Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- Election

- copper

- Brazil

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

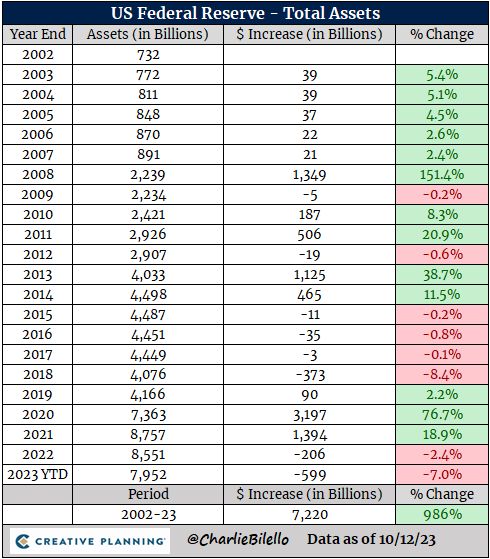

The Fed's balance sheet hit its lowest level since June 2021 this week, down over $1 trillion from the peak in April 2022

Annual changes in the Fed's balance sheet since 2002... Source: Charlie Bilello

In case you missed it:

Fed Balance sheet has dropped <$8tn for 1st time since Summer 2021 on QT. Fed's total assets are now equal to 29.4% of US's GDP vs ECB's 50.9%, SNB's 111.5%, or BoJ's 125.7%. Source: Bloomberg, HolgerZ

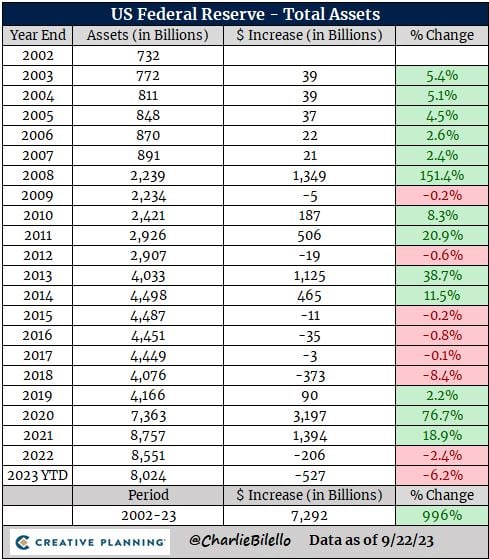

The Fed's balance sheet hit its lowest level since June 2021 this week, down $941 billion from the peak in April 2022

Changes in the Fed's balance sheet since 2002... Source: Charlie Bilello

Warren Buffett's Berkshire Hathaway reported $1 trillion of assets for the first time last quarter

That's roughly triple the assets of Apple, 10 times Tesla's figure, and 20 times Nvidia's total. Berkshire's assets have ballooned 33,000-fold under Buffett, from under $30 million when he started. Source: business insider

Over the last few weeks, the newsflow for China assets has been horrendous, whether it’s the macro data or the policy side (disappointment at the scale and lack of detail)

While sentimnet on China is very bearish, Greater China stocks have outperformed over the past month. This could be a sign that the worst is behind and that bad news are already priced in. Source: J-C Gand, Bloomberg

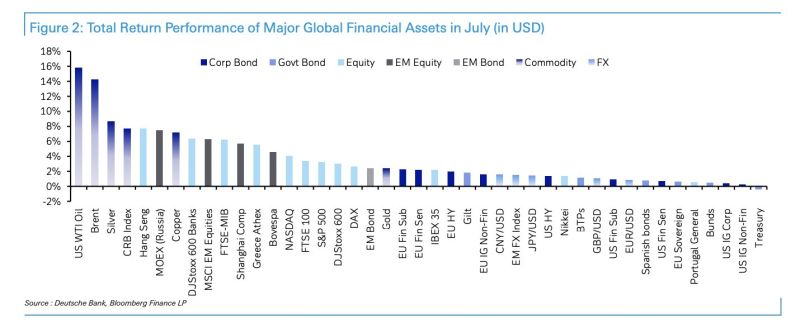

July cross-assets performance billboard by DB -> After a mixed performance in June, July was largely positive for assets across the board

Oil stole the show, as supply cuts spurred upward pressure on prices, and the AI excitement saw the S&P 500 and the Nasdaq extend their rally, both securing their fifth consecutive month of positive total returns. Fixed income took a hit in July, as central banks continued their hiking cycle (via HolgerZ)

Investing with intelligence

Our latest research, commentary and market outlooks