Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- us

- Food for Thoughts

- equities

- Bonds

- technical analysis

- bitcoin

- sp500

- Stocks

- inflation

- China

- macro

- Federal Reserve

- investing

- Crypto

- ETF

- Central banks

- AI

- performance

- earnings

- gold

- Rate

- Real Estate

- markets

- Commodities

- debt

- Treasury

- tech

- yield

- nvidia

- europe

- Germany

- Japan

- bank

- oil

- warren-buffett

- nasdaq

- fed

- apple

- cpi

- Forex

- useful

- interest

- humor

- interest-rates

- market cap

- GDP

- dollar

- energy

- returns

- quotes

- hedge fund

- geopolitics

- magnificent-7

- valuations

- asset

- finance

- india

- BOJ

- ECB

- crudeoil

- sentiment

- Swiss

- Volatility

- highyield

- economy

- options

- recession

- vix

- cash

- semiconductor

- growth

- mortgage

- Money Market

- Positioning

- charts

- exports

- trading

- bubble

- ipo

- tesla

- ESG

- deficit

- price

- sales

- EM

- EV

- UK

- assetmanagement

- bearish

- wages

- Flows

- credit-card

- russia

- saudiarabia

- spending

- yen

- Turkey

- cocoa

- futures

- index

- meta

- revenue

- watches

- EUR

- bankruptcy

- chart

- consumers

- profit

- supply

- unemployment

- copper

- Brazil

- Election

- amazon

- car

- credit-rating

- cryptocurrencies

- currencies

- manufacturing

- seasonality

- $nycb

- Asia

- FUNDS

- Renewable

- airlines

- insider

- spx

- FUND

- africa

- deflation

- investmentgrade

- jobs

- microsoft

- productivity

- spy

- taiwan

- yuan

- Alternatives

- SMCI

- SuperBowl

- charlie-munger

- compounding

- concentration

- debt-ceiling

- france

- lvmh

- msci

- pricing-power

- private markets

- sec

- sharebuybacks

- smallcaps

- sustainable

- switzerland

- world-economy

- Focus

- chatgpt

- dowjones

- economic surprise

- fixed income

- greed

- halvings

- income

- leadership

- liquidity

- luxury

- moneydebasement

- retirement

- russel2000

- savings

- silver

- tax

- world

- BOE

- EM Sovereign

- Granolas

- Hong Kong

- Industrial-production

- Market Outlook

- Nikkei

- TIPS

- brics

- ceo

- corporate

- cost-of-living

- dividend

- emerging-markets

- ethereum

- fashion

- gas

- greece

- jpmorgan

- lending

- monetarypolicy

- opec

- saudiaramco

- snb

- storytelling

- trump

- unicorn

- valentine's-day

- venture capital

- vietnam

- Beware

- CTAs

- Coinbase

- Convexity

- Crypto corner

- Deindustrialization

- GlobalAgg

- Italy

- Marketing

- Nestle

- Precious-Metals

- Rally

- SoftBank

- ToyotaMotor

- UAE

- bankrupt

- behavior

- booking.com

- calls

- childbirth

- cisco

- climate

- coal

- cobalt

- cocacola

- construction

- counterparty-risk

- cta

- demographics

- design

- dragonyear

- elon musk

- eurozone

- fees

- financial-stress

- football

- golf

- hedgeye

- hungary

- imf

- intel

- international-women's-day

- job-cuts

- korea

- kpi

- lng

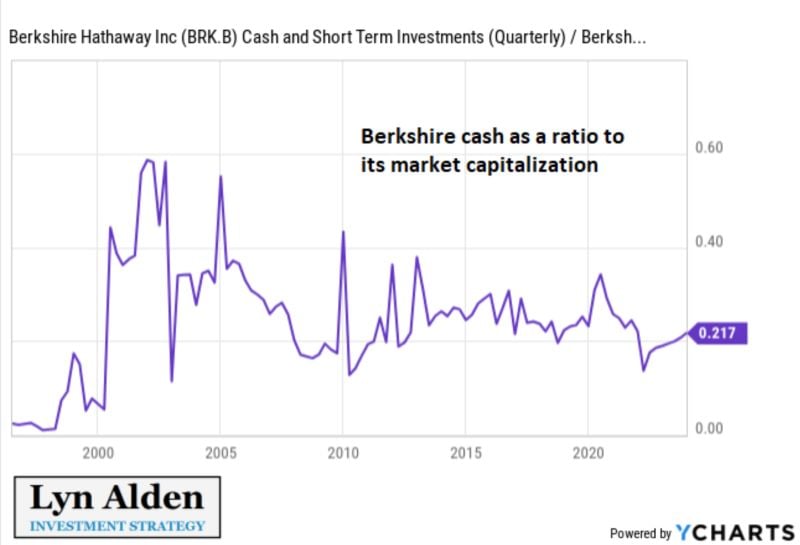

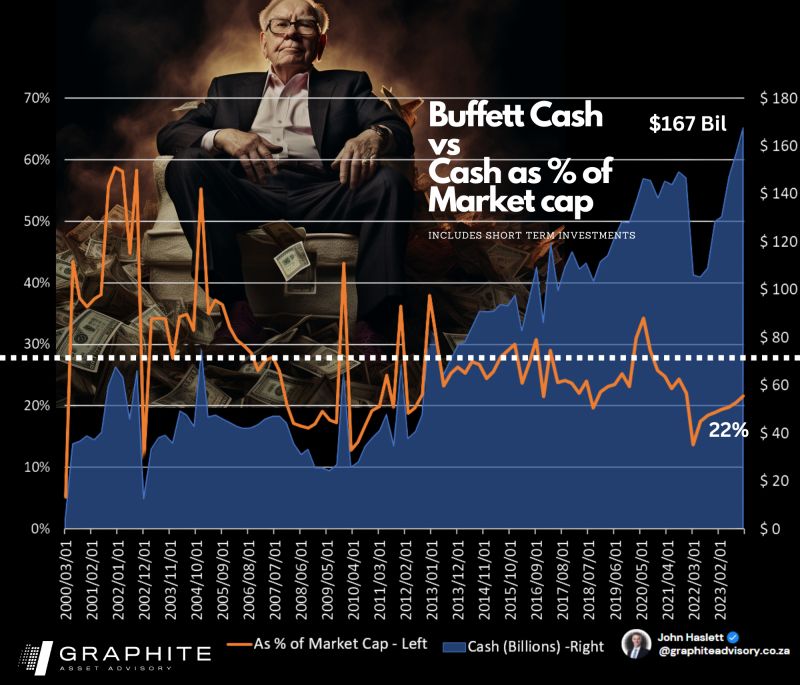

As highlighted by Lyn Alden ->

"People often report the nominal amount of cash that Berkshire $BRK.B has, as though Buffett is hoarding cash. You can't just look at the nominal cash level. All of Berkshire's numbers go up. An insurer needs a lot of liquidity. His cash as a % of his assets is in a normal range".

“I don’t mind at all under current conditions building the cash position."

"When I look at what’s available in equity markets and the composition of what’s going on in the world, we find it quite attractive." - Warren Buffett

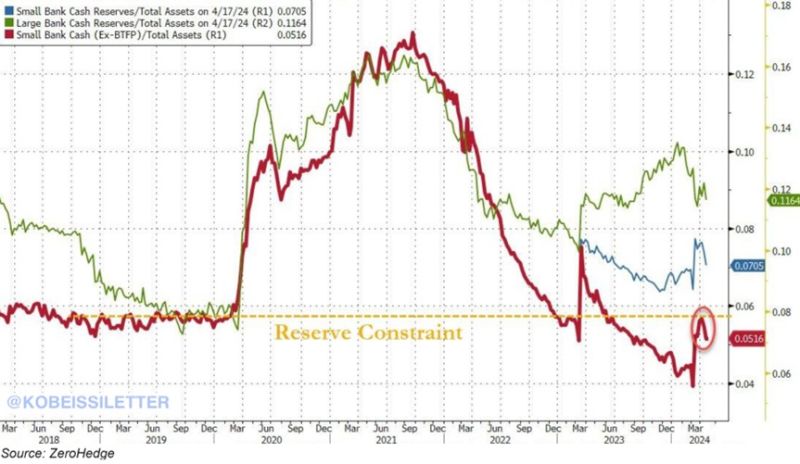

US small bank cash reserves plummeted by $258 billion last week below the level considered a constraint, according to ZeroHedge.

This excludes a $126 billion still sitting at the Fed’s emergency lending program that expired in March. It marked the largest decline in bank deposits since April 2022 when $336 billion came out of the banking system. Meanwhile, US regulators have seized Republic First Bank on Friday and agreed to sell it to Fulton Bank, another regional bank with $6 billion in total assets. The FDIC projects the failure will cost the fund around $667 million. Is the US regional bank crisis really over? Source: The Kobeissi Letter, www.zerohedge.com

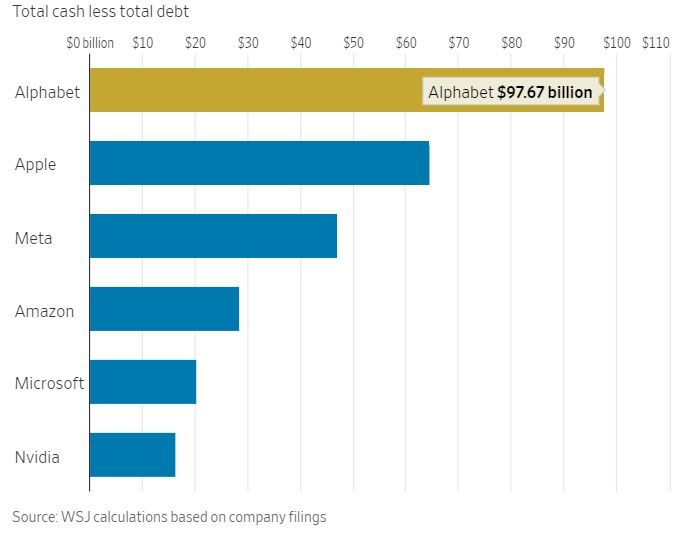

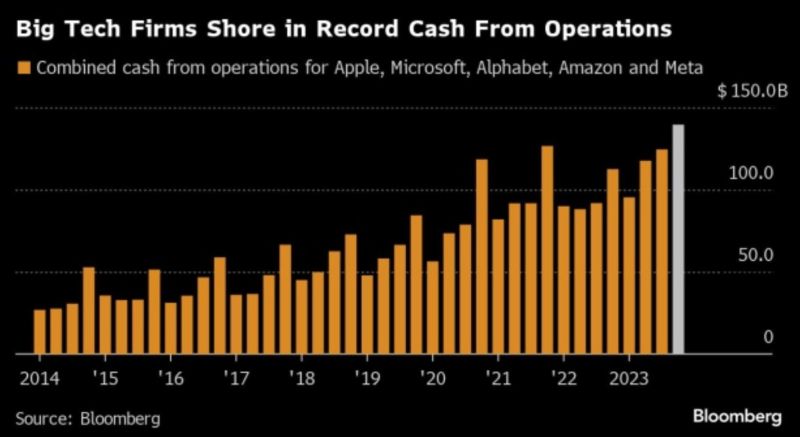

Total Cash Net of Debt...

Google $GOOGL: $98 billion Apple $AAPL: $65 billion Meta $META: $47 billion Amazon $AMZN: $28 billion Microsoft $MSFT: $20 billion Nvidia $NVDA: $16 billion Source: Charlie Bilello

𝗕𝘂𝗳𝗳𝗲𝘁𝘁'𝘀 𝗖𝗮𝘀𝗵 𝗕𝗼𝗻𝗮𝗻𝘇𝗮 𝗡𝗼𝘁 𝗮𝘀 𝗕𝗶𝗴 𝗮𝘀 𝗬𝗼𝘂 𝗧𝗵𝗶𝗻𝗸 💰

While Berkshire Hathaway is hoarding a record-breaking $167 billion cash pile, it accounts for just 22% of the market cap, trailing the 𝗵𝗶𝘀𝘁𝗼𝗿𝗶𝗰𝗮𝗹 𝟮𝟳% 𝗮𝘃𝗲𝗿𝗮𝗴𝗲 the last 23 years. Source: John Haslett, CA(SA), FRM

Over the past twelve months, Microsoft, Alphabet, Amazon, Apple, and Meta have produced a combined operating cash flow of $476.9 billion.

For three consecutive quarters, from Q2 to Q4, these five companies collectively generated over $100 billion each quarter. source : bloomberg

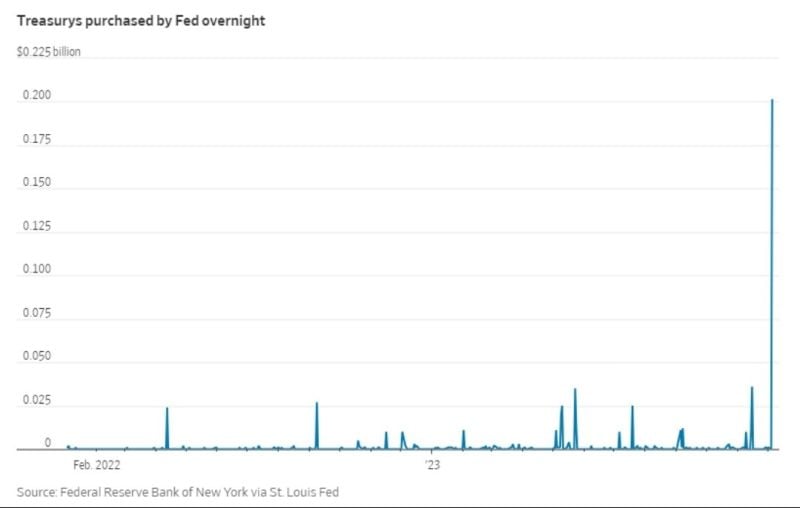

The Federal Reserve lent out roughly $200B in overnight cash on Wednesday through its standing repo facility

This is the highest amount since the onset of covid. What's going on? Is another repo crisis looming? Source: Win Smart, CFA

Investing with intelligence

Our latest research, commentary and market outlooks