrupt

- behavior

- booking.com

- brics

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- jpmorgan

- korea

- kpi

- lng

- marriage

- meetings

- mergers&acquisitions

- microstrategy

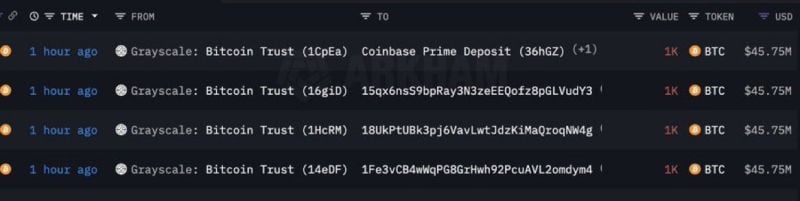

Bitcoin is down -12% from yesterday $49k high. So what's going on?

that some unexpected supply is coming to the market. Indeed, 4 Grayscale Bitcoin Trust wallets have just transferred over 4,000 BTC ($177,500,000+) to Coinbase Exchange. A lot of supply to absorb... Source: WhaleWire

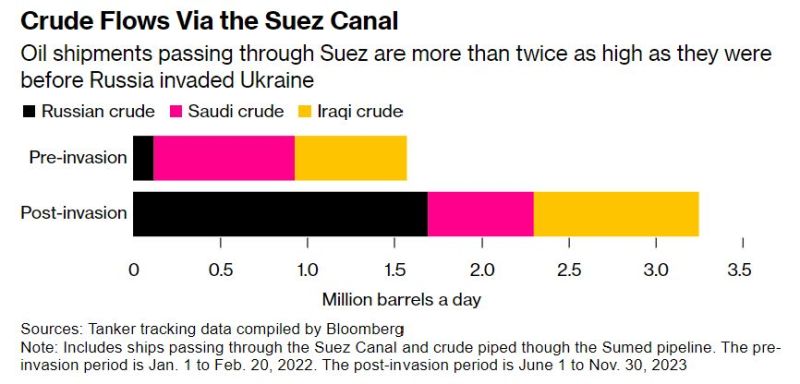

Red Sea disruption to oil supplies is overblown, argues Julian Lee. Why?

1. Houthis unlikely to attack Russian ships heading to India & China 2. Saudi pipeline can bypass Bab Al Mandab 3. Iraqi & Saudi shipments to the US don't go through the red sea Source: Bloomberg, Ziad Daoud

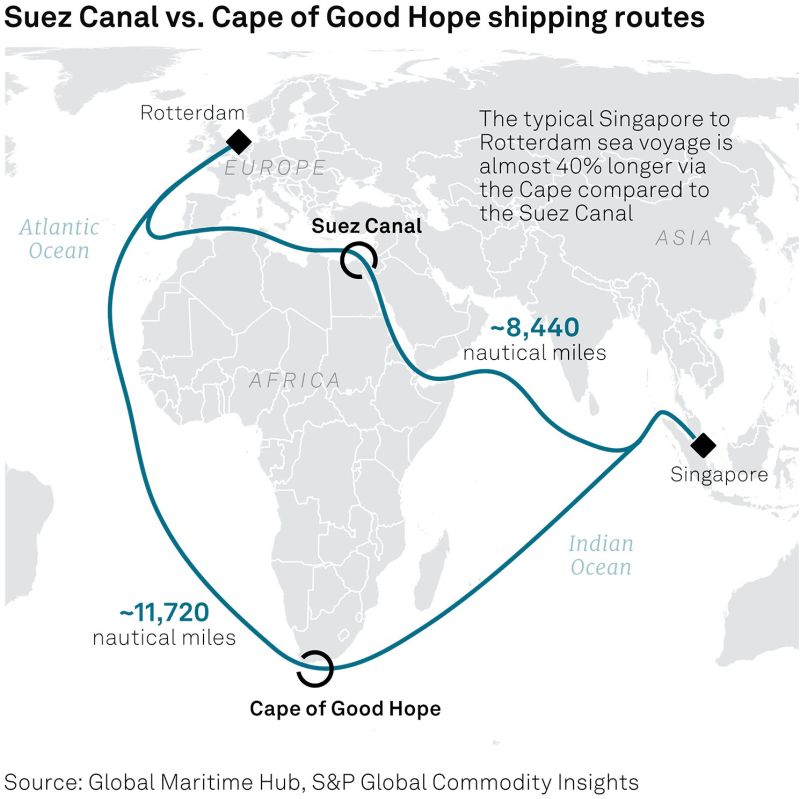

The supply chain / 3inflation risk ahead of 2024. Red Sea is now largely closed to traffic

That's 8.8 million bpd of daily oil transit, and nearly 380 million tons of daily cargo transit. Global traffic now will be rerouted around Cape of Good Hope, adding 40% to voyage distance (and even more to cost) Source: www.zerohedge.com

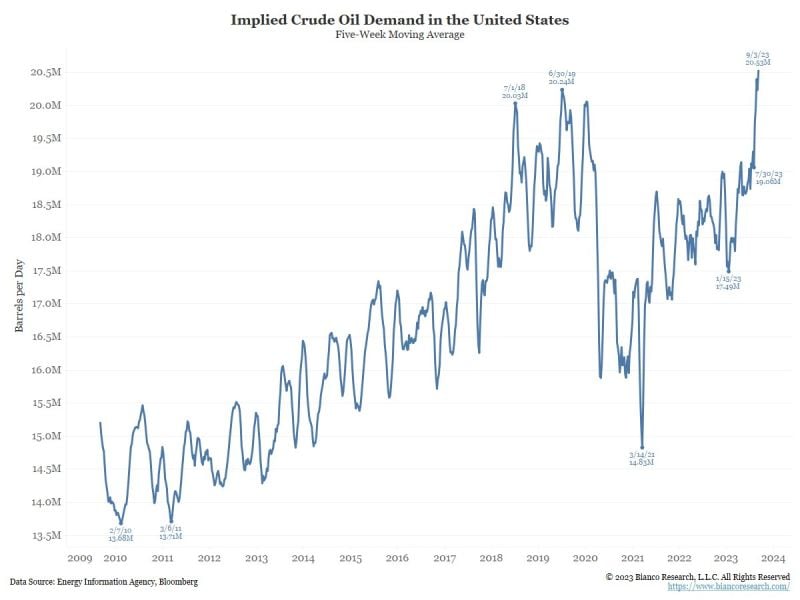

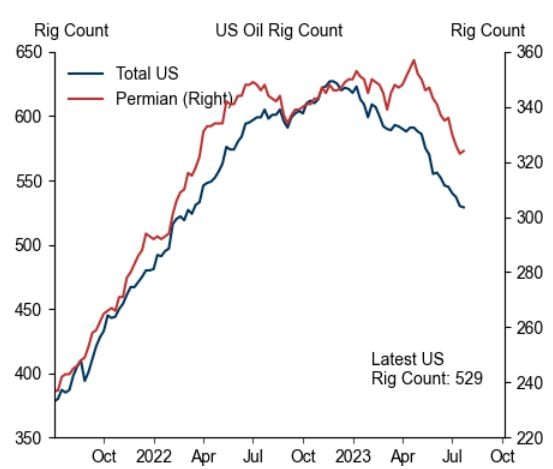

Crude oil prices are booming and is now up 34.5% since late June BUT THIS IS NOT JUST A SUPPLY STORY - WATCH OUT DEMAND AS WELL!!!

The OPEC+ (Saudi/Russian) production cuts are the easy culprit to blame for higher prices. They do matter. But another equally important factor is booming demand. Bloomberg uses Department of Energy data for production, imports, and inventory changes to "input" the weekly demand for crude oil. Below is a five-week average to smooth the noise. Demand is through the roof! This suggests the economy is okay (aka "no landing") as there are few if any, signs of "demand destruction." The combo OPEC+ cutting back + demand booming = 34.5% crude oil rally in 10 weeks... Is there more to come? Source: Jim Bianco

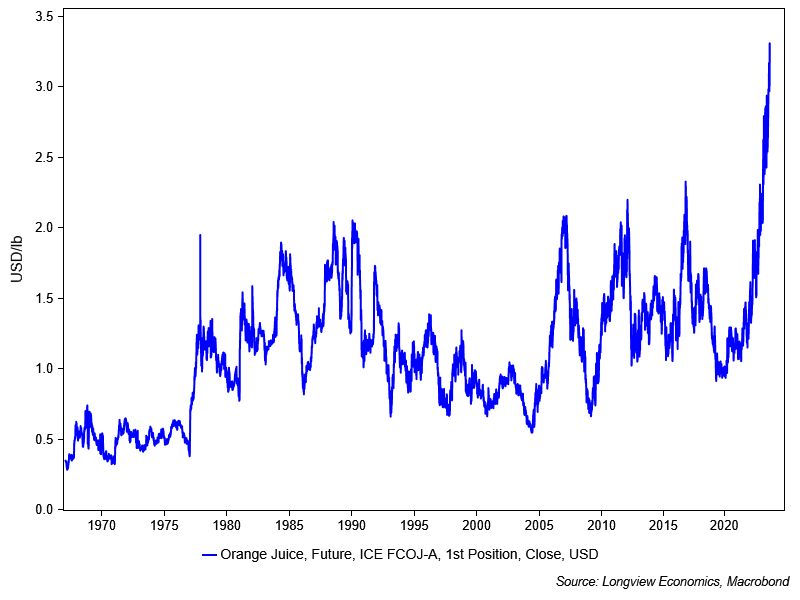

Orange juice futures are trading like a meme stock! The surge is mainly driven by #supply driven (exarcebated by speculators positioning). The 2 supply issues are the following:

1/ Extreme weather intensified by global heating ravaged this season’s crop of the citrus fruit: last year Florida, which produces more than 90% of the US’s orange juice supply, was hit by Hurricane Ian, Hurricane Nicole and freezing conditions in quick succession, devastating orange producers in the Sunshine State. 2/ A bacterial disease -> Florida Producers battled an incurable citrus greening disease that is spread by an invasive insect, rendering fruit unusable. Most infected trees die within a few years, and some producers said they were giving up farming and selling their land. Industry figures said US orange production would reach its lowest level for more than a century. Source: The Guardian, Longview Economics

Investing with intelligence

Our latest research, commentary and market outlooks